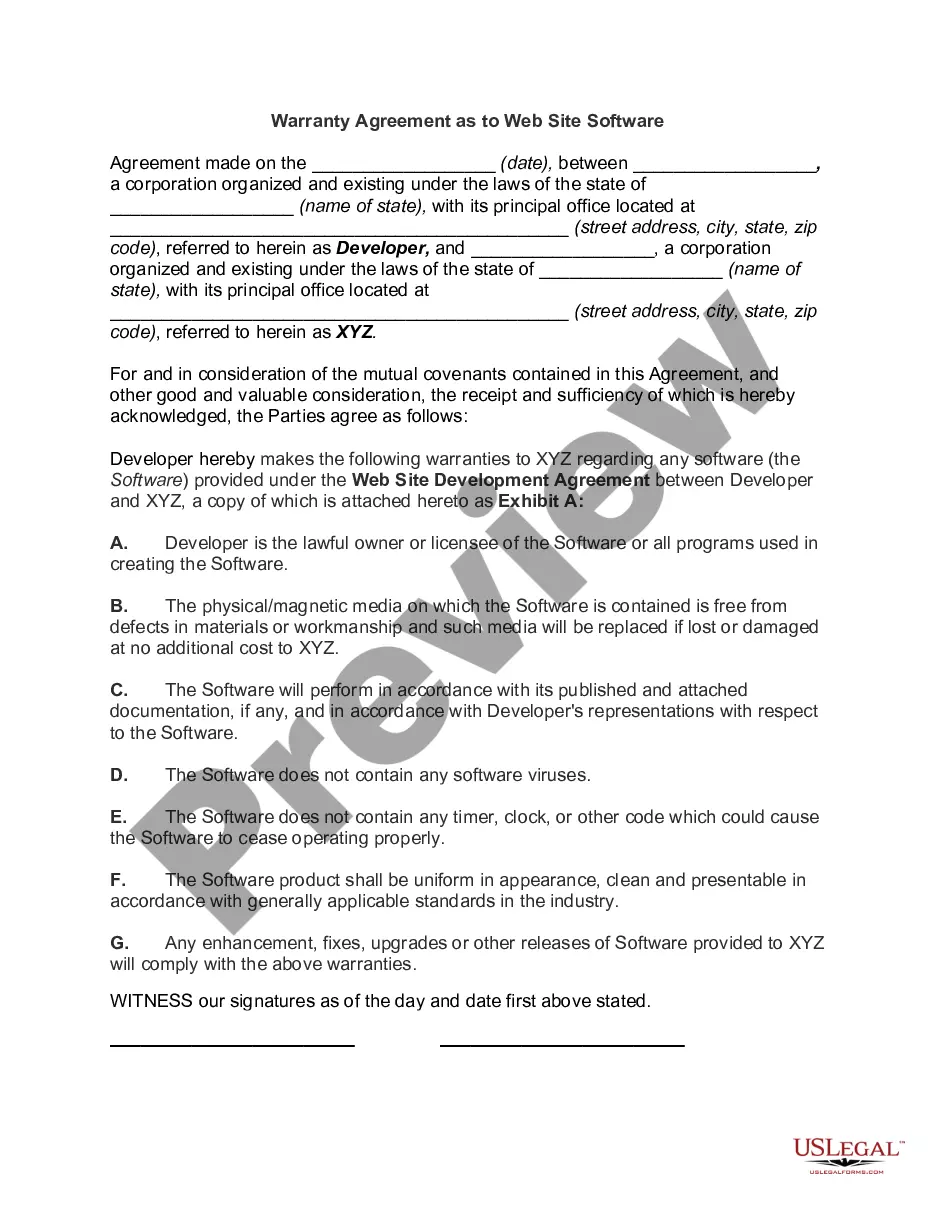

Massachusetts Warranty Agreement as to Web Site Software

Description

How to fill out Warranty Agreement As To Web Site Software?

Finding the correct valid document format can be challenging.

Of course, there are numerous templates available online, but how do you obtain the valid document you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Massachusetts Warranty Agreement for Web Site Software, which you can use for business and personal purposes.

First, ensure you have selected the correct form for your location. You can preview the form using the Review button and read the form description to confirm it is suitable for you.

- All documents are reviewed by experts and meet state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire button to obtain the Massachusetts Warranty Agreement for Web Site Software.

- Use your account to browse through the legal documents you have previously acquired.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

Form popularity

FAQ

According to the Department~'s data processing regulations, the punching or input of data is taxable only if it is the sole service provided under a contract. It is not taxable when performed as a step in processing a client's data.

Sales of custom software, personal and professional services, and reports of individual information are generally exempt from Massachusetts sales and use taxes.

California: SaaS is not a taxable service. However, software or information that is delivered electronically is exempt. The ability to access software from a remote network or location is exempt. Under California sales and use tax law, there must be a transfer of TPP, in order to have a taxable event.

Sales of prewritten computer software, regardless of the method of delivery, are subject to the Massachusetts sales tax. SaaS, cloud computing and electronically downloaded software are all taxable in the state because the object of the transaction is acquiring the right to use the software.

The sale, license, lease or other transfer of a right to use software on a server hosted by the taxpayer or a third party, as described in 830 CMR 64H. 1.3(3)(a), is generally taxable under Massachusetts sales and use tax law.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax.

According to the Department~'s data processing regulations, the punching or input of data is taxable only if it is the sole service provided under a contract. It is not taxable when performed as a step in processing a client's data.

Generally tax applies to the conversion of customer-furnished data from one physical form of recordation to another physical form of recordation. However, if the contract is for the service of developing original information from customer-furnished data, tax does not apply to the charges for the service.

Sales of custom software, personal and professional services, and reports of individual information are generally exempt from Massachusetts sales and use taxes.