Massachusetts Dissolution Package to Dissolve Limited Liability Company LLC

Understanding this form

The Massachusetts Dissolution Package to Dissolve Limited Liability Company (LLC) includes all necessary forms and instructions to dissolve an LLC or PLLC in Massachusetts. This package is specifically designed for voluntary dissolution, ensuring that users can manage the dissolution process effectively, unlike other forms that might address different types or situations of dissolution.

What’s included in this form

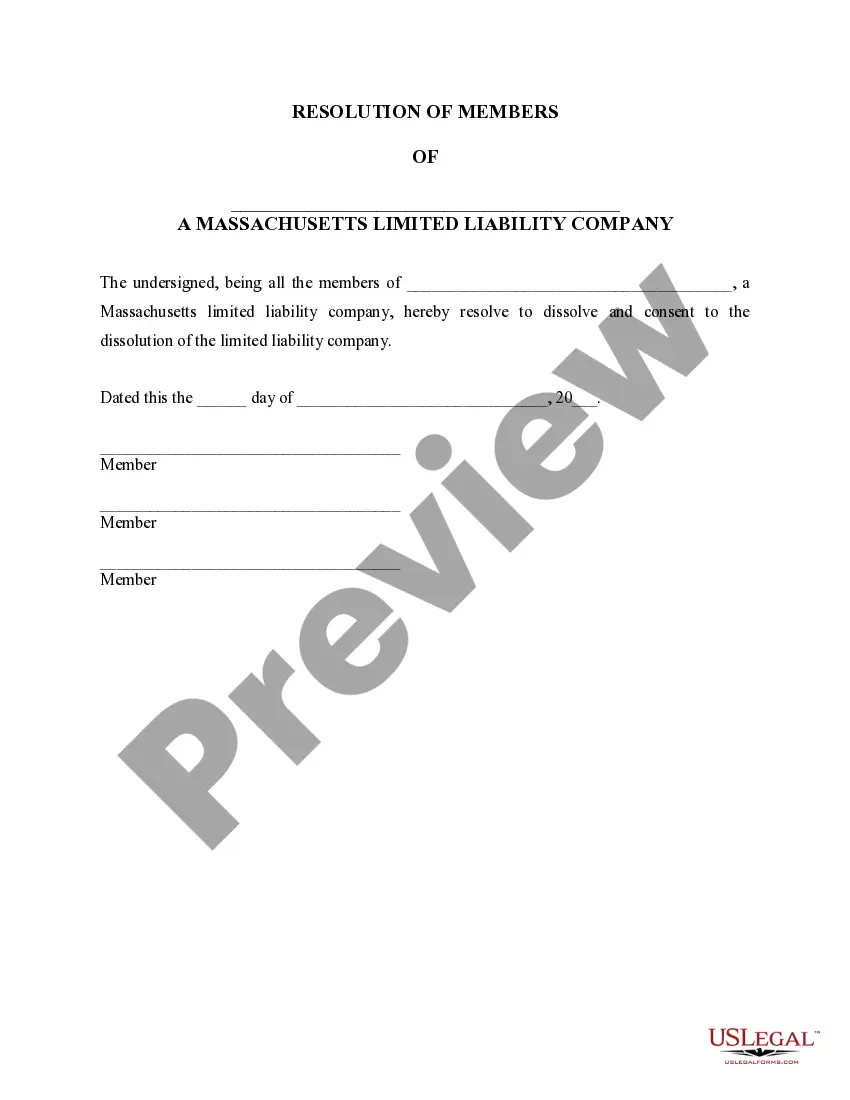

- Resolution of members consenting to dissolution

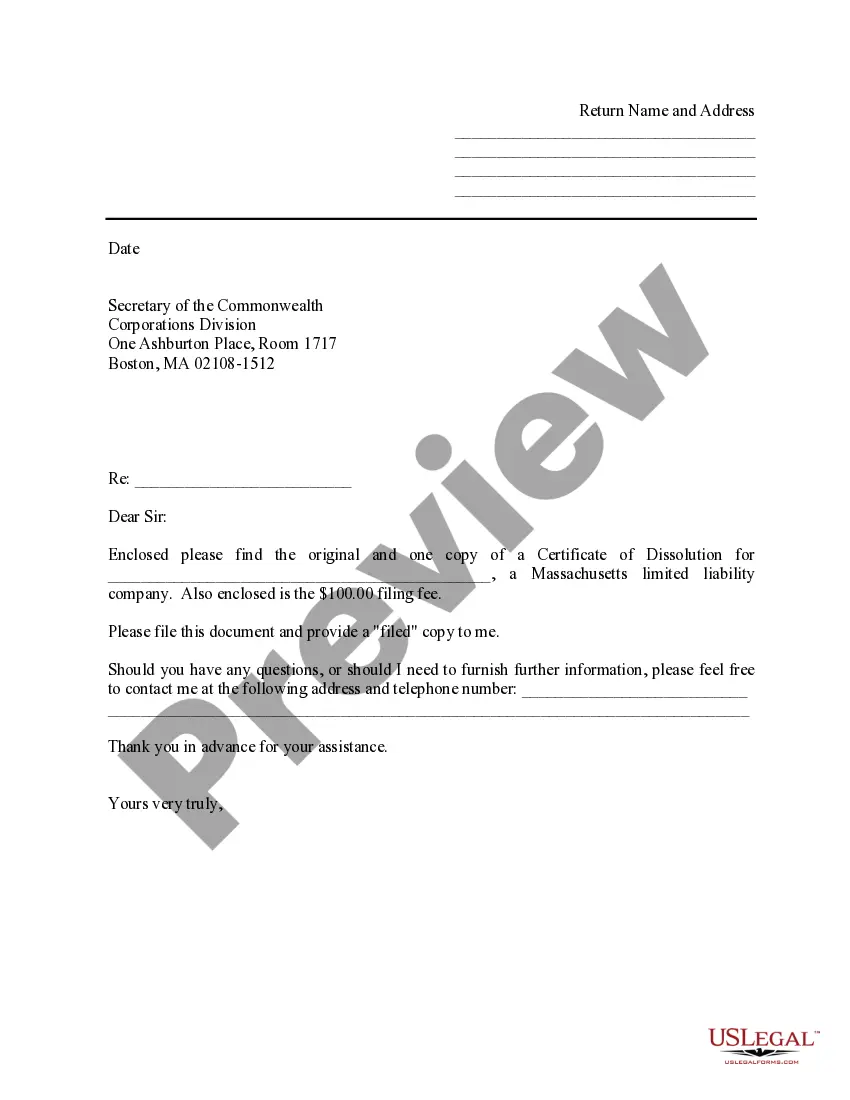

- Certificate of cancellation for filing with the Secretary of the Commonwealth

- Transmittal letter for submitting documents

- Instructions for completing the forms and filing requirements

State-specific compliance details

This form package complies with Massachusetts General Laws, specifically Chapter 156C, which governs the dissolution of LLCs. It includes detailed steps and legal requirements specific to Massachusetts, ensuring users meet state obligations when dissolving their company.

Common use cases

This dissolution package should be used when all members of a Massachusetts LLC agree to voluntarily dissolve the company. Scenarios may include the decision to cease operations, a merger with another entity, or any situation where continuing the business is no longer viable or desirable.

Who needs this form

- Members or managers of a Massachusetts LLC looking to dissolve the company

- Business owners seeking an organized and legal way to close their limited liability company

- Individuals needing to follow the statutory requirements for dissolving an LLC in Massachusetts

Instructions for completing this form

- Start by filling out the Resolution of Members Consenting to Dissolution to indicate agreement among members.

- Complete the Certificate of Cancellation by providing the LLC's name, filing date of the original Certificate of Organization, and reason for dissolution.

- Specify the effective date of the dissolution, which may be the same as the filing date.

- Include any additional pertinent information requested on the certificate.

- Print and sign the forms where indicated, and prepare for submission.

- Mail the original and one copy of the Certificate of Cancellation, along with a filing fee, to the appropriate state office.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Mistakes to watch out for

- Failing to obtain unanimous consent from all members for dissolution.

- Not specifying a reason for dissolution on the Certificate of Cancellation.

- Missing the effective date of dissolution.

- Not sending the required filing fee with the submission.

Why use this form online

- Convenience of downloading forms immediately from the website.

- Editability allows users to fill out specific details tailored to their situation.

- Access to expert-drafted documents ensures reliability and compliance with state law.

Legal use & context

- This form is legally binding and serves as evidence of the LLC's dissolution when filed correctly.

- Using this form helps protect members from future liabilities associated with ongoing business activities.

- Compliance with Massachusetts law is essential to ensure the dissolution is effective and valid.

Form popularity

FAQ

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.