Massachusetts Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

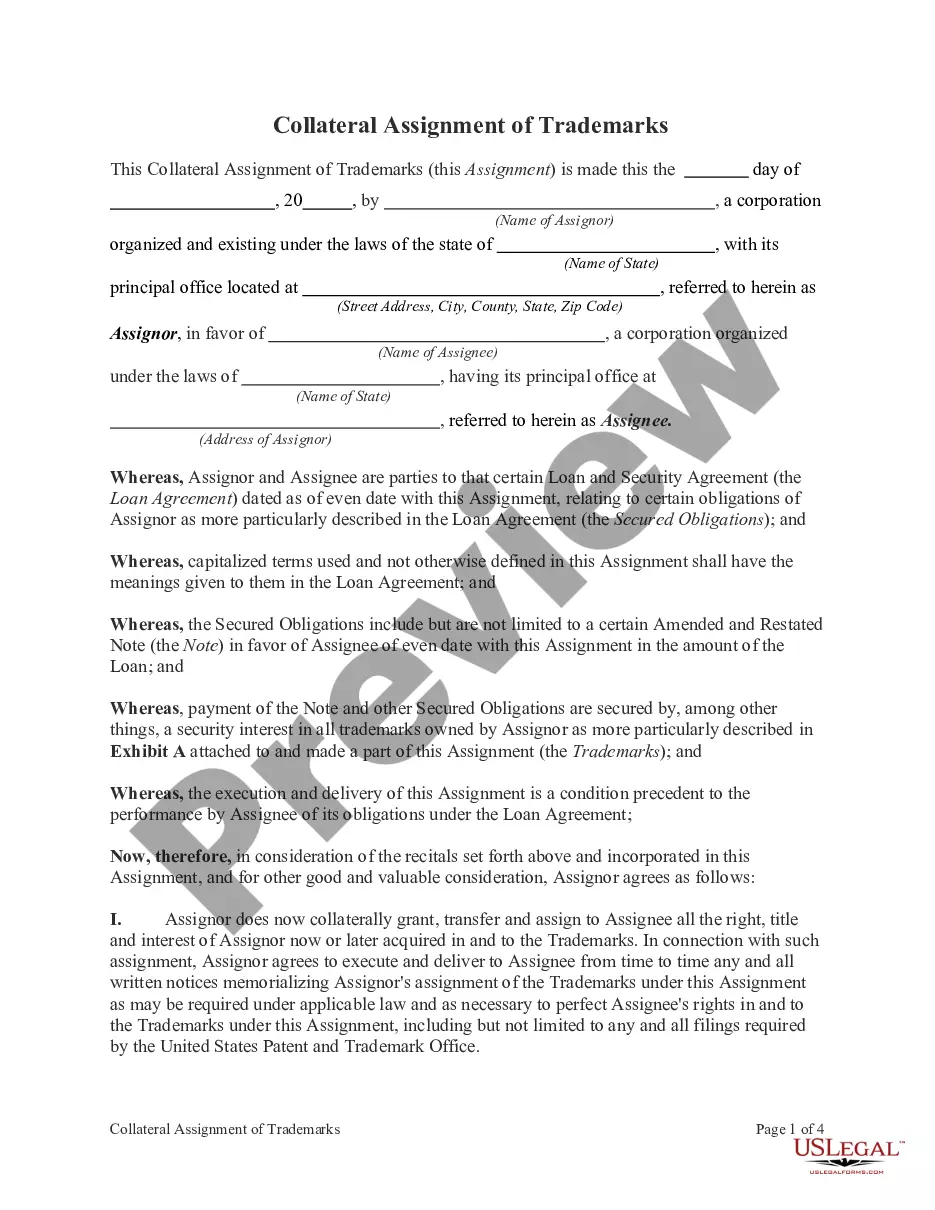

If you need to acquire, download, or print authentic legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site’s simple and convenient search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of your legal form and download it to your device.

- Utilize US Legal Forms to locate the Massachusetts Request for Loan Modification RMA Under Home Affordable Modification Program HAMP in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to access the Massachusetts Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

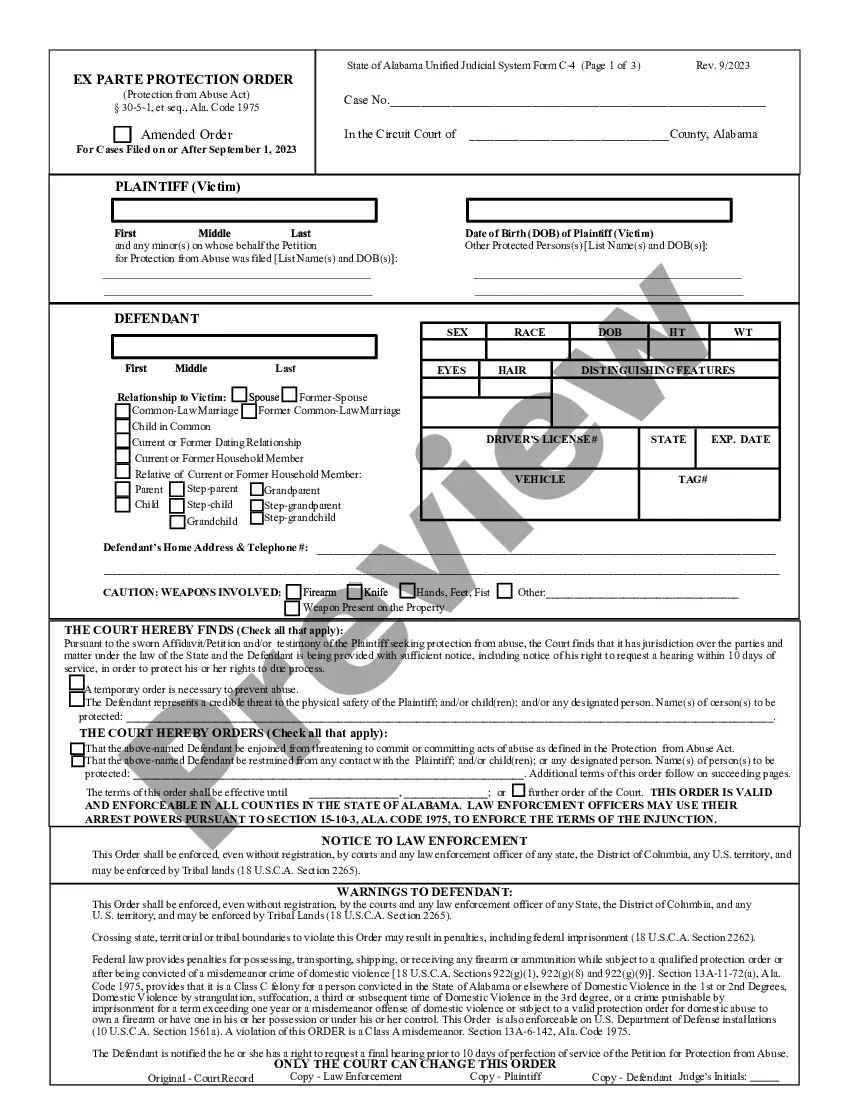

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Lookup field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Acquire now button. Choose your preferred payment plan and enter your credentials to register for an account.

Form popularity

FAQ

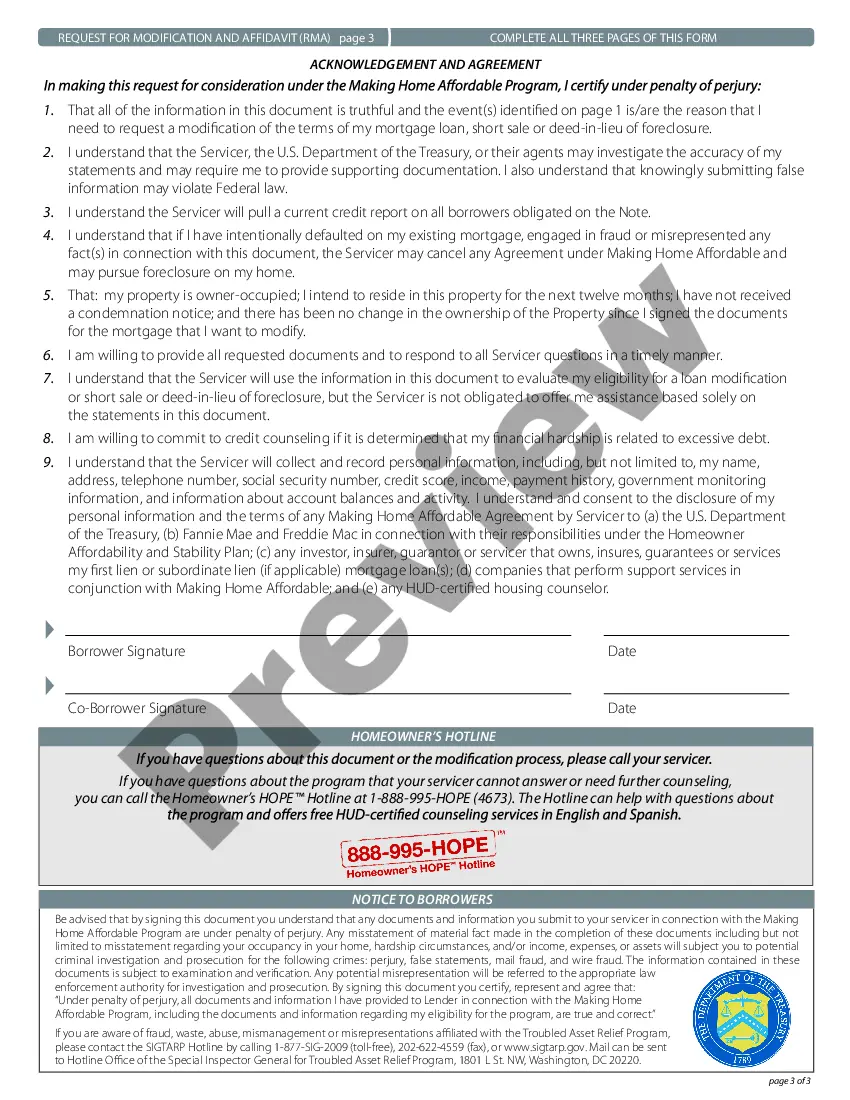

As of 2025, the Home Affordable Modification Program HAMP may not be actively available, but you can still find assistance through various other programs tailored for homeowners. While HAMP was a powerful tool for mortgage modifications, there are ongoing solutions that cater to those seeking help with their loans. It is wise to explore local resources and legal platforms, such as uslegalforms, that provide guidance on navigating available options in your area, including alternatives to HAMP.

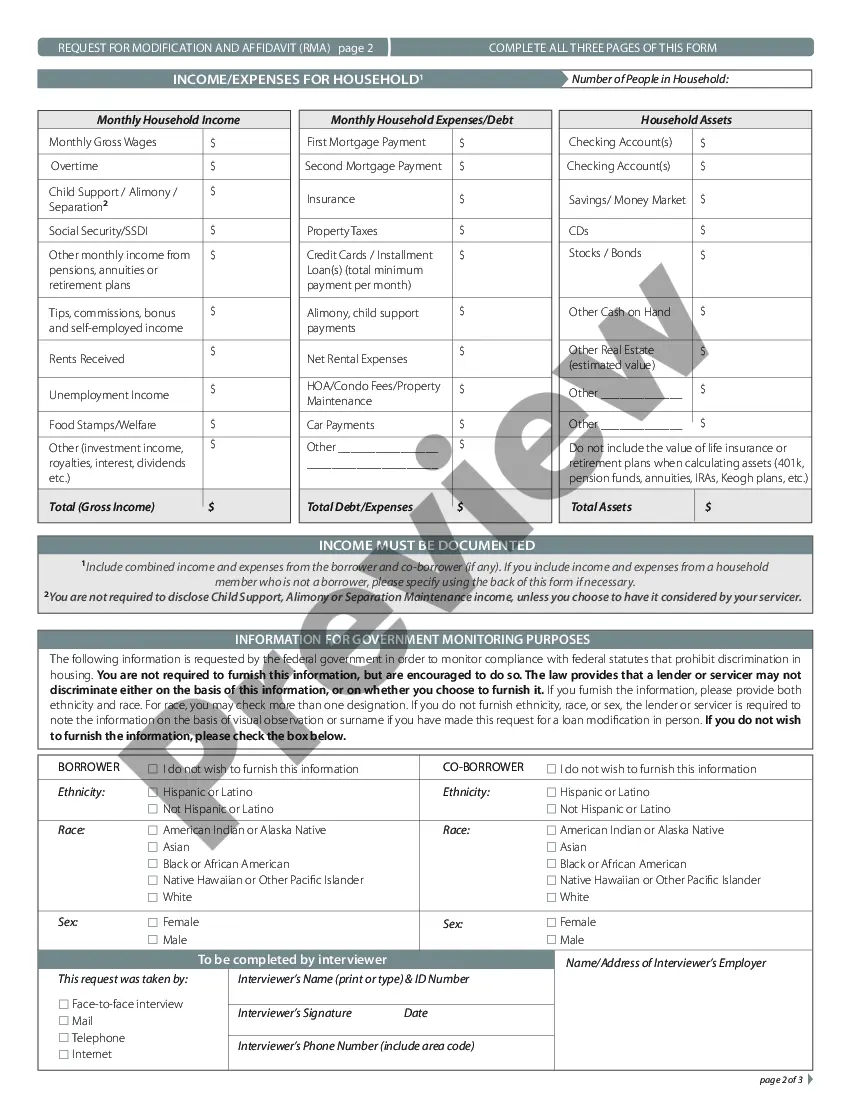

RMA stands for Request for Mortgage Assistance, a crucial step in the Massachusetts Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. This form helps homeowners apply for changes to their mortgage loan terms, making payments more manageable. By submitting an RMA, you initiate the process to potentially lower your monthly payments or achieve a more favorable loan condition. Each request is unique, so understanding the RMA can significantly impact your financial well-being.

Although the original HAMP program has ended, many other assistance options remain available for homeowners. The Massachusetts Request for Loan Modification RMA under similar frameworks can still provide relief to those who qualify. It is essential to consult with your lender or housing counselor to identify current modification programs that can help you manage your mortgage effectively. Seek guidance from professionals to navigate these options successfully.

Applying for a loan modification typically starts with gathering your financial information, including income and expenses. Once prepared, you can reach out to your lender or utilize services like uslegalforms to facilitate the Massachusetts Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. They can help simplify the process, ensuring you provide all required materials and meet necessary guidelines.

To request a mature modification on your loan, begin by contacting your mortgage servicer. Explain your situation and ask about the Massachusetts Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. They can guide you through the application process, assess your eligibility, and provide necessary documentation. Staying proactive in communication is key to a successful modification.

Yes, Congress passed several mortgage relief programs, including the Home Affordable Modification Program (HAMP). This program was designed to assist homeowners struggling with their mortgage payments. The Massachusetts Request for Loan Modification RMA under this program offers a pathway for you to modify your loan and maintain your home. It shows the ongoing commitment to support those facing financial difficulties.

The Home Owners' Loan Corporation (HOLC) is no longer operational. It was active during the Great Depression to provide mortgage relief. Today, various programs, including the Massachusetts Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, aim to assist homeowners facing mortgage challenges. You can explore current options through agencies that offer similar assistance.

A mortgage loan modification can be a wise choice for those facing financial hardship, as it helps to lower monthly payments. By adjusting your mortgage terms, you can reduce stress and maintain home ownership. If you're considering the Massachusetts Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, it may be the right step for you in achieving greater financial stability.

HAMP stands for the Home Affordable Modification Program, which was designed to help struggling homeowners avoid foreclosure. This program provides modifications to eligible mortgage loans, ensuring that monthly payments become more affordable. By leveraging the Massachusetts Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you can successfully navigate this process for better financial health.

RMA in the context of mortgages stands for Request for Mortgage Assistance. This document is essential when seeking a loan modification, as it outlines your financial challenges and requests assistance. Understanding the Massachusetts Request for Loan Modification RMA Under Home Affordable Modification Program HAMP will help you formulate an effective request for the aid you need.