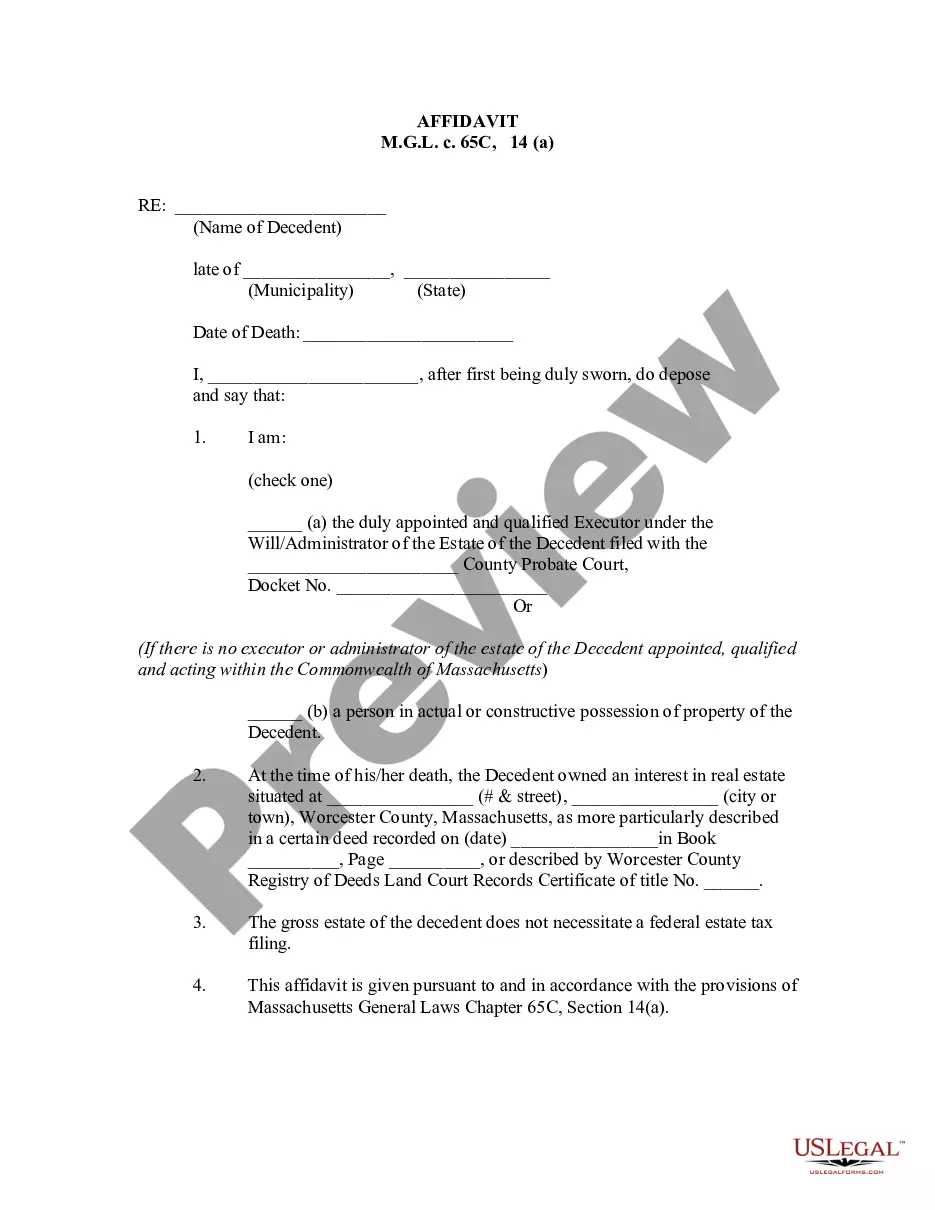

Massachusetts Sample Letter for Request for Tax Clearance Letter

Description

How to fill out Sample Letter For Request For Tax Clearance Letter?

It is possible to spend several hours on-line trying to find the lawful record template that meets the state and federal needs you require. US Legal Forms supplies a huge number of lawful kinds which can be analyzed by specialists. You can actually obtain or printing the Massachusetts Sample Letter for Request for Tax Clearance Letter from your support.

If you already have a US Legal Forms bank account, you are able to log in and then click the Acquire button. Following that, you are able to total, revise, printing, or signal the Massachusetts Sample Letter for Request for Tax Clearance Letter. Each and every lawful record template you acquire is your own property for a long time. To get another backup for any bought develop, check out the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms site for the first time, adhere to the simple guidelines under:

- Initial, make certain you have selected the best record template for your state/metropolis of your choice. Read the develop explanation to ensure you have picked out the right develop. If available, use the Preview button to search throughout the record template also.

- If you wish to find another edition from the develop, use the Research discipline to obtain the template that meets your requirements and needs.

- When you have discovered the template you would like, click Get now to continue.

- Pick the prices strategy you would like, type your credentials, and register for a free account on US Legal Forms.

- Complete the transaction. You can utilize your bank card or PayPal bank account to pay for the lawful develop.

- Pick the formatting from the record and obtain it to the product.

- Make alterations to the record if necessary. It is possible to total, revise and signal and printing Massachusetts Sample Letter for Request for Tax Clearance Letter.

Acquire and printing a huge number of record templates making use of the US Legal Forms site, which provides the greatest selection of lawful kinds. Use expert and status-specific templates to deal with your business or person demands.

Form popularity

FAQ

To receive a tax clearance certificate when shutting down a business, a business must file all returns to date and a final franchise and excise tax return through the date of liquidation or the date on which the business ceased operations in Tennessee.

Most commonly, states issue clearance certificates, demonstrating that an individual is compliant with all taxes and other obligations as of the date of the certificate. Those seeking clearance certificates will have to request them from state authorities, usually the state's Department of Revenue.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

In order to obtain a police clearance certificate from Tennessee, applicant should write an application letter explaining why a police clearance certificate is being requested. The Letter accompanied by a Documentary prove of legal stay in Tennessee is also required for this process.

A Tax Compliance Certificate is a document issued by a Secretary of State or State Department of Revenue. The Tax Compliance Certificate is evidence that a Corporation, LLC or Non Profit is in Good Standing with respect to any tax returns due and taxes payable to the state.

A clearance certificate certifies that all amounts for which the taxpayer is, or can reasonably be expected to become, liable under the Act at or before the time of distribution have been paid, or that the Minister of National Revenue has accepted security for payment.