Massachusetts Auto Expense Travel Report

Description

How to fill out Auto Expense Travel Report?

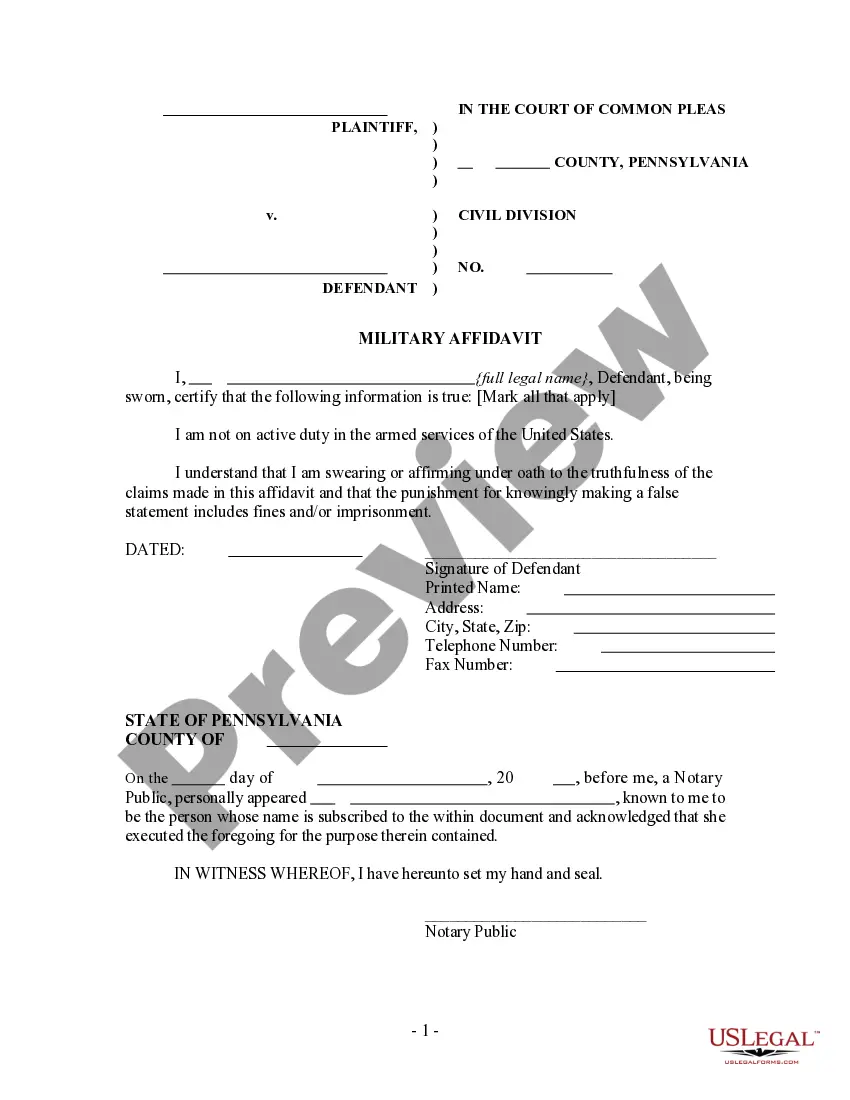

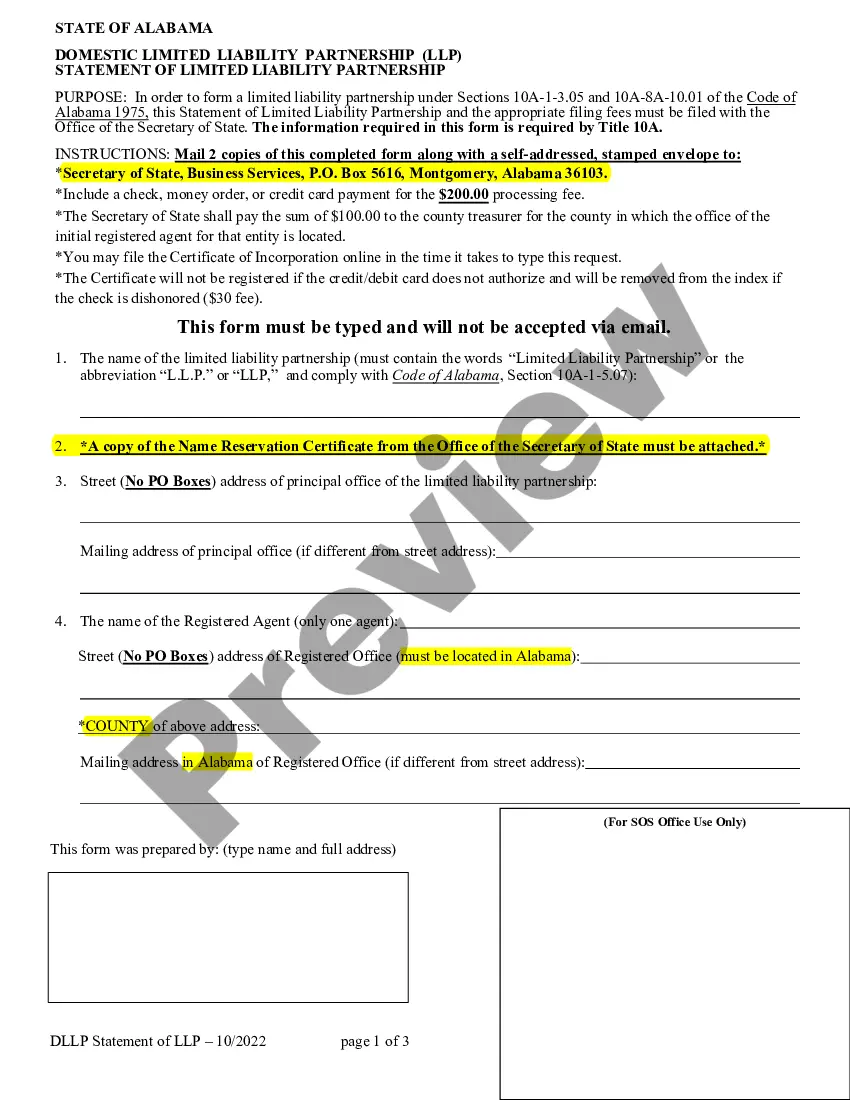

You could spend hours on the web attempting to locate the proper file format that complies with the state and federal requirements you need.

US Legal Forms provides a vast array of legal documents that are reviewed by experts.

It is easy to download or print the Massachusetts Auto Expense Travel Report from their services.

If available, utilize the Preview option to examine the file format as well. If you want to obtain another version of your form, use the Search section to find the format that meets your requirements.

- If you already have a US Legal Forms account, you can sign in and select the Download button.

- After that, you can complete, modify, print, or sign the Massachusetts Auto Expense Travel Report.

- Every legal document you obtain is yours permanently.

- To get another copy of the downloaded form, go to the My documents section and click the pertinent option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct file format for your area/city of preference.

- Review the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

In Massachusetts, employers are required to reimburse employees for mileage incurred during work-related travel. The state mandates this reimbursement to ensure that employees are not financially burdened by work-related travel expenses. Utilizing a Massachusetts Auto Expense Travel Report can simplify the mileage reporting process, making it easier for both employees and employers to track expenses accurately. This platform can help ensure compliance with the state's reimbursement requirements while also saving time.

A travel expense report is a document that tracks costs incurred during business travel. It includes details like transportation, lodging, meals, and other expenses, enabling employees to efficiently report their travel costs. Using a Massachusetts Auto Expense Travel Report can streamline this process, ensuring accurate records and timely reimbursements. This report not only helps in managing expenses but also supports budget planning for future travel.

The reimbursement law in Massachusetts mandates that employers must reimburse employees for expenses incurred while performing their job duties, including mileage. This law is fundamental for those submitting a Massachusetts Auto Expense Travel Report. It's essential to keep accurate records of expenses to ensure compliance and avoid disputes. For guidance on navigating these laws, uslegalforms offers valuable resources tailored to your needs.

As of now, the mileage reimbursement rate for 2025 in Massachusetts has not been officially released. However, it is crucial to stay informed as you prepare your Massachusetts Auto Expense Travel Report. The state updates rates regularly, reflecting changes in fuel costs and economic factors. Monitoring updates through reliable platforms such as uslegalforms can help you stay compliant and prepared.

The mileage reimbursement rate for the Disability Insurance Agency (DIA) in Massachusetts generally aligns with the state's set reimbursement rates. When filing a Massachusetts Auto Expense Travel Report, it is important to check the most current figures as they may change annually. Comprehensive reports enhance clarity, ensuring that employees claim the appropriate amount when traveling for work. For detailed guidelines, consider using resources from uslegalforms.

Yes, Massachusetts law does require mileage reimbursement for employees who use their personal vehicles for work-related tasks. This is key for anyone submitting a Massachusetts Auto Expense Travel Report, as accurate documentation of mileage ensures proper compensation. Understanding this requirement can help employees and employers streamline the reimbursement process. For ease, utilizing platforms like uslegalforms can assist in generating the necessary reports.

In most cases, Massachusetts auto excise tax is not deductible for federal income tax purposes. However, if the vehicle is used for business, you may be able to include that portion of the excise tax as part of your overall vehicle expenses. Using an organized Massachusetts Auto Expense Travel Report can assist you in calculating the business use percentage and reporting it accurately. Always consult a tax professional to clarify your eligibility based on your specific situation.

Filing vehicle expenses requires you to record your costs and summarize them on your tax return. If you opt for the standard mileage deduction, just report your total mileage. Alternatively, you can report actual vehicle expenses using a Massachusetts Auto Expense Travel Report that organizes your relevant costs. Be diligent about documenting your expenses accurately, as this will support your claims and streamline your filing process.

The rules for car expenses generally allow taxpayers to deduct costs that are ordinary and necessary for business purposes. You can either claim the standard mileage rate or deduct actual expenses like gas, insurance, and maintenance. The use of a Massachusetts Auto Expense Travel Report can guide you in understanding which expenses qualify for deductions and how to structure your claims effectively. Always stay informed about current IRS guidelines to maximize your deductions.

To support your vehicle expense deduction, maintain accurate records that include mileage logs and receipts for all related costs. Keep track of the date, purpose, and destination of each trip, along with receipts for gas, repairs, and maintenance. A well-organized Massachusetts Auto Expense Travel Report can help consolidate this information, providing the necessary evidence for your deductions and ensuring compliance with tax regulations.