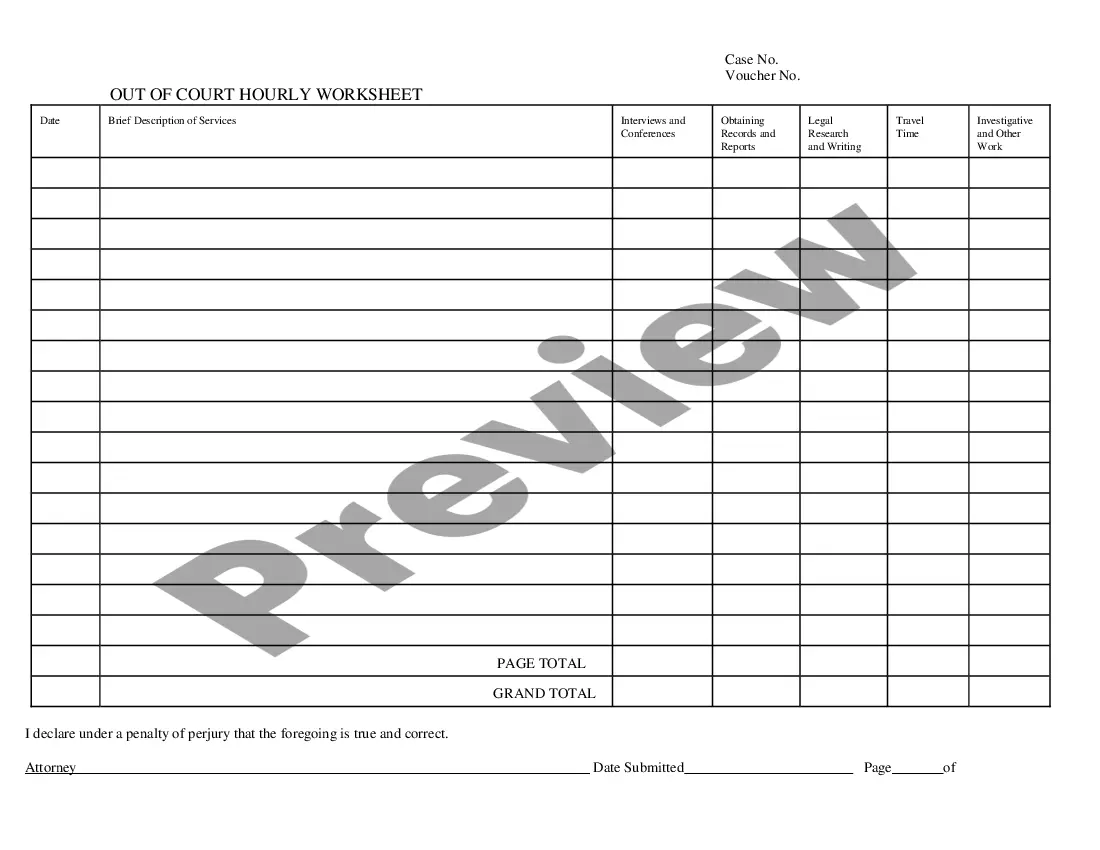

The Massachusetts Worksheet For Computing Amount of Wages Exempt From Attachment is a form used to calculate the amount of wages or salary exempted from attachment, or wage garnishment. It is used by creditors to determine how much of a debtor's wages can be legally garnished. The form is divided into two sections: (1) the Worksheet for Computing Amount of Wages Exempt From Attachment, and (2) the Worksheet for Computing Amount of Wages Exempt From Attachment -- Voluntary Agreement. The first section of the form requires the debtor to enter information such as wages earned, deductions made, and other income sources. The second section is used to enter information for any voluntary agreement between the debtor and creditor, such as a repayment plan. There are two types of Massachusetts Worksheet For Computing Amount of Wages Exempt From Attachment; one for wages earned, and the other for voluntary agreements.

Massachusetts Worksheet For Computing Amount of Wages Exempt From Attachment

Description

How to fill out Massachusetts Worksheet For Computing Amount Of Wages Exempt From Attachment?

Drafting legal documents can be quite a burden if you don't possess accessible fillable templates. With the US Legal Forms online repository of formal paperwork, you can be assured of the forms you acquire, as they all adhere to federal and state laws and have been verified by our professionals.

Thus, if you require to complete the Massachusetts Worksheet For Computing Amount of Wages Exempt From Attachment, our service is the ideal place to obtain it.

Here's a quick guide for you: Document compliance verification. You should carefully review the content of the template you want and ensure it meets your requirements and adheres to your state regulations. Previewing your document and checking its general description will assist you in this process. Alternative search (optional). If you detect any discrepancies, explore the library using the Search tab at the top of the page until you find the suitable template, then click Buy Now once you identify it. Account establishment and form purchase. Create an account with US Legal Forms. After account authentication, Log In and choose your desired subscription plan. Complete your payment to proceed (options for PayPal and credit cards are available). Template download and subsequent use. Choose the file format for your Massachusetts Worksheet For Computing Amount of Wages Exempt From Attachment and click Download to save it on your device. Print it to complete your documents by hand, or utilize a versatile online editor to prepare an electronic version more quickly and efficiently. Have you not tried US Legal Forms yet? Register for our service today to acquire any official document swiftly and conveniently each time you need, and maintain your paperwork organized!

- Acquiring your Massachusetts Worksheet For Computing Amount of Wages Exempt From Attachment from our catalog is as simple as 1-2-3.

- Previously registered users with a valid subscription just need to Log In and click the Download button after they find the appropriate template.

- Later on, if necessary, users can retrieve the same form from the My documents section of their account.

- However, even if you are not familiar with our service, signing up for a valid subscription will only take a few moments.

Form popularity

FAQ

Yes, Massachusetts allows wage garnishment under specific conditions as determined by law. However, there are limits to how much can be garnished, which is outlined in the Massachusetts Worksheet For Computing Amount of Wages Exempt From Attachment. It’s vital to know the laws in your state to ensure that you’re protected and not losing more from your paycheck than necessary.

Some states call levy attachment or garnishment. In Massachusetts, a bank account levy is allowed under Chapter 106: Section 4A-502. This subsection applies to creditor process with respect to an authorized account of the sender of a payment order if the creditor process is served on the receiving bank.

In Massachusetts, the most a creditor can garnish from your wages is the lesser of: 15% of your gross wages (that is, before taxes or other mandatory deductions are taken out) or. your disposable income less 50 times the greater of the federal or the Massachusetts hourly minimum wage per week.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673).

The amount that is 50 times the minimum wage. In January 2022, the Massachusetts minimum wage is $14.25 / hour so the amount protected is $712.50 / week.

Wage attachment in Massachusetts is one mechanism by which a creditor can enforce its judgment. In Massachusetts, unlike other jurisdictions, it is an absolute prerequisite that a creditor by a judgment creditor and not merely a non-judgment creditor before that creditor can attach a debtor's wages.

Exempt Employee Minimum Salary Starting January 1, 2023, the new minimum salary threshold is $796.17 per week, or $41,401 per year. In Massachusetts and New Hampshire this amount is $684 per week or $35,568 per year following the federal standard.