Massachusetts Cash Receipts Control Log

Description

How to fill out Cash Receipts Control Log?

Selecting the appropriate authorized form template may be a challenge. Obviously, there are numerous templates available on the web, but how do you find the legal document you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Massachusetts Cash Receipts Control Log, suitable for business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Massachusetts Cash Receipts Control Log. Use your account to search through the legal documents you have previously purchased. Proceed to the My documents section of your account to obtain another copy of the document you need.

Complete, edit, print, and sign the acquired Massachusetts Cash Receipts Control Log. US Legal Forms is the largest library of legal documents where you can find a variety of template forms. Use the service to obtain professionally crafted paperwork that complies with state regulations.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

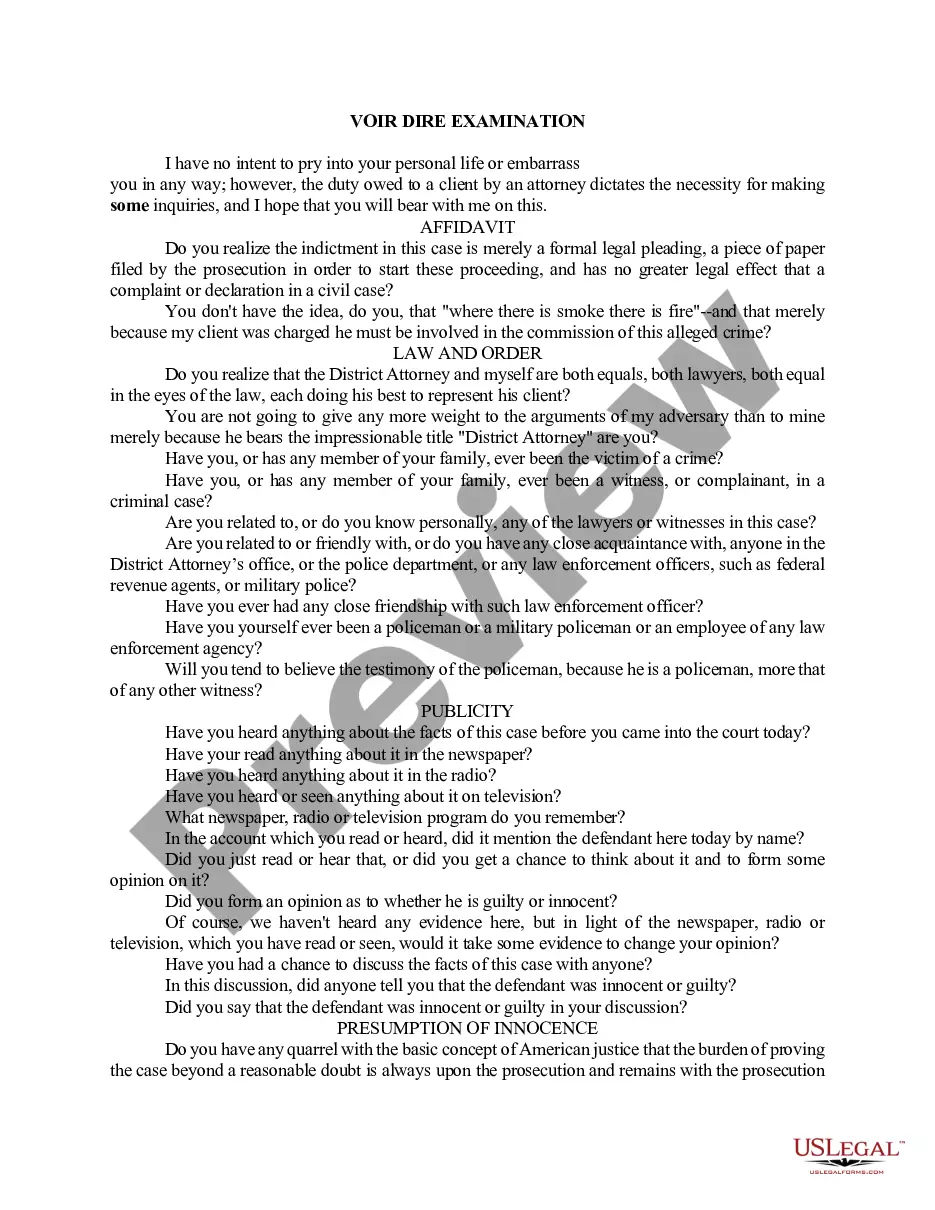

- First, ensure you have selected the correct form for your region/state. You can browse the document using the Preview feature and review the form details to confirm it meets your needs.

- If the form does not meet your expectations, use the Search box to find the appropriate form.

- Once you are certain that the form is suitable, click the Purchase now button to obtain the document.

- Choose the pricing plan you prefer and enter the required details. Create your account and pay for your order using your PayPal account or credit/debit card.

- Select the file format and download the legal form template to your device.

Form popularity

FAQ

To control cash transactions, organizations should adopt some of the following practices: Require background checks for employees, establish segregation of duties, safeguard all cash and assets in secure locations, and use a lockbox to accept cash payments from customers.

A Deposit Receipt is a receipt issued by a receiving party, also known as the depositary by someone who is known as a depositor. This document is commonly used by banks when receiving a check of cash deposit from clients and such receipt is given to the depositor as proof of deposit.

Safekeeping of cash-All cash and cash equivalents must be kept in a locked box in a safe or cabinet. Petty cash floats must also be stored in a safe or cabinet overnight. An office receipt must be issued, these must be pre-numbered, and the receipt books must be kept under lock and key.

A deposit receipt is a receipt issued by a bank to a depositor for cash and checks deposited with the bank. The information recorded on the receipt includes the date and time, the amount deposited, and the account into which the funds were deposited.

Receipt: This source document is prepared for showing the proof of giving any cash to the party (who receives the cash) on account of any business transaction. At least two copies are made of any receipt. The original copy is prepared for giving it to the party who makes the payment and another copy is kept for record.

The basic components of a receipt include:The name and address of the business or individual receiving the payment.The name and address of the person making the payment.The date the payment was made.A receipt number.The amount paid.The reason for the payment.How the payment was made (credit card, cash, etc)More items...

Cash receipts are proof that your business has made a sale. Cash receipts include receipts for cash sales, sales paid for by check, and purchases on store credit. Cash receipts from cash sales impact the cash account on the balance sheet and the sales account on the profit and loss statement.

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

Paying for things in cash may be becoming less common as technology marches on, but if you still use cash, you'll want to get some proof that you paid....Just make sure they include:The date of payment,A description of the services or goods purchased,The amount paid in cash, and.The name of the company or person paid.

Your cash receipts journal should have a chronological record of your cash transactions. Using your sales receipts, record each cash transaction in your cash receipts journal. Do not record the sales tax you collected in the cash receipts journal. You must record this in the sales journal instead.