Maryland Private Investigator Agreement - Self-Employed Independent Contractor

Description

How to fill out Private Investigator Agreement - Self-Employed Independent Contractor?

If you desire to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for commercial and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently.

You have access to every form you saved in your account. Click on the My documents section and choose a form to print or download again.

- Use US Legal Forms to obtain the Maryland Private Investigator Agreement - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to find the Maryland Private Investigator Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

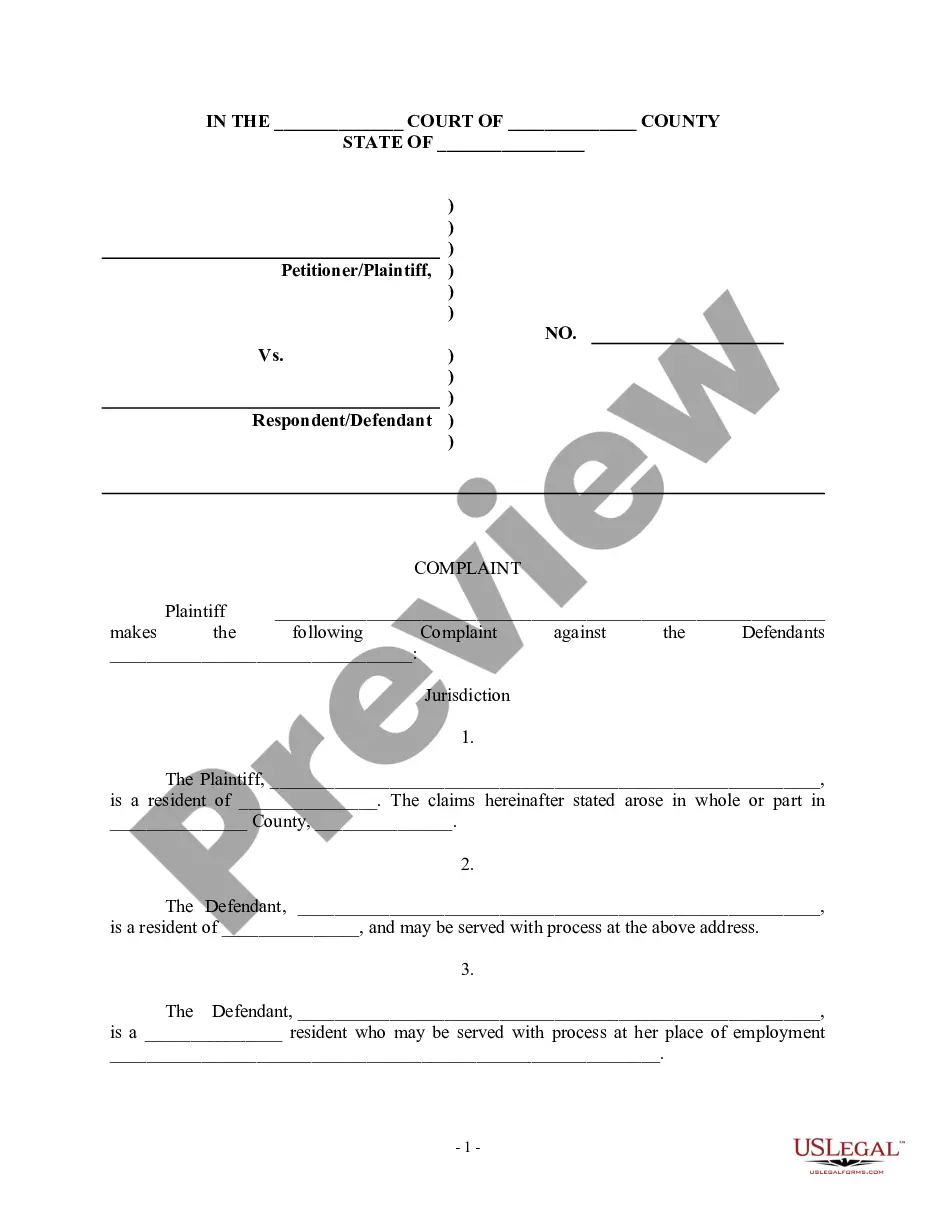

- Step 2. Utilize the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have located the form you need, click on the Get now button. Choose the payment plan you prefer and enter your details to create an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Maryland Private Investigator Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How Much Will a Private Investigator Charge? Fees in Maryland range from $40.00-$75.00 per hour and sometimes more. Investigators often have a specialty and like most services, you will pay a higher fee for the work of people with more experience and training.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.

The benefits of having a 1099 worker are that the company doesn't withhold income taxes, doesn't withhold and pay Social Security and Medicare taxes and doesn't pay unemployment taxes on what a contractor earns.

Five Things Your Contracts Should IncludeGet it in Writing. The most important part of every contract is that it must be in writing.Be Specific in Your Terms. Your contract should be specific in its terms.Dictate Terms for Contract Termination.Confidentiality Matters.

A 1099 refers to the tax form companies must provide to independent contractors for work performed throughout the year. Business taxpayers must report nonemployee compensation of $600 or more to the IRS using a Form 1099-NEC, Nonemployee Compensation.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.