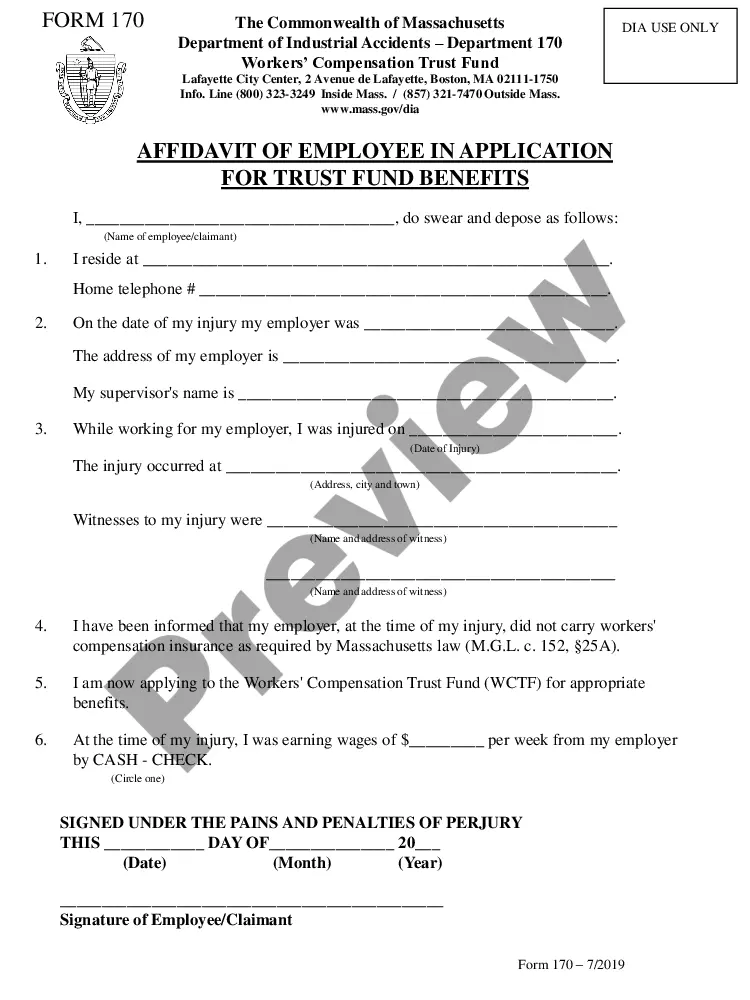

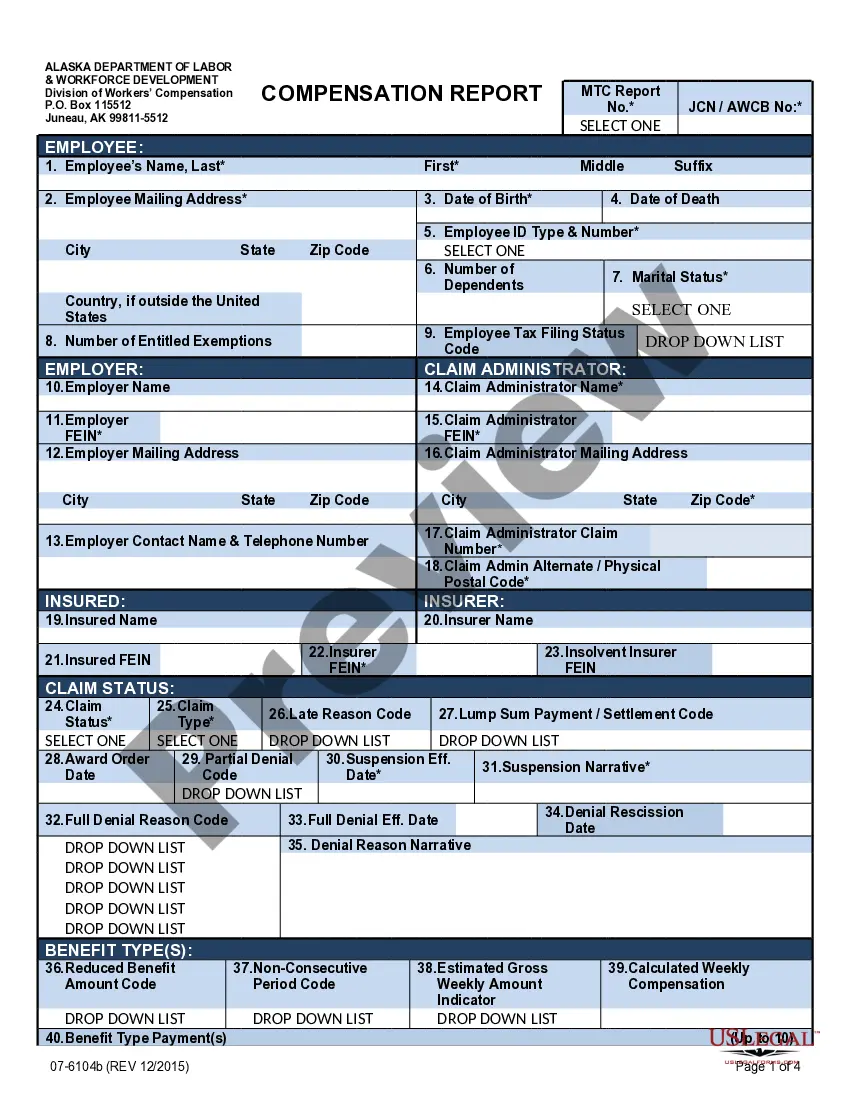

The Massachusetts Average Weekly Wage Computation Schedule is a form used to calculate the average weekly wage of workers covered by the Massachusetts Workers' Compensation Law. The form is used to determine the rate of compensation to be paid to an employee who has sustained an injury or illness that resulted in physical or mental incapacity, or death. The form is used to calculate the employee's average weekly wage by taking into account the employee's wages, tips, bonuses, commissions, and other compensation that was earned in the 12 months prior to the injury or illness. There are three types of Massachusetts Average Weekly Wage Computation Schedule: Schedule A, Schedule B, and Schedule C. Schedule A is used for employees who have only one job. Schedule B is for employees who have two or more jobs. Schedule C is for employees who have seasonal employment. Each schedule has different instructions and rules for calculating the average weekly wage.

Massachusetts Average Weekly Wage Computation Schedule

Description

How to fill out Massachusetts Average Weekly Wage Computation Schedule?

If you’re searching for a means to suitably prepare the Massachusetts Average Weekly Wage Computation Schedule without enlisting a legal expert, you’ve found the ideal location.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for every personal and commercial situation.

Another excellent aspect of US Legal Forms is that you never misplace the documents you’ve acquired - you can access any of your downloaded forms in the My documents section of your profile whenever necessary.

- Verify that the document visible on the page aligns with your legal circumstances and state regulations by reviewing its text description or examining the Preview mode.

- Type the form name in the Search tab at the top of the page and select your state from the dropdown to locate an alternative template in case of any discrepancies.

- Repeat the content verification and click Buy now when you are assured of the paperwork’s compliance with all stipulated requirements.

- Log in to your account and click Download. Create an account with the service and choose a subscription plan if you do not already have one.

- Utilize your credit card or the PayPal option to settle your payment for the US Legal Forms subscription. The document will be ready for download immediately after.

- Select the format in which you wish to save your Massachusetts Average Weekly Wage Computation Schedule and download it by clicking the corresponding button.

- Incorporate your template into an online editor for quick completion and signing, or print it out to prepare a physical copy manually.

Form popularity

FAQ

Massachusetts PFML contribution rates. The shared PFML contribution rate for 2023 is 0.63% of an employee's earnings for employers with 25 or more covered individuals. Between 0.63%, the medical leave contribution is 0.52% and the family leave is 0.11%.

Date Of ChangeMaximum RateMinimum Rate10/1/21$ 1,694.24$ 338.8510/1/20$ 1,487.78$ 297.5610/1/19$ 1,431.66$ 286.3310/1/18$ 1,383.41$ 276.6827 more rows

Examples. If you generally worked five days per week, your AWW will be set by dividing your total salary by the total number of days paid, then multiplying the result by 260, and dividing that total by 52.

These calculations are the maximum benefit amount you can receive each week- other factors could reduce this amount, such as tax withholdings or other sources of income like unemployment. For 2023, the new state average weekly wage is $1,765.34 and the new maximum weekly benefit rate is $1,129.82.

The average weekly wage (or AWW) is the key number in your case. It is calculated by taking your gross pay in the job of your injury for the 52 weeks prior to the date of your injury and averaging that gross pay by the number of weeks you worked during that 52-week period.

Examples. If you generally worked five days per week, your AWW will be set by dividing your total salary by the total number of days paid, then multiplying the result by 260, and dividing that total by 52.

The maximum weekly benefit is 75% of your weekly total temporary benefits. (Temporary total benefits are 60% of your gross average weekly wage).

Simply multiply the number of hours you receive each week by the total amount you earn in an hour. For example, if you earn $18 per hour with a guaranteed 35 hours of work per week, you will have gross weekly wages of $630, gross monthly income of $2,520 and gross annual pay of $32,760 per year.