An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date

Description

How to fill out Agreement To Modify Promissory Note And Mortgage To Extend Maturity Date?

Are you in a situation where you need documents for either business or personal reasons almost every day? There are numerous legal document templates available online, but finding ones you can trust is challenging. US Legal Forms provides thousands of form templates, including the Massachusetts Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date, which are designed to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. Then, you can download the Massachusetts Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date template.

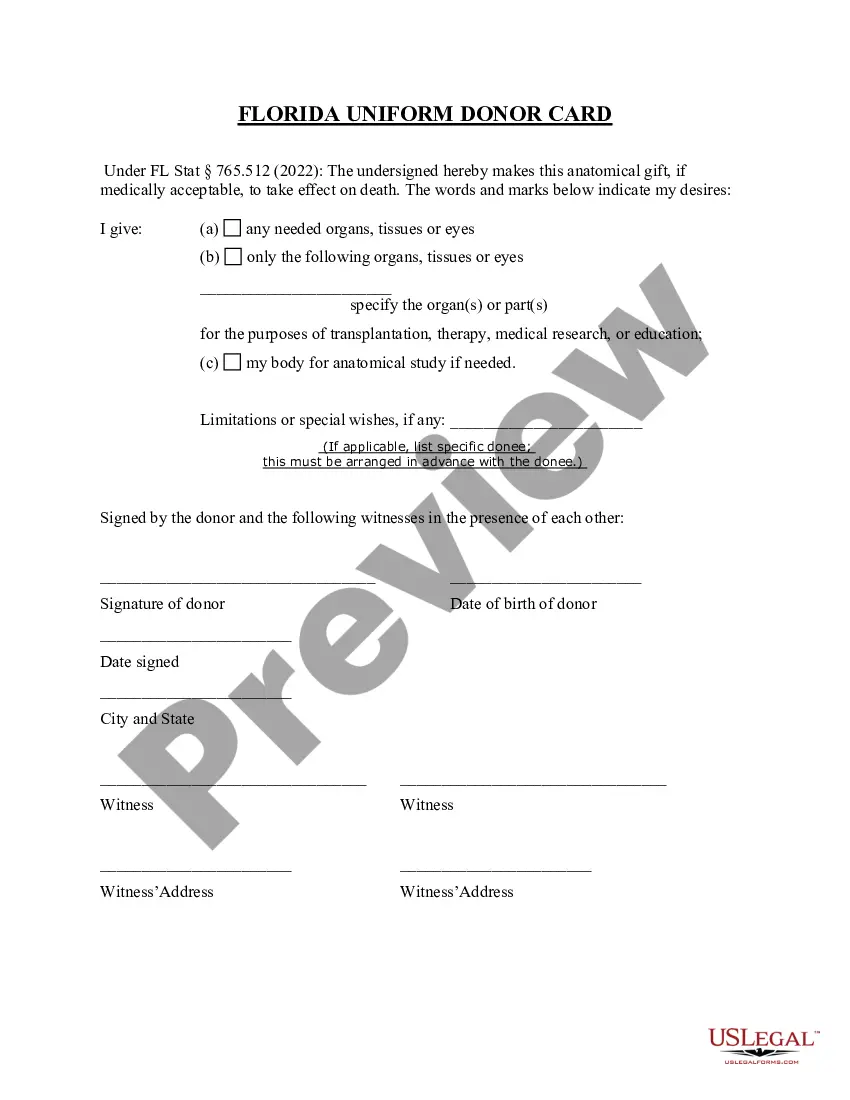

If you do not have an account and wish to start using US Legal Forms, follow these instructions: Obtain the form you require and ensure it is for your specific city/region. Utilize the Preview button to review the form. Check the details to confirm that you have selected the correct form. If the form is not what you are seeking, use the Search field to find the form that meets your requirements. Once you find the appropriate form, click on Get now. Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Refrain from altering or deleting any HTML tags. Only change plain text outside of the HTML tags.

- Select a suitable document format and download your copy.

- Find all the document templates you have purchased in the My documents section.

- You can download another copy of the Massachusetts Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date at any time, if necessary.

- Click on the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

- The service provides expertly crafted legal document templates that you can use for various purposes.

- Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Homeowners with an FHA loan who are experiencing financial hardship and are unable to afford their current mortgage payment may be able to lower their monthly payment by extending their loan term to 40 years.

An amendment to a promissory note is a legal document that makes changes to the original promissory note in a legal manner. The original contract may be restated in order to include the new changes that were made by the amendment to the promissory note.

The modification can reduce your monthly payment to an amount you can afford. Modifications may involve extending the number of years you have to repay the loan, reducing your interest rate, and/or forbearing or reducing your principal balance.

What is a Mortgage Modification Agreement? The mortgage modification agreement is a legal document between a lender and borrower to change an existing loan's terms. A typical modification may include reducing the interest rate, extending the repayment term, lowering monthly payments, or even forgiving part of the debt.

Loan modification is a change made to the terms of an existing loan by a lender. It may involve a reduction in the interest rate, an extension of the length of time for repayment, a different type of loan, or any combination of the three.

If you aren't able to make your mortgage payments and you want to stay in your home, a modification is usually a good option, ing to Roitburg. "The single largest benefit that borrowers would expect is that they avoid foreclosure," he says. A loan modification can affect your credit.

For example, your 30-year mortgage may change to a 40-year mortgage. This gives you longer to repay the amount, so your payments would be lower, but you'll also pay more in interest over the life of your loan.

Loan modifications are a long-term mortgage relief option for borrowers experiencing financial hardship, such as loss of income due to illness. A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable.