Massachusetts Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

How to fill out Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

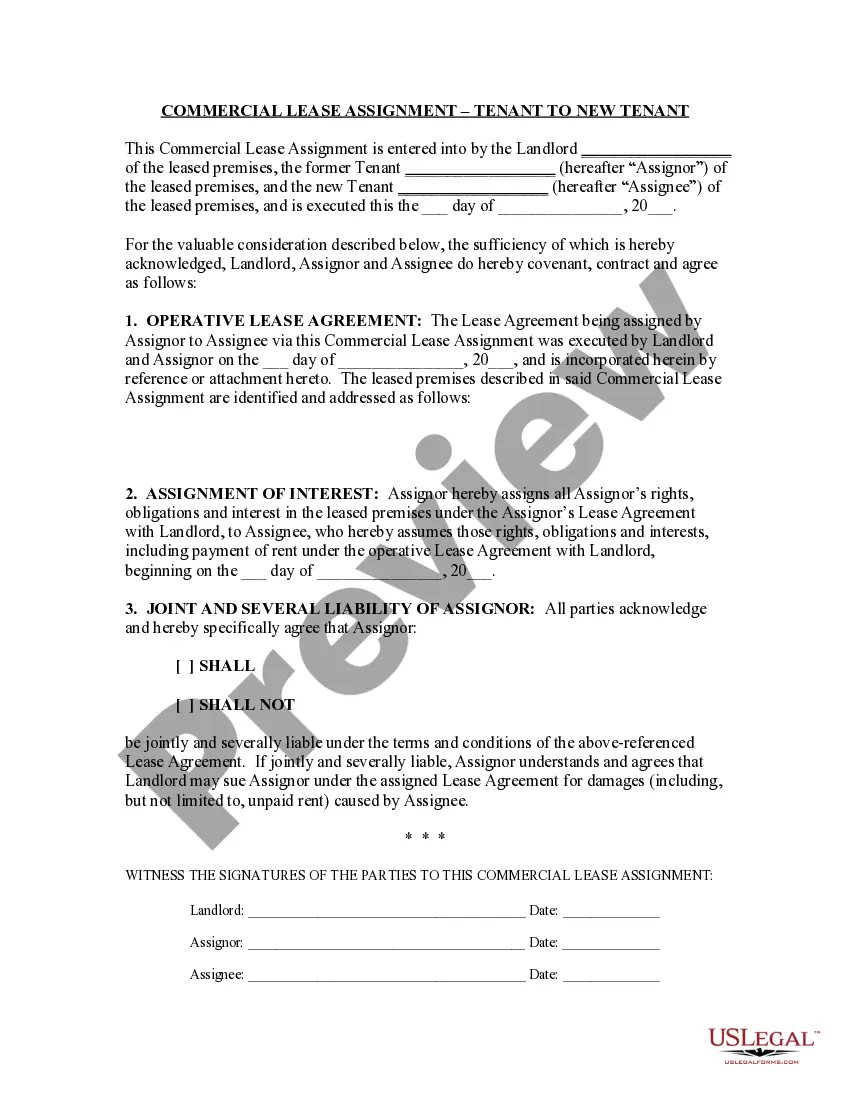

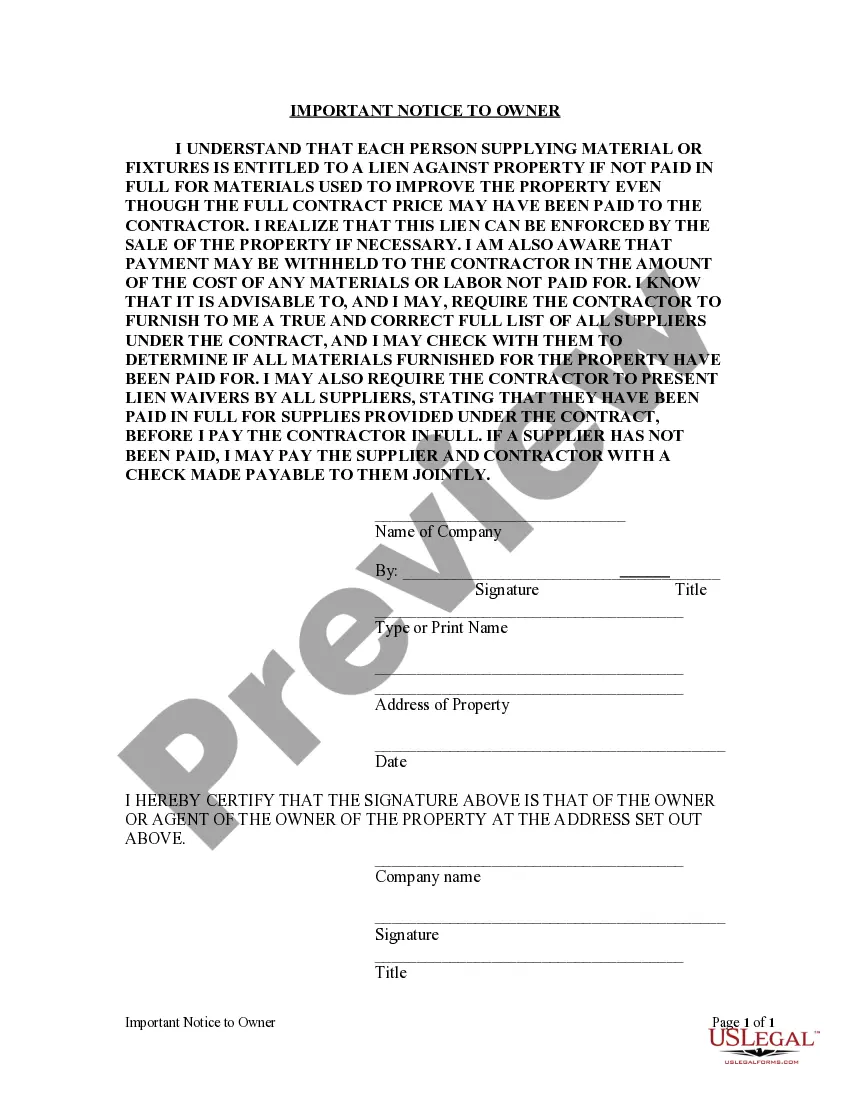

Discovering the right legal document design can be a battle. Obviously, there are tons of themes available online, but how do you get the legal form you want? Take advantage of the US Legal Forms site. The service offers a large number of themes, for example the Massachusetts Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation, that you can use for organization and personal requirements. All the forms are checked by pros and meet up with federal and state requirements.

When you are presently registered, log in for your bank account and then click the Obtain button to obtain the Massachusetts Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation. Use your bank account to search with the legal forms you might have ordered formerly. Check out the My Forms tab of your bank account and get yet another backup of the document you want.

When you are a new customer of US Legal Forms, listed here are easy directions so that you can stick to:

- Initial, make sure you have chosen the correct form for your personal town/state. You can check out the shape utilizing the Preview button and look at the shape explanation to make sure it will be the right one for you.

- If the form is not going to meet up with your requirements, use the Seach area to discover the proper form.

- Once you are sure that the shape is acceptable, click the Buy now button to obtain the form.

- Choose the costs program you would like and type in the necessary information. Design your bank account and purchase your order with your PayPal bank account or bank card.

- Select the file formatting and down load the legal document design for your system.

- Comprehensive, edit and printing and indication the received Massachusetts Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation.

US Legal Forms is the largest library of legal forms that you can find different document themes. Take advantage of the company to down load appropriately-made papers that stick to status requirements.

Form popularity

FAQ

Vested employee stock options contain guarantees, so when a company is acquired employees with vested options will have some options. First is the acquiring company may buy out the options for cash. They may also offer to replace those contracts with options of the acquirer of equal or greater value.

The new company could assume your current unvested stock options or RSUs or substitute them. The same goes for vested options. You'd likely still have to wait to buy shares or receive cash, but could at least retain your unvested shares.

If your ESOP is going to be rolled over into the purchasing company's ESOP, you will not receive a distribution. Instead, your shares will be rolled into the new company's ESOP.

Unvested Options ? Depending on the structure of the deal, there are three possibilities for unvested options. The holdings could be canceled, they might be converted to cash and paid out over time, or they could be converted to the acquiring company stock and subject to a new vesting schedule.

"When an underlying security is converted into a right to receive a fixed amount of cash, options on that security will generally be adjusted to require the delivery upon exercise of a fixed amount of cash, and trading in the options will ordinarily cease when the merger becomes effective.

If a startup never goes public, the stock options that employees have may become worthless or may have limited value. Stock options give employees the right to purchase a certain number of shares in the company at a predetermined price (also known as the exercise price or strike price).

How do stocks work with mergers? Depending on the specifics of the merger, investors may have their shares cashed-out, or exchanged for shares of the new company. Prices of stocks may increase or decrease, often depending on if they're shares of the target or acquiring company.

Vested employee stock options contain guarantees, so when a company is acquired employees with vested options will have some options. First is the acquiring company may buy out the options for cash. They may also offer to replace those contracts with options of the acquirer of equal or greater value.