A debt collector may not use unfair or unconscionable means to collect a debt. This includes causing a person to incur charges for communications by concealing the true propose of the communication.

California Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication

Description

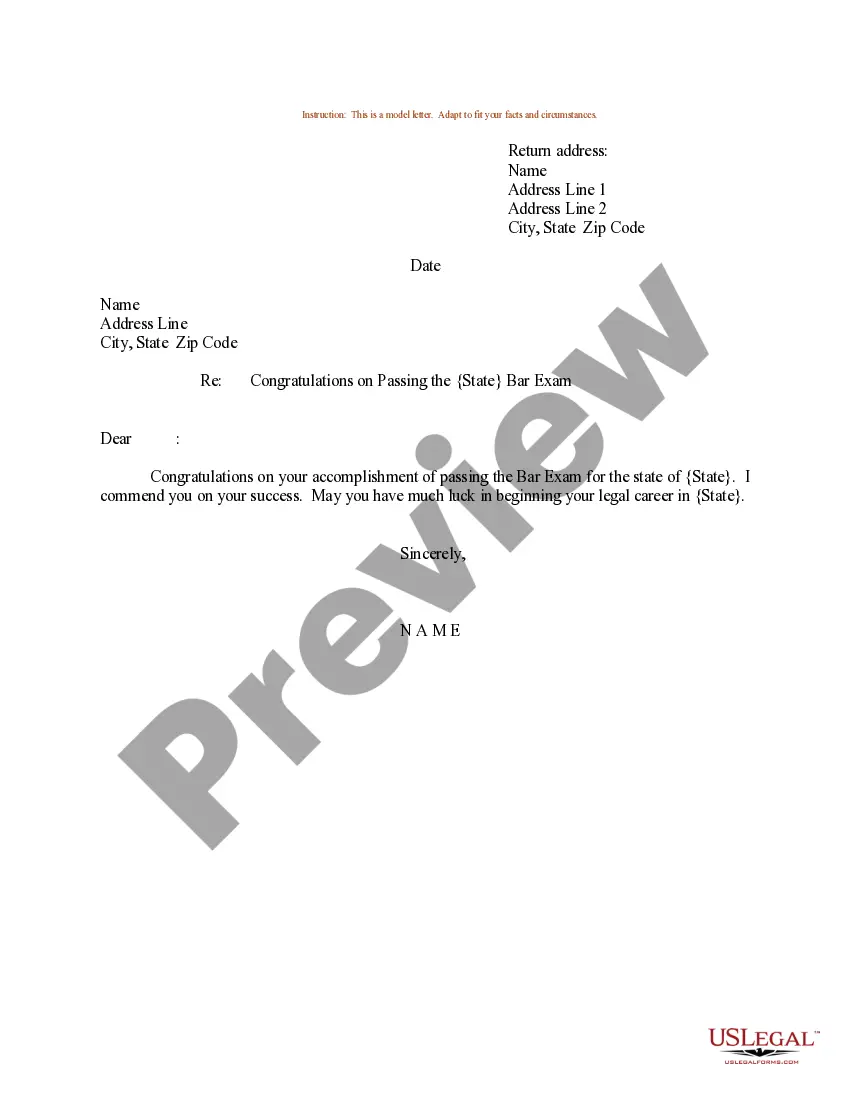

How to fill out Notice To Debt Collector - Causing A Consumer To Incur Charges For Communications By Concealing The Purpose Of The Communication?

If you need to complete, obtain, or print authentic document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to find the documents you require.

A range of templates for business and personal use is organized by categories and states, or keywords.

Step 4. Once you have found the desired form, click the Buy now button. Choose your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the California Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download button to access the California Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Utilize the Review option to examine the content of the form. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other templates of the legal form type.

Form popularity

FAQ

The law makes it illegal for debt collectors to harass debtors in other ways, including threats of bodily harm or arrest. They also cannot lie or use profane or obscene language. Additionally, debt collectors cannot threaten to sue a debtor unless they truly intend to take that debtor to court.

You have 30 days to dispute a debt or part of a debt within 30 days from when you first receive the required information from the debt collector.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

If you have a personal vehicle, a debt collector can legally take your car, sell it, and use the money to settle the debt. There's one crucial thing to keep in mind. If your debt is related to a property like a piece of land or defaulted on a car loan, these possessions can be repossessed to settle the debts.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

The California statute is called the Rosenthal Fair Debt Collection Practices Act. Creditors and debt collection agencies are permitted to take reasonable steps to enforce and collect payment of debts. That is because an efficient and productive economy requires a credit process.

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

If, within the 30-day period, the consumer disputes in writing any portion of the debt or requests the name and address of the original creditor, the collector must stop all collection efforts until he or she mails the consumer a copy of a judgment or verification of the debt, or the name and address of the original

The Rosenthal Act requires a debt collector to inform you if the statute of limitations for a particular debt has passed. The collector has to include the notice in the first written communication it sends you after the statute of limitations expires.