Massachusetts Acquisition, Merger, or Liquidation

Description

How to fill out Acquisition, Merger, Or Liquidation?

If you want to comprehensive, obtain, or printing legitimate papers web templates, use US Legal Forms, the most important assortment of legitimate types, that can be found on-line. Use the site`s basic and hassle-free search to discover the paperwork you want. Various web templates for business and person purposes are sorted by types and claims, or search phrases. Use US Legal Forms to discover the Massachusetts Acquisition, Merger, or Liquidation within a handful of mouse clicks.

In case you are presently a US Legal Forms buyer, log in to the accounts and then click the Download switch to find the Massachusetts Acquisition, Merger, or Liquidation. You may also entry types you in the past downloaded in the My Forms tab of your accounts.

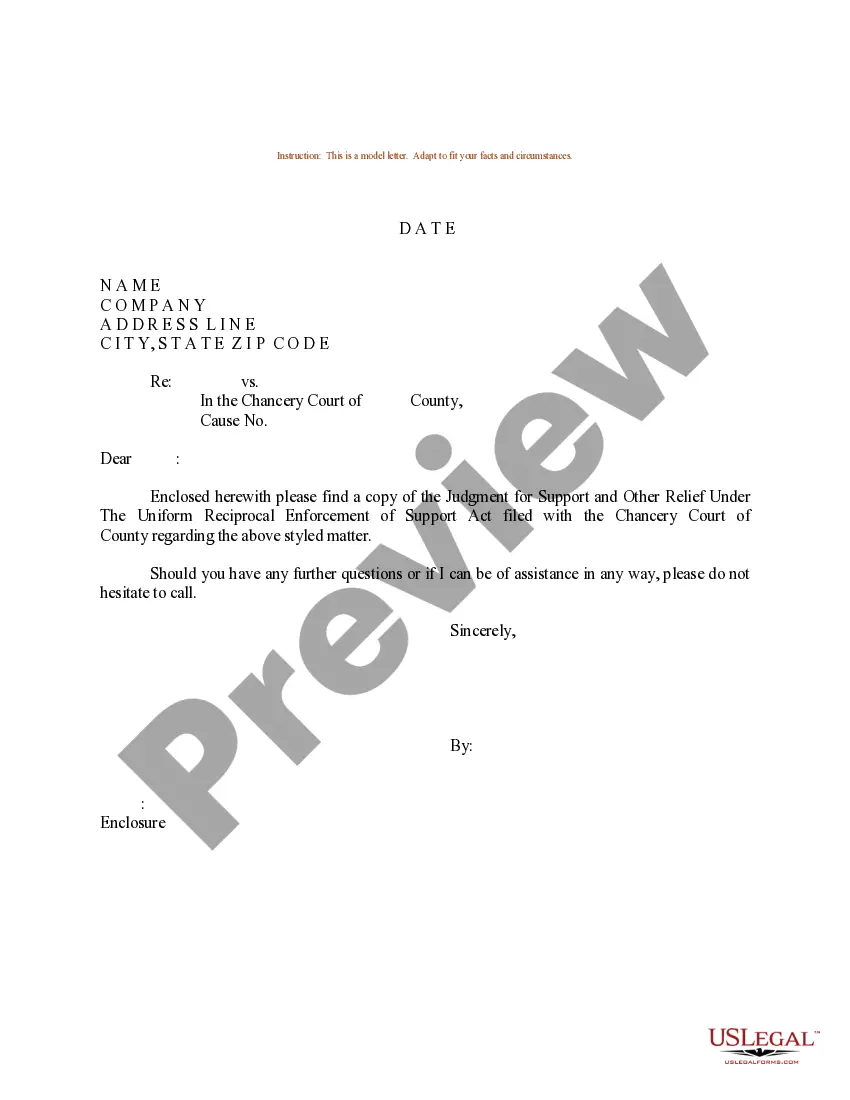

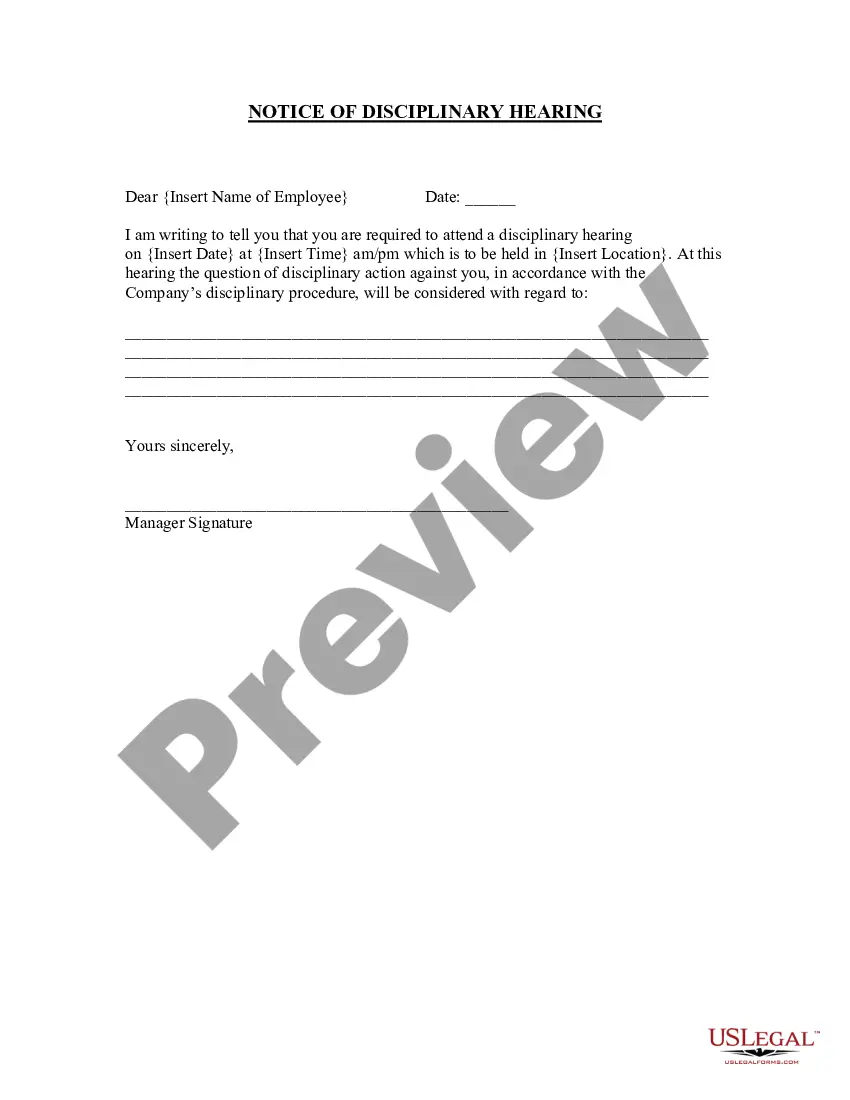

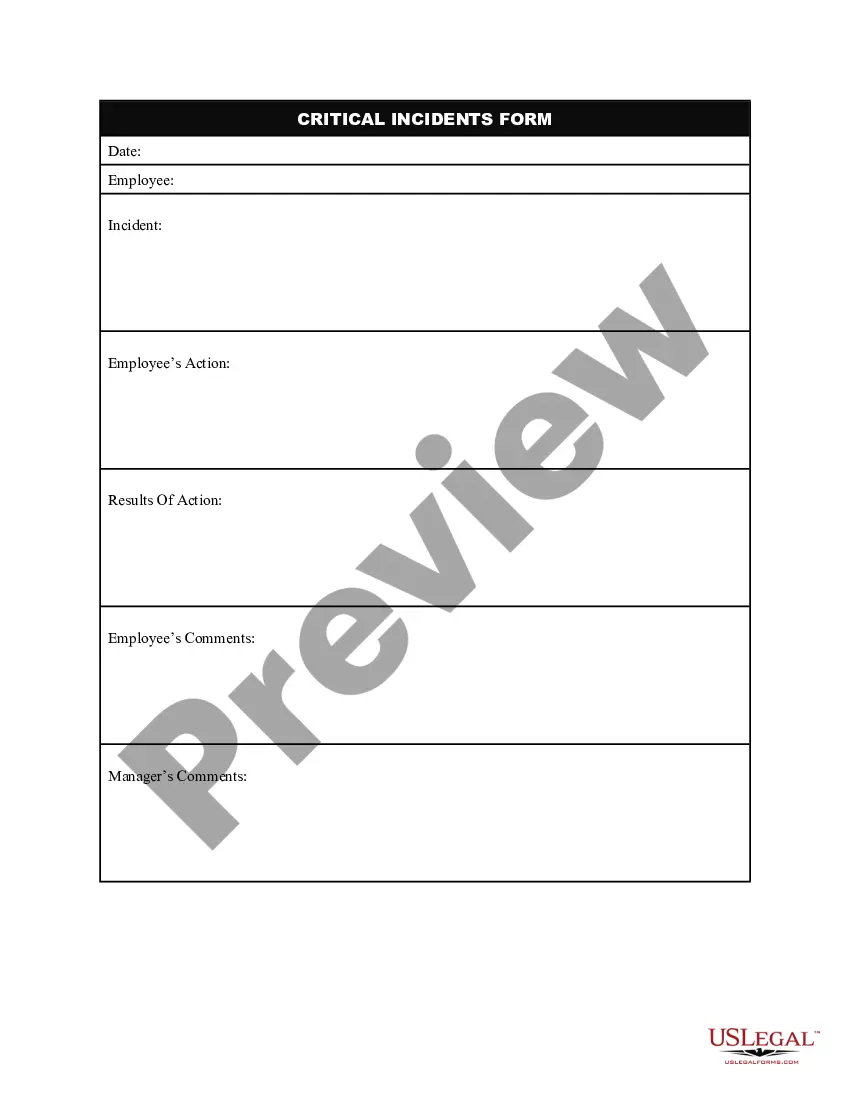

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have chosen the shape for that right metropolis/region.

- Step 2. Take advantage of the Preview method to look through the form`s information. Don`t overlook to see the explanation.

- Step 3. In case you are unsatisfied together with the type, use the Lookup field on top of the screen to find other types in the legitimate type design.

- Step 4. After you have located the shape you want, click on the Purchase now switch. Opt for the prices plan you choose and add your references to register for the accounts.

- Step 5. Approach the transaction. You can use your charge card or PayPal accounts to finish the transaction.

- Step 6. Pick the format in the legitimate type and obtain it on your system.

- Step 7. Complete, modify and printing or indicator the Massachusetts Acquisition, Merger, or Liquidation.

Every legitimate papers design you acquire is your own property permanently. You might have acces to every type you downloaded within your acccount. Click the My Forms section and choose a type to printing or obtain yet again.

Be competitive and obtain, and printing the Massachusetts Acquisition, Merger, or Liquidation with US Legal Forms. There are many skilled and express-specific types you can utilize for your business or person requires.

Form popularity

FAQ

A merger occurs when two separate entities combine forces to create a new, joint organization. Meanwhile, an acquisition refers to the takeover of one entity by another. Mergers and acquisitions may be completed to expand a company's reach or gain market share in an attempt to create shareholder value.

The non-surviving corporation as a separate entity goes out of existence as part of the merger process, but does not technically ?dissolve,? which is a separate kind of corporate transaction.

When a company merges with another company, in some cases the first company needs to pay on acquired assets, so the second company need not to pay any taxes. But if the second company is not dissolved then they must pay tax on their assets. These are the tax consequence faced by the companies in the merger process.

A liquidation or administration can happen during or after an acquisition. An acquisition is a process that occurs when one company decides to take over the operations of another company.

Depending on how the deal is executed, a reverse triangular merger can be either taxable or nontaxable. If it is taxable, then it is treated as a stock purchase as described above. On the other hand, it can also be structured as a tax-free reorganization if it qualifies under Internal Revenue Code Section 368(a)(2)(E).

A merger is a business deal where two existing, independent companies combine to form a new, singular legal entity. Mergers are voluntary. Typically, both companies are of a similar size and scope and both stand to gain from the transaction. Mergers happen for a variety of reasons.

With a merger ?continuity? can be achieved since assets and liabilities are being transferred to the absorbing ? surviving company. Liquidation brings an end to the existence of the company. The merger requires approval by the Court. The voluntary liquidation does not.

In a qualifying merger, there is no tax on the target corporation (Section 361) as long as property received is distributed, and the purchaser keeps the original basis (Section 362), the stockholders of the target pay tax on the lesser of boot or gain (Section 356), and they retain their basis in the target company ...