In this form, the beneficiary of a trust acknowledges receipt from the trustee of all monies due to him/her pursuant to the terms of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Receipt for Payment of Trust Fund and Release

Description

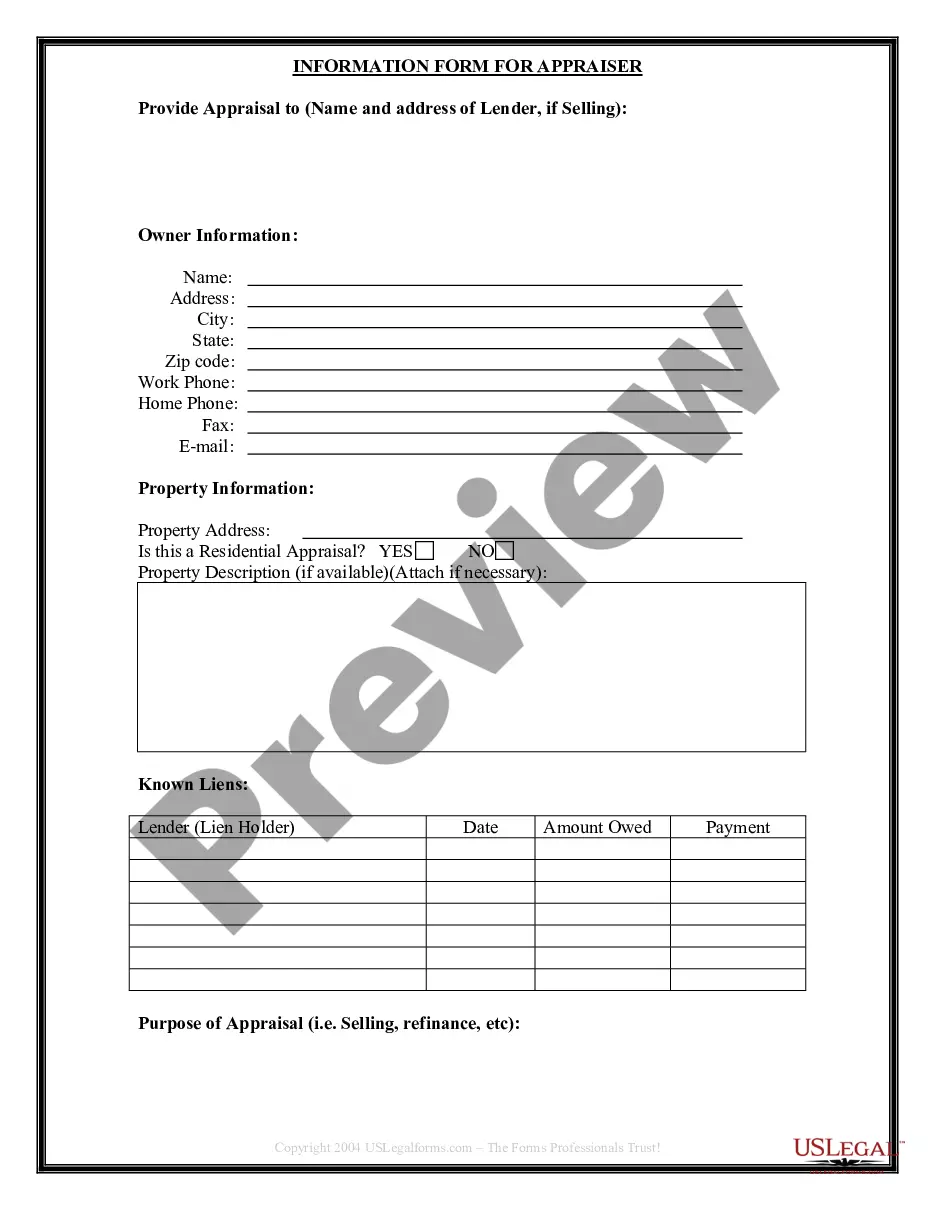

How to fill out Receipt For Payment Of Trust Fund And Release?

You can spend several hours online searching for the official document template that meets the federal and state requirements you will need.

US Legal Forms offers thousands of official forms that are reviewed by experts.

You can easily download or print the Massachusetts Receipt for Payment of Trust Fund and Release from your service.

If available, utilize the Review button to check the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Massachusetts Receipt for Payment of Trust Fund and Release.

- Each and every official document template you obtain is yours for a lifetime.

- To get another copy of any purchased form, go to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/town of your choice.

- Review the form description to guarantee you have chosen the right format.

Form popularity

FAQ

To file a small estate affidavit in Massachusetts, you should gather necessary documents, including the death certificate and proof of assets. You must complete the affidavit according to state law, which should detail the assets and liabilities. Once ready, submit it to the appropriate court; this is where the Massachusetts Receipt for Payment of Trust Fund and Release may come into play. Utilizing platforms like USLegalForms can simplify obtaining the necessary forms and ensure accuracy during this process.

Closing an estate in Massachusetts involves several steps. First, you'll need to ensure that all debts, claims, and taxes are settled. After obtaining a Massachusetts Receipt for Payment of Trust Fund and Release, you can file a petition to close the estate with the Probate Court. It’s advisable to work with a legal expert to navigate this process smoothly.

In Massachusetts, trust income is generally taxable. The state requires trustees to report income earned by the trust on the trust's income tax return. When dealing with the Massachusetts Receipt for Payment of Trust Fund and Release, it’s essential to consult with a tax professional. This ensures compliance and helps you understand any tax implications for the trust.

In Massachusetts, trusts are generally not public records. Unlike wills, which must be filed with the probate court, the details of a trust typically remain private. However, the Massachusetts Receipt for Payment of Trust Fund and Release may be necessary when dealing with trust assets. To ensure you handle trust matters correctly, consider using USLegalForms to access reliable legal documents tailored for Massachusetts.

Yes, in Massachusetts, beneficiaries are entitled to receive a copy of the trust document, which includes all its terms. This right helps beneficiaries understand their interests and how the trust operates. Additionally, the trustee should offer transparency regarding the management of the trust. If you need assistance in obtaining or managing trust documents, our platform offers resources on creating a Massachusetts Receipt for Payment of Trust Fund and Release that can help clarify these important details.

In Massachusetts, a trustee is required to notify beneficiaries of the trust within a reasonable time after the trust becomes effective. Typically, this notification should occur within 30 days of the trustee's appointment. By providing this timely notice, trustees ensure that beneficiaries are aware of their rights and interests in the trust. If you are navigating the complexities of trust management, consider using our platform to generate a Massachusetts Receipt for Payment of Trust Fund and Release to streamline processes.

Bringing a trust to an end involves following the specific terms laid out in the trust document and fulfilling all obligations to the beneficiaries. You will need to distribute the remaining assets accordingly and secure signatures of acknowledgment from beneficiaries. Utilizing a Massachusetts Receipt for Payment of Trust Fund and Release can help formalize this closure.

Letters of authority for a personal representative in Massachusetts empower an individual to act on behalf of an estate or trust. These letters are issued by the court and grant the authority to manage assets, make distributions, and settle debts. If you're involved in such processes, consider using a Massachusetts Receipt for Payment of Trust Fund and Release to document your actions.

To deactivate a trust, you need to follow the legal procedures established in the trust document. This often involves distributing the trust's assets to the beneficiaries and obtaining their consent. A Massachusetts Receipt for Payment of Trust Fund and Release may be necessary to document this action adequately.

The purpose of a receipt and release is to confirm that a beneficiary has received their portion of the trust assets and to protect the trustee from future claims. This documentation instills trust and transparency within the distribution process. It's recommended to use a Massachusetts Receipt for Payment of Trust Fund and Release to achieve this.