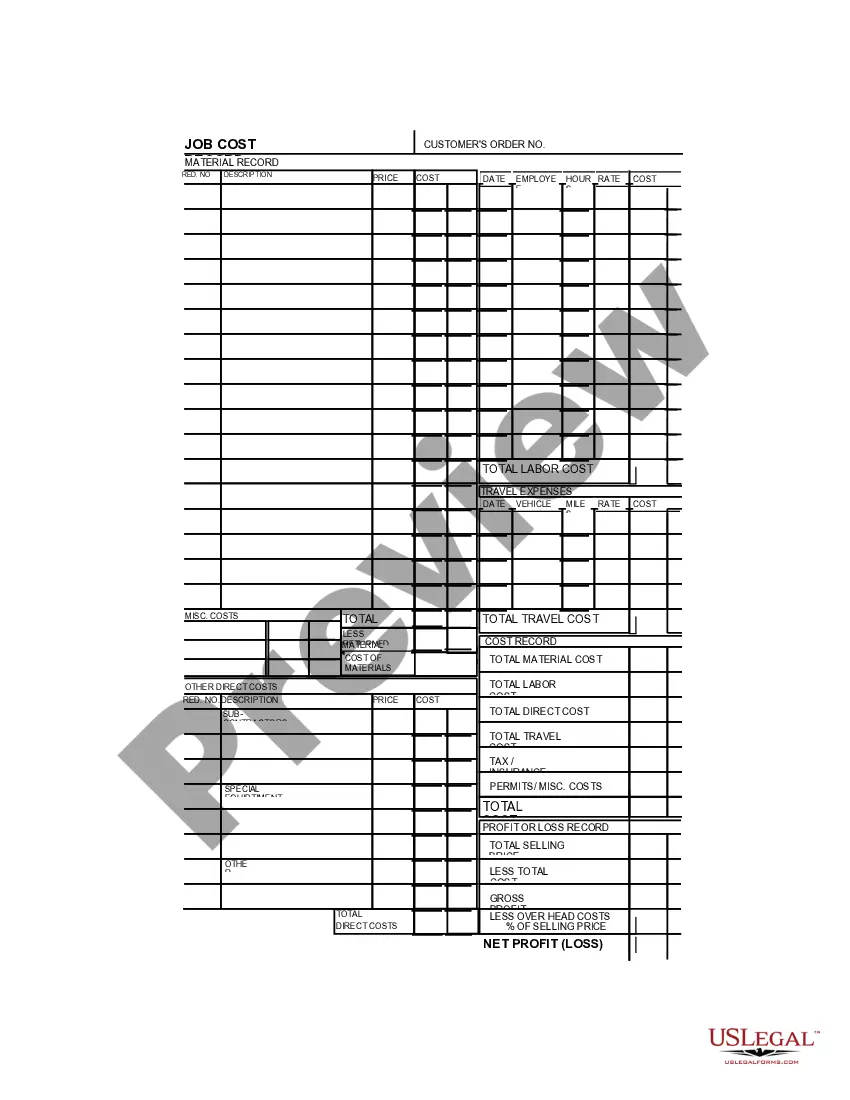

Massachusetts Job Invoice - Long

Description

How to fill out Job Invoice - Long?

If you need to obtain, download, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the website's user-friendly and convenient search feature to locate the documents you require.

A wide selection of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Download now button. Select the pricing plan you prefer and enter your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.Step 6. Choose the format of the legal form and download it to your device.Step 7. Complete, modify, and print or sign the Massachusetts Job Invoice - Long. Each legal document template you acquire is yours forever. You have access to every form you purchased in your account. Click the My documents section and select a form to print or download again. Compete and download, and print the Massachusetts Job Invoice - Long with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the Massachusetts Job Invoice - Long with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Massachusetts Job Invoice - Long.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form format.

Form popularity

FAQ

How long does a company have to invoice you for services? Invoices should be issued within a duration of 30 days after a company uses your services. Ideally, invoices must be issued as soon as the product is delivered, or the service is completed.

How to Fill out an Invoice Professional Invoicing ChecklistThe name and contact details of your business.The client's contact information.A unique invoice number.An itemized summary of the services provided.Specific payment terms.The invoice due date.The total amount owing on the invoice.

6 Years. This is the statute of limitation for invoices. The time frames will vary as per where you reside, but basically, it's usually six years. After six years, and you have not made any payment on the invoice at this time, then you are not obligated to pay the invoice.

Unless you agree a payment date, the customer must pay you within 30 days of getting your invoice or the goods or service. You can use a statutory demand to formally request payment of what you're owed.

The business name and address of the customer you're invoicing. a clear description of what you're charging for. the date you provided the goods or services (which is also known as the supply date) the date of the invoice.

Invoice on time You have to choose but never more than 30 days after you provide service to that client. If you are in the trades such as a plumber, you might bill the day after service, but you cannot wait months to bill a customer. The other way to look at it is to make sure you are billing on a regular schedule.

The general rule is 30 days from the invoice date. However, you can discuss this with your customer and either make it shorter or longer than 30 days. Regardless of what you agree upon, the payment terms and the due date should be clearly stated on the invoice.

How long should you wait for an invoice to be paid? As a business owner, you can set your payment terms, and the most common are either 30 days, 60 days, or 90 days.

It's best practice to use three to four digits (like 1001 instead of 1) to avoid confusion as your business grows and you bring on more clients and jobs. Chronological invoice numbers typically include the date as well as a unique invoice number so that not all invoices from the same day end up with the same number.

It might surprise many companies that unpaid invoices, under a simple contract, can be legitimately chased for up to 6 years. Legal proceedings would need to be issued within 6 years of the date of the invoice to prevent any claim from being statute barred.