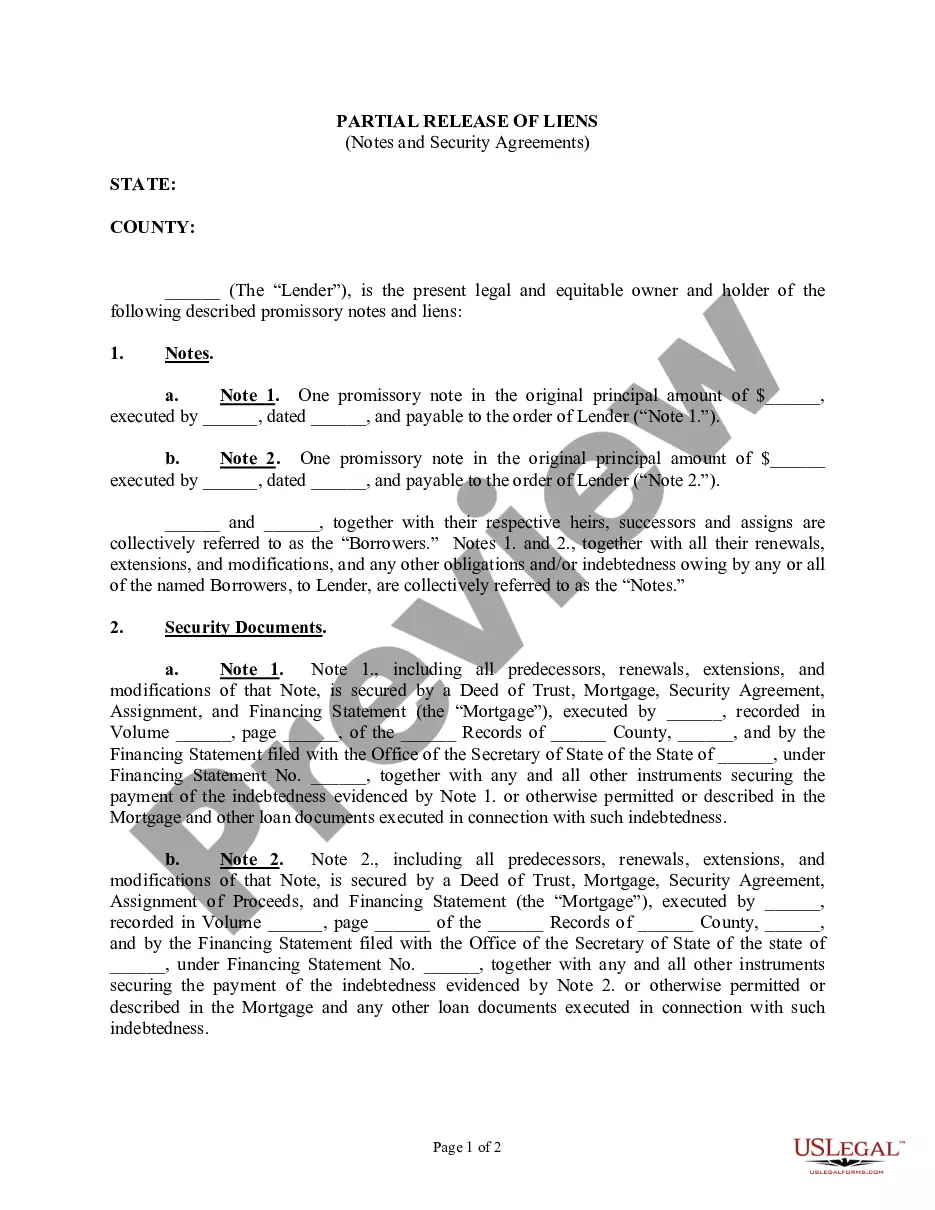

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage

Description

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

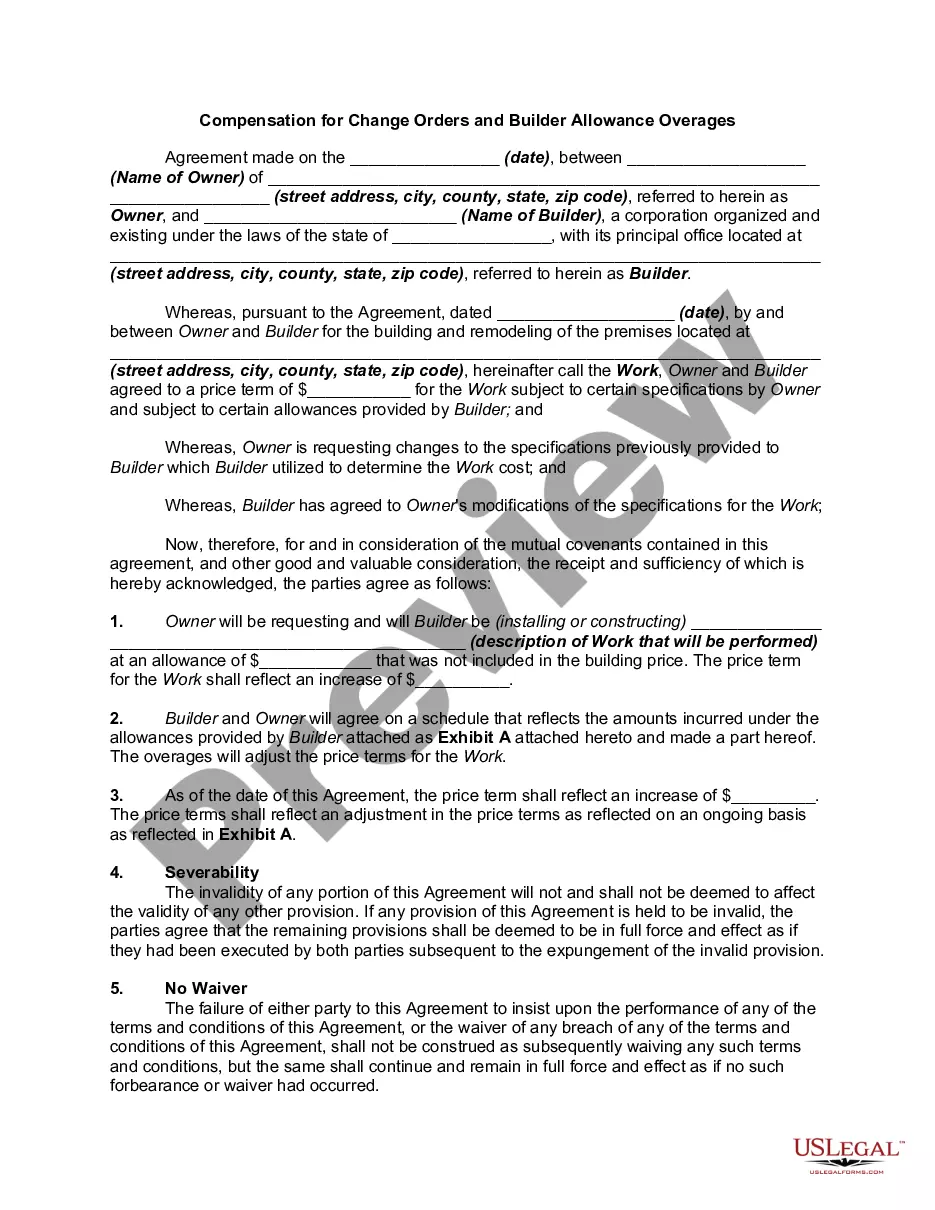

Are you currently inside a situation the place you require files for either company or specific functions virtually every day time? There are tons of lawful record web templates available on the net, but getting types you can rely isn`t simple. US Legal Forms offers a large number of kind web templates, just like the Massachusetts Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage, that are created to fulfill state and federal specifications.

Should you be previously knowledgeable about US Legal Forms web site and possess a merchant account, merely log in. Afterward, you are able to download the Massachusetts Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage web template.

Should you not offer an profile and need to begin using US Legal Forms, follow these steps:

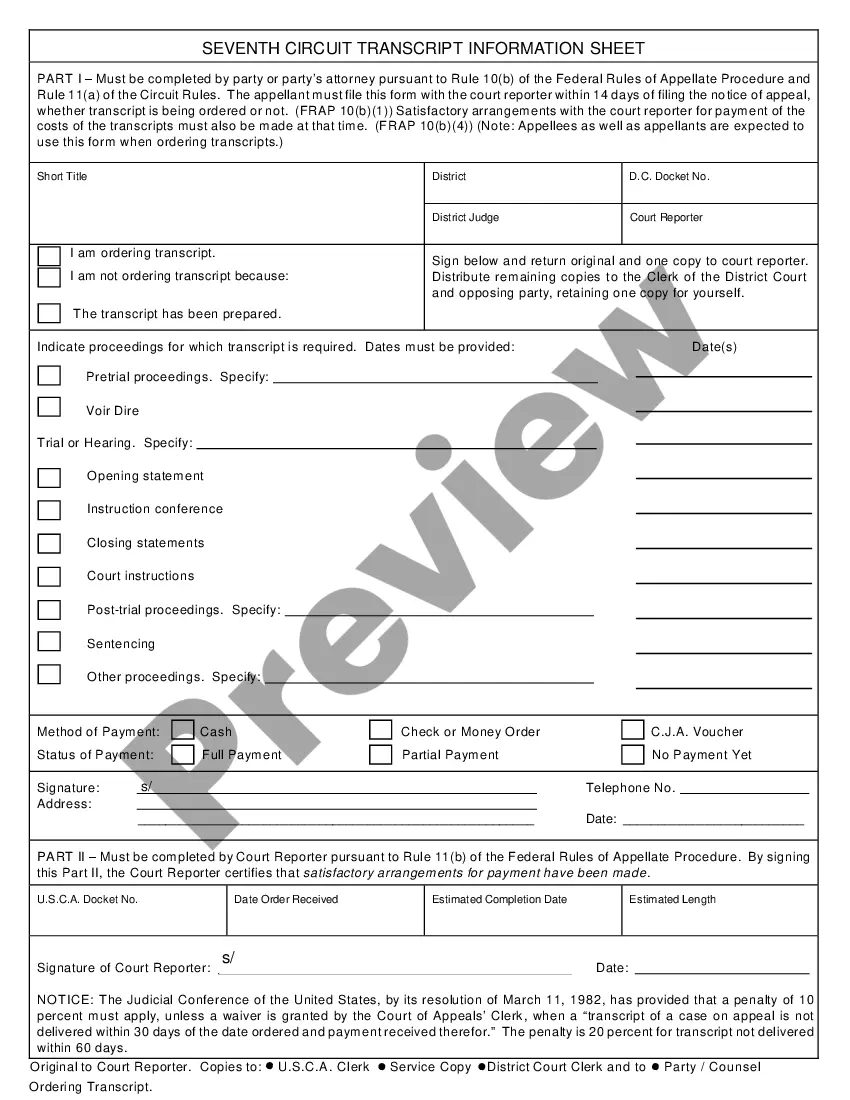

- Obtain the kind you require and make sure it is to the appropriate town/county.

- Make use of the Review key to review the shape.

- Browse the outline to ensure that you have selected the appropriate kind.

- In the event the kind isn`t what you are looking for, take advantage of the Lookup discipline to find the kind that meets your requirements and specifications.

- Whenever you discover the appropriate kind, just click Purchase now.

- Select the pricing prepare you need, complete the desired information to create your bank account, and pay money for an order with your PayPal or Visa or Mastercard.

- Pick a convenient paper file format and download your duplicate.

Locate all the record web templates you might have purchased in the My Forms menu. You can get a additional duplicate of Massachusetts Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage anytime, if possible. Just click on the required kind to download or print the record web template.

Use US Legal Forms, one of the most considerable assortment of lawful varieties, to save time and stay away from mistakes. The services offers professionally produced lawful record web templates which you can use for a range of functions. Make a merchant account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline for repayment. Once the document is signed by both parties, it becomes a legally binding contract.

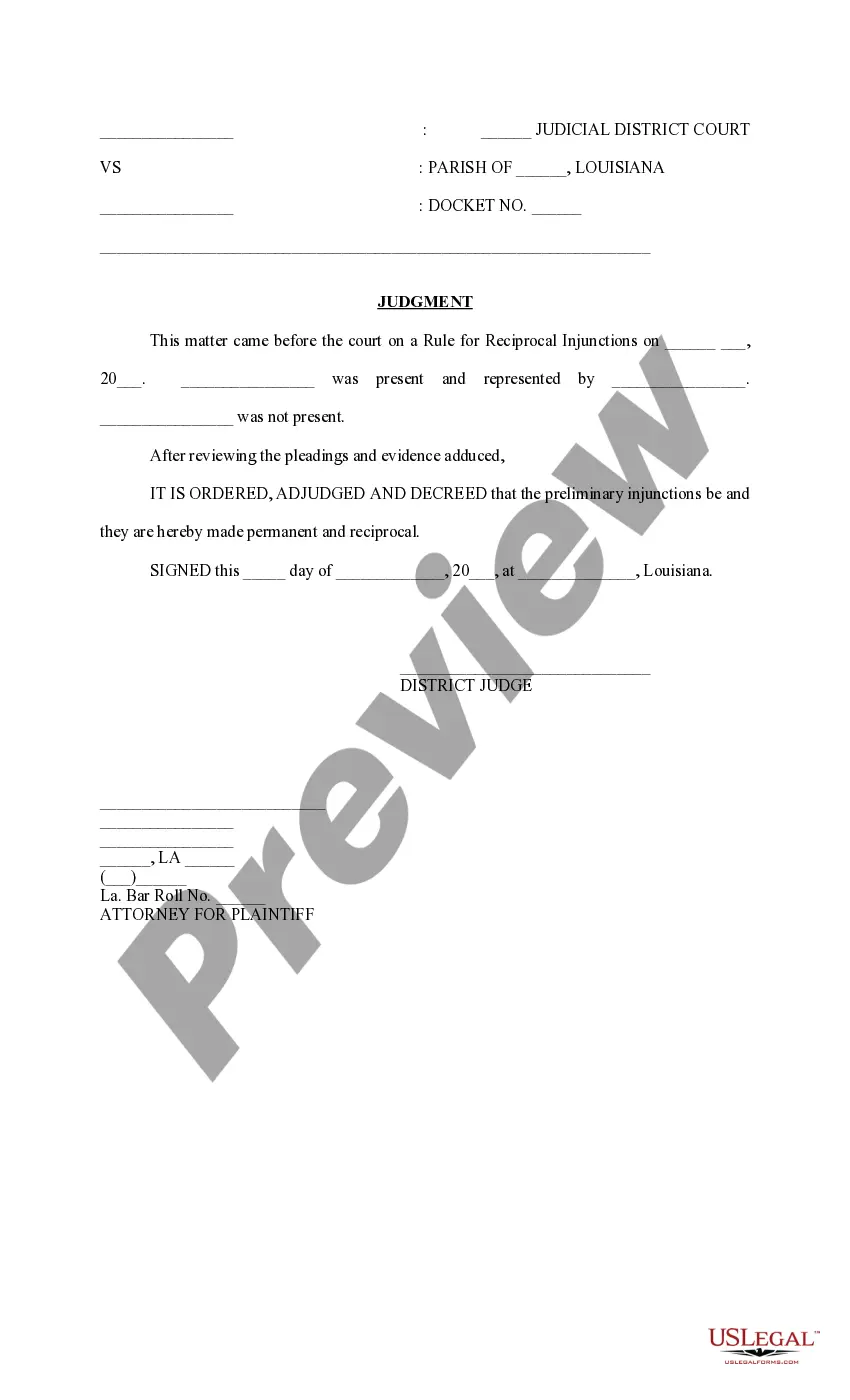

A "loan modification" is a written agreement that permanently changes the promissory note's original terms to make the borrower's mortgage payments more affordable. A modification typically lowers the interest rate and extends the loan's term.

If you lend money to someone and the borrower later wants more time to pay, or lower monthly payments, you can use this form to make changes to the original promissory note.

The borrower will then review and sign the document, thus making the Promissory Note legally binding and enforceable. Depending on the agreement, the lender may wish to have the document signed before a witness or notary public.

If you lend money to someone and the borrower later wants more time to pay, or lower monthly payments, you can use this form to make changes to the original promissory note.

For example, you might agree to change the interest rate or the length of the loan. Always put promissory note changes in writing and have the borrower sign off on them, as oral changes can't be enforced in court. Changing a note without the borrower's written agreement makes a promissory note invalid.