Massachusetts LLC Operating Agreement - Taxed as a Partnership

Description

How to fill out LLC Operating Agreement - Taxed As A Partnership?

Are you in a position that you need documents for either business or personal reasons nearly every day.

There are numerous legal document templates available online, but finding ones you can trust can be challenging.

US Legal Forms offers thousands of form templates, including the Massachusetts LLC Operating Agreement for S Corp, which are designed to comply with state and federal regulations.

Once you locate the appropriate form, click Get now.

Select the pricing plan you want, fill in the required information to create your account, and pay for the order using PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can always retrieve another copy of the Massachusetts LLC Operating Agreement for S Corp if needed. Just select the desired form to download or print the document template. Utilize US Legal Forms, the largest selection of legal forms, to save time and avoid errors. This service provides professionally crafted legal document templates that can be used for a wide array of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts LLC Operating Agreement for S Corp template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

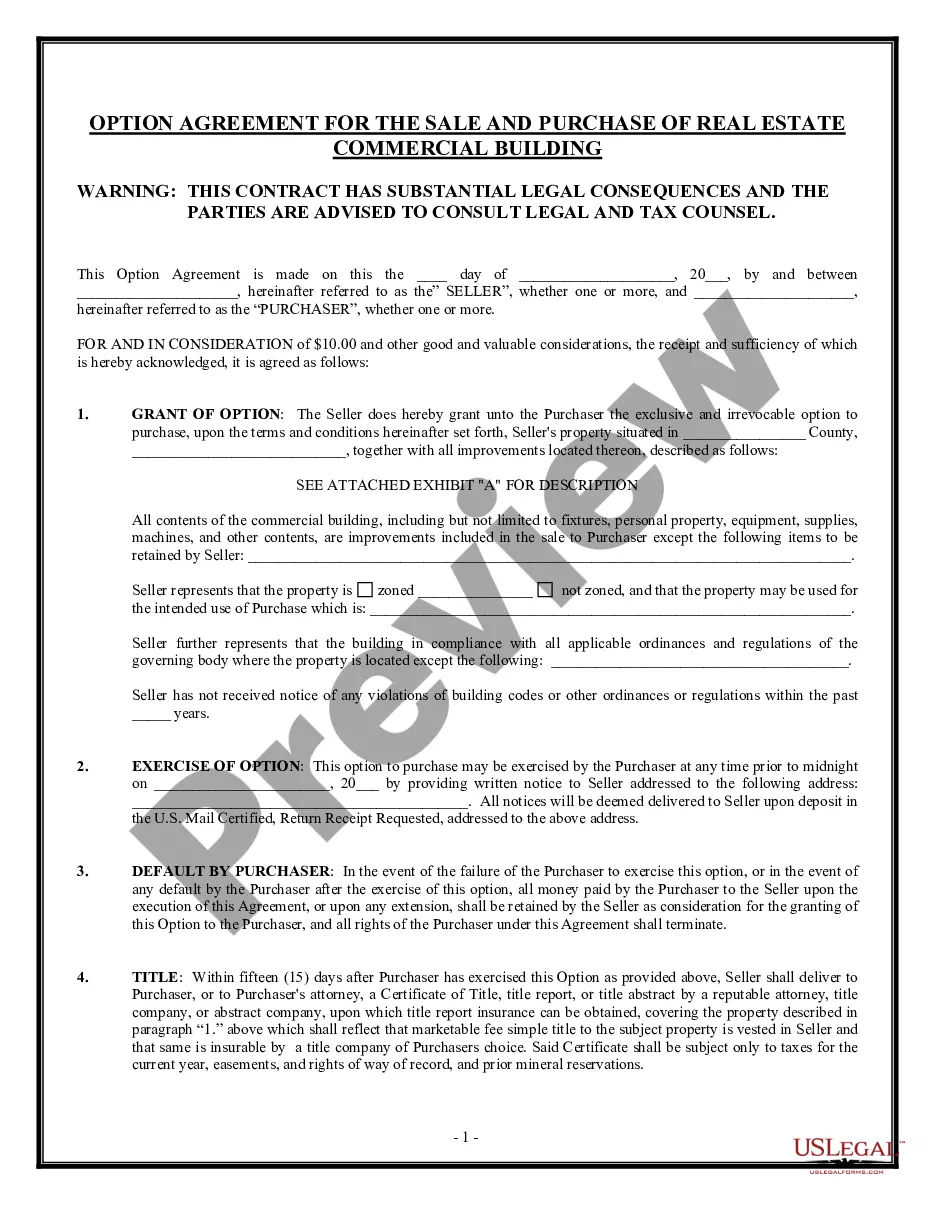

- Utilize the Review option to check the form.

- Examine the description to confirm you have selected the right form.

- If the form is not what you are searching for, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

An S corp operating agreement is a business entity managing document. Typically, an operating agreement is a document that defines how a limited liability company will be managed. An S corp actually uses corporate bylaws and articles of incorporation for the purpose of organizing the business operation.

Similarly, corporations (S corps and C corps) are not legally required by any state to have an operating agreement, but experts advise owners of these businesses to create and execute their version of an operating agreement, called bylaws.

Domestication of Foreign Corporation to Massachusetts Corporation. If a foreign business corporation's law permits the domestication of a foreign business corporation into a Massachusetts business corporation, Massachusetts law governs the domestication (M.G.L. ch. 156D, § 9.20(a)).

GENERAL. Massachusetts has approved single member LLCs to organize under state law. In the past, an LLC had to have two members. By allowing single member LLCs, a sole proprietorship can now convert to a single member LLC and get liability protection from creditors.

Starting a Massachusetts LLC and electing S corp tax status is easy....Step 1: Name Your LLC.Step 2: Choose Your Massachusetts Registered Agent.Step 3: File the Massachusetts LLC Certificate of Organization.Step 4: Create an LLC Operating Agreement.Step 5: Get an EIN and Complete Form 2553 on the IRS Website.

Massachusetts does not require an operating agreement in order to form an LLC, but executing one is highly advisable. . . An operating agreement is the basic written agreement between the members (i.e., owners) of the LLC, or between the members and the managers of the company, if there are managers.

Prepare an Operating AgreementAn LLC operating agreement is not required in Massachusetts, but is highly advisable. This is an internal document that establishes how your LLC will be run. It is not filed with the state.