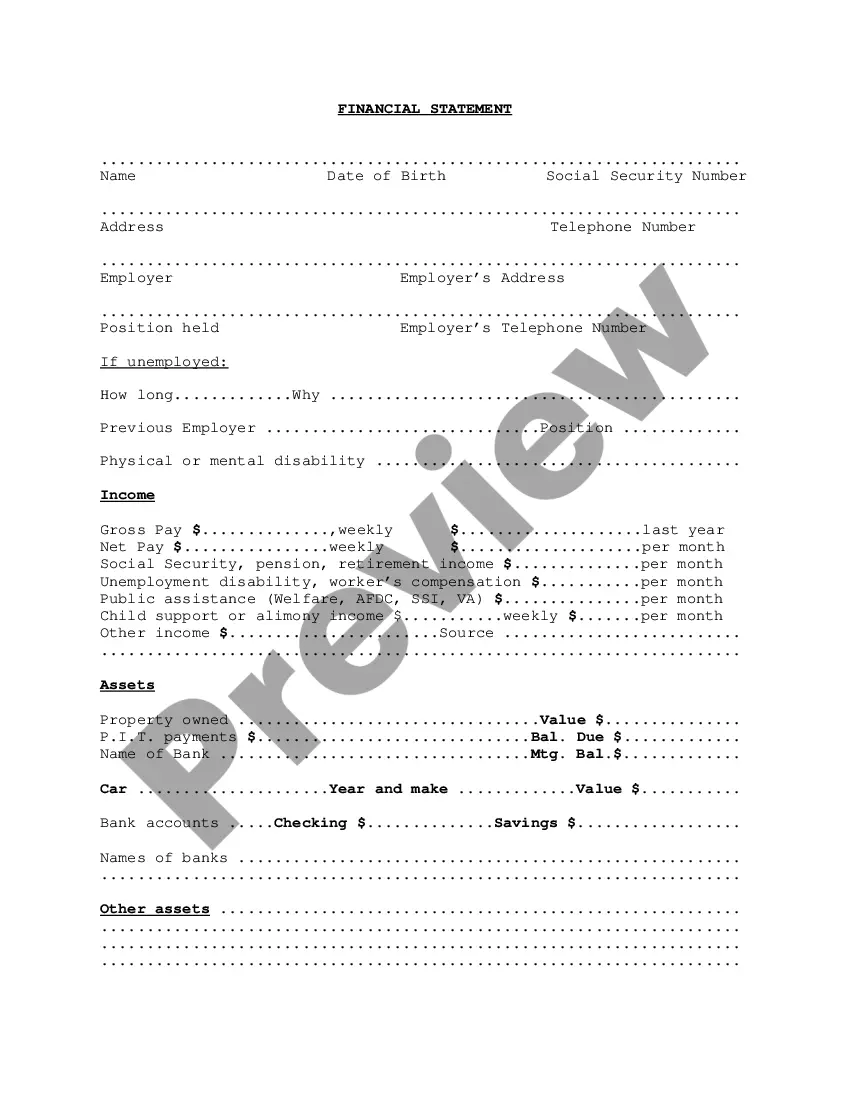

A Massachusetts Financial Statement is a document used to provide detailed information about an individual or organization's financial position. It includes income, expenses, assets, liabilities, and net worth. It is often used to apply for a loan, secure a line of credit, or assess current financial health. Types of Massachusetts Financial Statement include a Personal Financial Statement, Business Financial Statement, and Non-Profit Financial Statement. The Personal Financial Statement is used for individuals and includes the assets, liabilities, and net worth of an individual. The Business Financial Statement is used for organizations, and includes detailed information about the company's assets, liabilities, revenue, and expenses. Lastly, the Non-Profit Financial Statement is used for organizations that are exempt from taxes, and includes information about the organization's sources of income, expenses, assets, and liabilities.

Massachusetts Financial Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Financial Statement?

If you are searching for a method to properly prepare the Massachusetts Financial Statement without engaging a legal expert, then you have found the perfect place.

US Legal Forms has established itself as the most comprehensive and esteemed library of official templates for every personal and business circumstance.

Another significant benefit of US Legal Forms is that you will never lose the documents you purchased - you can find any of your downloaded templates in the My documents section of your profile whenever necessary.

- Ensure that the document displayed on the page aligns with your legal needs and state regulations by reviewing its text description or exploring the Preview mode.

- Enter the form title in the Search tab at the top of the page and select your state from the dropdown menu to locate another template in case of discrepancies.

- Perform the content verification again and click Buy now when you are confident in the paperwork's compliance with all regulations.

- Log in to your account and click Download. Sign up for the service and choose a subscription plan if you do not have one yet.

- Utilize your credit card or the PayPal method to pay for your US Legal Forms subscription. The template will be ready for download immediately afterward.

- Select the format you prefer to save your Massachusetts Financial Statement and download it by clicking the right button.

- Incorporate your template into an online editor to fill it out and sign it quickly or print it to prepare your hard copy manually.

Form popularity

FAQ

How to Prepare Financial Statements Step 1: Verify Receipt of Supplier Invoices.Step 2: Verify Issuance of Customer Invoices.Step 3: Accrue Unpaid Wages.Step 4: Calculate Depreciation.Step 5: Value Inventory.Step 6: Reconcile Bank Accounts.Step 7: Post Account Balances.Step 8: Review Accounts.

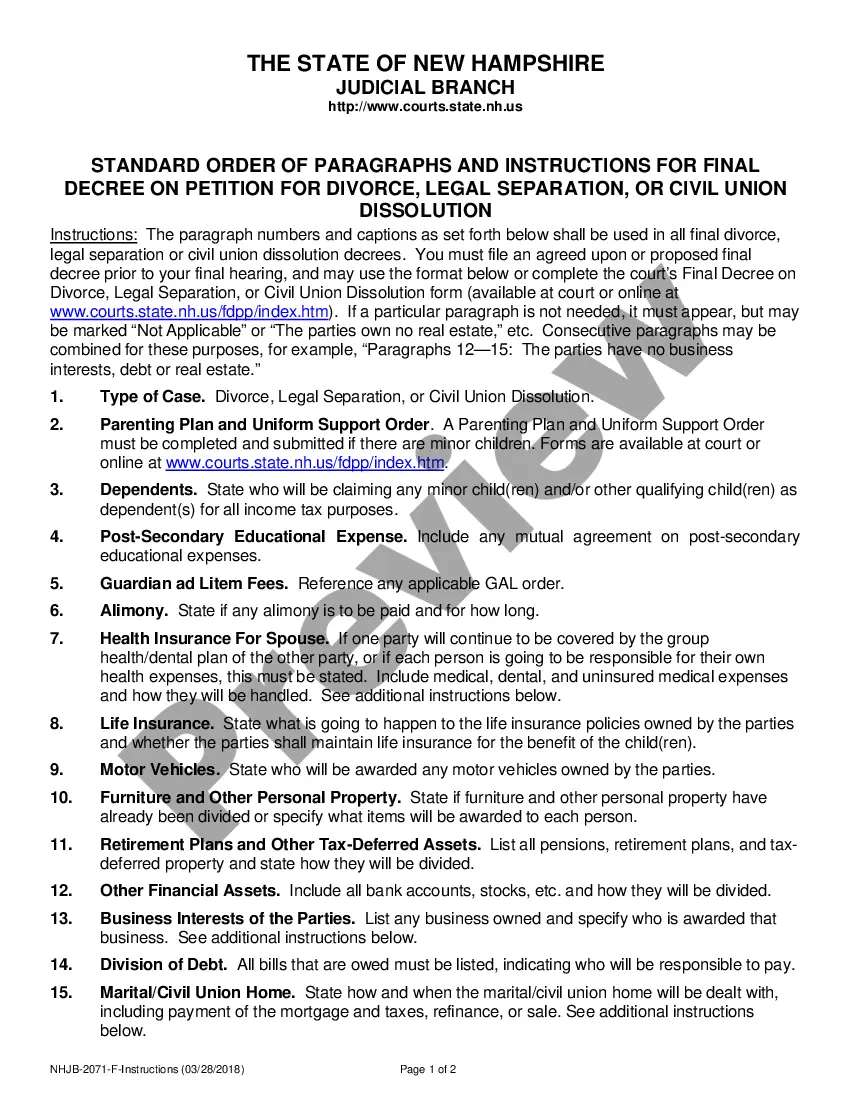

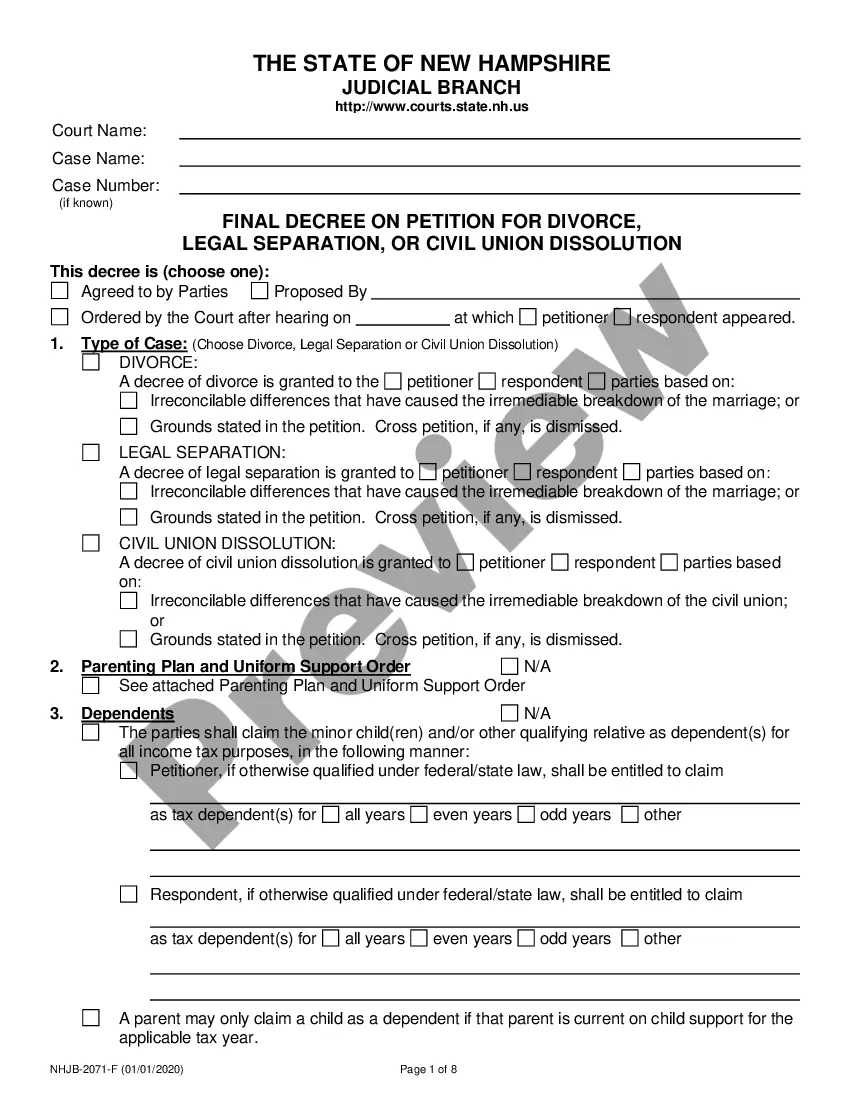

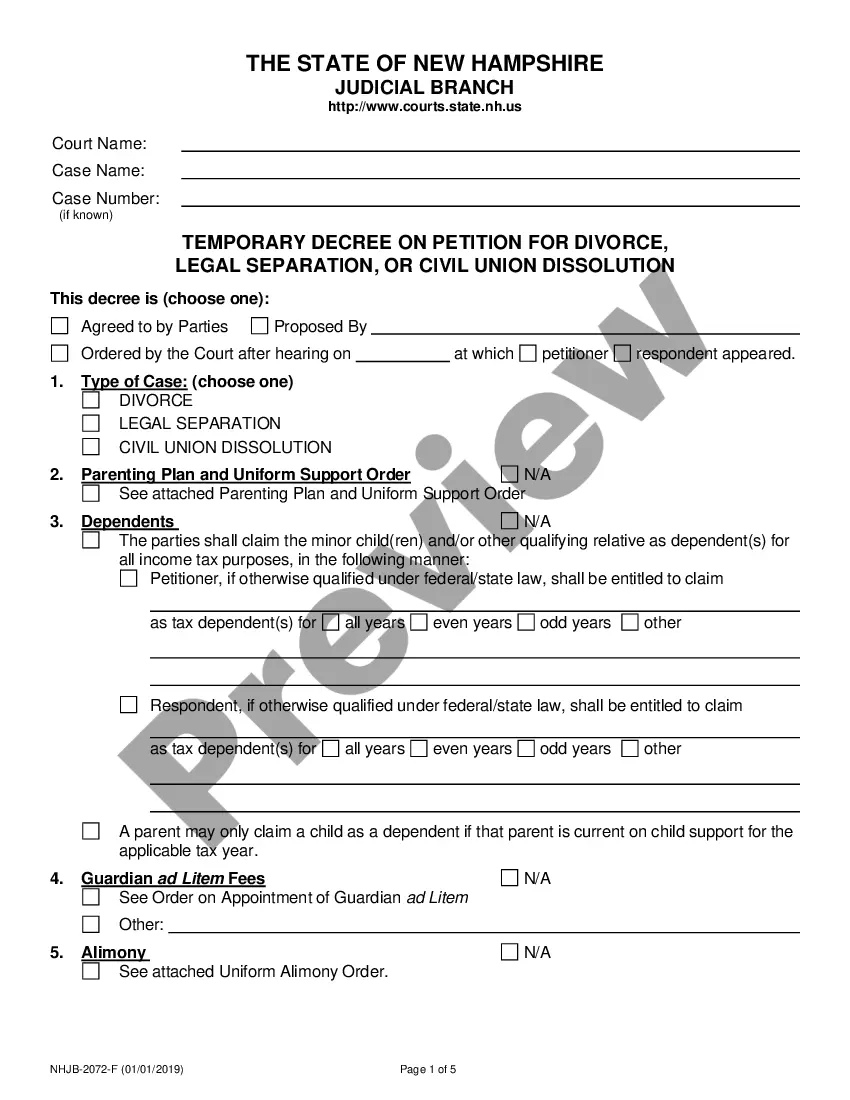

The divorce financial statement is a form that lists all assets and liabilities of each person involved in the divorce. Each person must fill one out their portion and submit it to the court in order to explain their financial situation to the court.

The 5 types of financial statements you need to know Income statement. Arguably the most important.Cash flow statement.Balance sheet.Note to Financial Statements.Statement of change in equity.

In California, each spouse to the divorce settlement must disclose all community and separate assets that they own. Each spouse must also provide information regarding his or her current income. This is the Declaration of Disclosure requirement.

5 Tips for an Accurate Financial Statement in a Divorce Do not estimate your monthly expenses.Make sure you account for all income.Report assets at their proper fair market value.Make sure all the assets and liabilities are accounted for.Update your financial statement.

What are Financial Disclosure Reports? Financial Disclosure Reports include information about the source, type, amount, or value of the incomes of Members, officers, certain employees of the U.S. House of Representatives and related offices, and candidates for the U.S. House of Representatives.

Massachusetts only has $41.5 billion of assets available to pay bills totaling $115.5 billion. Because Massachusetts doesn't have enough money to pay its bills, it has a $74 billion financial hole. To fill it, each Massachusetts taxpayer would have to send $28,100 to the state.

The past three years federal and state income tax returns; intangible personal property tax returns; corporate, partnership, or trust tax returns; as well as sales tax returns for any entity the spouse has an interest in. All loan applications and financial statements provided to third parties.