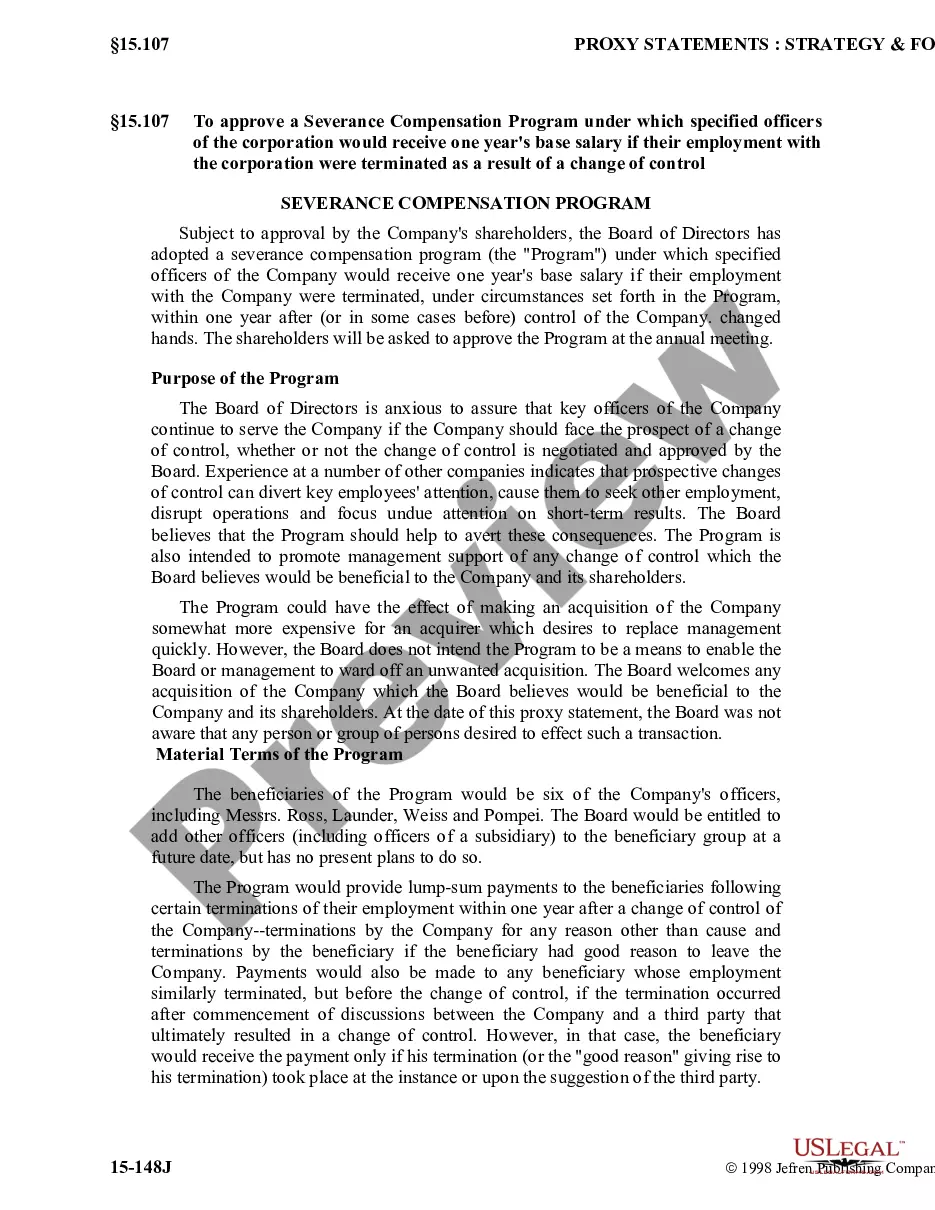

Massachusetts Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

How to fill out Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

US Legal Forms - among the biggest libraries of lawful types in America - gives an array of lawful file themes it is possible to download or printing. Making use of the internet site, you may get a huge number of types for company and person functions, categorized by classes, claims, or search phrases.You will discover the latest types of types such as the Massachusetts Sample Letter for Request for IRS not to Off Set against Tax Refund within minutes.

If you already have a subscription, log in and download Massachusetts Sample Letter for Request for IRS not to Off Set against Tax Refund through the US Legal Forms local library. The Acquire switch will appear on each kind you perspective. You get access to all in the past acquired types inside the My Forms tab of your respective bank account.

If you want to use US Legal Forms for the first time, listed below are easy recommendations to help you started off:

- Ensure you have selected the correct kind for your town/region. Go through the Review switch to review the form`s content. Read the kind outline to actually have selected the right kind.

- When the kind does not suit your specifications, make use of the Search area towards the top of the display screen to get the one that does.

- Should you be content with the shape, affirm your option by simply clicking the Get now switch. Then, choose the costs strategy you want and supply your references to register on an bank account.

- Procedure the deal. Make use of your Visa or Mastercard or PayPal bank account to perform the deal.

- Pick the format and download the shape on the device.

- Make changes. Fill up, change and printing and indicator the acquired Massachusetts Sample Letter for Request for IRS not to Off Set against Tax Refund.

Each format you included with your money lacks an expiry day and is also your own forever. So, if you would like download or printing another version, just proceed to the My Forms area and then click about the kind you will need.

Gain access to the Massachusetts Sample Letter for Request for IRS not to Off Set against Tax Refund with US Legal Forms, probably the most comprehensive local library of lawful file themes. Use a huge number of specialist and express-distinct themes that meet up with your organization or person demands and specifications.

Form popularity

FAQ

Prevent an offset Pay the full amount listed on the Intent to Offset Federal Payments (FTB 1102). Use the payment coupon included in the letter when you send your check or money order. To make a payment online, visit Payment options .

We send the money we withhold to the federal Office of Child-Support Enforcement, which is part of the Department of Health and Human Services (HHS). They send the money to the states.

The Department of the Treasury will notify you by mail when a federal offset occurs. The letter includes the amount and date of the offset, and EDD contact information.

BFS will send you a notice if an offset occurs. The notice will reflect the original refund amount, your offset amount, the agency receiving the payment, and the address and telephone number of the agency. BFS will notify the IRS of the amount taken from your refund once your refund date has passed.

The Treasury Offset Program (TOP) collects past-due (delinquent) debts (for example, child support payments) that people owe to state and federal agencies. TOP matches people and businesses who owe delinquent debts with money that federal agencies are paying (for example, a tax refund).

In response to the COVID-19 pandemic, the government has paused all collections through the Treasury Offset Program until June 30, 2023. This means, as a taxpayer, the IRS won't seize your 2023 federal income tax refund for a student loan offset.

Your audit reconsideration letter should: Say that it is an audit reconsideration request. Identify the taxpayer, the tax period(s), the type of tax (such as income tax), and, if available, the name and contact information for the IRS auditor who previously worked the case. Explain the circumstances for the audit,

So, your explanation letter to IRS should include the following writing items: Name, address, and contact information of the taxpayer. An explanation expressing your desire to appeal the IRS conclusions. The tax period. A list of the points you disagree with and your explanations. Facts supporting your position.