This due diligence form is used to summarize data for each partnership entity associated with the company in business transactions.

Massachusetts Partnership Data Summary

Description

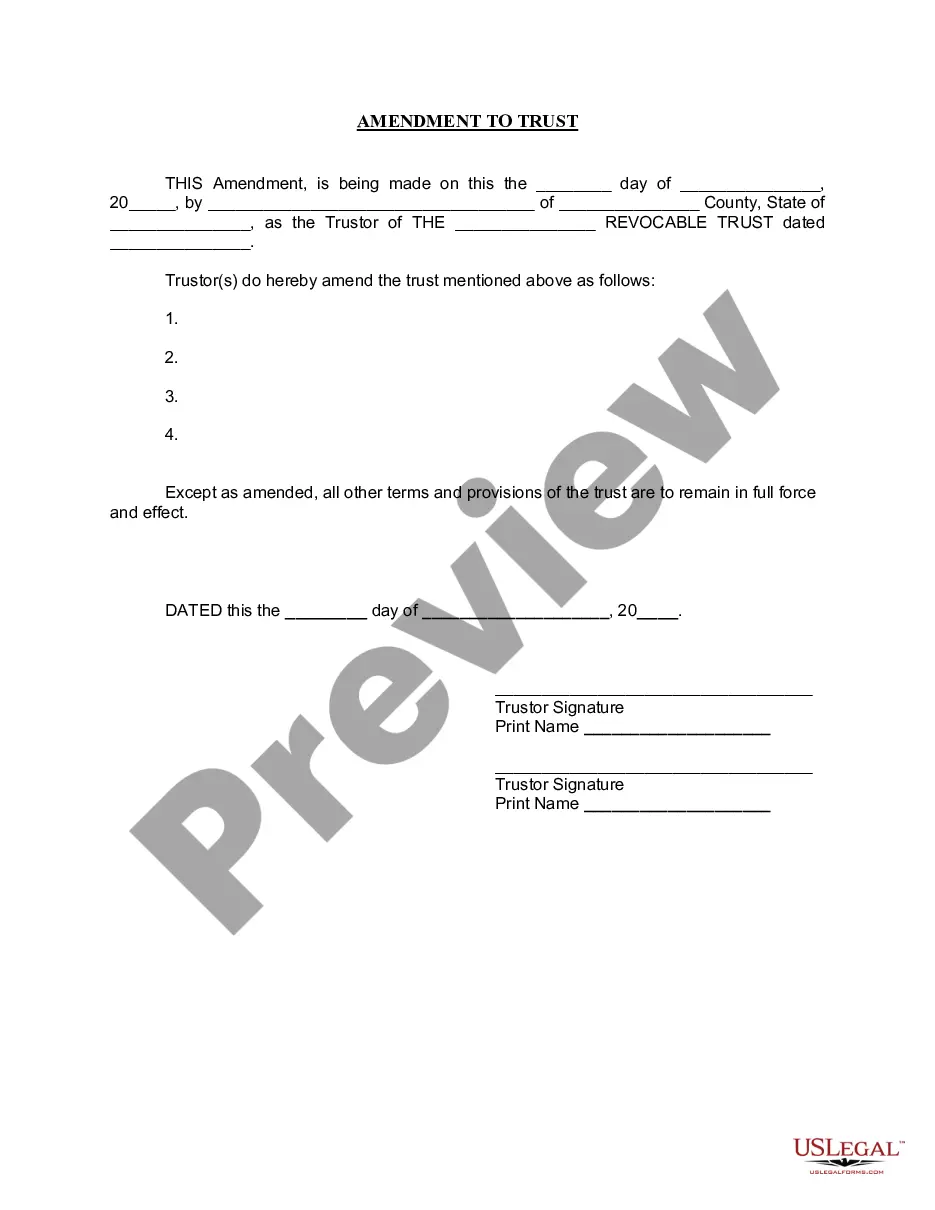

How to fill out Partnership Data Summary?

You can spend numerous hours online trying to locate the appropriate legal document template that meets the federal and state criteria you need. US Legal Forms offers a vast array of legal forms that are examined by professionals.

You can easily download or print the Massachusetts Partnership Data Summary from my services.

If you already have a US Legal Forms account, you may Log In and then click the Get button. Subsequently, you can complete, modify, print, or sign the Massachusetts Partnership Data Summary. Every legal document template you obtain belongs to you permanently.

Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Choose the format of your document and download it to your system. Make changes to the document if necessary. You can complete, edit, sign, and print the Massachusetts Partnership Data Summary. Obtain and print numerous document layouts using the US Legal Forms website, which offers the most extensive collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To acquire another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice. Review the form outline to confirm you have chosen the right one.

- If available, use the Preview button to look through the document template as well.

- If you wish to find another version of the document, use the Search field to locate the template that matches your needs and requirements.

- Once you have found the template you want, click on Buy now to proceed.

- Select the pricing plan you desire, enter your details, and create your account on US Legal Forms.

Form popularity

FAQ

Massachusetts Form 3 must be filed by partnerships doing business in the state, reporting income earned during the tax year. It's essential for partnerships to complete this form as part of their tax obligations and ensure compliance with state regulations. By understanding your requirements through the Massachusetts Partnership Data Summary, you can take proactive steps to meet your filing duties. If you need assistance, consider using uslegalforms for comprehensive resources and guidance.

Yes, Massachusetts requires certain business entities to file an annual report. This report helps maintain your business's active status and keeps your information current with the state. Filing an annual report is part of managing your Massachusetts Partnership Data Summary effectively. You can easily navigate this process by using online services that simplify document preparation and submission.

You can file Massachusetts Form 1 NR py electronically through the Massachusetts Department of Revenue's website. This process allows for efficient submission and reduces errors. Alternatively, you may choose to mail your completed form to the appropriate address listed in the instructions of the Massachusetts Partnership Data Summary. Using the online platform can save you time and ensure your information is processed quickly.

You enter partnership distributions on your tax return, specifically on Schedule E. This schedule allows you to detail your income from the partnership. The Massachusetts Partnership Data Summary provides guidance on how to accurately report and track these distributions for seamless filing.

The Massachusetts partnership return form is Form 3, which is specifically designed for filing partnerships in the state. This form helps report the income and expenses on a partnership level and is essential for compliance. You can utilize the Massachusetts Partnership Data Summary to navigate through the form's requirements.

To report partnership distributions, you will need to include the amounts on your personal tax return, typically using Schedule E. This documentation will clarify your share of the partnership's income and losses. Referring to the Massachusetts Partnership Data Summary can help ensure you don’t miss any important details.

Partnership distributions do count as income for tax purposes. However, the taxable amount can vary based on the partnership’s overall earnings and your individual stake. The Massachusetts Partnership Data Summary can provide essential insights on how to assess these distributions effectively.

Yes, partnership distributions reported on Form 1099 are generally taxable. You should include this income when filing your individual tax return. Make sure to consult the Massachusetts Partnership Data Summary to understand how these distributions may affect your overall tax liability.

Yes, in Massachusetts, LLCs are required to file an annual report with the Secretary of the Commonwealth. This report is necessary for compliance and helps keep your business details updated in the state records. For reference, the Massachusetts Partnership Data Summary outlines relevant guidelines for your reporting obligations.

Partnerships must fill out Form 1065, which serves as the U.S. Return of Partnership Income. This form is crucial for reporting income, gains, losses, deductions, and credits from the partnership. To simplify this process, many reference the Massachusetts Partnership Data Summary to ensure accurate and appropriate filing.