This due diligence checklist lists liability issues for future directors and officers in a company regarding business transactions.

Massachusetts Checklist for Potential Director and Officer Liability Issues

Description

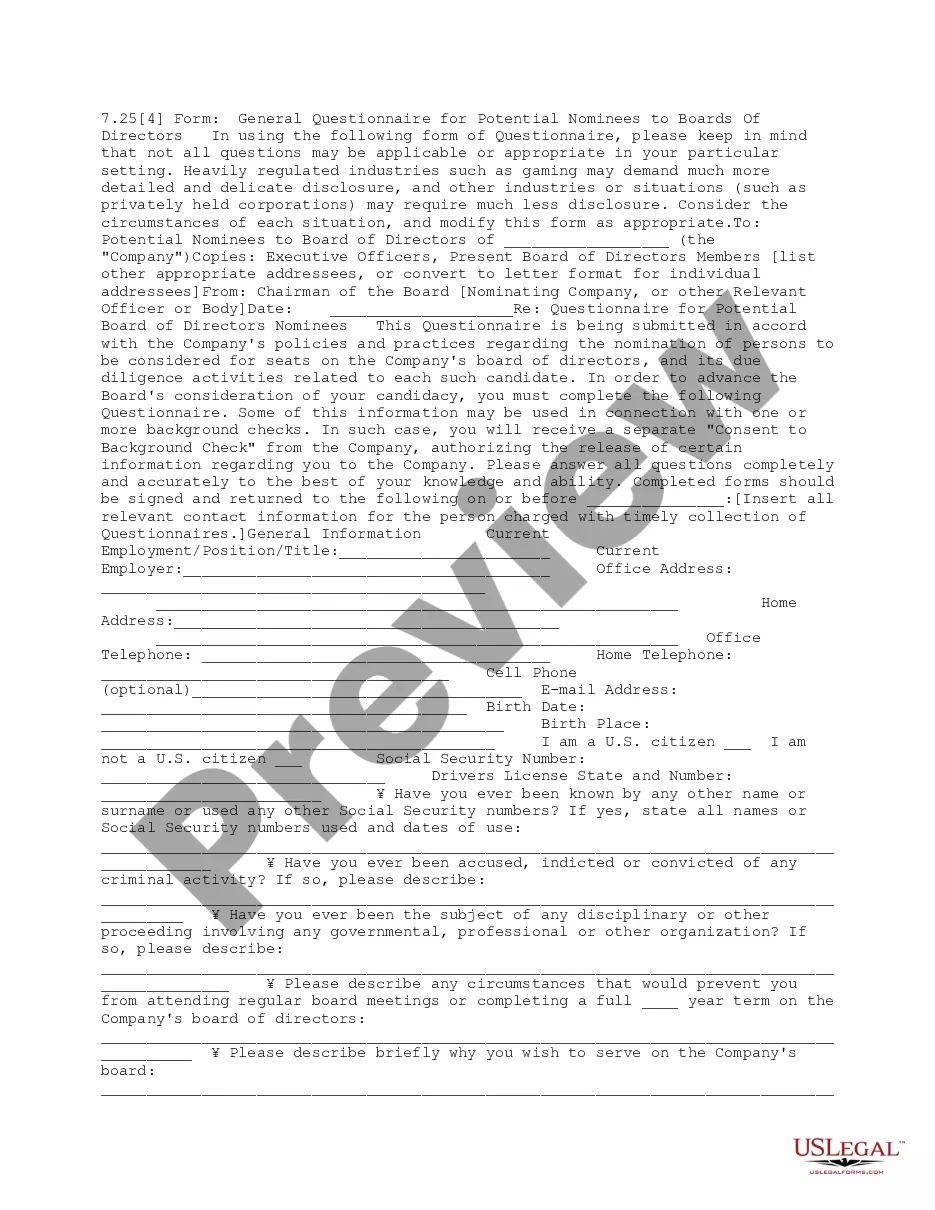

How to fill out Checklist For Potential Director And Officer Liability Issues?

Have you ever been in a situation where you require documents for various organizational or personal activities almost daily.

There are numerous legitimate document templates available online, but finding ones you can trust is quite challenging.

US Legal Forms offers thousands of form templates, including the Massachusetts Checklist for Potential Director and Officer Liability Issues, which are designed to comply with state and federal requirements.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Massachusetts Checklist for Potential Director and Officer Liability Issues template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and ensure it corresponds to the correct state/region.

- 2. Use the Review option to assess the form.

- 3. Read the description to confirm you have selected the right form.

- 4. If the form is not what you're searching for, utilize the Search field to find the template that fits your needs and criteria.

- 5. Once you find the right form, click Buy now.

- 6. Choose the pricing plan you want, fill in the required information to create your account, and complete the order using your PayPal or credit card.

- 7. Select a convenient file format and download your copy.

- 8. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Massachusetts Checklist for Potential Director and Officer Liability Issues whenever necessary. Click on the desired form to download or print the document.

- 9. Utilize US Legal Forms, the most extensive collection of legal templates, to save time and prevent errors.

- 10. The service provides professionally crafted legal document templates that can be utilized for a variety of purposes.

- 11. Create an account on US Legal Forms and make your life a little easier.

Form popularity

FAQ

Directors & Officers (D&O) Liability insurance is designed to protect the people who serve as directors or officers of a company from personal losses if they are sued by the organization's employees, vendors, customers or other parties.

Directors and Officers (D&O) liability insurance protects your organization's directors and officers from personal financial loss that may result from allegations and lawsuits of wrongful acts or mismanagement carried out in their appointed capacity.

Bodily injury/property damage. Customer injuries or property damage would typically fall under a general liability insurance policy. Insured-versus-insured claims. One director or officer suing another is not covered.

5 Important Things to Look for in Your D&O Insurance PolicyCriminal Act Exclusions.Notification Requirements.Insured vs. Insured.Exceptions To Exclusions.Unique Details.

The following are several examples of Management Liability (D&O) claims.Misrepresentation. Directors and officers at a company failed to disclose material facts and provided inaccurate and misleading information to their investors.Credit Fraud.Stolen Corporate Secrets.Recruiting Sales Executives.Investment Agreement.

Key Takeaways. Directors and officers (D&O) liability insurance covers directors and officers or their company or organization if sued (most policies exclude fraud and criminal offenses). D&O insurance claims are paid to cover losses associated with the lawsuit, including legal defense fees.

While E&O and D&O insurance provide liability protection for incidents that affect people outside of a company, such as dissatisfied clients or investors, employment practices liability insurance (EPLI) protects a company from claims filed by people who work within it.

D&O insurance will not provide coverage for what many would consider the worst acts of the directors or officers; dishonesty, fraud, criminal or malicious acts committed deliberately. Insurance is created to transfer risk and not to cover the intentional acts of the insured.

D&O policies include an exclusion for losses related to criminal or deliberately fraudulent activities. Additionally, if an individual insured receives illegal profits or remuneration to which they were not legally entitled, they will not be covered if a lawsuit is brought forward due to this.

While D&O insurance can cover clients who lost money due to the director's or officer's actions, the individual on the board is not providing a professional or specialized service, thus they would not be covered under professional liability insurance.