Massachusetts Certificate of Formation for Domestic Limited Liability Company LLC

Description

How to fill out Massachusetts Certificate Of Formation For Domestic Limited Liability Company LLC?

You are invited to the most crucial legal document repository, US Legal Forms. Here you can discover any template including Massachusetts Certificate of Formation for Domestic Limited Liability Company LLC formats and acquire them (as many as you desire/require). Prepare formal documents in just a few hours, instead of days or weeks, without needing to spend a fortune with a lawyer. Obtain the state-specific template in a few clicks and feel confident knowing that it was created by our skilled legal experts.

If you’re already a registered user, simply Log In to your account and click Download next to the Massachusetts Certificate of Formation for Domestic Limited Liability Company LLC you need. Since US Legal Forms provides an online service, you’ll always have access to your downloaded documents, regardless of the device you’re using. Find them within the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our instructions below to get started.

After you’ve filled out the Massachusetts Certificate of Formation for Domestic Limited Liability Company LLC, submit it to your attorney for verification. It’s an extra step but a vital one for ensuring you’re fully protected. Enroll in US Legal Forms now and receive a large number of reusable templates.

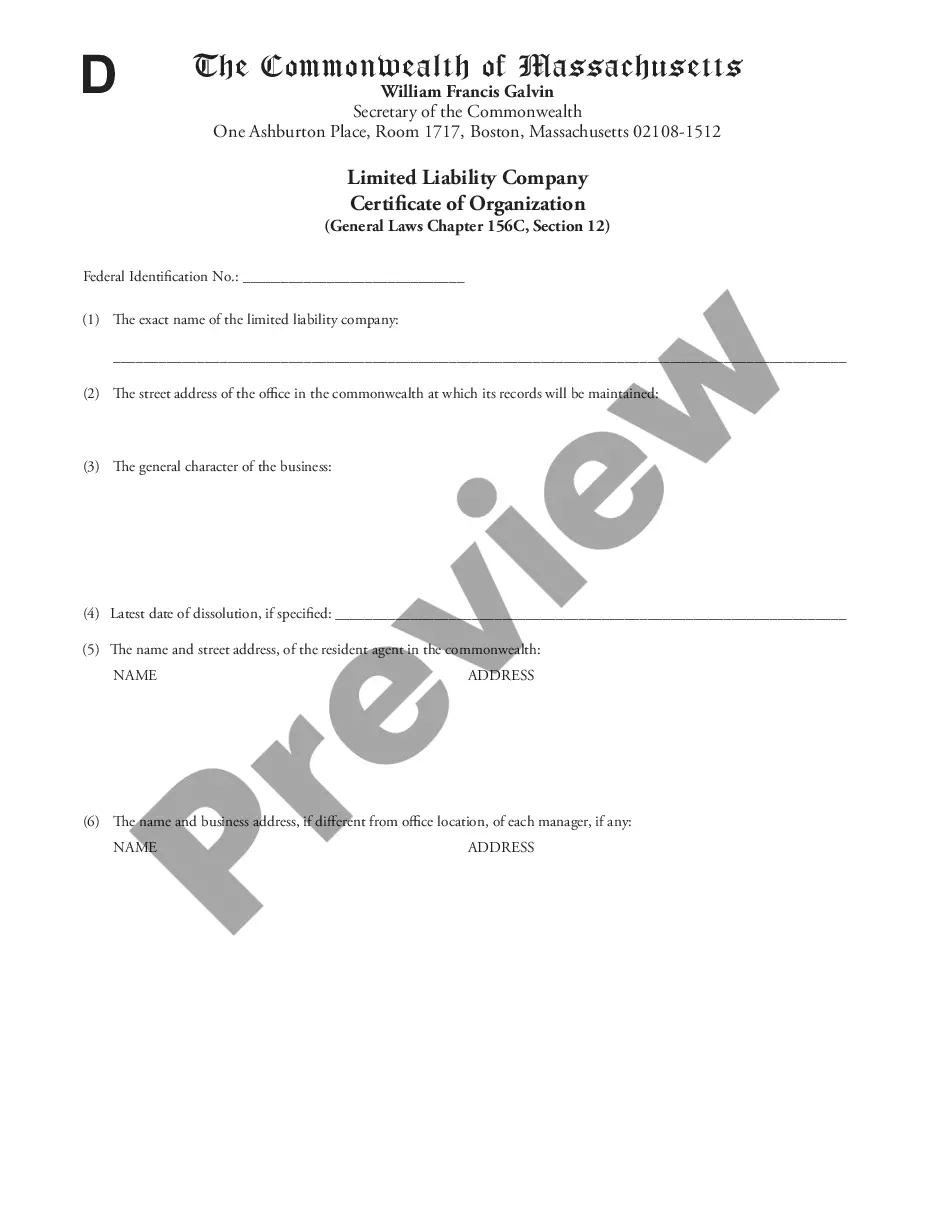

- If this is a state-specific document, verify its relevance in the state you reside in.

- Read the description (if available) to determine if it’s the right template.

- Explore additional content using the Preview option.

- If the template meets your requirements, click Buy Now.

- To set up an account, choose a subscription plan.

- Utilize a credit card or PayPal account to join.

- Download the file in the format you prefer (Word or PDF).

- Print the document and fill it in with your/your business’s information.

Form popularity

FAQ

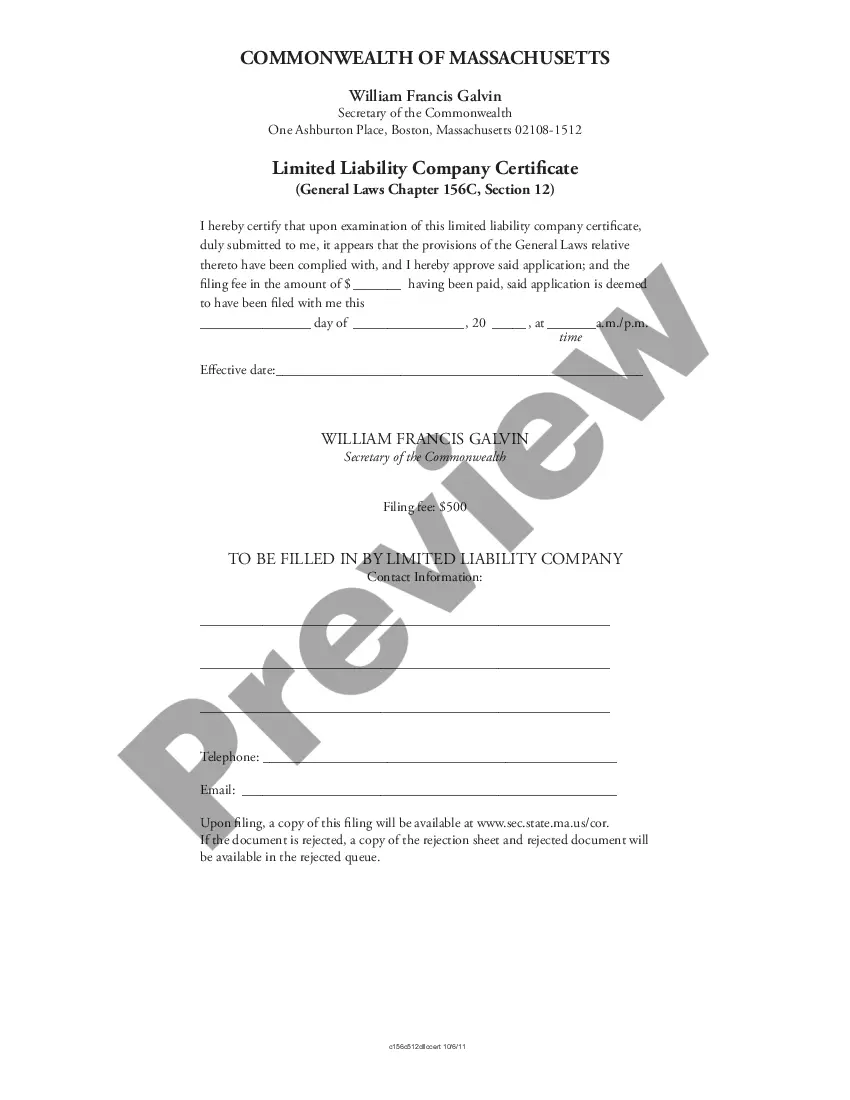

The costs to start an LLC in Massachusetts are significant. LLCs pay a $500 formation fee and $500 annual report fee. Most corporations pay only $275 to get started then $125 per year. Massachusetts registered agent and resident agent are synonymous.

The costs to start an LLC in Massachusetts are significant. LLCs pay a $500 formation fee and $500 annual report fee. Most corporations pay only $275 to get started then $125 per year. Massachusetts registered agent and resident agent are synonymous.

LLCs are formed by filing articles of organization with the secretary of state's office.Depending on the state, the filing fee varies, and the articles of organization may be referred to as a different name, like the certificate of formation.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

An LLC operating agreement is a legal document that outlines the ownership structure and member roles of an LLC. Although most states don't officially require you to have an operating agreement, it's still a good idea to create one when forming an LLC.

How long does it take to form an LLC in Massachusetts? Filing the Articles of Organization can take 4 hours online post-payment, or 4 to 5 business days by mail. Expedited filings are also available.

Choose a Name for Your LLC. Appoint a Registered Agent. File a Certificate of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements. File Annual Reports.

To customize your small business. To protect real estate assets. To shield intellectual property. To raise seed capital for your business. To plan your estate. To do a short-term project. To segregate assets. To minimize your tax burden.