Idaho Triple Net Lease for Industrial Property

Description

How to fill out Triple Net Lease For Industrial Property?

Are you in a scenario where you require documents for potentially professional or personal purposes nearly every business day.

There is a multitude of legitimate form templates available online, but locating reliable ones isn't straightforward.

US Legal Forms offers a vast selection of form templates, including the Idaho Triple Net Lease for Commercial Property, which are designed to comply with state and federal regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can retrieve an additional copy of the Idaho Triple Net Lease for Commercial Property at any time, if necessary. Just access the relevant form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and minimize errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Idaho Triple Net Lease for Commercial Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to the correct city/state.

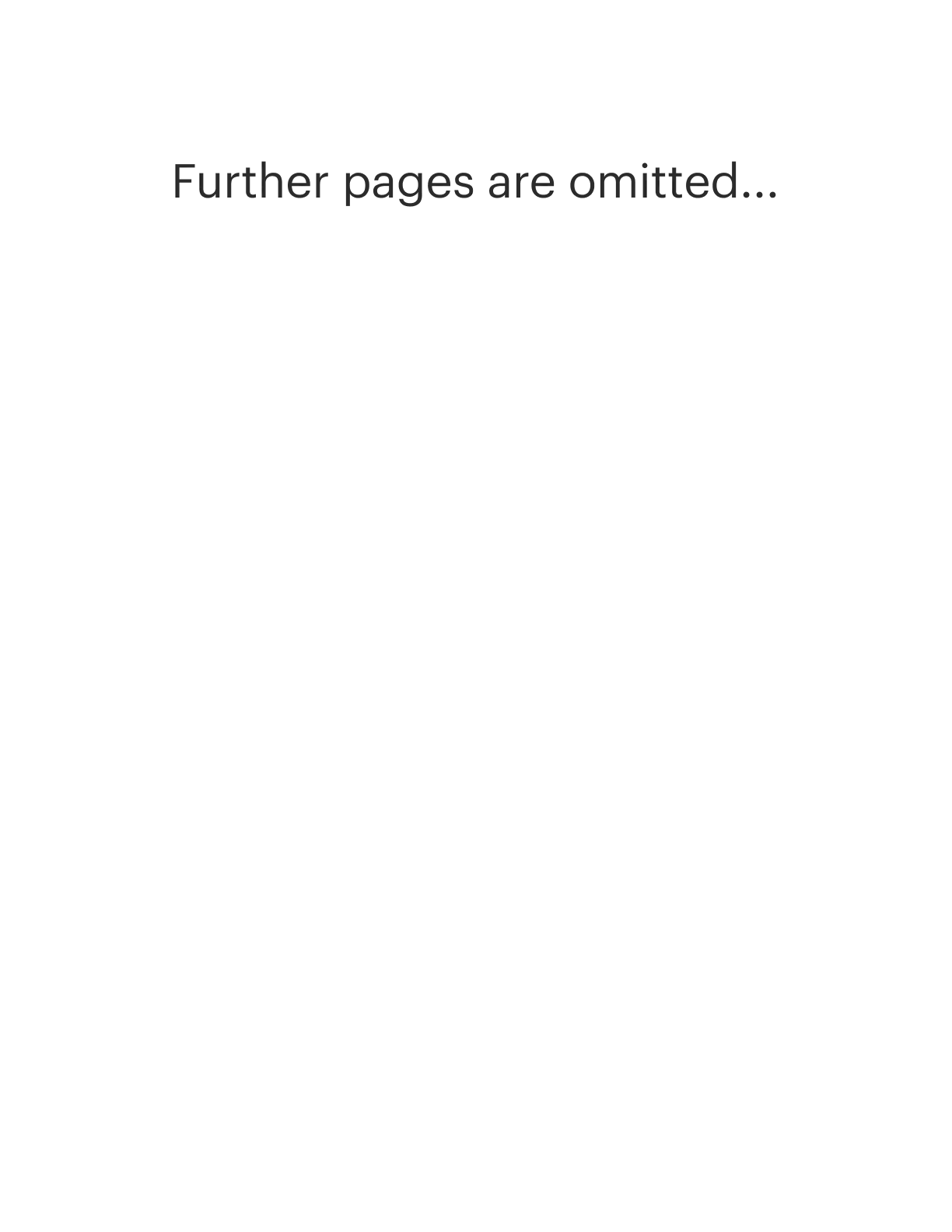

- Use the Review button to examine the document.

- Check the outline to confirm that you have chosen the appropriate form.

- If the form isn’t what you’re looking for, use the Search field to find a form that suits your needs and requirements.

- If you find the correct form, click Get now.

- Choose the pricing plan you desire, fill out the necessary information to create your account, and complete the purchase with your PayPal or credit card.

Form popularity

FAQ

When structuring an Idaho Triple Net Lease for Industrial Property, start by drafting a detailed agreement that specifies the rent, lease duration, and responsibilities for operating expenses. It is vital to include provisions for adjustments in costs and regular communication between the landlord and tenant. Using a platform like USLegalForms can help streamline this process by providing templates and guidance for drafting a comprehensive lease.

Calculating an Idaho Triple Net Lease for Industrial Property involves adding together the rent and estimated expenses for property taxes, insurance, and maintenance. First, determine the total square footage of the property, then calculate the shared costs based on that size. It can be beneficial to consult with experts to obtain accurate estimates for expenses before finalizing the lease.

To structure an Idaho Triple Net Lease for Industrial Property, start by defining the terms for rent, responsibility for property-related expenses, and any additional clauses. It is crucial to specify who pays for repairs and major maintenance, as well as how these costs are calculated. Consulting with legal professionals can also help ensure that the lease meets all regulatory requirements and safeguards both parties.

In an Idaho Triple Net Lease for Industrial Property, the tenant usually takes on the responsibility for property taxes, insurance, and maintenance costs. This structure allows the landlord to focus on their investment while the tenant manages day-to-day expenses. Both parties should clearly outline these responsibilities in the lease agreement to avoid any misunderstandings.

Calculating commercial rent with an Idaho Triple Net Lease for Industrial Property involves understanding both base rent and additional expenses. The base rent is typically set per square foot, while additional costs include property taxes, insurance, and maintenance fees. When these are summed, tenants can anticipate a more accurate total monthly payment, allowing for better budgeting and financial planning.

To get approved for an Idaho Triple Net Lease for Industrial Property, potential tenants must present a solid financial background and credit history. Property owners often require proof of business revenue, any past lease agreements, and personal guarantees. By demonstrating reliability and understanding lease obligations, you enhance your chances of securing the lease.

When considering an Idaho Triple Net Lease for Industrial Property, certain criteria come into play. These typically include the length of the lease, the condition of the property, and the financial strength of the tenant. Additionally, it's essential to review the terms regarding property maintenance and the responsibilities for taxes and insurance, ensuring both parties understand their commitments.

A triple net lease allows landlords to transfer certain costs, like property taxes, insurance, and maintenance, to the tenant. This arrangement provides predictability for property owners, as they enjoy steady income without unexpected expenses. For tenants, an Idaho Triple Net Lease for Industrial Property can offer lower rents and the opportunity to have more control over the property they occupy.

Commercial leases encompass a variety of property types, including retail and office spaces, while industrial leases specifically pertain to properties used for manufacturing, warehousing, or distribution. This distinction influences lease terms, costs, and tenant responsibilities. For those focused on an Idaho Triple Net Lease for Industrial Property, recognizing these differences can help align your business needs with suitable leasing options.

The main difference between industrial gross and NNN leases lies in the allocation of expenses. In an industrial gross lease, the landlord covers some costs, while in a triple net lease, tenants take on all expenses related to the property, including taxes, insurance, and maintenance. Understanding these differences is key when considering options such as the Idaho Triple Net Lease for Industrial Property.