Massachusetts Subscription Agreement

Description

How to fill out Subscription Agreement?

If you have to total, acquire, or print authorized papers themes, use US Legal Forms, the biggest selection of authorized forms, which can be found online. Take advantage of the site`s simple and practical look for to obtain the documents you require. Various themes for business and personal uses are sorted by groups and claims, or keywords and phrases. Use US Legal Forms to obtain the Massachusetts Subscription Agreement in a number of click throughs.

Should you be already a US Legal Forms customer, log in to your profile and click the Acquire key to obtain the Massachusetts Subscription Agreement. You can even gain access to forms you previously acquired within the My Forms tab of your profile.

Should you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for the appropriate town/country.

- Step 2. Utilize the Preview method to look over the form`s content material. Do not forget to read the description.

- Step 3. Should you be unhappy together with the type, utilize the Look for industry towards the top of the screen to discover other versions of the authorized type format.

- Step 4. Once you have located the shape you require, click on the Get now key. Choose the rates prepare you favor and add your qualifications to register for the profile.

- Step 5. Method the transaction. You can use your Мisa or Ьastercard or PayPal profile to accomplish the transaction.

- Step 6. Select the file format of the authorized type and acquire it on your system.

- Step 7. Comprehensive, modify and print or signal the Massachusetts Subscription Agreement.

Each and every authorized papers format you get is your own for a long time. You possess acces to every type you acquired in your acccount. Select the My Forms area and choose a type to print or acquire once more.

Compete and acquire, and print the Massachusetts Subscription Agreement with US Legal Forms. There are thousands of skilled and state-particular forms you can use for your personal business or personal demands.

Form popularity

FAQ

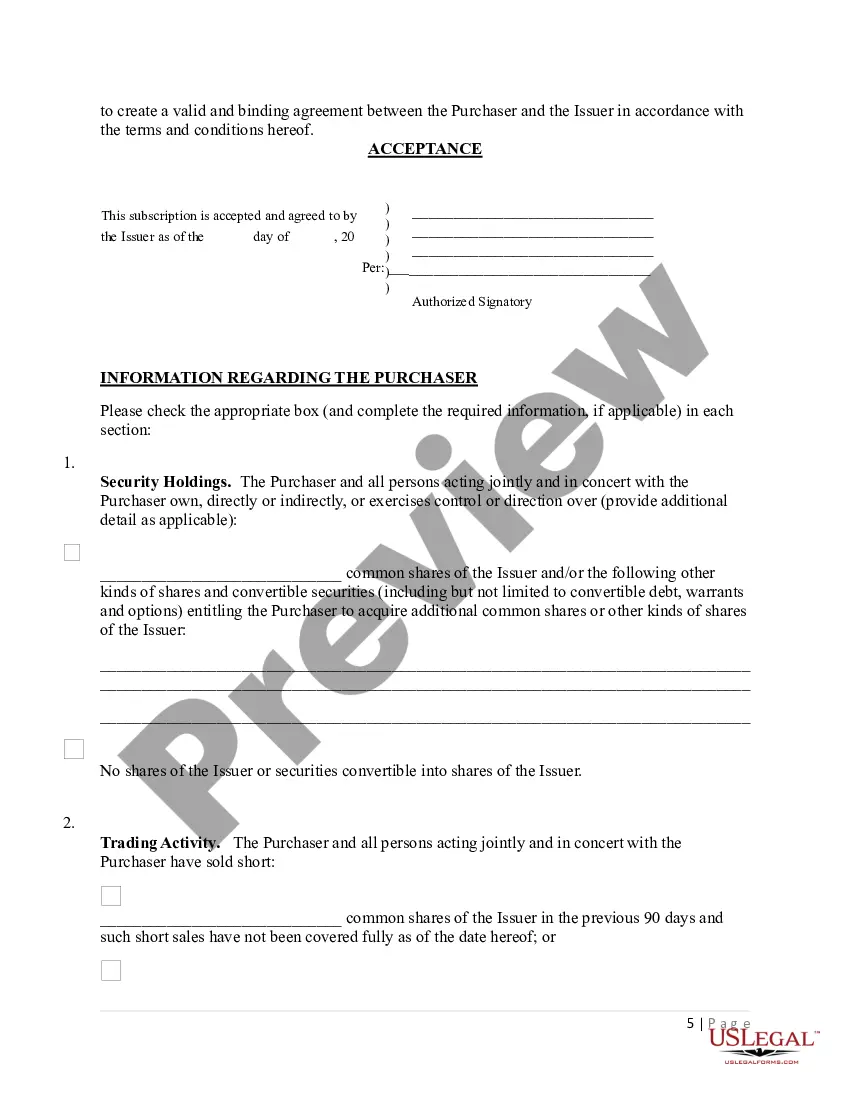

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement. The importance of an LLC Operating Agreement - Propel(x) propelx.com ? blog ? llc-operating-agreement propelx.com ? blog ? llc-operating-agreement

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares. Sample Share Subscription Agreement - WVU College of Law wvu.edu ? files ? sample-ssa-clean-versi... wvu.edu ? files ? sample-ssa-clean-versi...

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts. Subscription Agreement - Overview, How It Works, Regulation corporatefinanceinstitute.com ? resources ? equities corporatefinanceinstitute.com ? resources ? equities

The Operating Agreement outlines how the governing body will operate. The Subscription Agreement is the legally binding agreement between the investor and the Issuer.

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

Subscription agreements are legal contracts that allow an investor to buy shares, bonds, or units of a company as a subscriber and shareholder with limited partnerships (LP) or private placement rights. Share subscription agreements are a type of subscription agreement that involves purchasing shares specifically. Subscription Agreement: How They Work, What's Included contractscounsel.com ? subscription-agreem... contractscounsel.com ? subscription-agreem...