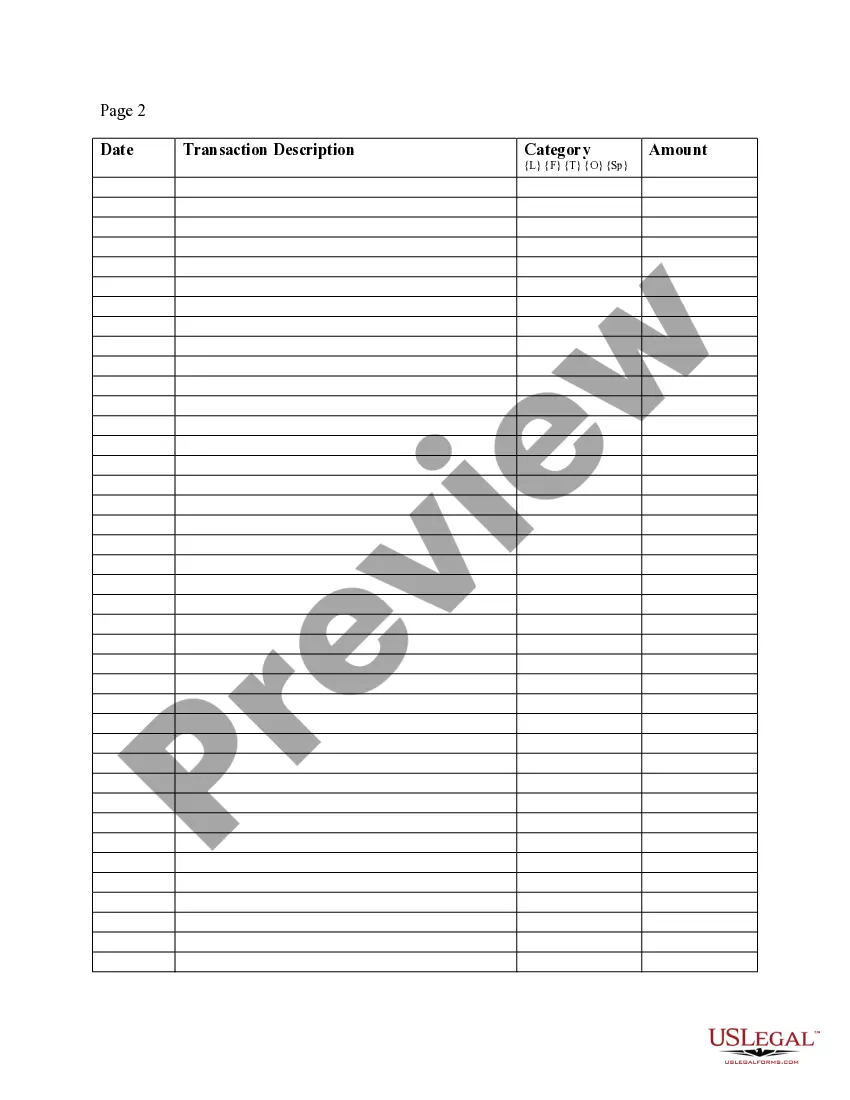

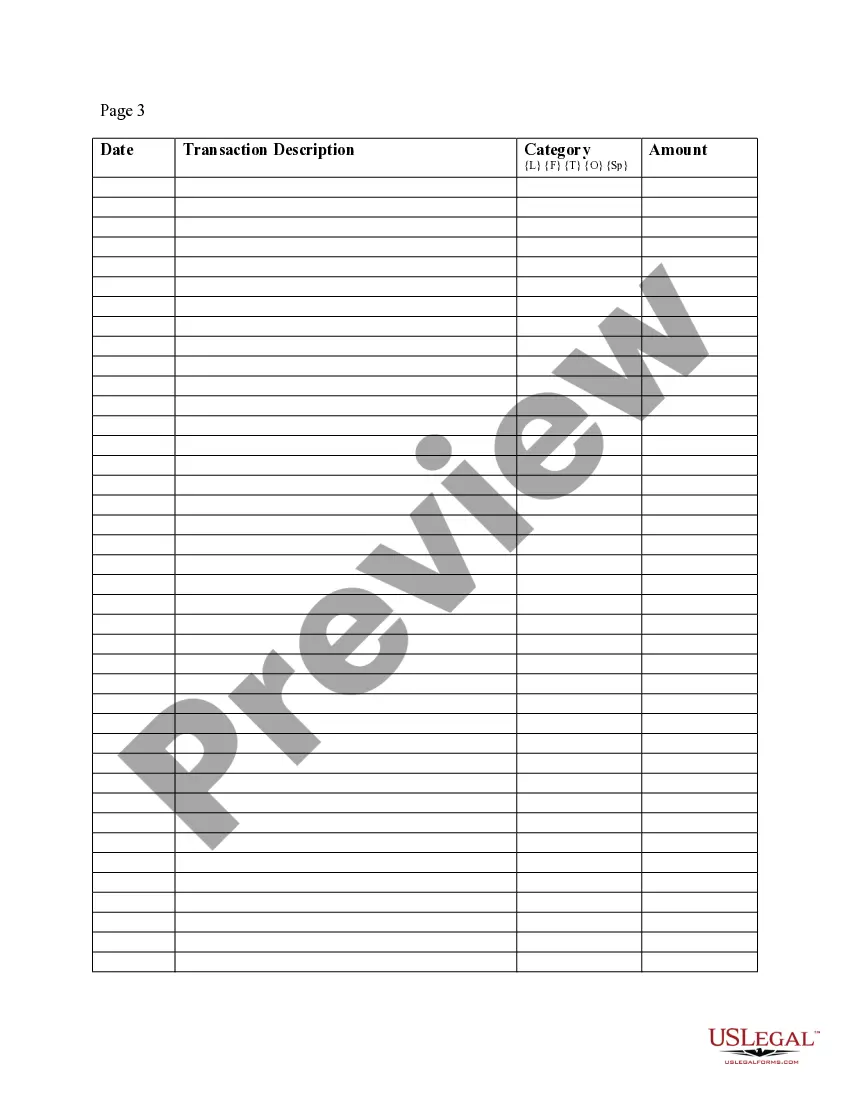

Massachusetts Expense Account Form

Description

How to fill out Expense Account Form?

If you require to total, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the platform's straightforward and efficient search to acquire the documents you need.

Diverse templates for corporate and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you acquired in your account. Click the My documents section and select a form to print or download it again.

Stay competitive and download, and print the Massachusetts Expense Account Form with US Legal Forms. There are countless professional and state-specific forms you can utilize for your business or personal requirements.

- Utilize US Legal Forms to secure the Massachusetts Expense Account Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to procure the Massachusetts Expense Account Form.

- You can also access forms you have previously obtained within the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Massachusetts Expense Account Form.

Form popularity

FAQ

MA does not allow federal itemized deductions. MA has several additional deductions of it's own. An example would be medical or adoption deduction, which are specifically allowed in MA law. The Massachusetts estate tax references the Federal Tax code as of 1/1/1999 with a $1,000,000 exemption.

As a result of the TCJA, for the tax years 2018 through 2025, you cannot deduct home office expenses if you are an employee. The TCJA did not change the home office expense rules for self-employed persons. If you are self-employed, you can continue to deduct qualifying home office expenses.

If you are single you can claim a standard deduction of $12,400. So, if you pay more than $12,400 in state income taxes and other itemized deductions, then consider itemizing your taxes.

Itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster losses. You may also include gifts to charity and part of the amount you paid for medical and dental expenses.

Home office deductionThe allowable deduction for home office expense is $5 per square foot (maximum of 300 square feet) of qualified home office space used, up to a maximum yearly deduction of $1,500.

The home office deduction Form 8829 is available to both homeowners and renters. There are certain expenses taxpayers can deduct. They include mortgage interest, insurance, utilities, repairs, maintenance, depreciation and rent. Taxpayers must meet specific requirements to claim home expenses as a deduction.

The 2020 standard deduction is increased to $24,800 for married individuals filing a joint return; $18,650 for head-of-household filers; and $12,400 for all other taxpayers. Under the new law, no exceptions are made to the standard deduction for the elderly or blind.

Qualifying expenses are determined using the federal CDCTC criteria, but the deduction is not subject to the federal limits. The Massachusetts deduction is instead capped at $4,800 for one qualifying individual and $9,600 for two or more.

The Massachusetts income tax rate will drop to 5% on January 1, 2020. For more information, please see the release from the Baker-Polito administration. Please review the Income Tax Withholding Tables at 5.0% - effective January 1, 2020 (pdf).

Claiming home office expenses One of the benefits of running your own business is that you can choose who you work for and where you work from. If you use a room in your home as office space for running your business, you may be entitled to claim certain costs as a business expense.