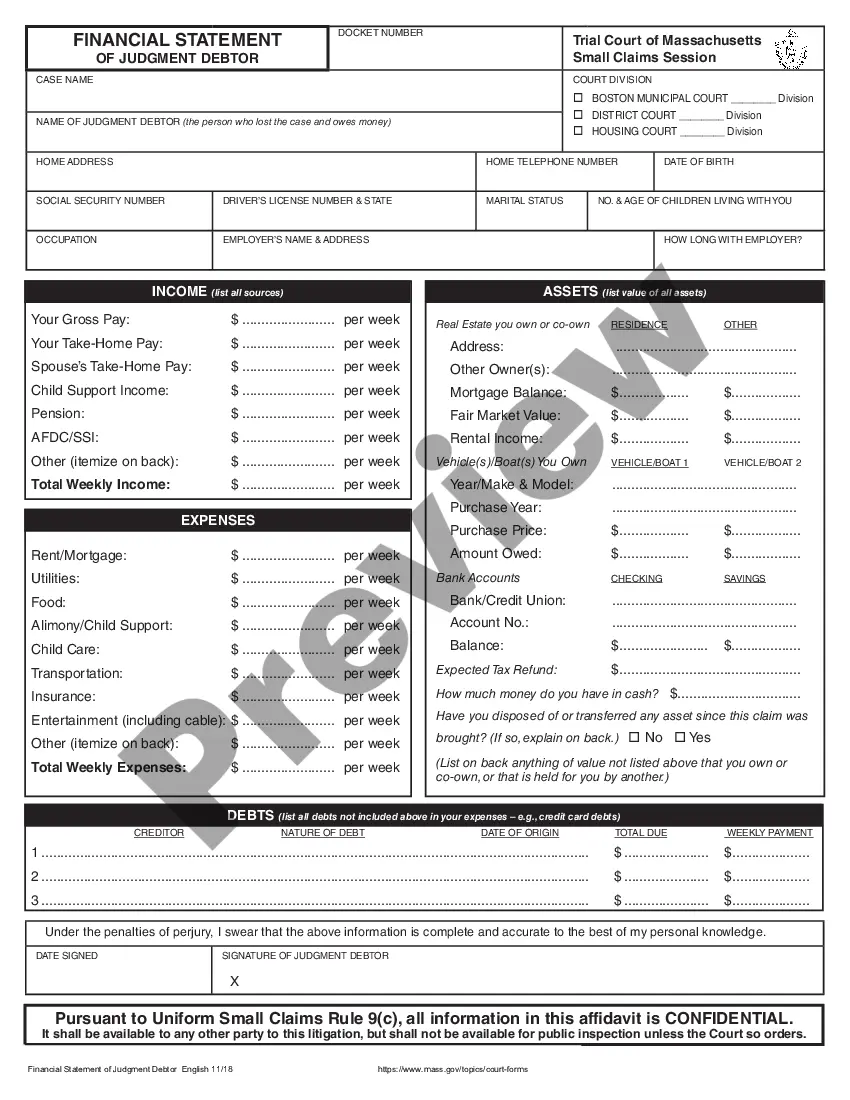

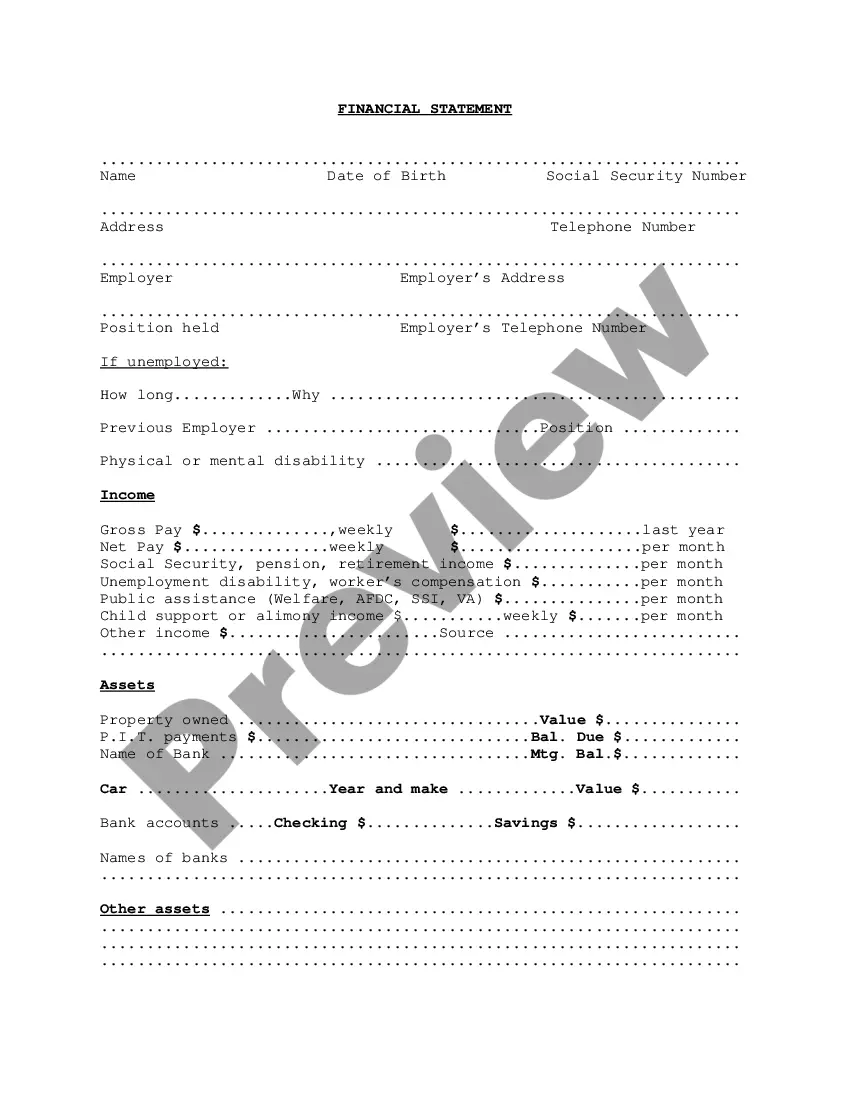

A Massachusetts Financial Statement of Judgment Debtor is a document that is filed by a creditor in order to collect money owed to them. This document is used to determine the assets and liabilities of a debtor, as well as their ability to pay a judgment. It is a required document in Massachusetts before an enforcement of judgment (EON) can be issued. There are two types of Massachusetts Financial Statement of Judgment Debtor: voluntary and involuntary. A voluntary statement is filed by the debtor and is used to inform the court of their financial situation so that the court can make a decision on the amount of the judgment. An involuntary statement is filed by the creditor and is used to summarize the debtor's assets and liabilities so that the court can determine the debtor's ability to pay the judgment.

Massachusetts Financial Statement of Judgment Debtor

Description

How to fill out Massachusetts Financial Statement Of Judgment Debtor?

What amount of time and resources do you typically allocate to creating formal documentation.

There’s a more efficient way to obtain such documents than employing legal professionals or spending hours scouring the internet for an appropriate template. US Legal Forms is the top online repository that offers expertly crafted and verified state-specific legal documents for any purpose, such as the Massachusetts Financial Statement of Judgment Debtor.

Another advantage of our library is that you can access previously downloaded documents which you securely keep in your profile under the My documents tab. Retrieve them at any time and redo your paperwork as often as necessary.

Conserve time and energy in preparing official documents with US Legal Forms, one of the most reliable online solutions. Join us today!

- Review the document content to confirm it aligns with your state regulations. To do this, read the document description or utilize the Preview option.

- If your legal document does not fulfill your criteria, search for another one using the search bar at the upper section of the page.

- If you are already a member of our service, Log In and download the Massachusetts Financial Statement of Judgment Debtor. If you are not, proceed to the following steps.

- Click on Buy now once you locate the appropriate blank. Select the subscription plan that fits you best to unlock the full advantages of our library.

- Create an account and pay for your subscription. You have the option to make a payment using your credit card or through PayPal - our service is completely trustworthy in this regard.

- Download your Massachusetts Financial Statement of Judgment Debtor to your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

Yes, a financial statement is a legal document that outlines the financial condition of a judgment debtor. Specifically, a Massachusetts Financial Statement of Judgment Debtor provides crucial information such as assets, liabilities, income, and expenses. This document serves to inform the court and creditors about the debtor's financial status and is often required in legal proceedings related to debt collection. If you need assistance in creating or understanding this document, uslegalforms can provide reliable resources and templates to help you.

Negotiate With the Judgment Creditor It's never too late to negotiate. The process of trying to grab property to pay a judgment can be quite time-consuming and burdensome for a judgment creditor.

When a person against whom a monetary judgment has been entered, the person owes a judgment debt. This party will be a judgment debtor. The party who the judgment debtor owes money to is the judgment creditor. The judgment creditor has the right to collect the judgment debt.

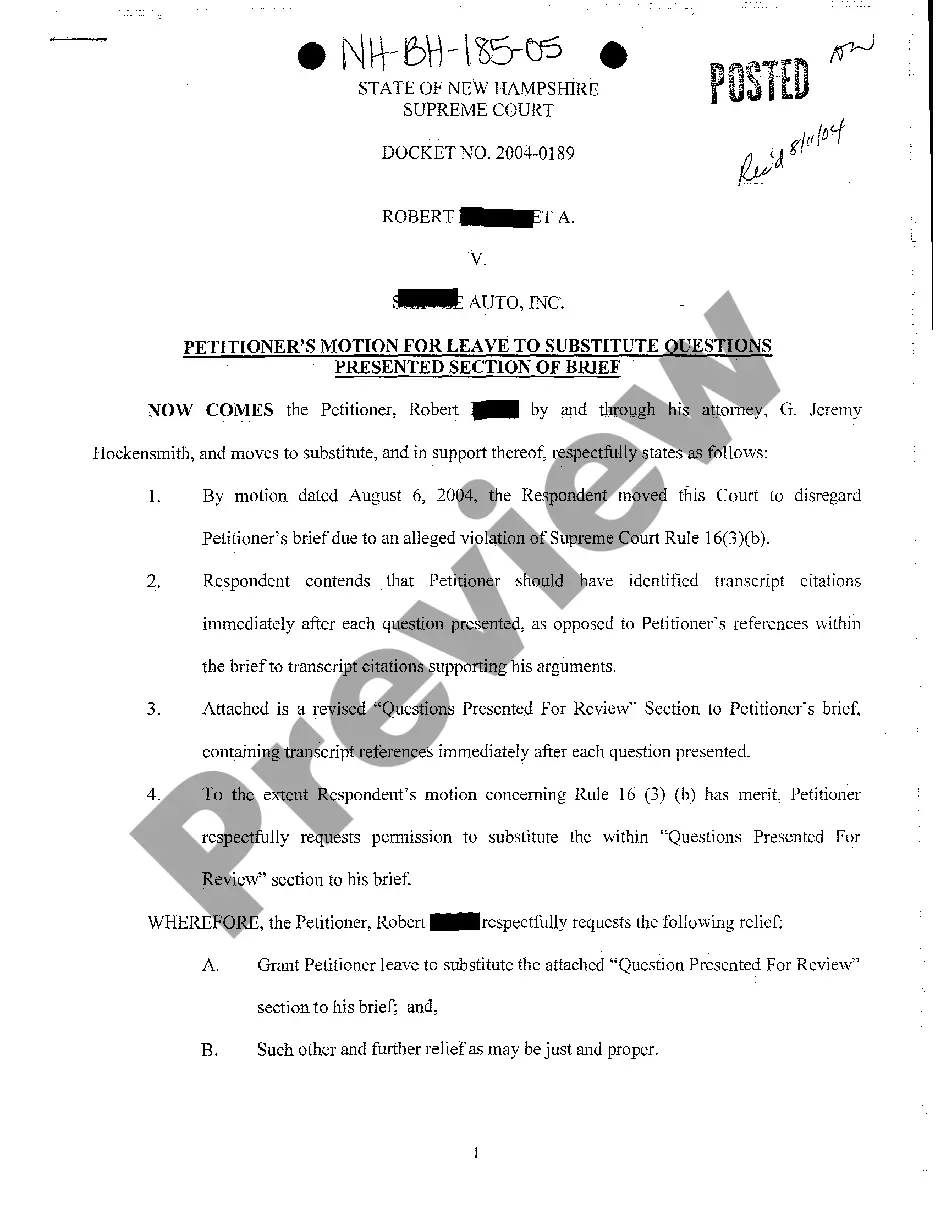

Vacating a Judgment Dismissing a Claim Massachusetts Rules of Civil Procedure (the Rules) allow a party to move to vacate a judgment if certain parameters are met. Specifically, a judgment may be vacated due to excusable neglect, mistake or inadvertence, or because of newly discovered evidence.

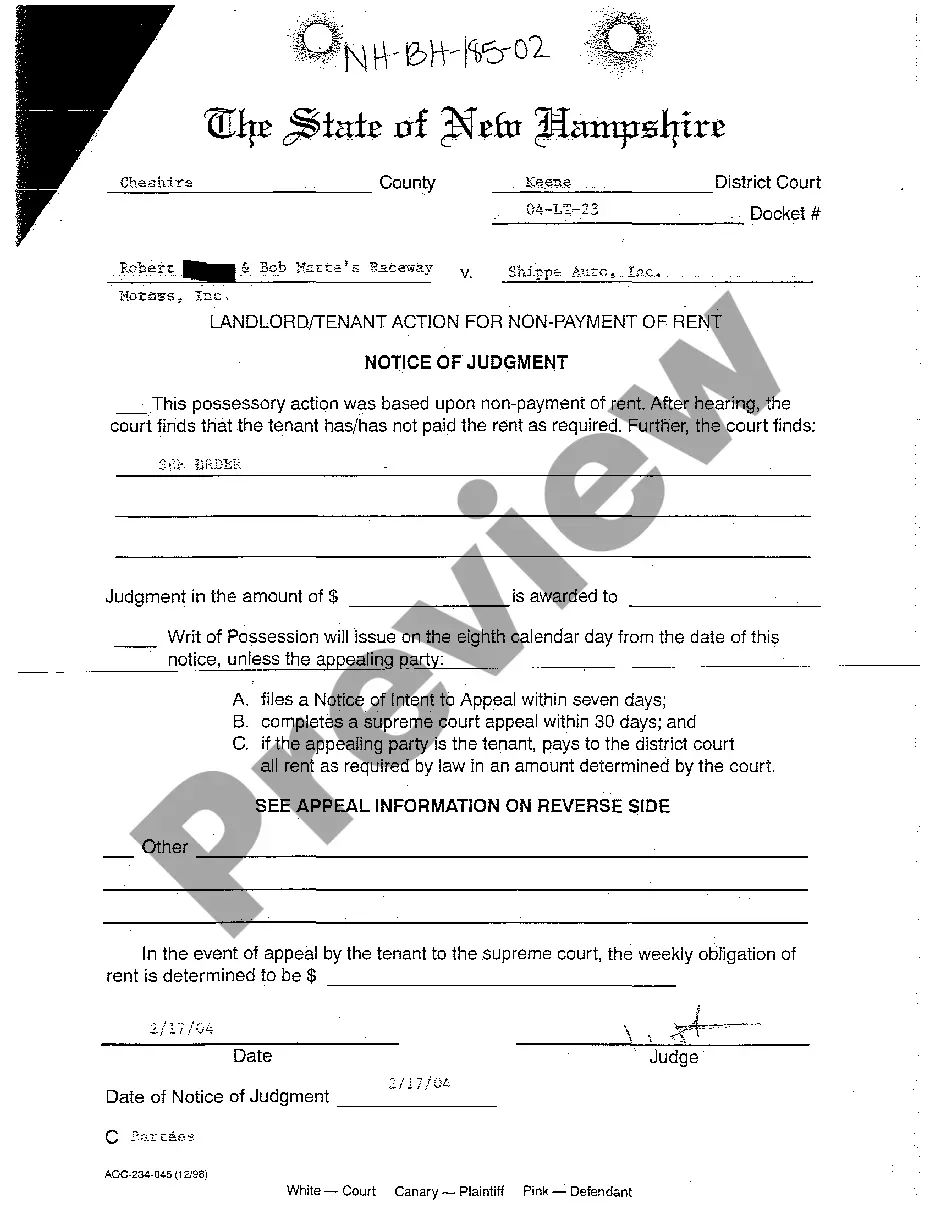

If a payment hearing wasn't scheduled, you can ask for a Writ of Execution 30 days after the judgment date. Give the Writ of Execution to a constable or a deputy sheriff to seize and sell the judgment debtor's property to pay the judgment.

If you don't pay the amount required even though you're able to, you may be held in contempt of court and imprisoned or given additional costs. Pay the full amount directly to the other party (the "judgment creditor") unless the magistrate has ordered otherwise.

Massachusetts laws The statute of limitations for consumer-related debt is six years. This period applies to credit card debt and oral and written contracts.

What to do if you win your small claims case Step 1: Ask for payment. The party that wins the case is called the ?judgment creditor,? and the party that needs to pay is called the "judgment debtor."Step 2: Attend a payment hearing if one has been scheduled.Step 3: Tell the court that you've received payment.

You don't have an unlimited amount of time to file a claim. You'll have to bring it within the statute of limitations period for your particular case. For example, the Massachusetts statute of limitations periods is six years for oral and written contracts, and three years for personal injury and property damage cases.