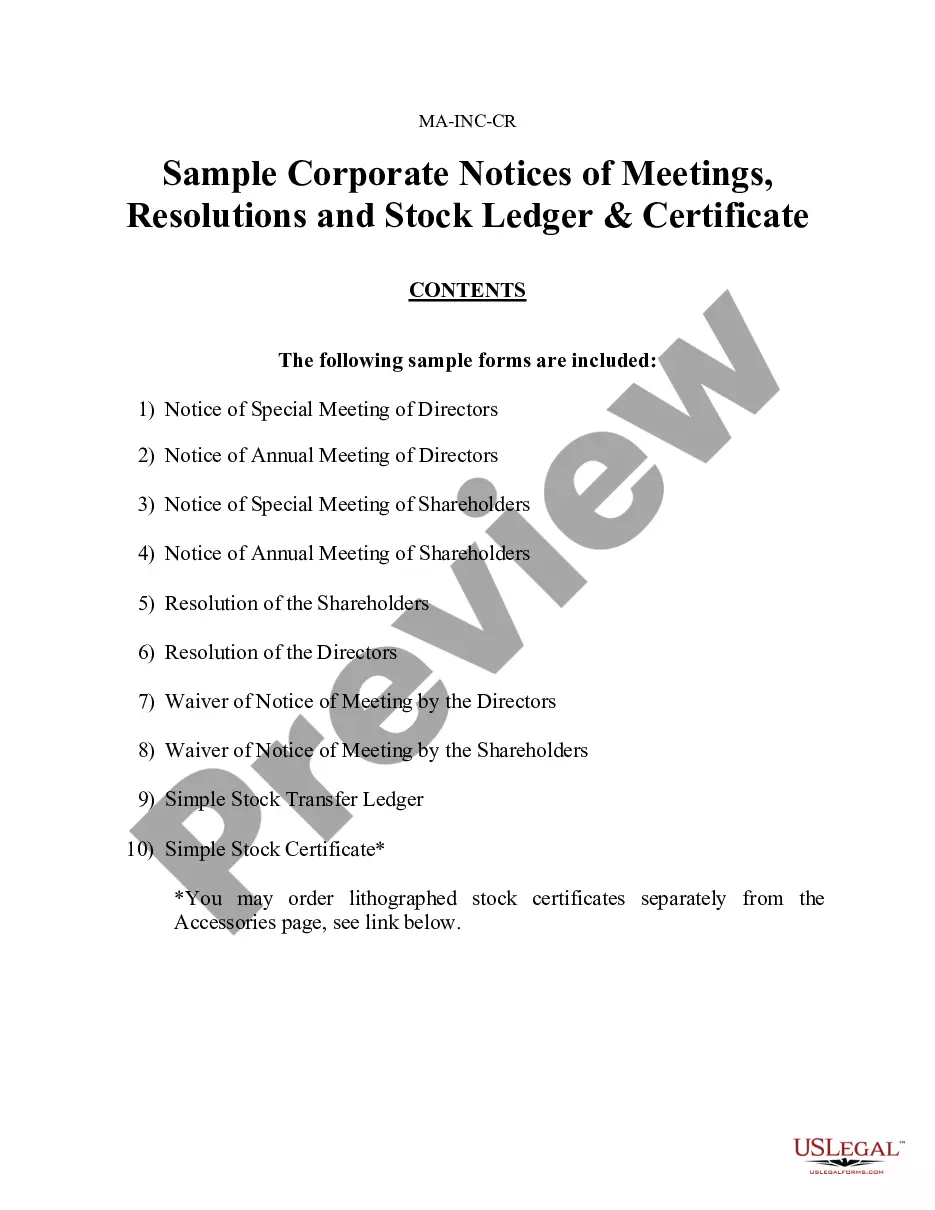

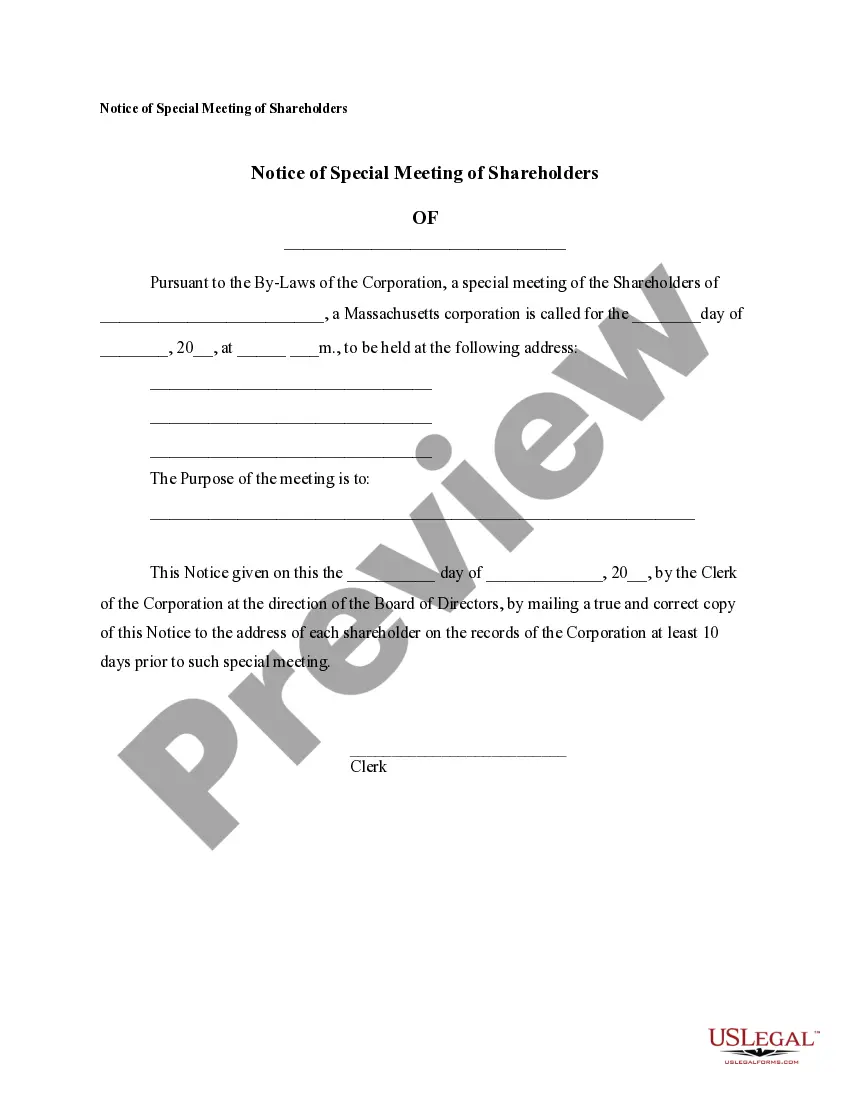

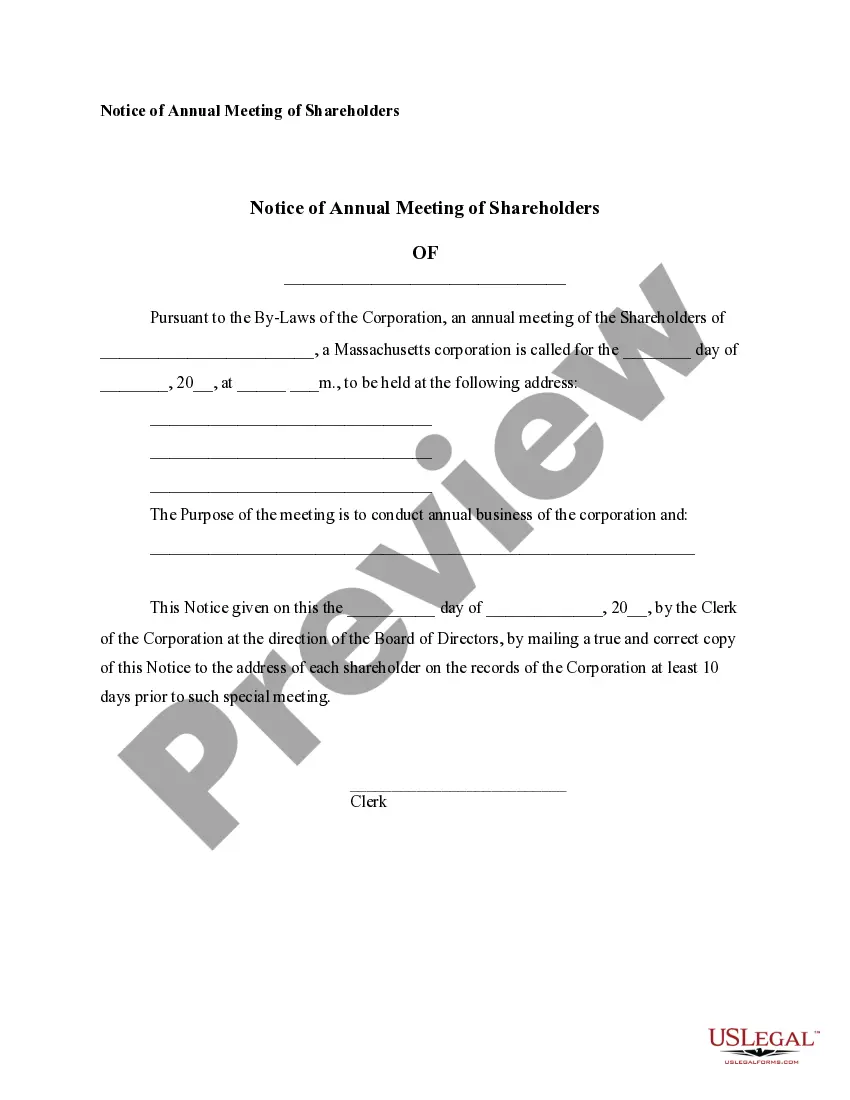

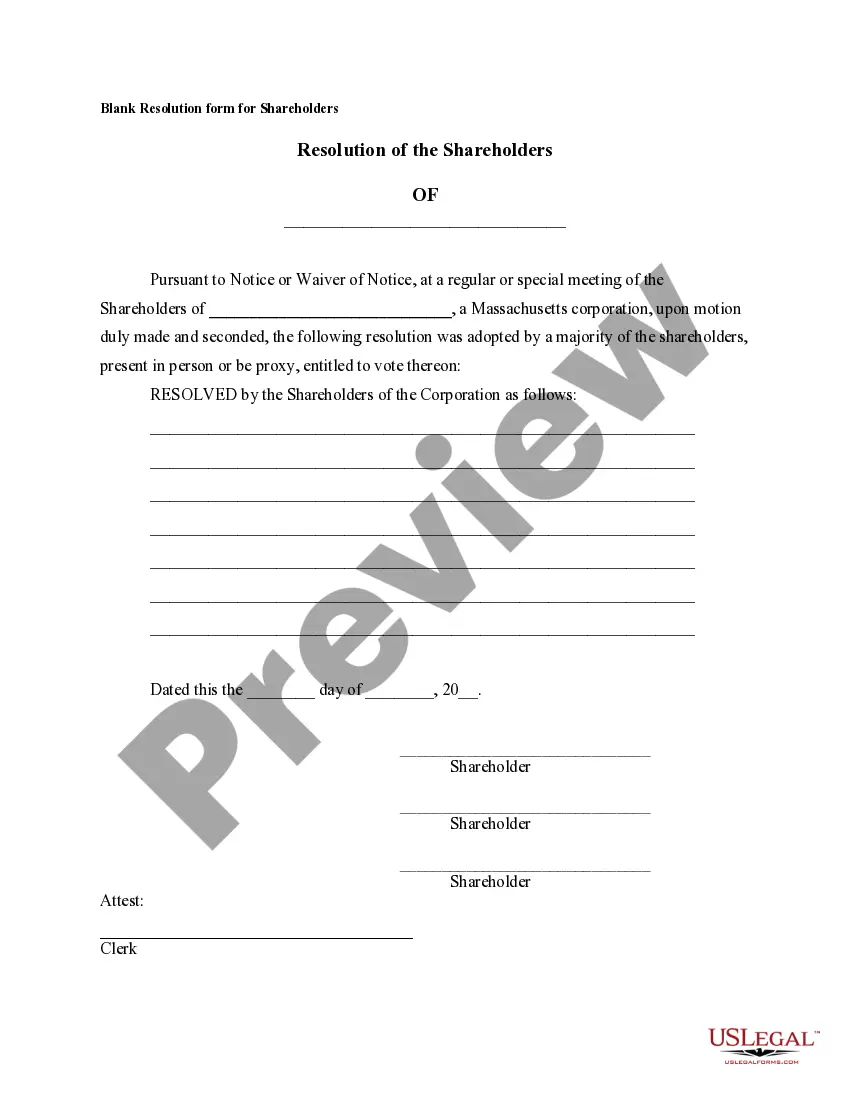

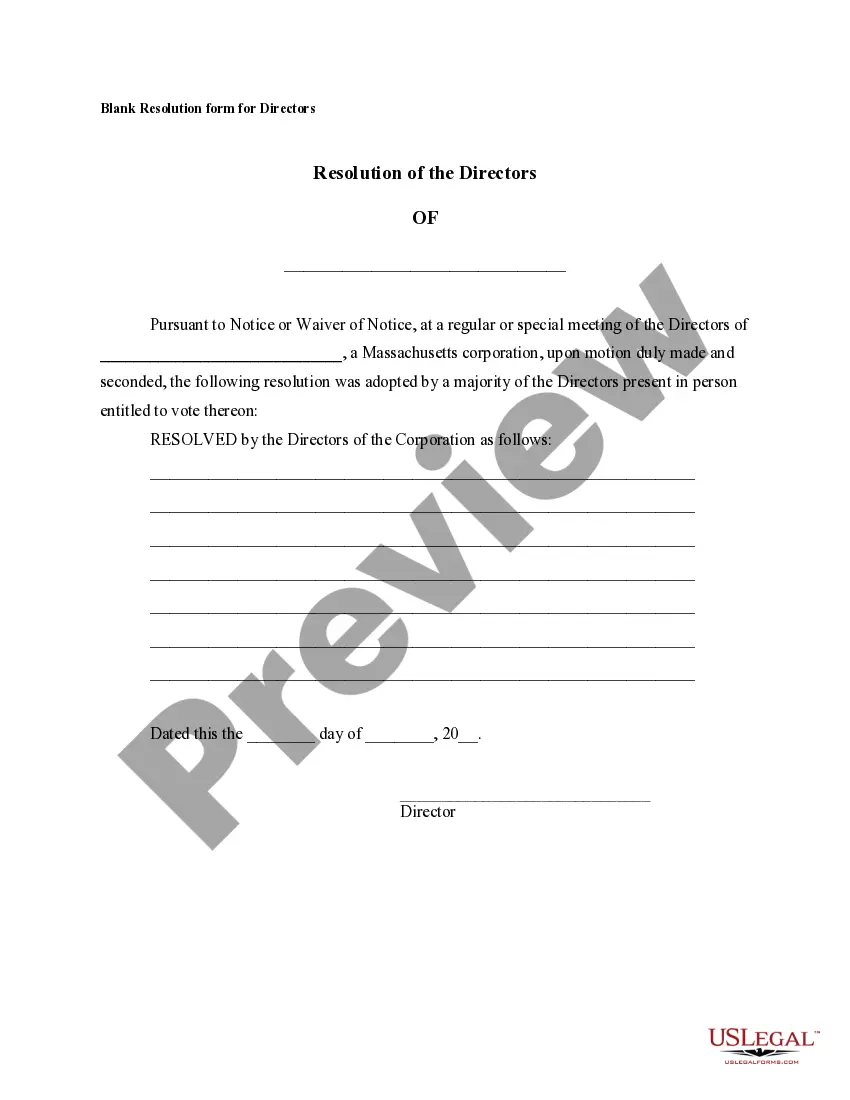

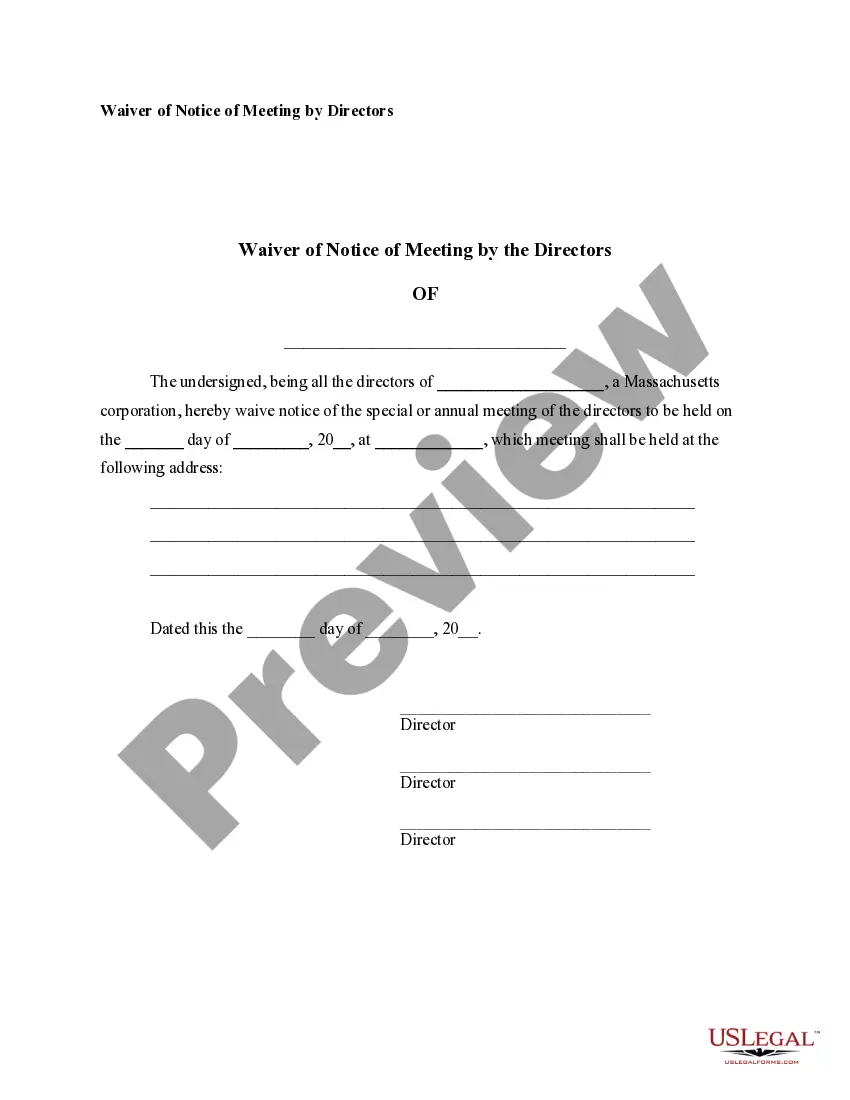

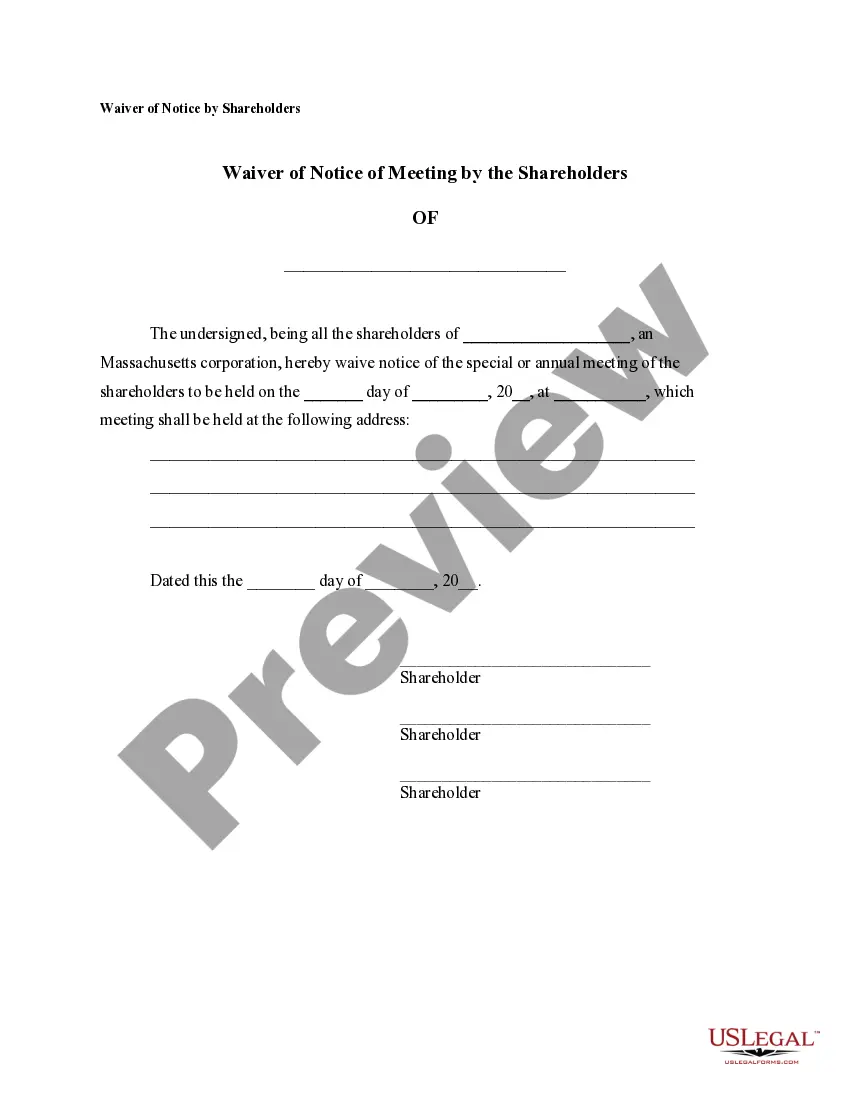

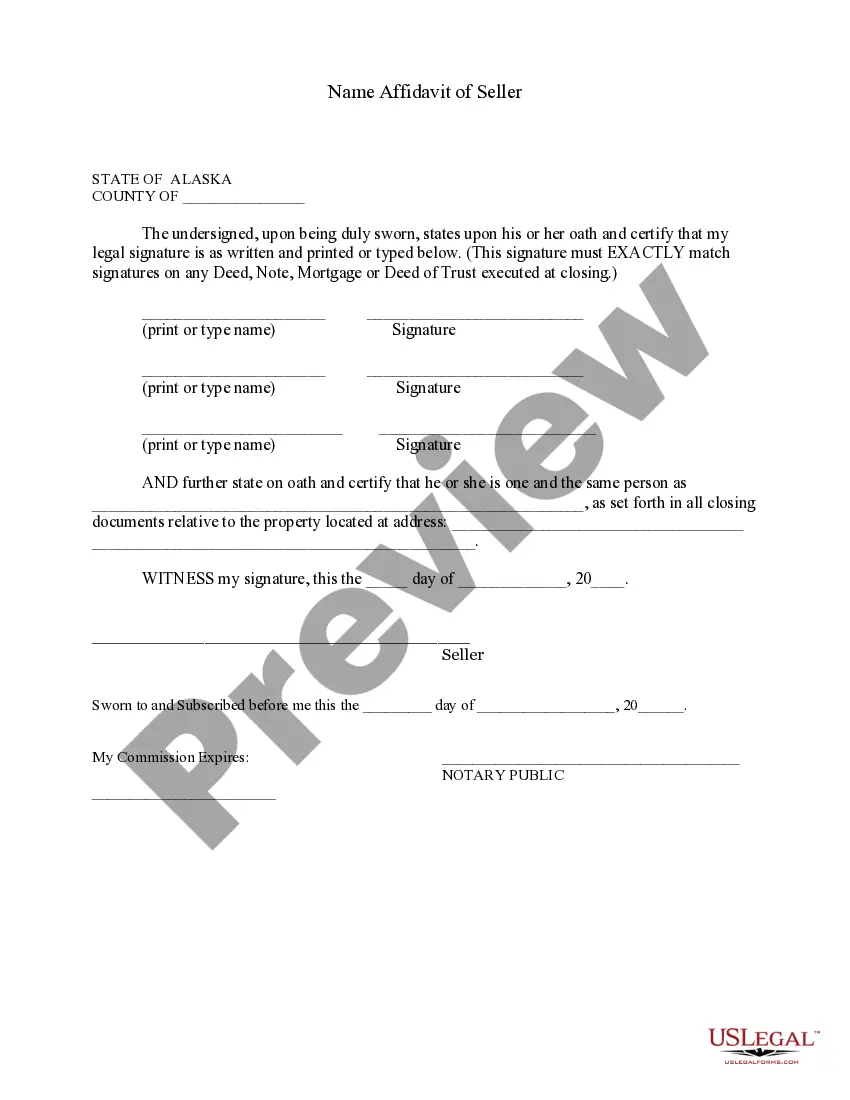

This is a group of forms that includes Notices of Meetings, Corporate Resolutions, a Stock Ledger, and a sample Stock Certificate.

Massachusetts Notices, Resolutions, Simple Stock Ledger and Certificate

Description

How to fill out Massachusetts Notices, Resolutions, Simple Stock Ledger And Certificate?

You are invited to the most crucial legal documents repository, US Legal Forms.

Right here, you can access any template such as Massachusetts Notices, Resolutions, Simple Stock Ledger, and Certificate layouts and store them (as many as you desire/require).

Create official documents within hours, instead of days or weeks, without needing to expend a fortune on a lawyer.

If the template fits your needs, click Buy Now. To establish an account, select a pricing plan, utilize a card or PayPal account to subscribe, download the file in the format you require (Word or PDF), print the document, and complete it with your/your business's details. Once you’ve filled out the Massachusetts Notices, Resolutions, Simple Stock Ledger, and Certificate, send it to your attorney for validation. It’s an extra step, but a vital one to ensure you’re completely protected. Join US Legal Forms now and access a plethora of reusable templates.

- Acquire the state-specific form with just a few clicks and have confidence knowing it was crafted by our state-certified legal experts.

- If you are an existing subscriber, simply Log Into your account and click Download next to the Massachusetts Notices, Resolutions, Simple Stock Ledger, and Certificate you desire.

- Since US Legal Forms is an online service, you'll always have access to your saved documents, no matter the device you are using.

- Locate them within the My documents section.

- If you haven't created an account yet, what are you waiting for? Follow our instructions below to get started.

- If this is a state-specific document, verify its validity in the state where you reside.

- Review the description (if available) to see if it’s the correct template.

- Use the Preview feature to see additional content.

Form popularity

FAQ

This is a clear and straightforward process. Surrender your share certificate to the Corporation's transfer agent. Wait for the transfer agent to issue a certificate to a new shareholder, thereby transferring the shares. Waif for the transfer agent to cancel your old certificate.

The stock ledger holds financial data that allows you to monitor your company's performance. It incorporates financial transactions related to merchandising activities, including sales, purchases, transfers, and markdowns; and is calculated weekly or monthly.

Name of the shareholder; Complete mailing address of the stock shareholder including contact number; Stock certificate number; The total number of shares outstanding; The date the shares were purchased;

Be sure the purchaser is eligible. Being taxed as an S corp. Review the shareholders' agreement and bylaws. You can find your company's restrictions on stock transfers in its shareholders' agreement or bylaws. Determine the stock's value. Prepare and execute a stock transfer agreement. Update corporate records.