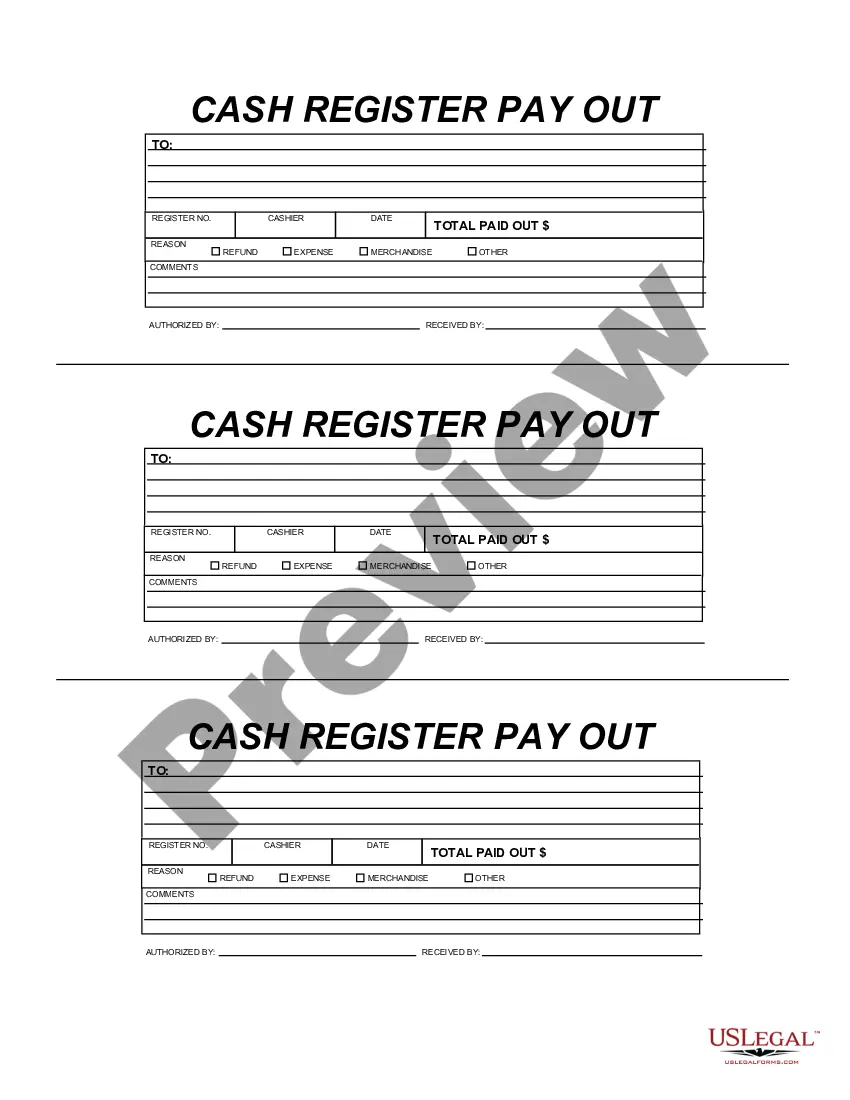

Massachusetts Cash Register Payout

Description

How to fill out Cash Register Payout?

If you need to accumulate, procure, or produce official document templates, utilize US Legal Forms, the most extensive selection of legal documents available online.

Leverage the site's straightforward and convenient search to find the documents you require. A variety of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Use US Legal Forms to locate the Massachusetts Cash Register Payout in just a few clicks.

Every legal document you acquire is yours permanently. You have access to all forms you have obtained in your account. Select the My documents section and choose a form to print or download again.

Compete and obtain, and print the Massachusetts Cash Register Payout with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your personal or business needs.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to obtain the Massachusetts Cash Register Payout.

- You can also access forms you previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Remember to read the information.

- Step 3. If you are not content with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, choose the Buy Now option. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your Misa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Massachusetts Cash Register Payout.

Form popularity

FAQ

The California courts have held that losses occurring without any fault on the part of the employee or that are merely the result of simple negligence are inevitable in almost any business operation and thus, the employer must bear such losses as a cost of doing business.

Is it Legal to Dock Pay for Poor Performance or for Mistakes? Generally, no an employer cannot engage in docking pay or fining employees for poor performance or mistakes, shortages, or damages. However, if the employee agreed in writing that a deduction could be made, the employer may be able to do so.

Massachusetts law is clear; if you were terminated or laid-off, you are owed your last paycheck on the same day. If you quit, you are owed your final paycheck by the next regularly scheduled payday. So, if you normally are paid every Friday, and you quit, you should receive your last paycheck on that Friday.

There are no circumstances under which an employer can totally withhold a final paycheck under Massachusetts law; employers are typically required to issue a final paycheck containing compensation for all earned, unpaid wages.

No, your employer cannot legally make such a deduction from your wages if, by reason of mistake or accident a cash shortage, breakage, or loss of company property/equipment occurs.

Massachusetts laws Payment of Wages. In most circumstances, if you are fired you should be paid in full on your last day. "any employee discharged from such employment shall be paid in full on the day of his discharge..."

Workers who are fired or laid off must be paid in full on their last day of work. Employers may require workers to be paid their wages through direct deposit, however, employers cannot choose the financial institution where workers will receive the funds. Workers cannot be charged a fee to have access to their pay.

The basic rule regarding final pay in Massachusetts is this: 1) An employee who is terminated involuntarily must be paid in full on the day of discharge. 2) An employee who quits a job can be paid on the next regular pay date after his or her departure.

If your employer has not paid you your paycheck, Massachusetts law guarantees you certain rights. First, your employer must pay you within six days after your pay period ends (seven days if you work a seven-day workweek). If you are fired, your employer must pay you all your earned wages on your last day of work.