Oklahoma Option For the Sale and Purchase of Real Estate - Commercial Building

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Commercial Building?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can swiftly acquire the latest versions of forms such as the Oklahoma Option For the Sale and Purchase of Real Estate - Commercial Building.

If the form doesn’t meet your requirements, use the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your credentials to register for an account.

- If you already have an account, Log In to obtain the Oklahoma Option For the Sale and Purchase of Real Estate - Commercial Building from your US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms in the My documents tab of your account.

- To use US Legal Forms for the first time, here are simple guidelines to get started.

- Ensure you have selected the correct form for your city/state.

- Click the View button to review the form’s details.

Form popularity

FAQ

To obtain a commercial real estate license in Oklahoma, you must complete specific education requirements, pass an exam, and submit a background check application. After fulfilling these requirements, you can apply for the license through the Oklahoma Real Estate Commission. This license will enable you to explore the vast opportunities in the market, particularly in the area of commercial buildings.

Closing costs in Oklahoma run, on average, $2,511 for a home loan of $134,618, according to a 2021 report by ClosingCorp, which provides research on the U.S. real estate industry. That price tag makes up 1.87 percent of the home's price tag.

First, in Oklahoma it is required to have some form of consideration, in this case money, accompanying a contract in order for the contract to be legally binding. Second, a contract to purchase a house is also a contract not to sell the house to anyone else.

In general, the requirements for the payment of transfer tax are the following:Certificate Authorizing Registration from the Bureau of Internal Revenue;Realty tax clearance from the Treasurer's Office; and.Official receipt of the Bureau of Internal Revenue (for documentary stamp tax).

In Oklahoma, your closing is usually handled through a title and escrow company. In large part, this is because of how title insurance is handled in this state.

54 Since July 2001, the tax can be paid by the mortgagor, mortgagee, or any interested party but prior to that time it was unlawful for a mortgagee to charge or otherwise exact this tax from the mortgagor.

In Oklahoma, you'll pay about 0.9% of your home's final sale price in closing costs, not including realtor fees. Keep in mind that this is only an estimate. While closing costs will always have to be paid, your real estate agent can often negotiate who pays them you or the buyer.

The fundamental difference between an Option and a Right of First Refusal is that an Option to Buy can be exercised at any time during the option period by the buyer. With a Right of First Refusal, the right of the potential buyer to complete the transaction is triggered only if the seller wants to complete a sale.

A purchase option is a right to purchase or lease land or other property interests without any obligation to do so.

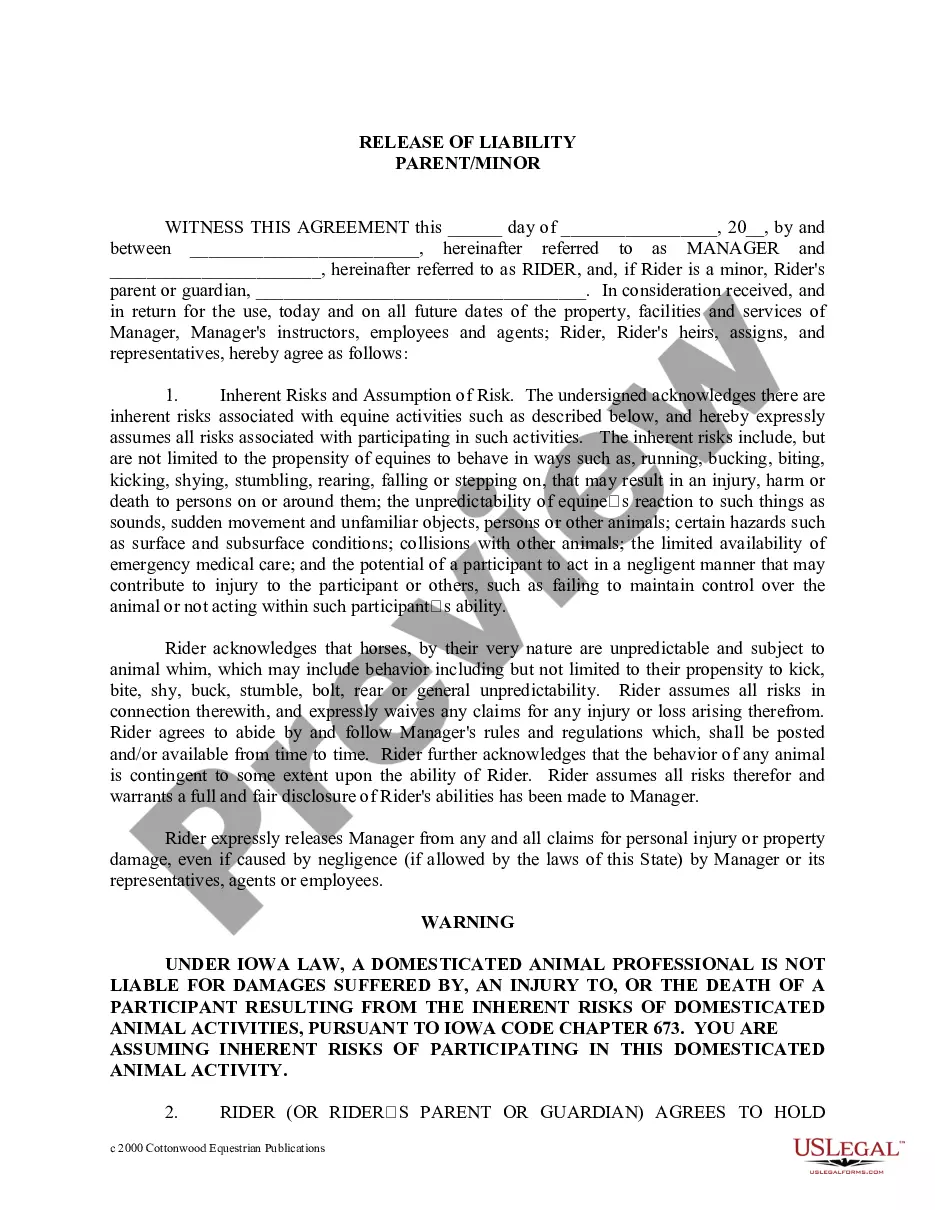

In this agreement, a seller offers an option to the buyer to purchase property at a fixed price within a limited time frame. In other words, this option is a specific contract on a distinct piece of real estate that gives a buyer the exclusive right to purchase that specific property.