Massachusetts Petty Cash Funds

Description

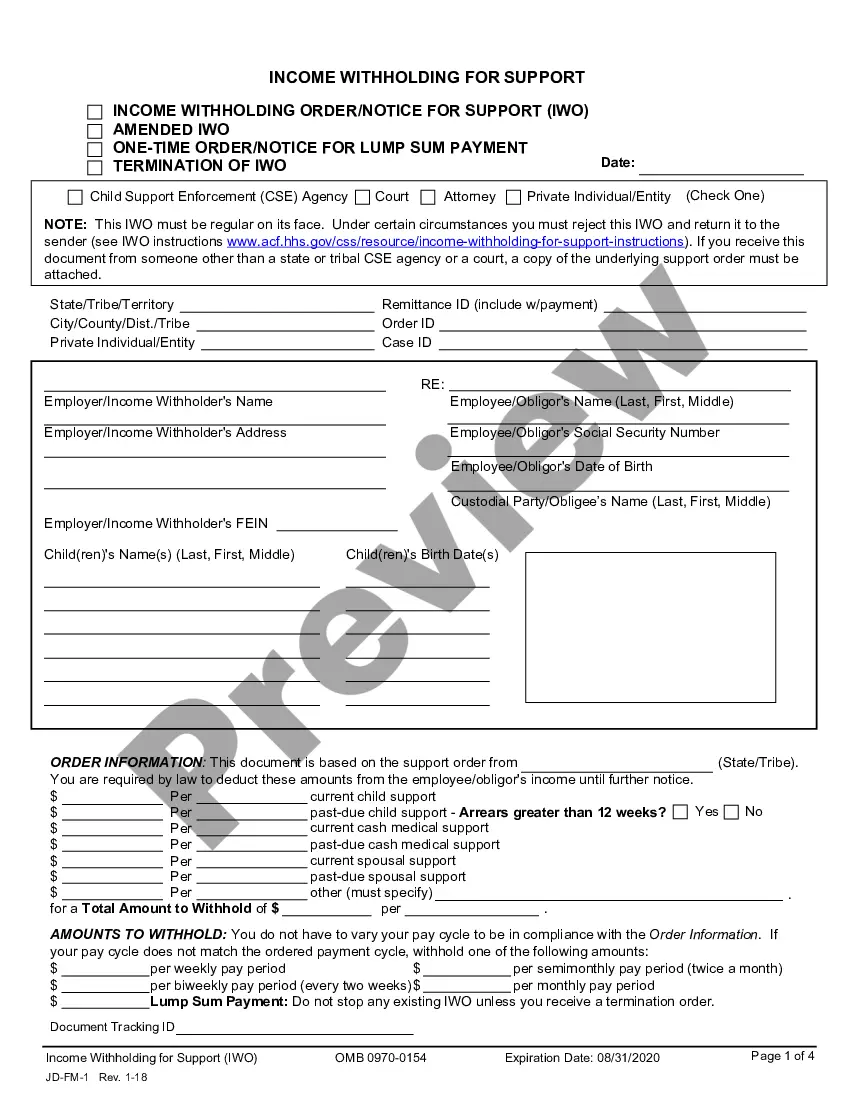

How to fill out Petty Cash Funds?

If you aim to fill, acquire, or print valid document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to access the documents you require.

Various templates for business and personal use are categorized by types and jurisdictions, or keywords.

Every legal document template you obtain is yours permanently. You will have access to every form you acquired in your account. Visit the My documents section to print or download a form again.

Stay competitive and procure, and print the Massachusetts Petty Cash Funds using US Legal Forms. There are thousands of professional and jurisdiction-specific forms available for your business or personal needs.

- Employ US Legal Forms to obtain the Massachusetts Petty Cash Funds in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to locate the Massachusetts Petty Cash Funds.

- You can also view forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your correct state/country.

- Step 2. Use the Review feature to examine the content of the form. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other variations of the legal document template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Choose the pricing option you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Massachusetts Petty Cash Funds.

Form popularity

FAQ

The approval process for cash assistance in Massachusetts usually takes about 30 days from the date you submit your application. However, providing comprehensive documentation can expedite the review of your case, enabling quicker access to Massachusetts Petty Cash Funds. If there are delays or your application needs more information, the agency will contact you, ensuring transparency throughout the process. Use US Legal Forms to streamline your application, so you can receive your funds without unnecessary delay.

The amount of cash assistance you may receive in Massachusetts varies based on your household size and income level. Massachusetts Petty Cash Funds typically provide a monthly benefit that aims to help cover basic living expenses. For example, a family of three can receive a specific amount that helps address their essential needs. When applying, you will learn about the potential benefits tailored to your situation through platforms like US Legal Forms.

In Massachusetts, individuals and families who meet specific income and resource limits may qualify for cash assistance through Massachusetts Petty Cash Funds. Generally, those with low income, including parents and caretakers of children, the elderly, and the disabled, can apply. It's important to gather necessary documents which verify your income, expenses, and household information, as these will support your application. Applying is straightforward when using resources like US Legal Forms, which can guide you through the process.

Yes, petty cash still exists and is widely used in many Massachusetts businesses today. While digital payment methods have gained popularity, petty cash remains useful for handling small transactions efficiently. Organizations often leverage platforms like USLegalForms to manage their petty cash systems effectively, ensuring proper documentation and compliance with accounting standards.

The primary rule for maintaining petty cash is to establish a clear process for its use and tracking. Businesses should create a petty cash policy that outlines who can access the funds and for what purposes. This structure ensures that Massachusetts Petty Cash Funds are used responsibly and accounted for systematically, preventing misuse or discrepancies.

Most businesses in Massachusetts choose to maintain petty cash between $100 and $500, depending on their specific operational needs and size. The objective is to have enough funds for minor expenses without tying up too much cash. For those looking for a streamlined solution to manage these funds, the USLegalForms platform offers templates and resources that simplify the process.

The limit for petty cash funds varies from one business to another, but it should not exceed what is necessary for daily operations. In Massachusetts, many businesses find a cap of $200 to $300 to be effective. Setting a clear limit helps manage cash flow and maintain accurate records, aligning with best practices for handling Massachusetts Petty Cash Funds.

Generally Accepted Accounting Principles (GAAP) require businesses to record petty cash funds on their balance sheet and monitor them carefully. Companies must set up a petty cash account, which reflects the total amount available for immediate disbursement. This structured approach helps ensure that Massachusetts Petty Cash Funds are handled in a transparent manner, providing clear financial statements and compliance.

In Massachusetts, businesses typically keep between $100 to $500 in petty cash funds, depending on their particular needs. This amount allows companies to manage small expenses effectively without excessive cash handling. By maintaining a reasonable limit, businesses can ensure better tracking of funds while minimizing the risk of loss or theft.

Completing petty cash involves reconciling your records regularly. At month-end, review all transactions related to Massachusetts Petty Cash Funds to ensure that expenses match receipts. Tally the remaining cash versus the total documented spend. If discrepancies arise, investigate promptly to maintain accurate financial reporting and budget compliance.