Massachusetts Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares

Description

How to fill out Legend On Stock Certificate With Reference To Separate Document Restricting Transfer Of Shares?

Are you in the place in which you need to have files for either company or person functions almost every day time? There are a lot of legitimate file web templates available on the net, but discovering types you can depend on isn`t simple. US Legal Forms offers 1000s of form web templates, like the Massachusetts Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares, which can be composed in order to meet state and federal needs.

When you are previously knowledgeable about US Legal Forms website and have your account, just log in. Next, you may download the Massachusetts Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares design.

Unless you offer an profile and need to begin to use US Legal Forms, adopt these measures:

- Discover the form you want and make sure it is for that proper area/county.

- Take advantage of the Preview key to examine the form.

- Read the outline to actually have chosen the right form.

- In case the form isn`t what you are trying to find, use the Research area to find the form that meets your needs and needs.

- If you obtain the proper form, click on Buy now.

- Select the pricing prepare you need, submit the necessary info to generate your account, and pay for the transaction utilizing your PayPal or credit card.

- Select a hassle-free document structure and download your duplicate.

Discover all the file web templates you possess purchased in the My Forms food list. You can aquire a more duplicate of Massachusetts Legend on Stock Certificate with Reference to Separate Document Restricting Transfer of Shares anytime, if necessary. Just go through the necessary form to download or produce the file design.

Use US Legal Forms, one of the most extensive selection of legitimate kinds, to conserve some time and stay away from blunders. The assistance offers skillfully created legitimate file web templates that can be used for a range of functions. Make your account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

A restricted security must bear a legend giving notice of the restrictions. That legend which must be removed after the restrictions are lifted. A security with a legend cannot be transferred or sold and must be removed before any transaction.

The transfer agent will require an opinion letter from the issuer's counsel or from his or her own lawyer plus 144 papers completed by a broker?stating that the restricted legend can be removed.

Removing a restricted stock legend is a matter solely in the discretion of the issuer of the securities. State law, not federal law, covers disputes about the removal of legends. Thus, the SEC will not take action in any decision or dispute about removing a restrictive legend.

The purpose of the restrictive legend or notation is to protect the issuing company from loosing its private placement exemption for the initial sale of the securities and to notify the investor that the restricted securities cannot be resold into the public securities market without satisfying certain requirements.

The purpose of the restrictive legend or notation is to protect the issuing company from loosing its private placement exemption for the initial sale of the securities and to notify the investor that the restricted securities cannot be resold into the public securities market without satisfying certain requirements.

Restricted stock refers to unregistered shares of ownership in a corporation that are issued to corporate affiliates, such as executives and directors. Restricted stock is non-transferable and must be traded in compliance with special Securities and Exchange Commission (SEC) regulations.

Rule 144 is a set of regulations that outline the conditions in which the sale of unregistered or restricted stock shares can be sold. Typically, criteria must be met before a sale is allowed, including a minimum period in which the stock should be held, which can be up to one year.

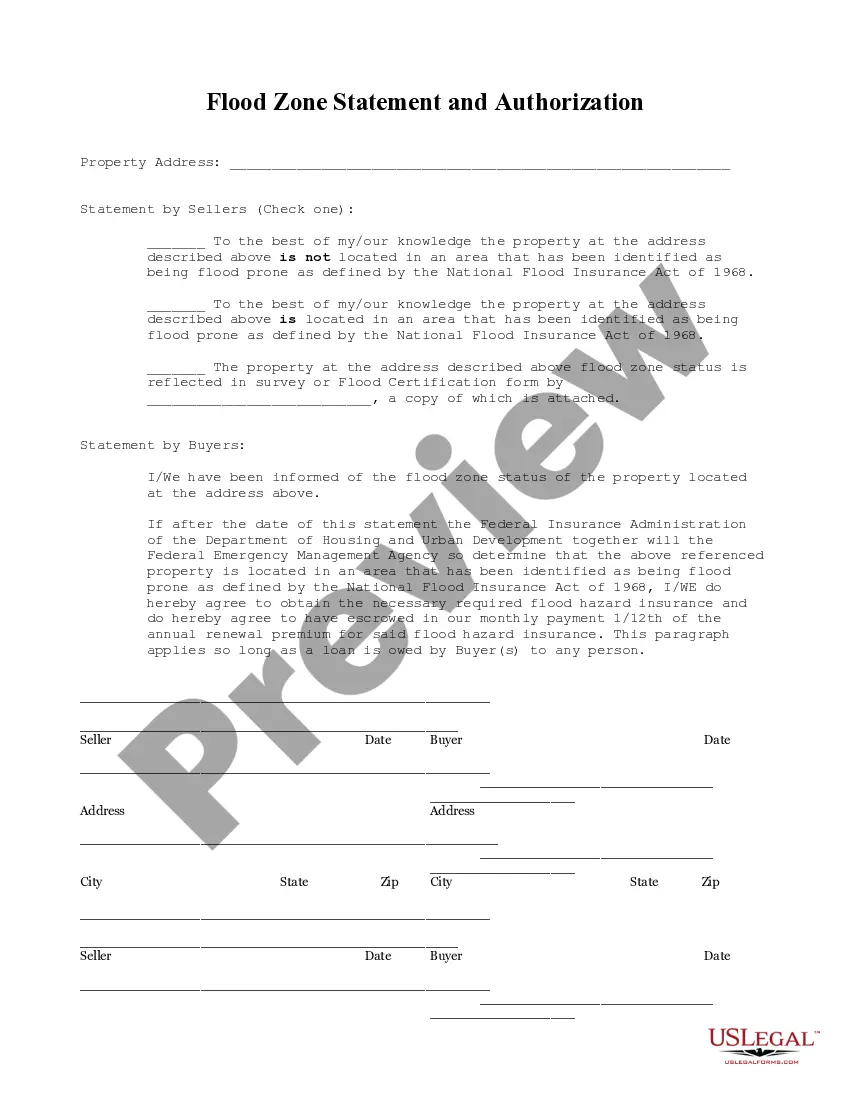

A legend is a statement on a stock certificate noting restrictions on the transfer of the stock.