A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

Massachusetts Continuing Guaranty of Business Indebtedness By Corporate Stockholders

Description

How to fill out Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

If you desire to complete, acquire, or print legal document templates, utilize US Legal Forms, the leading assortment of legal forms, which are accessible online.

Employ the site's straightforward and effective search feature to find the documents you require.

Different templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Massachusetts Continuing Guaranty of Business Indebtedness By Corporate Stockholders with just a few clicks.

Each legal document template you acquire is yours indefinitely. You will have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Massachusetts Continuing Guaranty of Business Indebtedness By Corporate Stockholders with US Legal Forms. There are countless professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Obtain button to get the Massachusetts Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

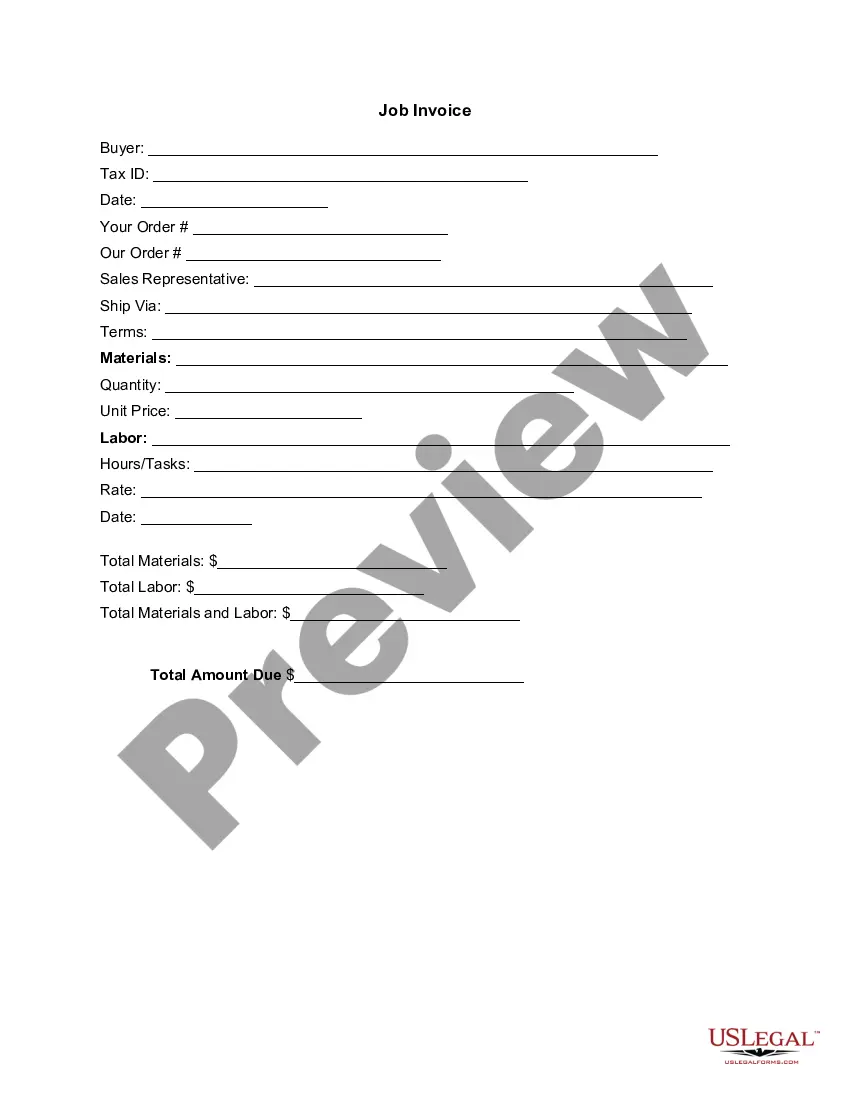

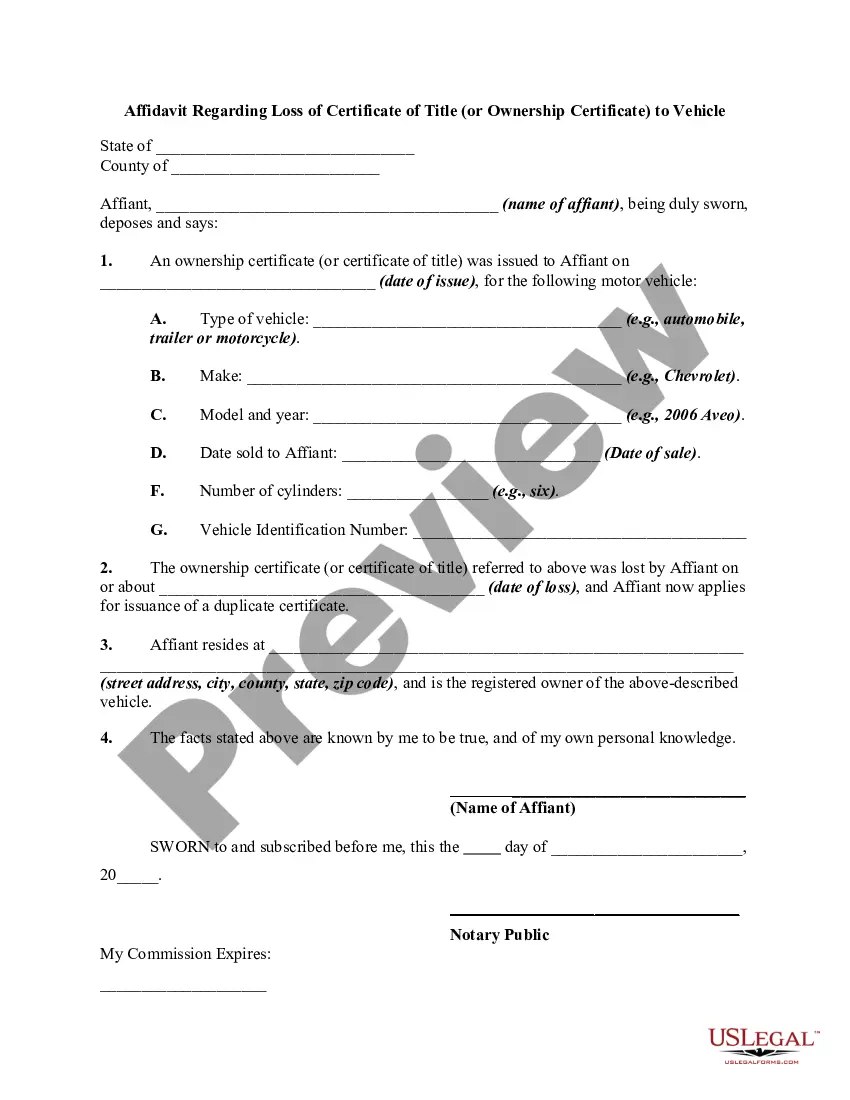

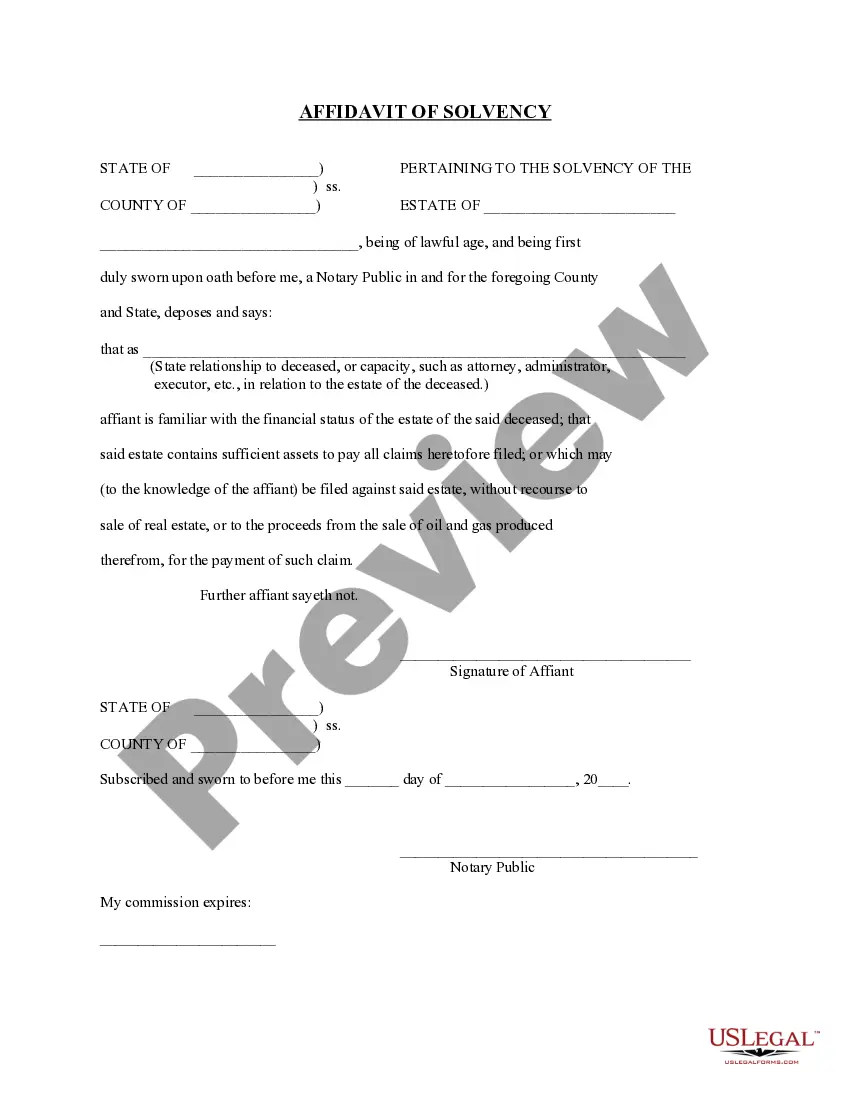

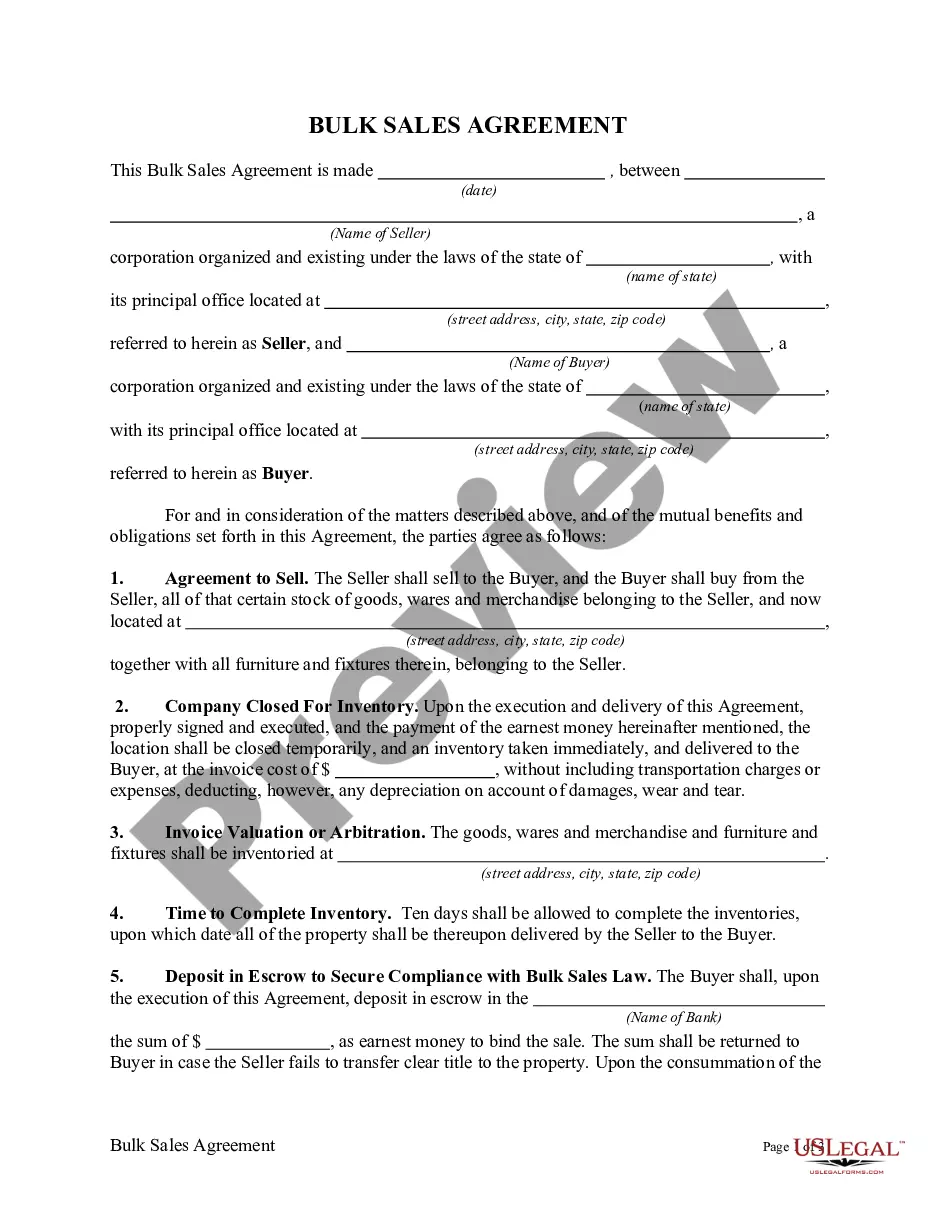

- Step 2. Use the Preview option to review the document’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions in the legal form type.

- Step 4. Once you have found the form you want, click on the Acquire now button. Choose the payment plan you prefer and provide your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Step 6. Obtain the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Massachusetts Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

Form popularity

FAQ

Personal guarantors to corporate debtors are individuals who legally commit to repay debts owed by the corporation if it fails to do so. These guarantors increase the perceived reliability of the business, making it easier to obtain loans and other financing. In light of the Massachusetts Continuing Guaranty of Business Indebtedness By Corporate Stockholders, these guarantees play a significant role in bolstering the credit profile of a corporation. If you're navigating these complexities, consider using the US Legal Forms platform for tailored legal solutions.

A corporate guarantee involves a company promising to fulfill the financial obligations of its subsidiaries or affiliates. In contrast, a personal guarantee binds an individual to cover a company's debts. In the case of the Massachusetts Continuing Guaranty of Business Indebtedness By Corporate Stockholders, stockholders may offer personal guarantees, making them liable if the company defaults. Understanding this distinction is crucial for stockholders considering their financial commitments.

Terminating a personal guarantee generally involves either paying off the associated debt or reaching a mutual agreement with the creditor. In some cases, creditors may release you from the guarantee if certain conditions are met, such as a significant change in business conditions. For comprehensive guidance on dissolving a personal guarantee, consider utilizing platforms like US Legal Forms, which offer tailored solutions related to the Massachusetts Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

Yes, there are various financial institutions and service providers that specialize in offering corporate guaranties. Companies in the lending and financial services sectors often provide these guarantees as part of their offerings. Using a resource like US Legal Forms can help you find a related company that simplifies the process of obtaining a Massachusetts Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

A personal guarantee of corporate debt is a commitment made by an individual to repay the debt of a corporation if the corporation fails to do so. This type of guarantee is often required by lenders when extending credit to a business, particularly small businesses. The Massachusetts Continuing Guaranty of Business Indebtedness By Corporate Stockholders can offer an additional layer of assurance for creditors, ensuring that stockholders are personally responsible for the company's debts.

The three common types of guarantees include payment guarantees, performance guarantees, and specific guarantees. Payment guarantees promise to repay debts if the borrower defaults, performance guarantees ensure that contractual obligations will be fulfilled, and specific guarantees apply to defined obligations. Understanding these types helps stockholders make informed choices regarding the Massachusetts Continuing Guaranty of Business Indebtedness.

The corporate guarantee process involves several key steps, starting with the drafting of the guarantee agreement. This agreement clearly outlines the terms under which the company commits to make payments should the borrower default. In Massachusetts, proper documentation and legal advice are essential to ensure compliance with regulations related to the Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

Personal guarantees are commitments made by individuals who agree to be personally liable for a debt or obligation, while corporate guarantees involve obligations made by a business entity. In Massachusetts, stockholders may realize that personal guarantees carry individual risk, whereas corporate guarantees typically involve the resources of the company. Understanding these types of guarantees helps stockholders make informed decisions when securing business indebtedness.

An example of a corporate guarantee occurs when a parent company guarantees the debts of its subsidiary. In the context of a Massachusetts Continuing Guaranty of Business Indebtedness By Corporate Stockholders, a corporate entity might commit to honor financial obligations to reassure creditors about the subsidiary's financing activities. This setup strengthens lender confidence by ensuring that even if the subsidiary encounters issues, the parent company will uphold its obligations.

A guarantee of collection requires the lender to exhaust all options to collect the debt from the borrower before seeking payment from the guarantor. On the other hand, a guaranty of payment allows the lender to demand payment directly from the guarantor, regardless of the status of the borrower. In Massachusetts, understanding these distinctions is crucial for stockholders providing guarantees in a corporate setting.