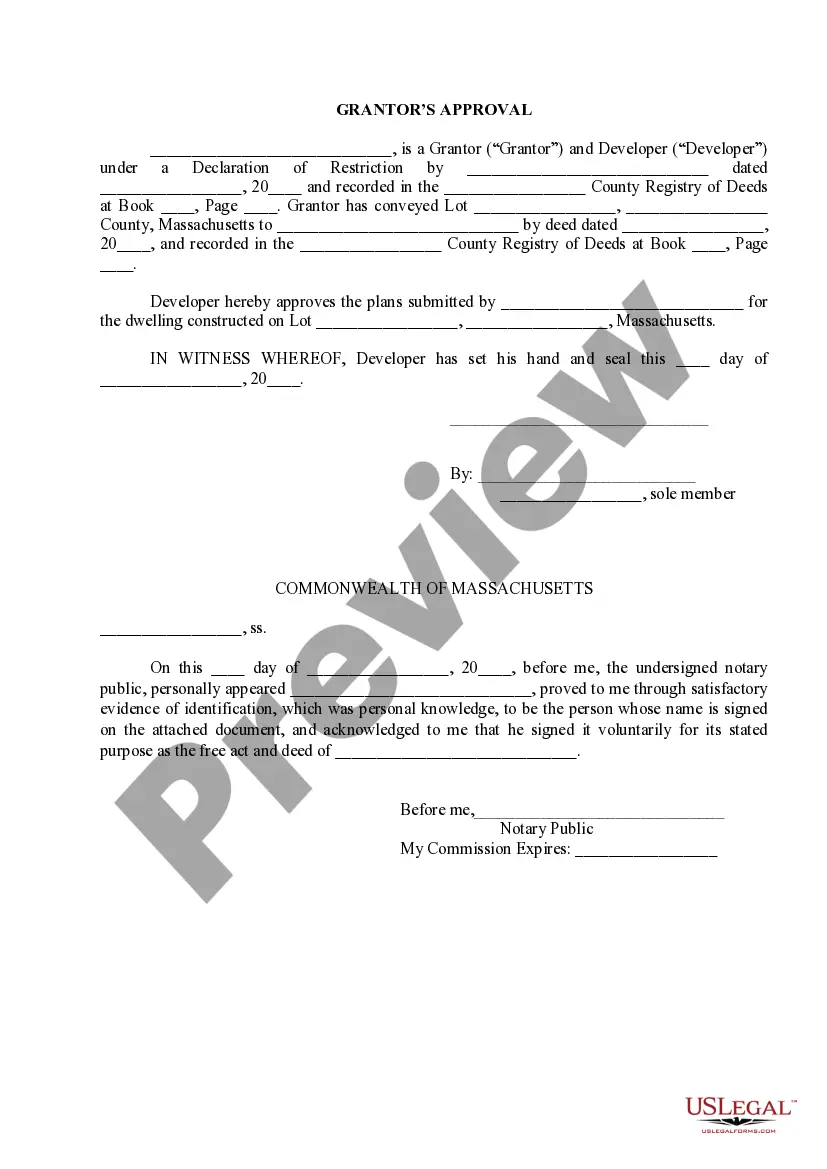

Massachusetts Grantor's Approval

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

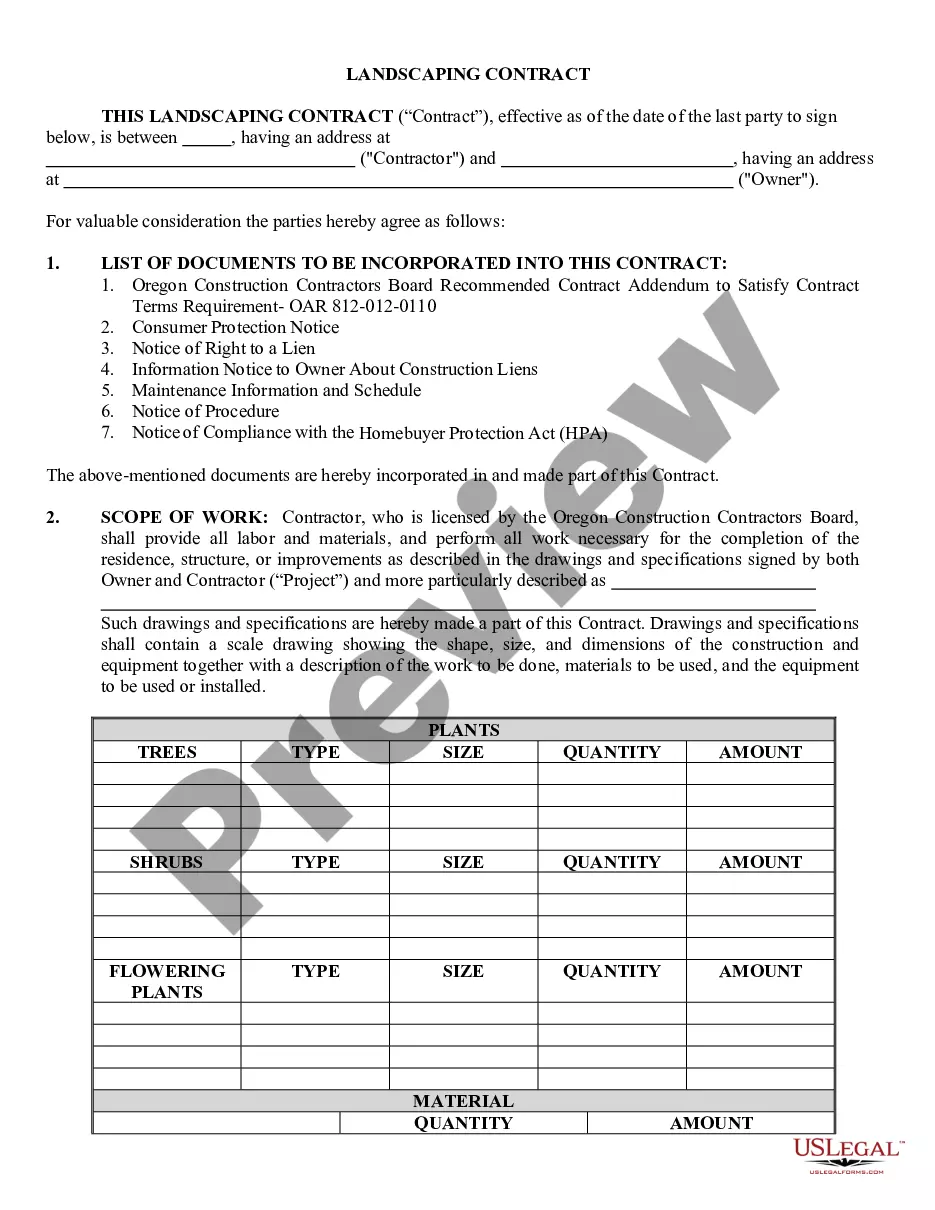

How to fill out Massachusetts Grantor's Approval?

Greetings to the finest legal document repository, US Legal Forms. Here, you can discover any template including Massachusetts Grantor's Approval forms and save them (as many as you wish or require). Prepare official documents within hours, instead of days or weeks, without shelling out a fortune for a lawyer. Acquire the state-specific example with mere clicks and feel confident knowing it was crafted by our experienced legal professionals.

If you are already a registered client, simply Log Into your account and click Download next to the Massachusetts Grantor's Approval you need. Since US Legal Forms is a web-based service, you will always have access to your saved documents, regardless of the device you are using. Find them under the My documents section.

If you haven't registered yet, what are you waiting for? Follow our instructions below to get started.

After you’ve completed the Massachusetts Grantor's Approval, present it to your legal advisor for validation. It’s an additional measure, but an important one to ensure you’re entirely protected. Register for US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific document, verify its legitimacy in your state.

- Review the description (if available) to determine if it’s the correct template.

- View additional content with the Preview function.

- If the sample fulfills all your requirements, simply click Buy Now.

- To create an account, select a pricing option.

- Utilize a credit card or PayPal account to register.

- Download the document in your desired format (Word or PDF).

- Print the document and fill it out with your or your business’s information.

Form popularity

FAQ

A living trust in Massachusetts is created by the grantor, the person putting things into trust. As the grantor you must choose a trustee who is charged with managing the trust for your benefit while you are alive and distributing your assets to your beneficiaries after your death.

Subsequent Proceedings Involving Registered Land ("S-Petitions") Massachusetts is unique in that one can "register" their land, to ensure the integrity of their title to land. Once a title is "registered" it continues to be "registered", even if "mortgaged." Under G.L.

In California, a trust does not have to be recorded to be legal unless it holds title on real estate. If a trust does not hold title on real estate property, all assets held in the name of the trust are kept private. The trustee maintains a record of all trust property in a trust portfolio.

If you die intestate, according to Massachusetts intestacy law, everything goes to your next of kin. Your next of kin are the people who have the closest relation to you. If you're married, then that's your spouse. If you're not married, your closest blood relations or equivalent, will inherit your property.

Prior to enacting G.L.c. 184, §35, Massachusetts was among the few states requiring the full trust document for trusts containing real property to be recorded.The trustee's certificate is recorded either immediately upon the trust's acquisition of real property, or when the trustee acts upon the title 1.

Since the Schedule of Beneficiaries to a trust is not recorded with the Declaration of Trust at the Registry of Deeds, the identity of the Beneficiaries is not a matter of public record.There are two types of Trusts in Massachusetts.

An Irrevocable Trust is an estate planning tool designed to protect assets that may appreciate over time. When an individual establishes an Irrevocable Trust with identified beneficiaries, it cannot be changed by him or her without their consent, as all assets technically belong to them.

"If you die without a will in Massachusetts, your assets will go to your closest relatives under state 'intestate succession' laws.

An unrecorded deed is a deed for real property that neither the buyer nor the seller has delivered to an appropriate government agency. Unrecorded deeds can present many issues for sellers (or grantors) and buyers (or grantees) such as proof of ownership and tax implications.