Massachusetts Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders

Description

How to fill out Legend On Stock Certificate Giving Notice Of Restriction On Transfer Due To Stock Redemption Agreement Requiring First An Offer To The Corporation And Then An Offer To Other Stockholders?

You can invest hrs on-line trying to find the authorized record format that suits the federal and state specifications you require. US Legal Forms offers a huge number of authorized varieties which are analyzed by professionals. It is possible to download or print the Massachusetts Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders from the service.

If you already have a US Legal Forms accounts, you may log in and click on the Download button. Next, you may total, change, print, or sign the Massachusetts Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders. Each authorized record format you buy is your own permanently. To have an additional version for any acquired form, visit the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms internet site initially, stick to the straightforward instructions under:

- Very first, make certain you have chosen the best record format to the region/town of your liking. See the form explanation to make sure you have chosen the appropriate form. If available, use the Review button to look with the record format at the same time.

- If you would like find an additional version of your form, use the Search area to discover the format that meets your requirements and specifications.

- After you have discovered the format you would like, click on Buy now to continue.

- Choose the rates plan you would like, type in your qualifications, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You should use your bank card or PayPal accounts to pay for the authorized form.

- Choose the file format of your record and download it in your product.

- Make modifications in your record if necessary. You can total, change and sign and print Massachusetts Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders.

Download and print a huge number of record layouts making use of the US Legal Forms web site, which provides the most important variety of authorized varieties. Use specialist and status-certain layouts to deal with your business or individual demands.

Form popularity

FAQ

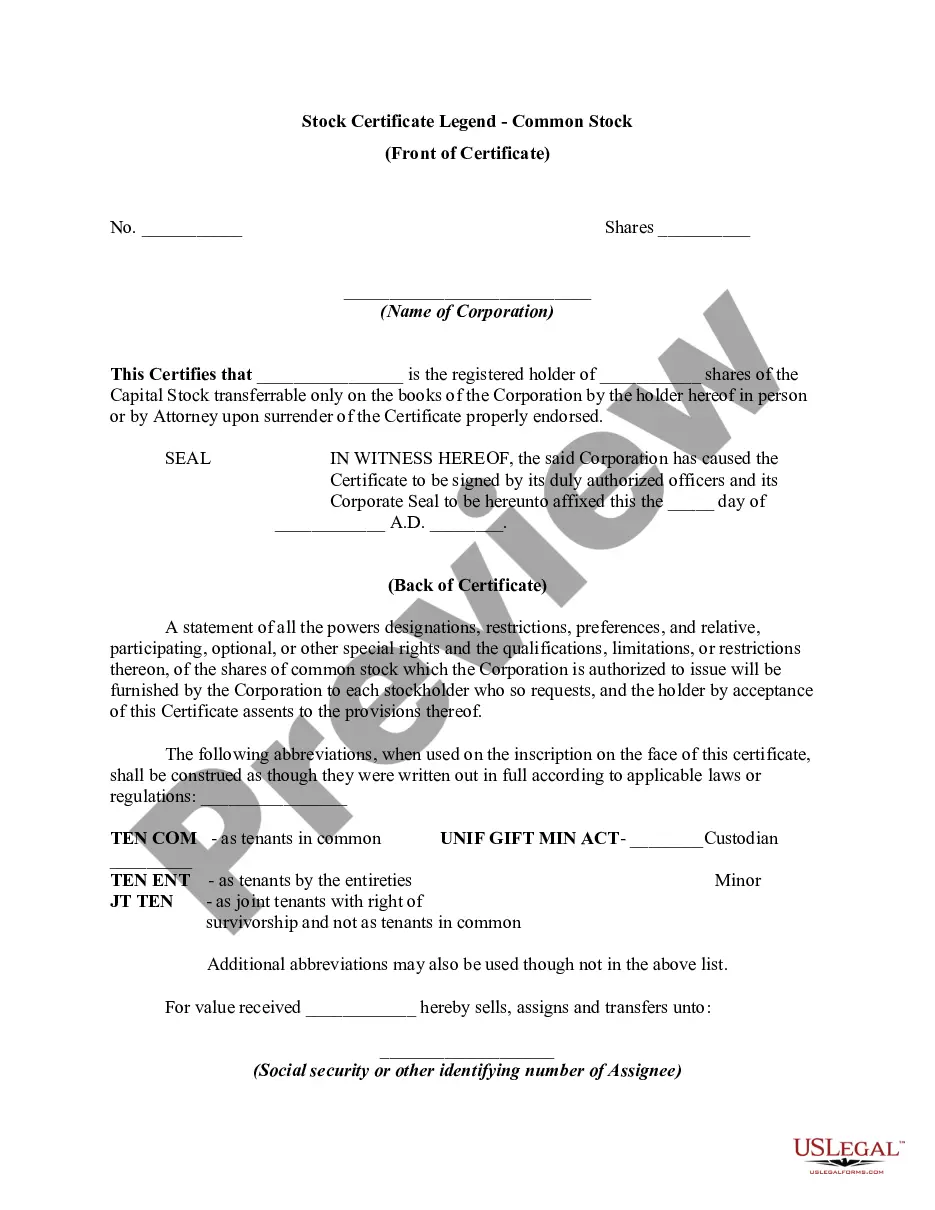

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal.

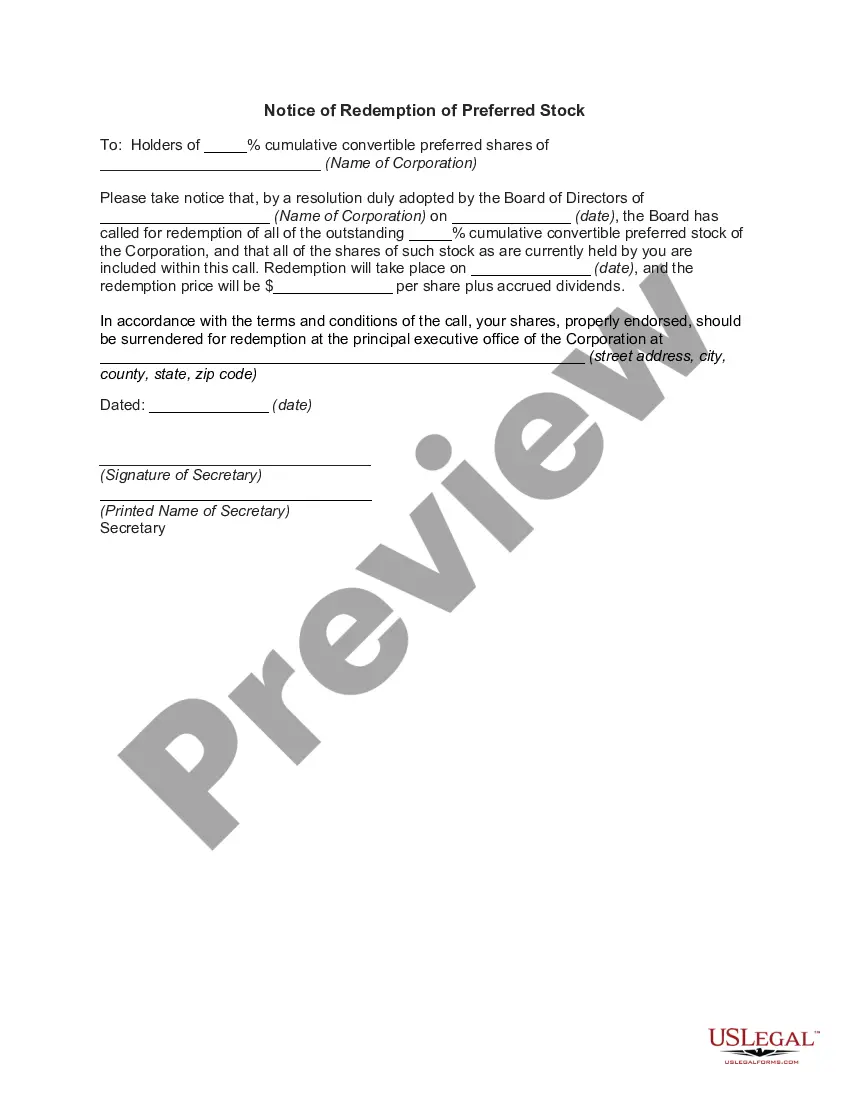

Most importantly, a stock redemption plan provides tax-free, cash resources to pay a deceased owner's surviving family for their share of the business. Without extra funds available, a business might otherwise have to liquidate or sell assets in order to stay afloat during such a challenging time.

A stock redemption agreement is a buy-sell agreement between a private corporation and its shareholders. The agreement stipulates that if a triggering event occurs, the company will purchase shares from the shareholder upon their exit from the company.

Unlike a redemption, which is compulsory, selling shares back to the company with a repurchase is voluntary. However, a redemption typically pays investors a premium built into the call price, partly compensating them for the risk of having their shares redeemed.

When a corporation purchases the stock of a departing shareholder, it's called a ?redemption.? When the other stockholders purchase the stock, it's called a cross-purchase. Typically, the redemption versus cross-purchase decision doesn't impact the ultimate control results.

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.