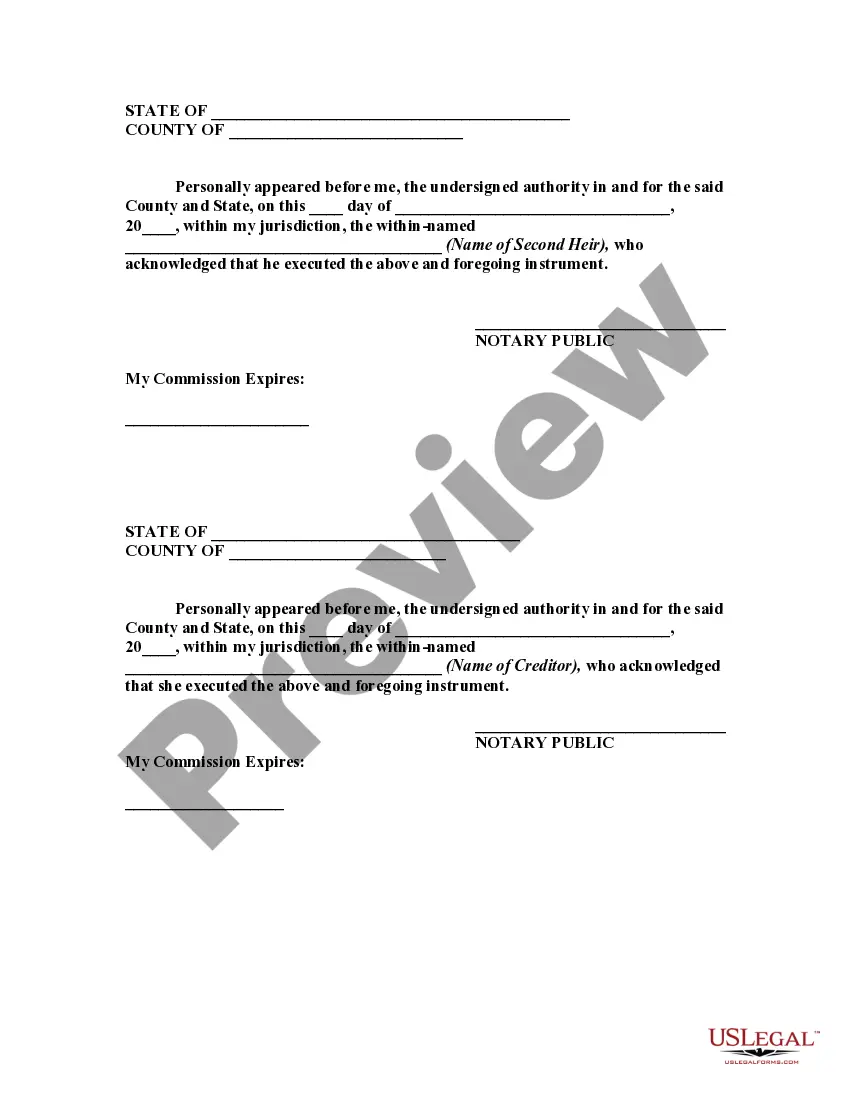

In this form, the heirs at law of an intestate estate are substituting their note for a note of the decedent. Intestate means that the decedent died without a valid will. The term heirs-at-law is used to refer to those who would inherit under the state statute of descent and distribution if the decedent dies intestate.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.