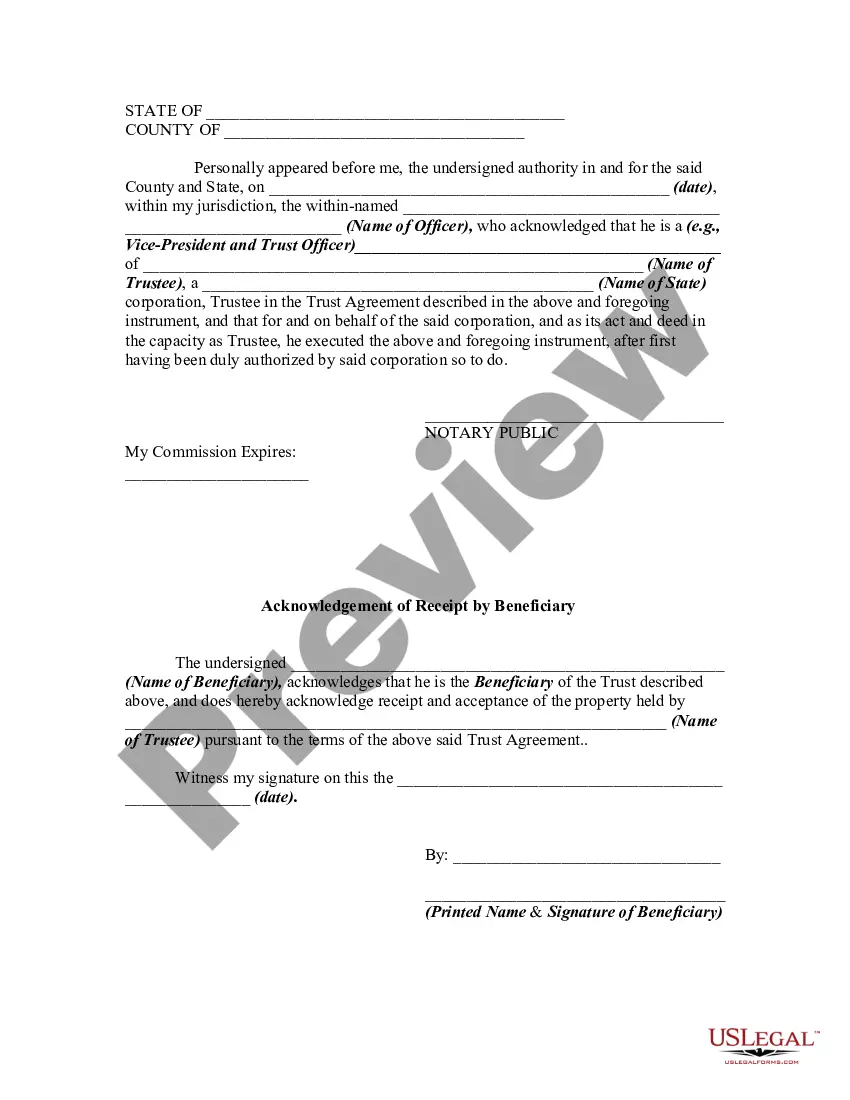

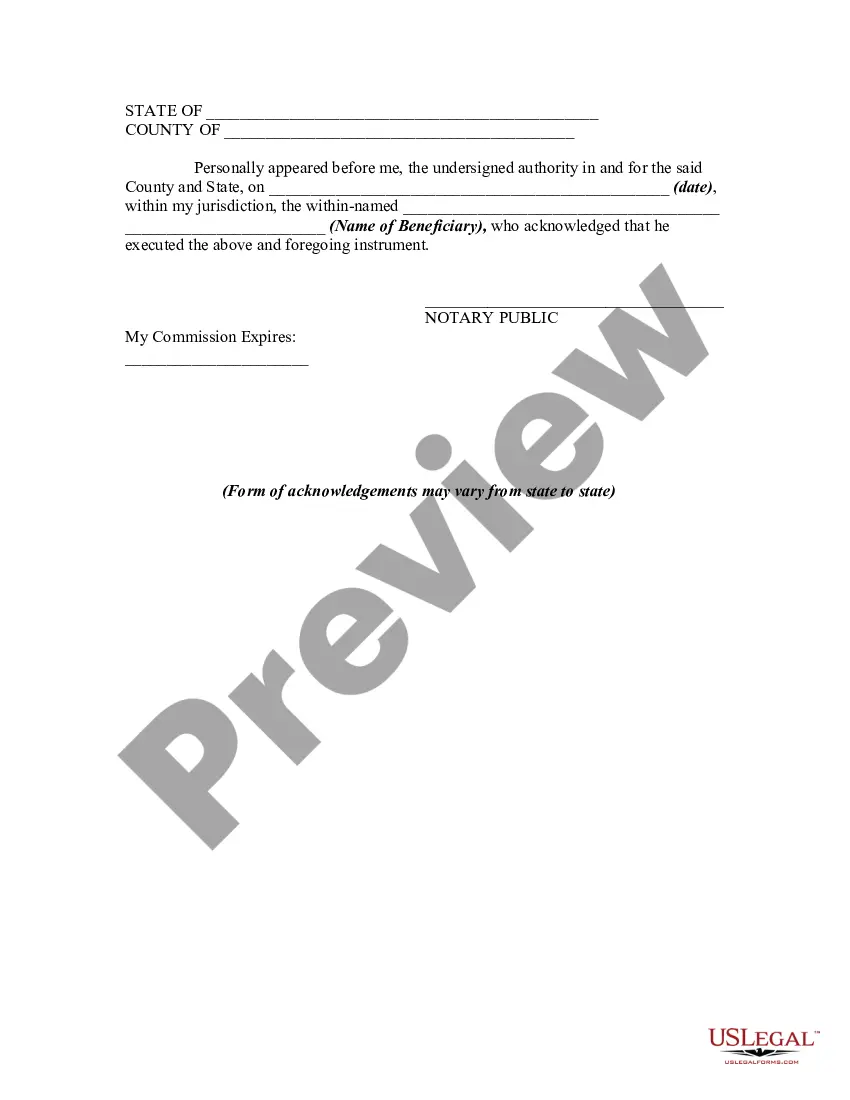

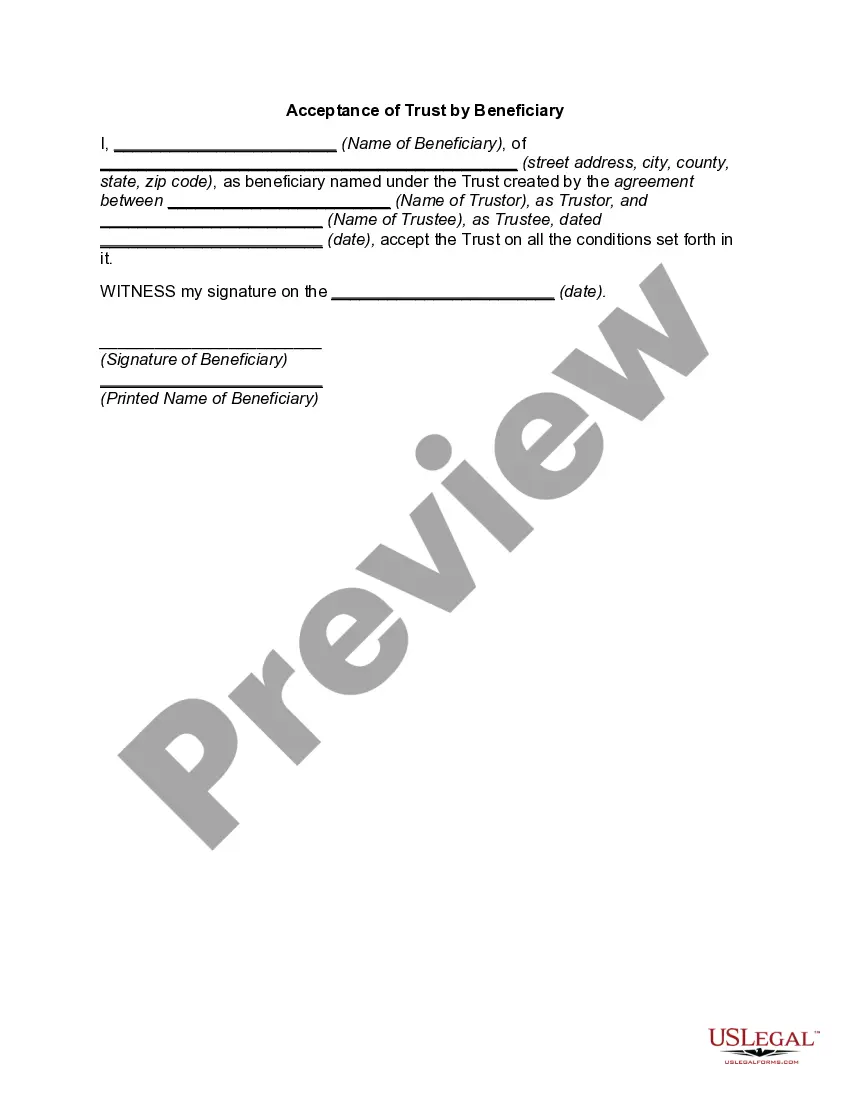

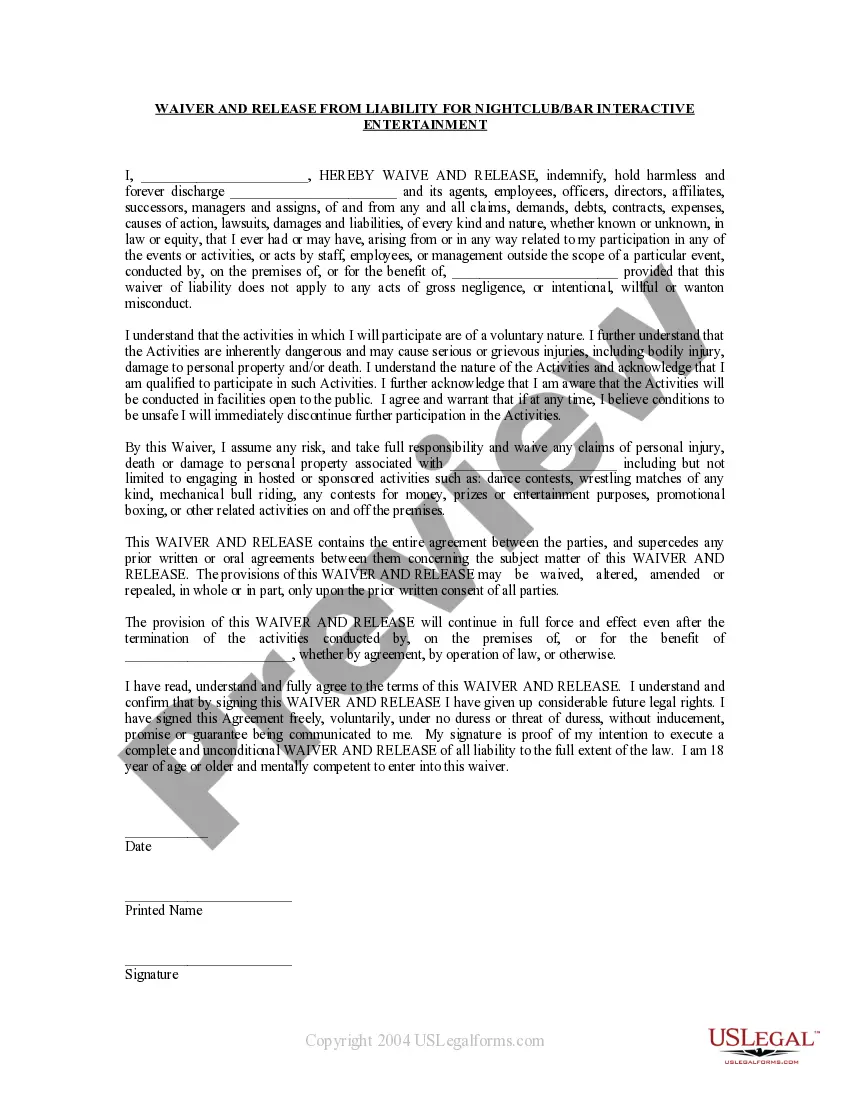

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary

Description

How to fill out Release By Trustee To Beneficiary And Receipt From Beneficiary?

Finding the appropriate legal document template can be a challenge.

Indeed, there are numerous formats available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The service offers a vast array of formats, including the Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary, which can be utilized for both business and personal purposes. All forms are reviewed by professionals and conform to state and federal regulations.

Once you are confident that the form is suitable, select the Acquire now button to obtain the form. Choose the pricing plan you prefer and input the necessary information. Create your account and complete the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary. US Legal Forms is the largest collection of legal forms where you can discover various document formats. Utilize the service to obtain well-crafted papers that comply with state regulations.

- If you are already registered, Log In to your account and click the Acquire button to obtain the Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary.

- Use your account to search through the legal forms you may have previously purchased.

- Navigate to the My documents section of your account and download an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your locality/state. You can examine the form using the Review button and read the form description to confirm that it is the right one for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

Form popularity

FAQ

Trustees have a fiduciary duty to act in the best interests of the beneficiaries and must consider their wishes and concerns. While trustees do not need to comply with every request from beneficiaries, they must provide transparent communication and manage the trust responsibly. This communication often includes discussions surrounding the Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary, ensuring that beneficiaries remain informed about their interests.

In Massachusetts, beneficiaries should expect to be notified of their status within a few months after a person's death. The executor typically has a duty to inform beneficiaries about the will and the estate's value. This notification process can vary depending on the complexity of the estate, but delays can sometimes occur. Once the estate is settled, beneficiaries will often receive a Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary as proof of their distribution.

Trust law in Massachusetts grants beneficiaries specific rights regarding the trust and its assets. Beneficiaries must receive information about the trust, including its purpose and the assets it contains. Understanding these laws can empower beneficiaries to ensure trustees comply with their duties, including handling releases properly, such as receiving a Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary when they receive their share.

In Massachusetts, an executor must disclose essential information such as the existence of the will, the estate's assets, and any debts owed. Beneficiaries have a right to understand how the executor intends to manage the estate. Transparency is vital, as beneficiaries should be fully informed of their rights and the administration process, which can include providing a Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary when distributions occur.

A release from beneficiaries is a formal document in which beneficiaries agree that they have received their distributions from the trust. This document shows that the beneficiaries acknowledge receipt and that they will not hold the trustee liable for the assets distributed. In the context of a Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary, this document is crucial for ensuring that trustees fulfill their duties properly and protect themselves from future claims.

An inheritance distribution letter communicates the specifics of what a beneficiary will receive from an estate or trust. It should specify the assets and their value, along with any conditions that may apply. Incorporating a Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary can enhance this letter, ensuring legal protection and clarity during the distribution process.

To write a trust distribution letter, clearly outline the details of the distribution, including the amount and type of assets being distributed. Address the letter to the beneficiary and include a section for their acknowledgment. Always ensure to include a Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary for transparency and record-keeping purposes.

A beneficiary release form is a document that confirms a beneficiary's receipt of their distribution from a trust or estate. It serves as a legal acknowledgment that the beneficiary has received their entitled assets under the trust agreement. This form is crucial for maintaining accurate records and may often be accompanied by a Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary.

Writing an inheritance letter involves clearly stating your intentions regarding the distribution of assets. Begin by addressing the intended recipient and outlining the specifics of what they are inheriting. Additionally, provide a Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary to formalize the distribution and acknowledge receipt of such assets.

A trust distribution occurs when assets from a trust are given to beneficiaries as stipulated by the trust agreement. For example, if a trustee distributes funds from a trust to a beneficiary to cover educational expenses, that represents a trust distribution. This process is essential and must include a Massachusetts Release by Trustee to Beneficiary and Receipt from Beneficiary to document the transaction properly.