Massachusetts Purchase Invoice

Description

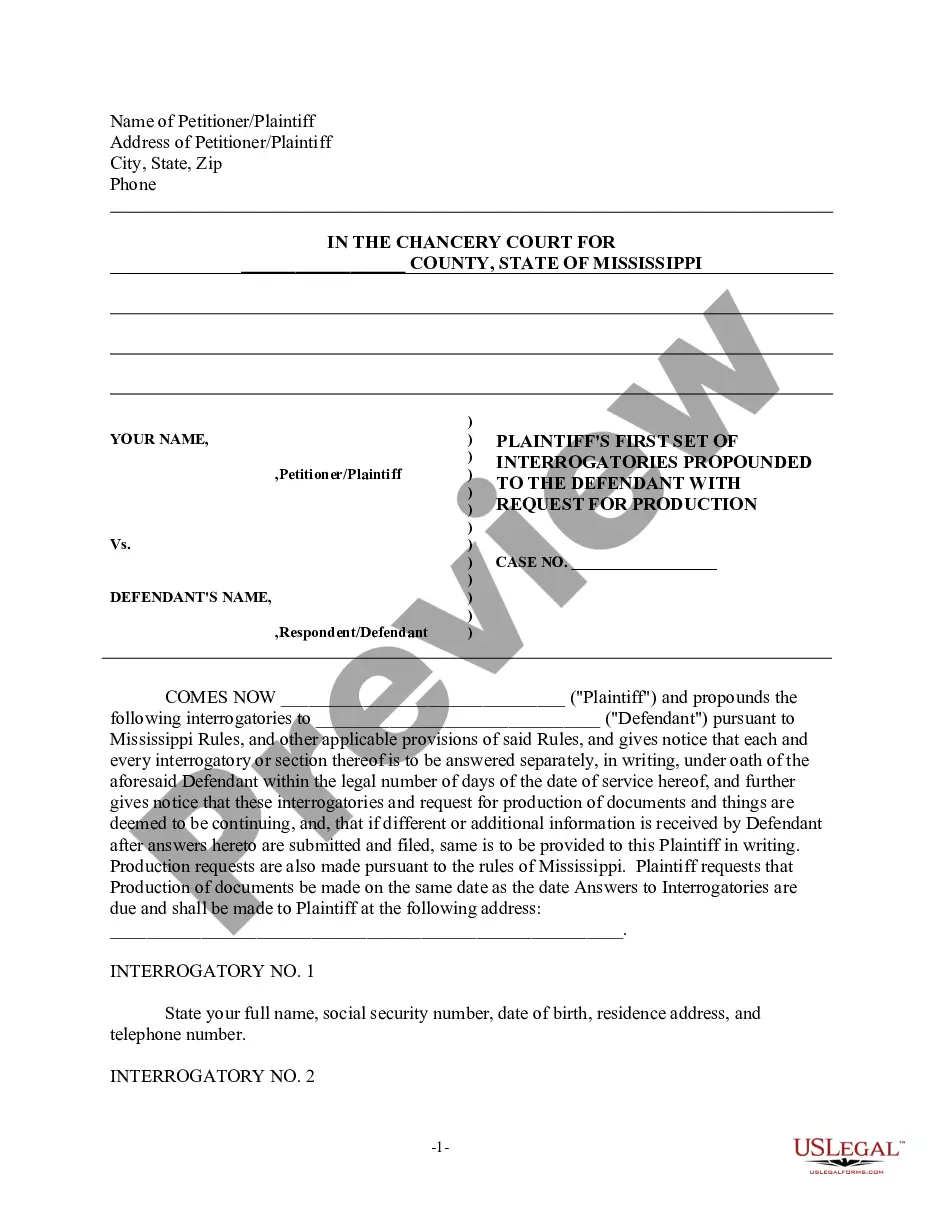

How to fill out Purchase Invoice?

Selecting the finest authentic document template can be a challenge. Of course, there are numerous formats available online, but how do you find the genuine type you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Massachusetts Purchase Invoice, that you can employ for business and personal purposes.

All forms are verified by professionals and comply with state and federal regulations.

If the form does not meet your needs, utilize the Search area to find the appropriate form. When you are confident that the form is suitable, click on the Get now button to retrieve the document. Select the payment plan you wish and provide the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document design to your device. Fill out, modify, print, and sign the received Massachusetts Purchase Invoice. US Legal Forms is the largest repository of legal forms where you can explore various document templates. Use the service to obtain professionally crafted paperwork that meets state standards.

- If you are already registered, Log In to your account and click the Download button to obtain the Massachusetts Purchase Invoice.

- Use your account to search through the legitimate forms you have acquired previously.

- Go to the My documents section of your account to get another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your area/region.

- You can review the form by clicking the Review button and read the form description to verify it is the right fit for you.

Form popularity

FAQ

Filling out a sales order invoice requires you to include important components like your business name, contact information, and the customer's details. Next, describe the items sold, indicating quantities and prices. Lastly, provide an invoice number and a summary of total costs. For an efficient way to generate a sales order invoice, you can use the resources available on USLegalForms, helping you create a precise Massachusetts Purchase Invoice.

To fill out an invoice for payment, start by including your business details, such as name, address, and contact information. Then, add the recipient's information, followed by a unique invoice number, date, and payment terms. Clearly list the products or services provided, along with their prices and totals. USLegalForms offers templates for creating a clear and professional Massachusetts Purchase Invoice that can ease this process.

structured purchase order should include essential details such as the buyer's information, supplier's information, order date, item descriptions, quantities, and prices. It may also contain terms regarding delivery and payment. Including all this information helps prevent misunderstandings and ensures smooth transactions. Consider using USLegalForms to generate a comprehensive Massachusetts Purchase Invoice that captures all necessary data.

A purchase order (PO) is a document that a buyer sends to a seller, indicating the specific products or services they wish to purchase. For instance, if a Massachusetts business orders 100 chairs from a supplier, the PO will outline the quantities, item descriptions, and agreed prices. This ensures both parties have a clear understanding of the transaction. Utilizing a streamlined platform like USLegalForms can help you create a professional Massachusetts Purchase Invoice along with your POs.

Vendor code and vendor ID often refer to the same thing, but it's good to confirm with your state department. These identifiers help you engage in transactions efficiently. For example, when dealing with a Massachusetts Purchase Invoice, knowing your vendor code or ID can streamline the payment and record-keeping process.

To get a Massachusetts vendor code, begin by filling out the vendor registration form available on the Massachusetts state website. After submitting your application, wait for confirmation. Once approved, you will receive your vendor code, enabling you to process transactions effectively, including your Massachusetts Purchase Invoice.

You can locate your Massachusetts vendor code by accessing your account on the state’s procurement website. If you cannot find it online, consider reaching out directly to the state office for support. Your vendor code is essential when handling Massachusetts Purchase Invoices, so keep it handy for future transactions.

Getting a vendor code is straightforward. First, you need to register with the appropriate state department, often the finance or procurement office. After completing the registration, you will receive your vendor code via email or through your account portal, which is crucial for processing your Massachusetts Purchase Invoice efficiently.

To obtain a Massachusetts sales tax number, you need to register your business with the Massachusetts Department of Revenue. You can complete this process online through their website. Once registered, you will receive a sales tax ID, which you will use for transactions involving a Massachusetts Purchase Invoice. Ensure you have all necessary business information ready for a smooth registration.

A Massachusetts vendor's registration is a formal acknowledgment by the state that allows businesses to participate in governmental procurement processes. By registering, you gain access to opportunities to submit Massachusetts Purchase Invoices for state contracts. Registration includes providing necessary documentation and basic business information. Leveraging the US Legal Forms platform can make this process easier, providing templates and guidance to help you succeed.