Massachusetts Letter of Intent to Form a Limited Partnership

Description

How to fill out Letter Of Intent To Form A Limited Partnership?

If you want to finalize, retrieve, or create valid document templates, utilize US Legal Forms, the largest collection of authentic forms available online.

Leverage the site's straightforward and convenient search to locate the documents you need. Various templates for business and personal purposes are organized by categories and titles, or keywords.

Use US Legal Forms to quickly find the Massachusetts Letter of Intent to Establish a Limited Partnership with just a few clicks.

Each legal document format you obtain belongs to you indefinitely. You will have access to every form you saved in your account. Go to the My documents section and select a form to print or download again.

Be proactive and download, then print the Massachusetts Letter of Intent to Establish a Limited Partnership with US Legal Forms. There are thousands of professional and region-specific forms you can use for business or personal needs.

- If you are an existing US Legal Forms client, sign in to your account and then click the Download button to retrieve the Massachusetts Letter of Intent to Establish a Limited Partnership.

- You can also access forms you have saved earlier from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure that you have selected the form for the appropriate town/region.

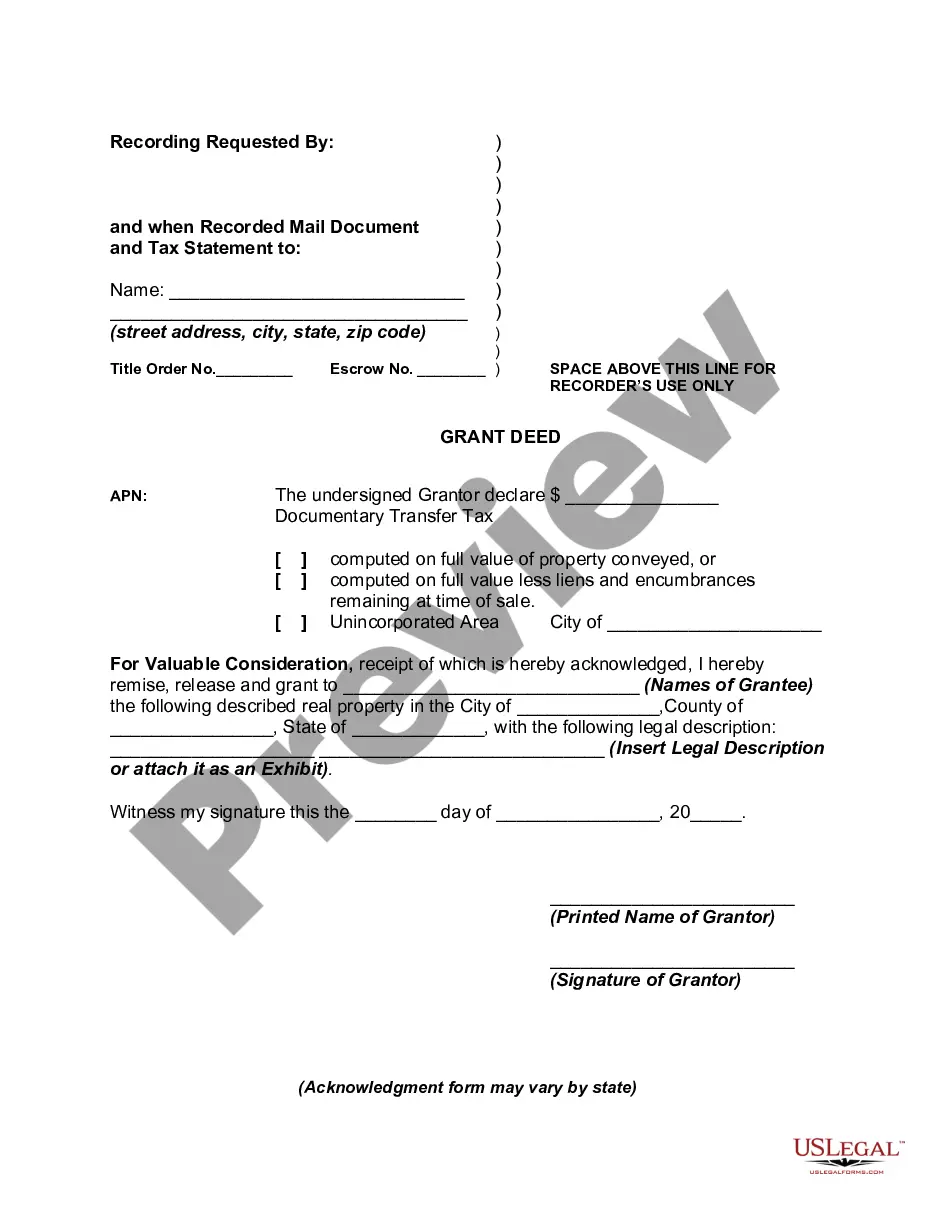

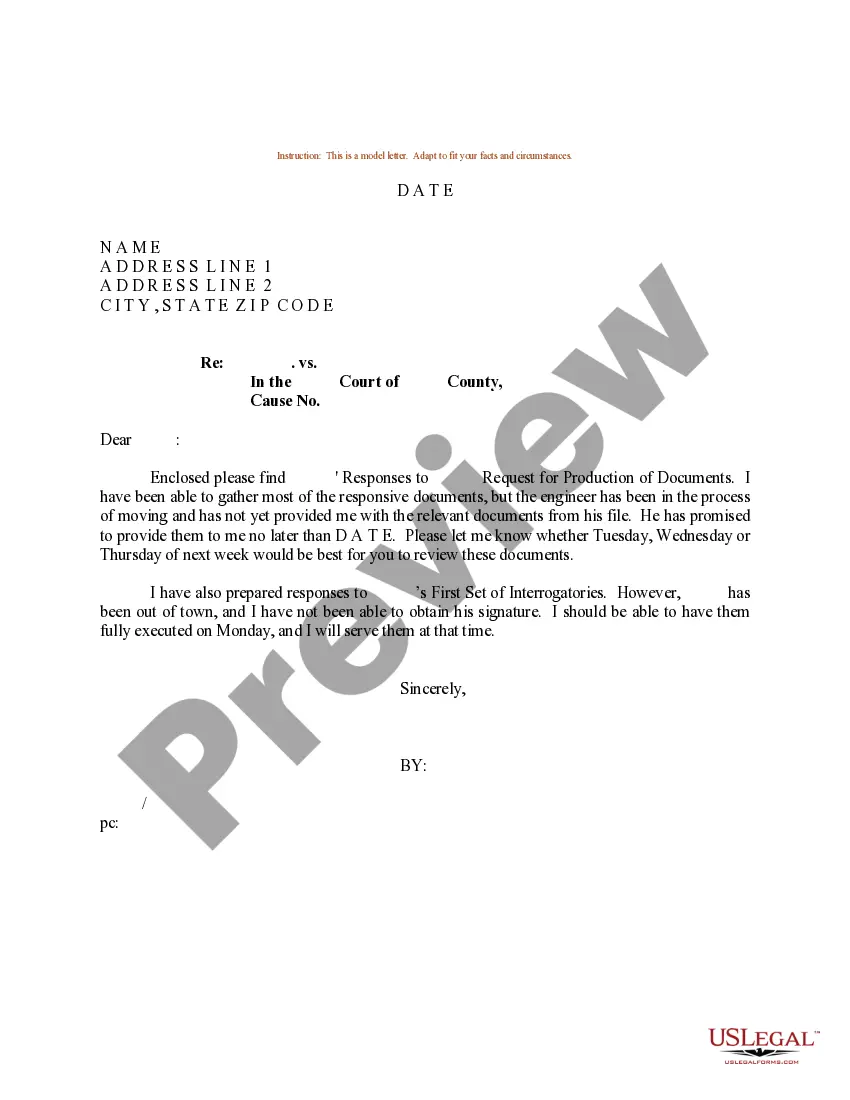

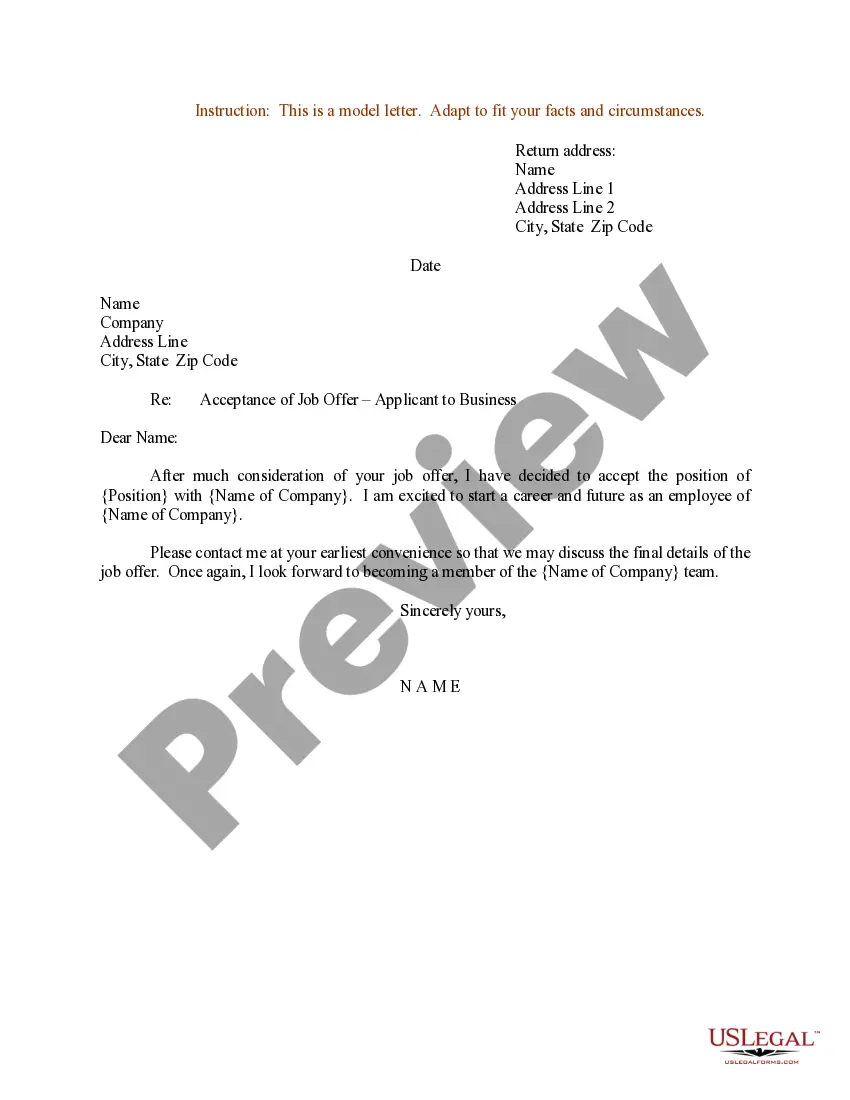

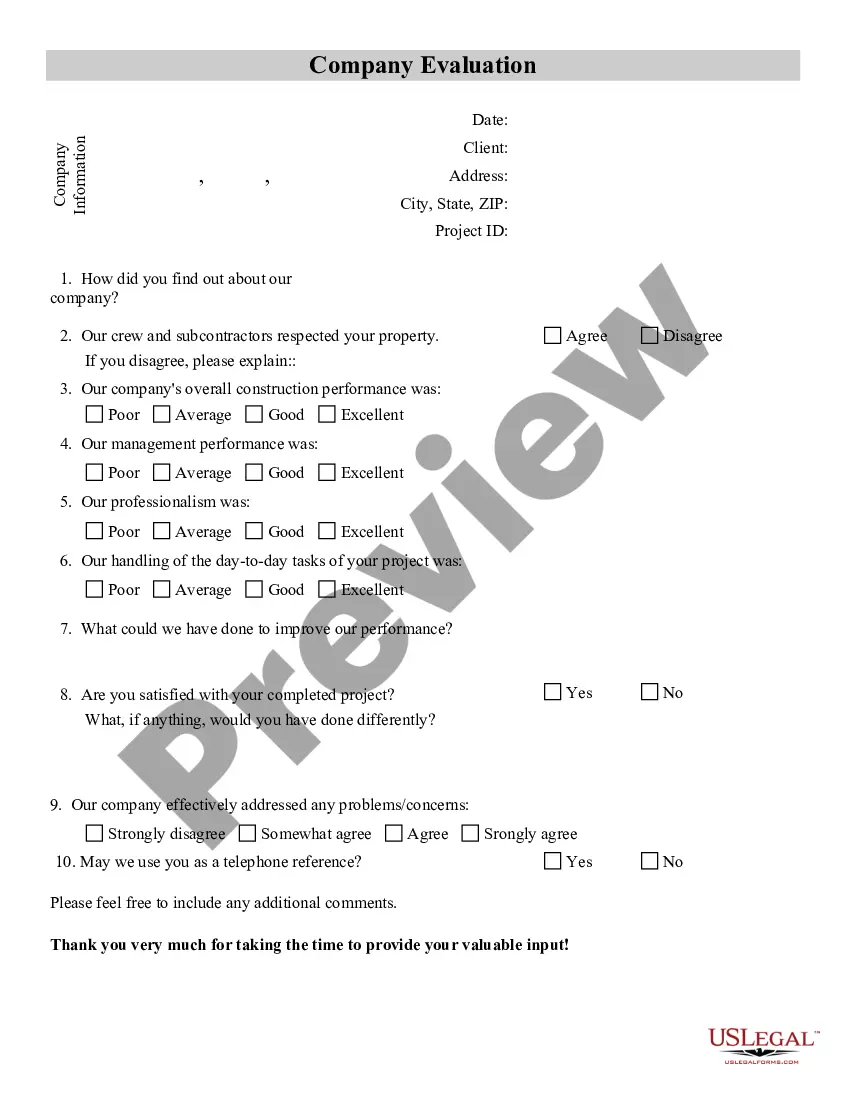

- Step 2. Utilize the Review feature to go through the form's provisions. Be sure to read the explanations.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of your legal document format.

- Step 4. Once you have located the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of your legal document and download it onto your device.

- Step 7. Fill out, modify, and print or sign the Massachusetts Letter of Intent to Establish a Limited Partnership.

Form popularity

FAQ

A limited partnership agreement helps protect your business into the future by outlining each partner's roles and responsibilities, as well as how they share in the business profits. You should use a limited partnership agreement if you want to form a limited partnership or formalize an existing limited partnership.

Based on ContractsCounsel's marketplace data, the average cost of a project involving a partnership agreement is $603.89 . Partnership agreement cost depends on many variables, which includes the service requested, number of partners, and the number of custom terms needed to be included in the document.

Real estate investors, for example, might use a limited partnership. Another common use of a limited partnership is in a family business, called a family limited partnership. Members of a family may pool their money, designate a general partner, and watch their investments grow.

Partnerships must file Form SS-4 with the Internal Revenue Service. Form SS-4 is used to get an employer identification number, also known as a federal tax ID number, from the IRS. The IRS allows a partnership to file Form SS-4 online using the IRS website, by telephone, by fax or by mail.

How to Form a Massachusetts Limited Partnership (in 6 Steps)Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Limited Partnership Certificate.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

The state of Massachusetts doesn't require any official formation for general partnerships, and they're also not required to pay any formation fees or participate in ongoing maintenance filings like annual reports.

Here are the basic steps to forming a partnership:Choose a business name.Register a fictitious business name.Draft and sign a partnership agreement.Comply with tax and regulatory requirements.Obtain Insurance.

Your Limited Partnership Agreement can include details like: the name, address, and purpose of forming the partnership; whether limited partners have any voting rights regarding the day-to-day business decisions; how decisions will be made (by unanimous vote, majority vote, or majority vote based on percent ownership);

A limited partnership is required to have both general partners and limited partners. General partners have unlimited liability and have full management control of the business. Limited partners have little to no involvement in management, but also have liability that's limited to their investment amount in the LP.

To establish a partnership in Massachusetts, here's everything you need to know.Choose a business name.File an assume business name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.