A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Massachusetts Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

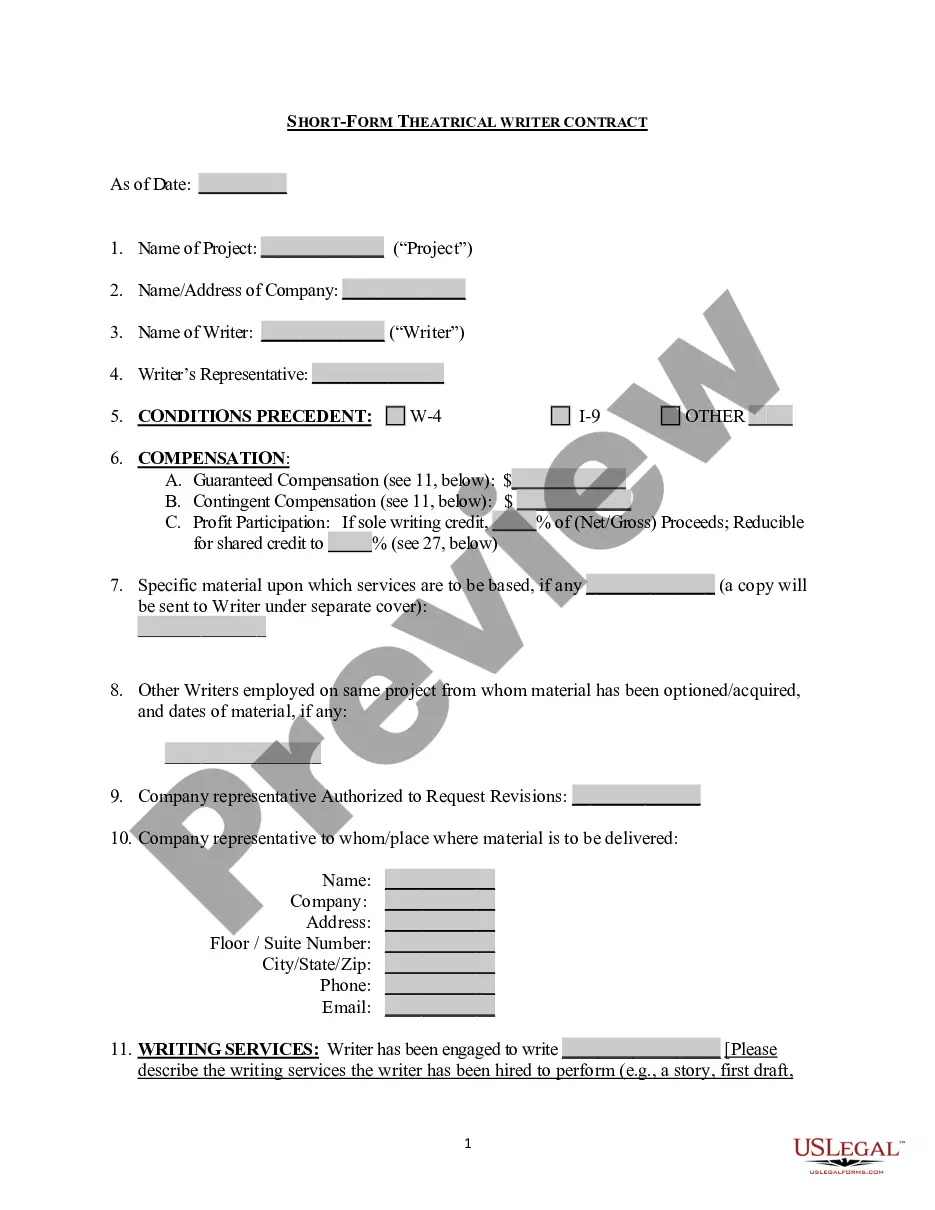

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

Locating the appropriate legal document template can be challenging.

Certainly, there are numerous templates accessible online, but how can you obtain the specific legal form you need.

Make use of the US Legal Forms website. This service offers thousands of templates, such as the Massachusetts Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, which you can employ for business and personal purposes.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Massachusetts Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

- Utilize your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the documents you require.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/county. You can preview the form using the Review button and examine the form details to confirm this is the right one for you.

Form popularity

FAQ

An unlimited continuing guaranty is a guarantee where the guarantor is liable for an indefinite amount of the borrower's obligations, throughout the duration of the guarantee. This means that as long as the guaranty is in force, the guarantor remains responsible for any debts incurred, without limitations. For businesses in Massachusetts, the Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability offers clarity in these situations, ensuring parties understand their obligations.

A guarantee of collection requires the creditor to attempt to collect from the borrower before seeking payment from the guarantor. In contrast, a guaranty of payment allows the creditor to demand payment directly from the guarantor without first pursuing the borrower. Knowing this distinction is essential, particularly in the context of Massachusetts Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, as it directly impacts the guarantor's responsibilities.

An unlimited guaranty is a type of guarantee where the guarantor accepts responsibility for the total amount of the borrower's indebtedness, without any cap or limit. This differs from limited guarantees, which restrict liability to a certain amount. When considering a Massachusetts Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, understanding the implications of an unlimited guaranty is crucial for both lenders and guarantors.

An example of a continuing guaranty would be a business owner who signs a document agreeing to guarantee their company's loans. If the company takes out multiple loans over several years, the guarantor remains liable for the debts incurred even if they exceed the original amount. In Massachusetts, a Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability encapsulates this scenario, ensuring creditors can secure their interests.

A continuing guarantee is a financial commitment that remains in effect until it is explicitly revoked. This type of guarantee provides assurance to a lender or creditor that they will receive payment for any future debts incurred by the borrower. In the context of Massachusetts Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, this means that the guarantor is responsible for the borrower's obligations as they arise over time.

A continuing guarantee obligates the guarantor to support debts incurred over time until the agreement is revoked. Under the Massachusetts Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, the guarantor's responsibilities can be extensive, which makes it critical to understand the scope and duration of financial commitments involved.

A guarantor assumes full responsibility for a debt, while a limited guarantor agrees to cover a debt only up to an agreed amount. In the case of a Massachusetts Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, understanding these roles can significantly affect risk management and financial protection.

Your liability as a guarantor is effective from the moment you sign the guarantee document. If you have a Massachusetts Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, it is essential to clarify the terms. Reviewing this agreement can help determine your financial obligations and potential risks.

Yes, a limited guarantee can still be joint and several, which means each guarantor can be held accountable for the entire debt. In the context of a Massachusetts Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, this arrangement specifies the limits of the guarantee while preserving joint liability aspects.

Yes, a guarantor can be jointly and severally liable, meaning they are responsible for the full debt, not just a portion. In a situation involving a Massachusetts Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, this arrangement ensures that creditors can pursue any one guarantor for the entire amount owed, regardless of promises made among the guarantors.