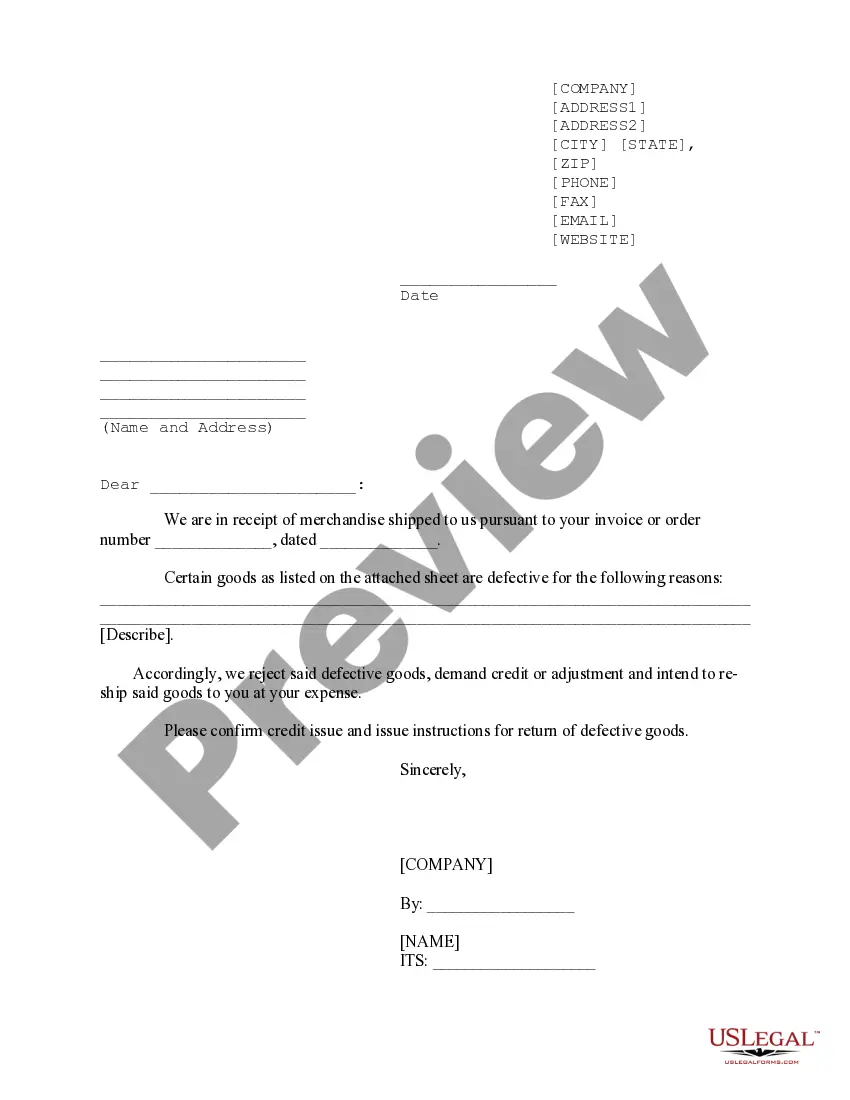

Virginia Bill of Sale (Communications Equipment)

Description

How to fill out Bill Of Sale (Communications Equipment)?

You can invest hrs on-line searching for the lawful file web template that fits the federal and state demands you want. US Legal Forms supplies a huge number of lawful kinds which can be reviewed by experts. It is possible to obtain or produce the Virginia Bill of Sale (Communications Equipment) from our support.

If you already have a US Legal Forms account, it is possible to log in and then click the Down load button. After that, it is possible to total, modify, produce, or indicator the Virginia Bill of Sale (Communications Equipment). Every single lawful file web template you buy is your own forever. To get an additional version of any purchased form, check out the My Forms tab and then click the corresponding button.

If you use the US Legal Forms web site the very first time, follow the straightforward instructions beneath:

- Initially, ensure that you have chosen the right file web template to the state/city of your liking. Read the form description to ensure you have picked out the proper form. If readily available, make use of the Review button to appear from the file web template as well.

- In order to find an additional edition in the form, make use of the Research industry to get the web template that meets your needs and demands.

- Upon having found the web template you need, simply click Buy now to move forward.

- Pick the rates strategy you need, enter your qualifications, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You may use your bank card or PayPal account to purchase the lawful form.

- Pick the structure in the file and obtain it for your device.

- Make adjustments for your file if required. You can total, modify and indicator and produce Virginia Bill of Sale (Communications Equipment).

Down load and produce a huge number of file templates while using US Legal Forms web site, which offers the most important assortment of lawful kinds. Use professional and state-certain templates to take on your business or personal demands.

Form popularity

FAQ

Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.

Sales Tax Rates The sales tax rate for most locations in Virginia is 5.3%. Several areas have an additional regional or local tax as outlined below.

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices. Sales of items paid for with food stamps.

Items that are exempted from sales taxes include hurricane preparedness items, school supplies, clothing, footwear, Energy Star and WaterSense items, but every item category has a specific cut-off on price, ing to the Virginia Regulatory Town Hall.

Communications taxes in Virginia include: 5% Communications Sales tax on telecommunications services. 75? State E-911 tax for landline and Voice Over Internet Protocol (VOiP) phones.

During Virginia's holiday, there are three categories of items that qualify: school supplies, clothing and footwear; hurricane and emergency preparedness products; and Energy Star and WaterSense products.

One-off sales where you sell an item for less than what you paid are considered nondeductible losses by the IRS. You can't deduct the loss, but you won't have to pay taxes on it either.

Virginia does not tax any cloud, SaaS, or digital products. The state only taxes physical goods and limited, explicitly enumerated services. However, businesses must remain vigilant in understanding the guidelines surrounding taxation in Virginia, as this can change over time with developing technology and regulations.