In a charitable lead trust, the lifetime payments go to the charity and the remainder returns to the donor or to the donor's estate or other beneficiaries. A donor transfers property to the lead trust, which pays a percentage of the value of the trust assets, usually for a term of years, to the charity. Unlike a charitable remainder trust, a charitable lead annuity trust creates no income tax deduction to the donor, but the income earned in the trust is not attributed to donor. The trust itself is taxed according to trust rates. The trust receives an income tax deduction for the income paid to charity.

Massachusetts Charitable Inter Vivos Lead Annuity Trust

Description

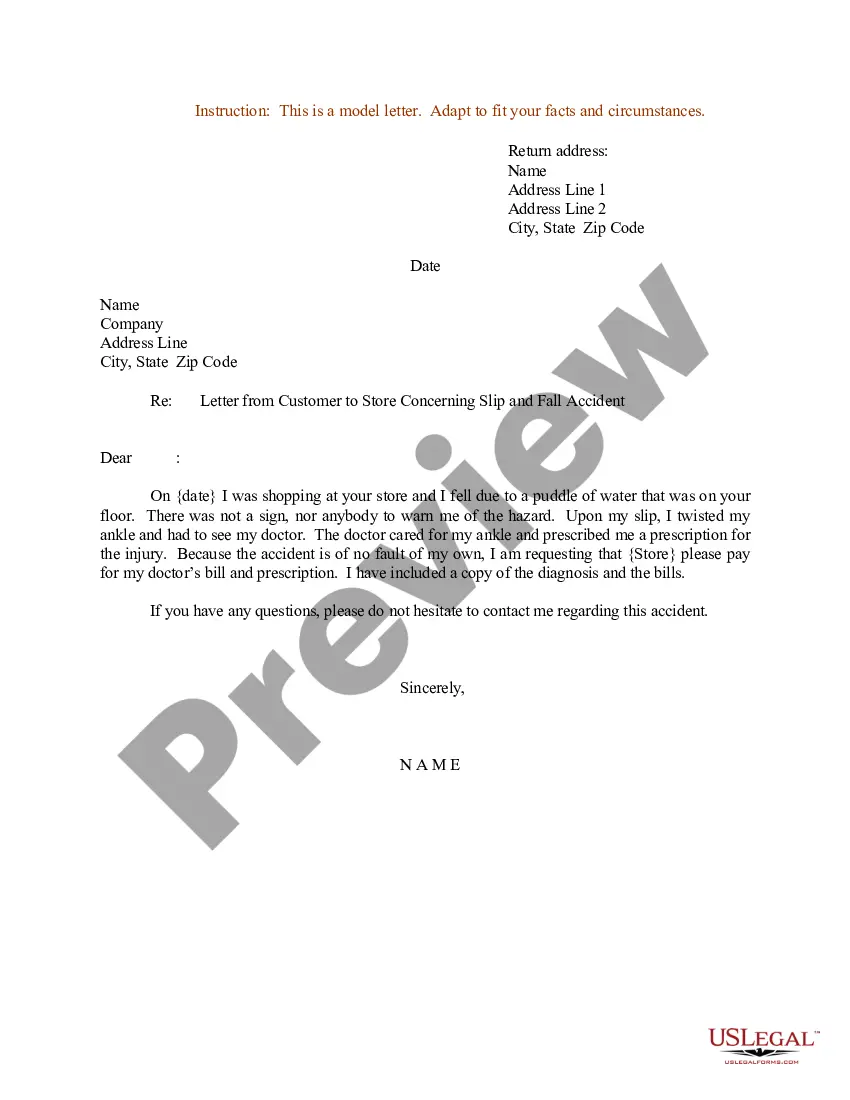

How to fill out Charitable Inter Vivos Lead Annuity Trust?

Selecting the optimal legal document format can pose challenges.

Of course, there is an abundance of templates accessible on the web, but how do you locate the legal format you require.

Utilize the US Legal Forms platform, which provides a vast array of templates, including the Massachusetts Charitable Inter Vivos Lead Annuity Trust, suitable for both professional and personal requirements.

You can review the form by clicking the Review button and examine the form summary to ensure it fits your needs.

- All documents are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and press the Acquire button to access the Massachusetts Charitable Inter Vivos Lead Annuity Trust.

- Use your account to browse through the legal documents you have previously obtained.

- Navigate to the My documents section of your account to obtain another copy of the form you require.

- For new users of US Legal Forms, here are some straightforward instructions to follow.

- First, confirm you have selected the correct template for your city/state.

Form popularity

FAQ

The primary difference lies in the flow of benefits. In a Massachusetts Charitable Inter Vivos Lead Annuity Trust, the charity receives payments first, and the remainder goes to your beneficiaries after a specific term. Conversely, a charitable remainder trust distributes assets to your beneficiaries first and then flows the remainder to the charity. Understanding these distinctions can aid in making informed decisions about your charitable and financial goals.

A Massachusetts Charitable Inter Vivos Lead Annuity Trust (CLAT) allows you to support a charity while receiving tax benefits. For instance, you might set up a CLAT that pays a fixed annual amount to a charitable organization for a set number of years. After that period, the remaining assets in the trust can go to your heirs. This structure not only provides financial assistance to a cause you care about but also helps in estate planning.

A charitable lead refers to a payment structure within a trust where a charity receives income for a fixed period before the remaining assets pass to beneficiaries. In the context of a Massachusetts Charitable Inter Vivos Lead Annuity Trust, this means the charity receives annuity payments, enhancing its funding for operations and projects. This setup enables you to support your chosen charitable causes while still benefiting from the trust’s assets.

Those who manage trusts, such as a Massachusetts Charitable Inter Vivos Lead Annuity Trust, typically need to file MA Form 2. This form is designated for fiduciaries who administer estates, trusts, or any income-producing property. Proper filing ensures compliance with state tax laws. If you are unsure, seeking guidance from a legal or tax expert is advisable.

Yes, trust income can be taxable in Massachusetts. The income generated by a Massachusetts Charitable Inter Vivos Lead Annuity Trust may be subject to state income tax rules. However, payouts made to charitable organizations can often provide you with tax advantages. It's essential to consult a tax professional to understand your specific situation.

A charitable lead annuity is a type of trust designed to support charitable organizations. In this arrangement, a fixed annuity payment is made to a charity over a term of years. After the trust term concludes, the remaining assets go to designated beneficiaries. By utilizing a Massachusetts Charitable Inter Vivos Lead Annuity Trust, you can combine philanthropy with financial planning.

A Massachusetts Charitable Inter Vivos Lead Annuity Trust (CLAT) allows you to donate to a charity while receiving income during the trust's term. Essentially, the trust pays a fixed annual amount to a charity for a specified period. Once this period ends, the remaining assets pass to your beneficiaries. This arrangement provides both charitable support and tax benefits.

A charitable remainder trust (CRT) pays income to the donor or beneficiaries for a term, with the remainder going to charity. In contrast, a charitable lead trust (CLT) distributes income to charity first, then returns the assets to the donor’s beneficiaries. Both vehicles, including the Massachusetts Charitable Inter Vivos Lead Annuity Trust, offer unique approaches to charitable giving and financial planning.

Charitable lead trusts, while beneficial for tax planning and philanthropy, can have disadvantages. Establishing a lead trust may involve complex legal requirements and ongoing management costs. Additionally, once assets are committed to the trust, the donor relinquishes control during the trust term. Understanding options like the Massachusetts Charitable Inter Vivos Lead Annuity Trust can provide clarity in evaluating your charitable investment decisions.

Charitable lead annuity trusts (CLATs) provide fixed payments to charities for a specified term, after which the remaining assets revert to the donor or their beneficiaries. This allows donors to fulfill charitable intentions while potentially mitigating gift tax exposure. The Massachusetts Charitable Inter Vivos Lead Annuity Trust operates similarly, creating a balance between philanthropy and personal financial planning.