Massachusetts Shared Leave Request Form

Description

How to fill out Shared Leave Request Form?

You have the capability to spend time online searching for the legal document template that fulfills the federal and state requirements you will need.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can obtain or print the Massachusetts Shared Leave Request Form from our service.

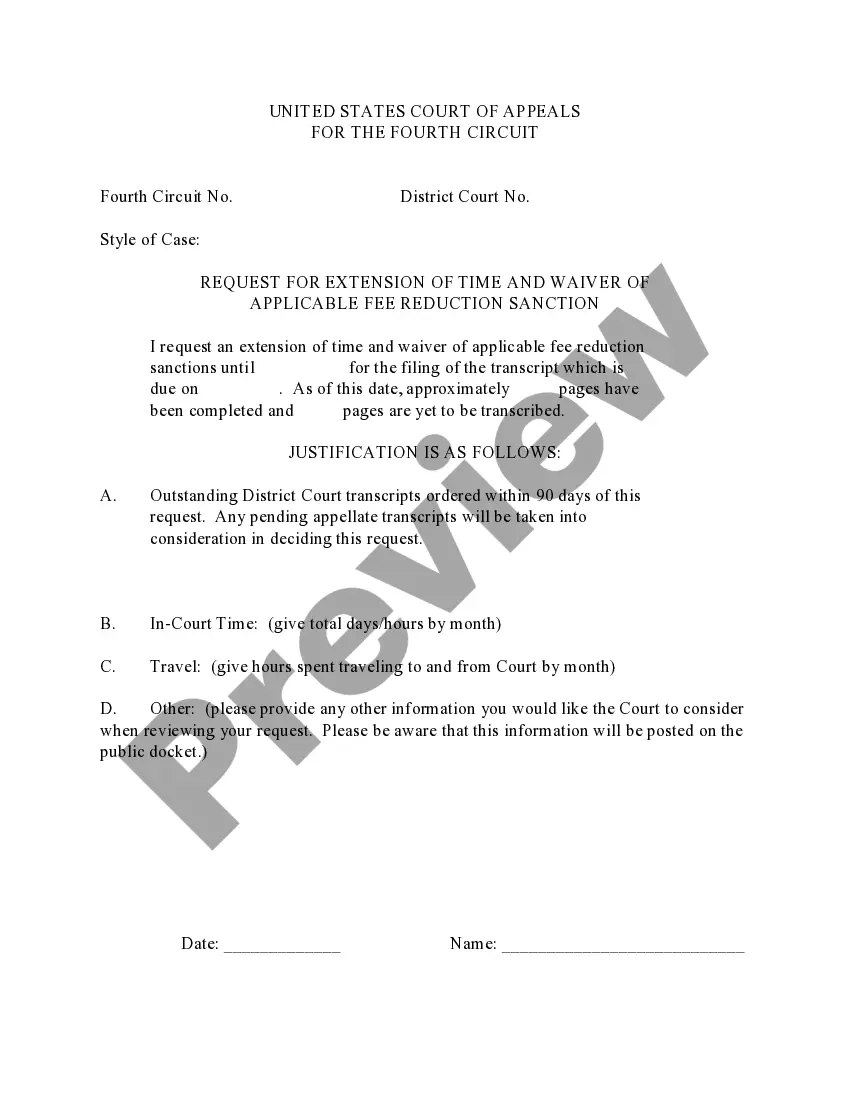

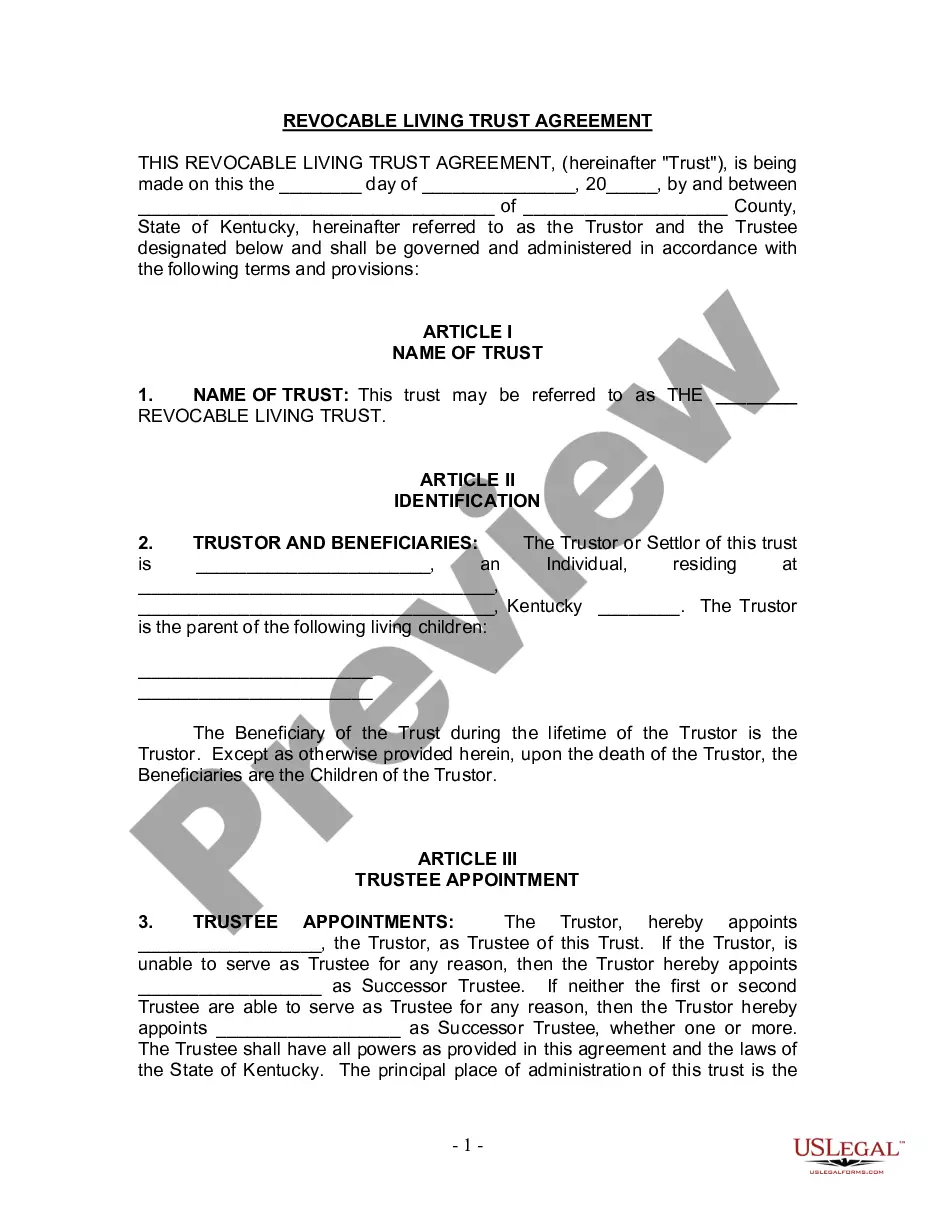

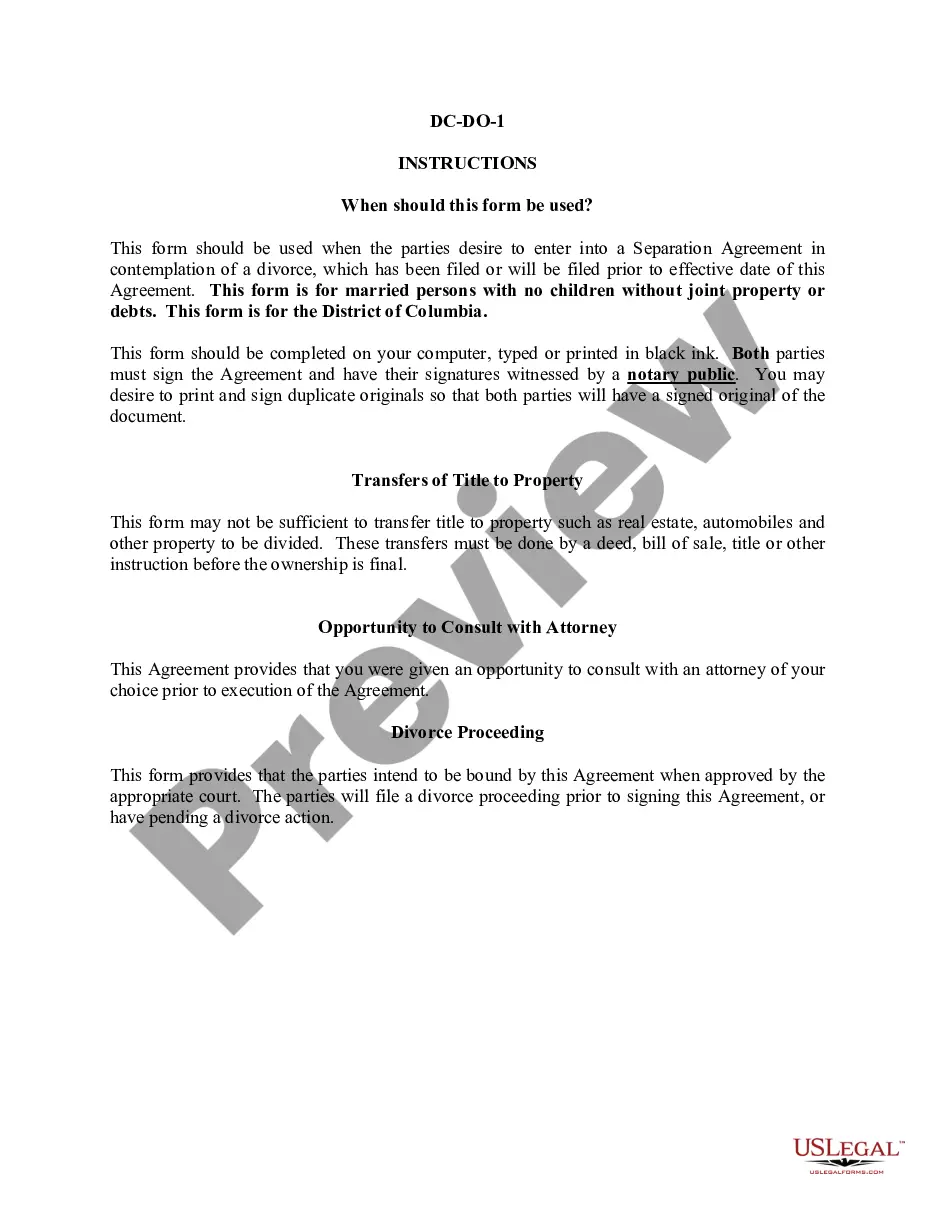

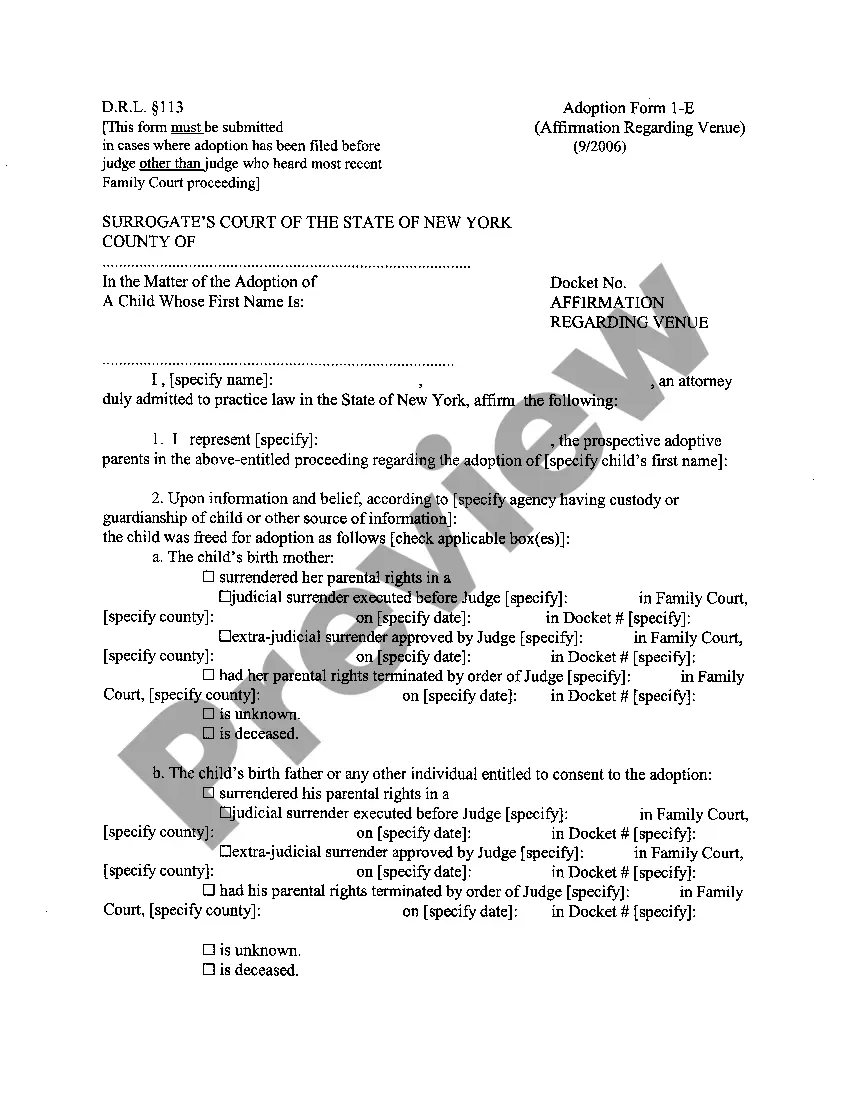

If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Next, you can complete, modify, print, or sign the Massachusetts Shared Leave Request Form.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have chosen the correct document template for the state/town of your preference.

- Check the form details to confirm that you have selected the correct form.

Form popularity

FAQ

'Leave request' refers to a formal appeal made by an employee to take time off for various reasons, such as illness, family care, or personal matters. It is essential to submit a leave request to maintain clear communication with your employer regarding your availability. The Massachusetts Shared Leave Request Form facilitates this process by allowing you to outline your reasons for needing leave in a structured format.

A. See below: Employees paid through W-2 and considered a covered individual under the statute cannot opt out of coverage, even if they don't plan to use the benefit. An owner paid through a W-2 is considered an employee of the company and cannot opt out of coverage.

Business owners and family businesses Any spouse, minor child (under 18), or parent of a business owner who is employed by their family member's business will have their wages excluded from PFML because their services are not considered "employment" in the statute.

If you are applying for military-related paid family leave benefits, or if you are currently self-employed or unemployed, please call the Department's Contact Center at (833) 344-7365 to begin your application.

Claimants who are on a leave of absence granted at their request will be considered not in unemployment and therefore ineligible for UI benefits during the period of their leave.

Massachusetts employers have until Dec. 20 to opt out of the state's paid family leave program and elect private coverage that meets certain criteria. Employers may opt for such plans to be self-funded or fully insured. "Employers who wish to apply for a self-funded private plan exemption for the quarter beginning Oct.

An individual may pay taxes on benefits if they received payments from PFML in a given calendar year. Contributions to the PFML Family and Employment Security Trust Fund are withheld from Massachusetts employees' paychecks to fund the program.

Generally no, you are not eligible for unemployment benefits if you take medical leave under the Family and Medical Leave Act and you cannot work.

You may not be eligible for Unemployment Insurance (UI) benefits if your only source of employment is from working as: An employee of a non-profit or religious organization. A worker trainee in a program run by a nonprofit or public institution. A real estate broker or insurance agent who work only on commission.

If you employ Massachusetts employees, you're required to comply with the PFML law. Learn more about the law, your obligations, how to make contributions, and other employer responsibilities.