Massachusetts Expense Report

Description

How to fill out Expense Report?

If you need to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and convenient search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document format you obtain is yours permanently. You have access to every form you purchased within your account. Click the My documents section and select a form to print or download again.

Compete and download, and print the Massachusetts Expense Report with US Legal Forms. There are numerous professional and state-specific templates you can utilize for your business or personal requirements.

- Use US Legal Forms to find the Massachusetts Expense Report within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Massachusetts Expense Report.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

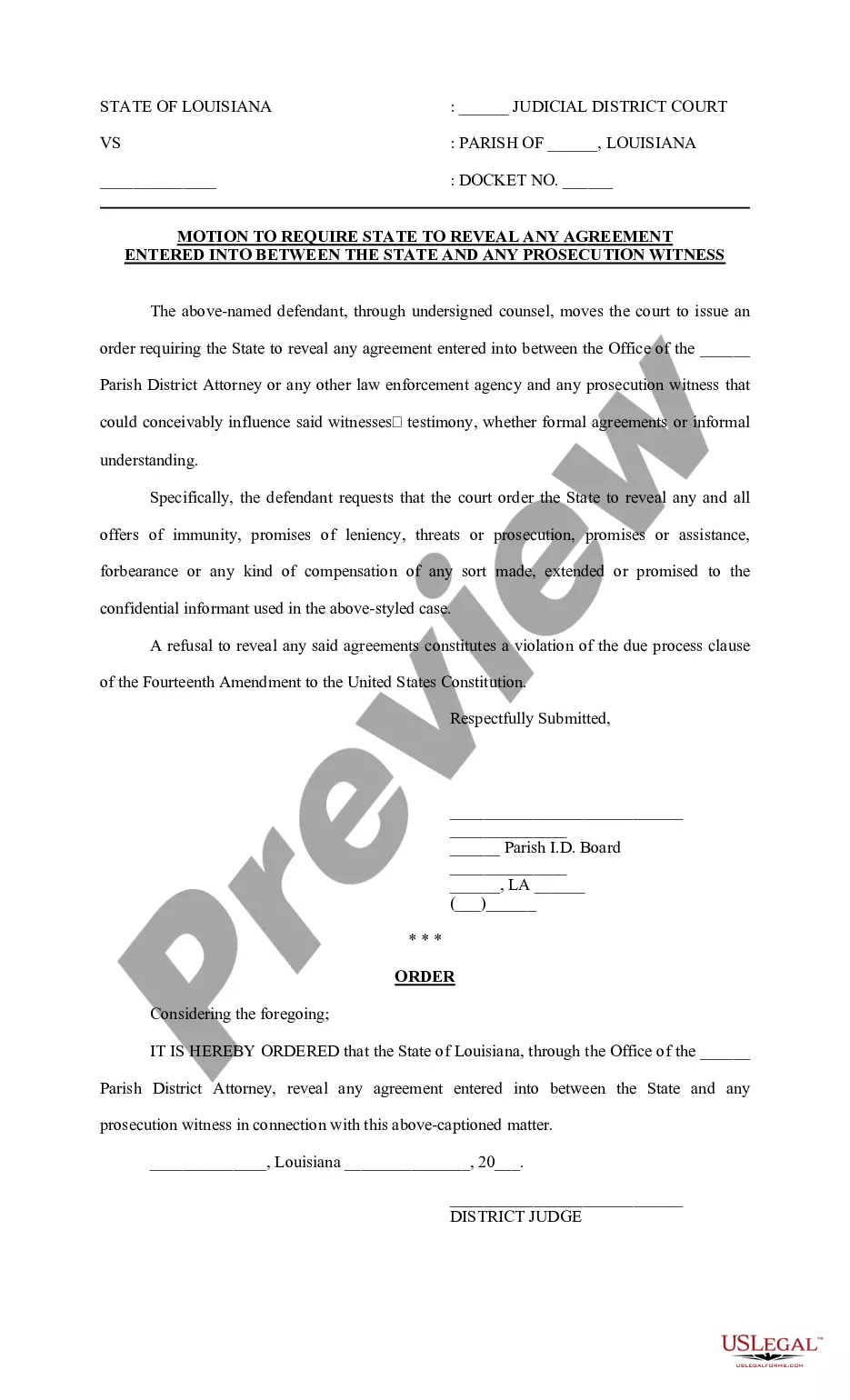

- Step 2. Use the Preview option to review the form's content. Be sure to read the summary.

- Step 3. If you are not satisfied with the document, utilize the Search field at the top of the screen to find alternative versions of the legal form format.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan that suits you and provide your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it onto your device.

- Step 7. Complete, modify, and print or sign the Massachusetts Expense Report.

Form popularity

FAQ

Yes, Massachusetts enforces self-employment tax, calculated based on the income you earn from self-employment. This tax is important for funding Social Security and Medicare. It is essential to account for this tax in your financial planning. To assist with managing these obligations, consider maintaining a Massachusetts Expense Report to keep track of your earnings and deductions.

The form used to calculate self-employment tax in Massachusetts is IRS Schedule SE. This form helps you determine your self-employment tax based on net earnings from self-employment. Understanding this tax is critical for properly budgeting your finances. Maintaining a Massachusetts Expense Report can help streamline your calculations and ensure accuracy in your reporting.

Massachusetts Schedule C, attached to your federal tax return, is used to report income or loss from your business or profession. This form details your gross income and allows for expense deductions, ultimately affecting your overall tax liability. Completing Schedule C requires a good grasp of your business finances. Using a Massachusetts Expense Report can greatly facilitate tracking your earnings and expenses.

Form 4835 is used by farmers and fishermen to report income and expenses from farm rental activities. If you earn income as a self-employed individual in these sectors, this form is essential for calculating your self-employment tax. Understanding and completing this form accurately helps maintain your tax records efficiently. Keep detailed records with your Massachusetts Expense Report to support any entries on Form 4835.

Self-employed individuals in Massachusetts should use IRS Form 1040 along with Schedule C to report their business income and expenses. Additionally, you may need to file Schedule SE to calculate your self-employment tax. By keeping a detailed Massachusetts Expense Report, you can organize your income and expenses, making tax time much easier. Using uslegalforms simplifies this process by providing essential templates.

Massachusetts state revenue encompasses various streams, including income tax, sales tax, and corporate tax. The state uses this revenue to fund public services and infrastructure. For individuals managing their finances, keeping track of how much you are contributing through taxes is crucial. Using a Massachusetts Expense Report can help you maintain clarity on your personal contributions.

In Massachusetts, the tax rate for 1099 income typically matches the state's income tax rate, which is around 5%. When you submit your Massachusetts Expense Report, ensure you account for all income reported on your 1099 forms. Properly calculating your tax can save you from unexpected liabilities later. Consider using uslegalforms to help you organize and report your income accurately.

Failing to file an annual report for your LLC in Massachusetts can lead to significant consequences, including penalties or administrative dissolution. The state may revoke your business's good standing and limit your ability to operate. By ensuring you file your annual report on time, you protect your LLC’s status and keep your records accurate for your Massachusetts expense report.

Yes, Massachusetts mandates that certain organizations file annual reports to maintain their business status. This requirement helps ensure transparency and accountability within the state's business environment. By filing your report timely, you can prevent potential penalties and stay compliant regarding your Massachusetts expense report.

Unreimbursed expenses for employees in Massachusetts refer to costs that workers incur without receiving reimbursement from their employers. These expenses might include travel, supplies, and meals necessary for their job duties. Understanding these expenses is essential, especially when preparing your Massachusetts expense report for tax purposes.