Louisiana Amended Equity Fund Partnership Agreement

Description

How to fill out Amended Equity Fund Partnership Agreement?

You are able to spend hrs on the Internet looking for the legitimate document design that suits the state and federal requirements you require. US Legal Forms offers a huge number of legitimate kinds which are evaluated by pros. It is possible to acquire or print the Louisiana Amended Equity Fund Partnership Agreement from my service.

If you have a US Legal Forms bank account, you can log in and then click the Down load switch. Next, you can comprehensive, change, print, or sign the Louisiana Amended Equity Fund Partnership Agreement. Each legitimate document design you purchase is yours for a long time. To get yet another version for any acquired type, visit the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms website initially, adhere to the straightforward instructions below:

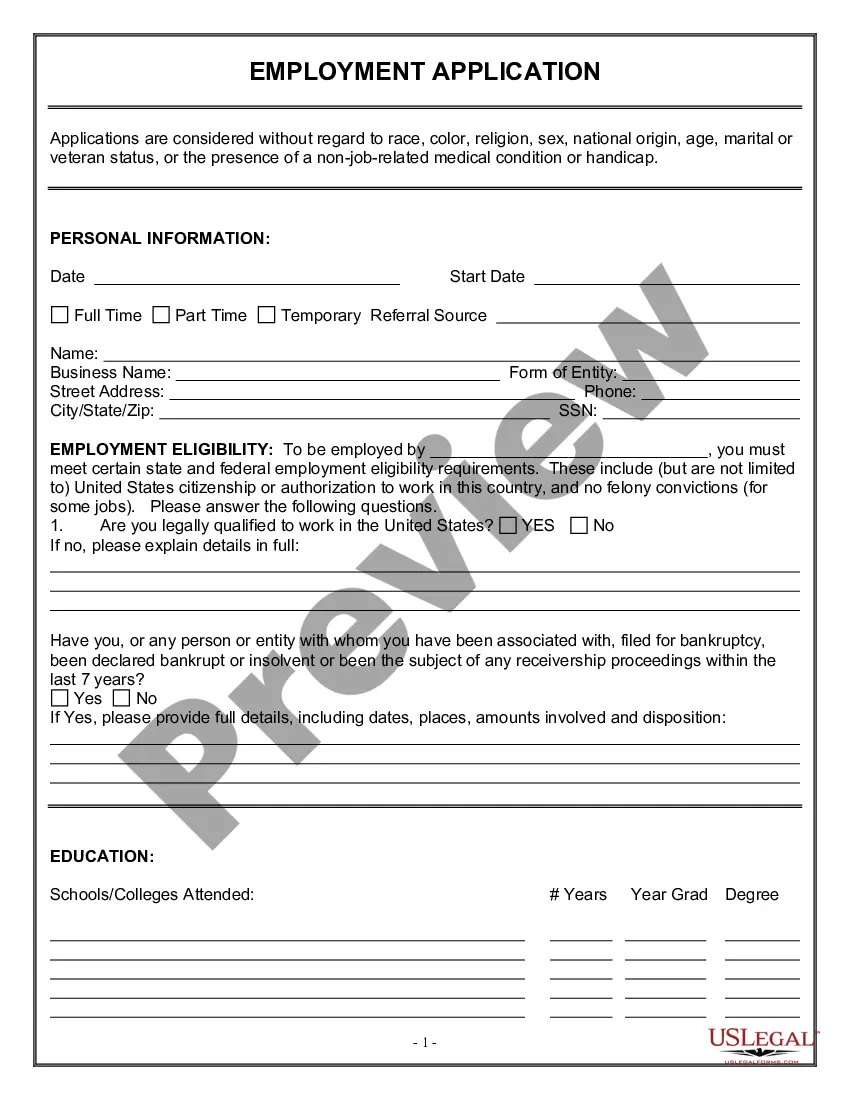

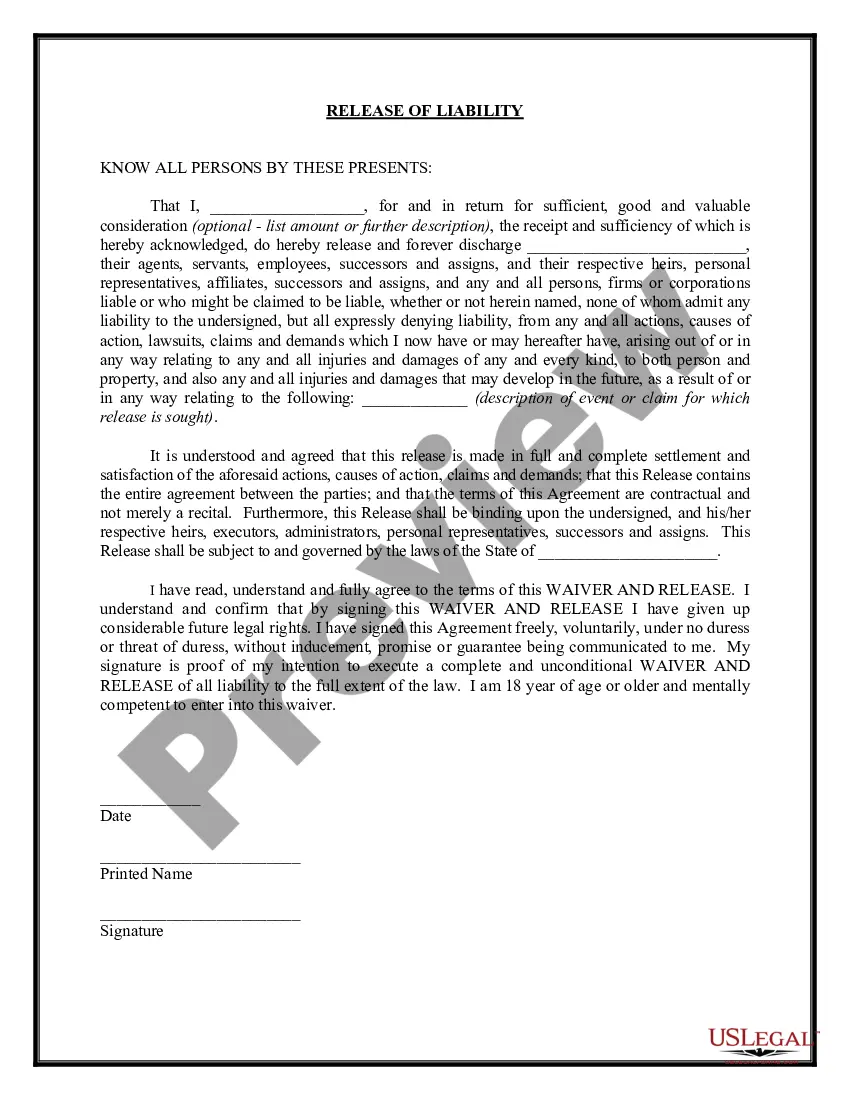

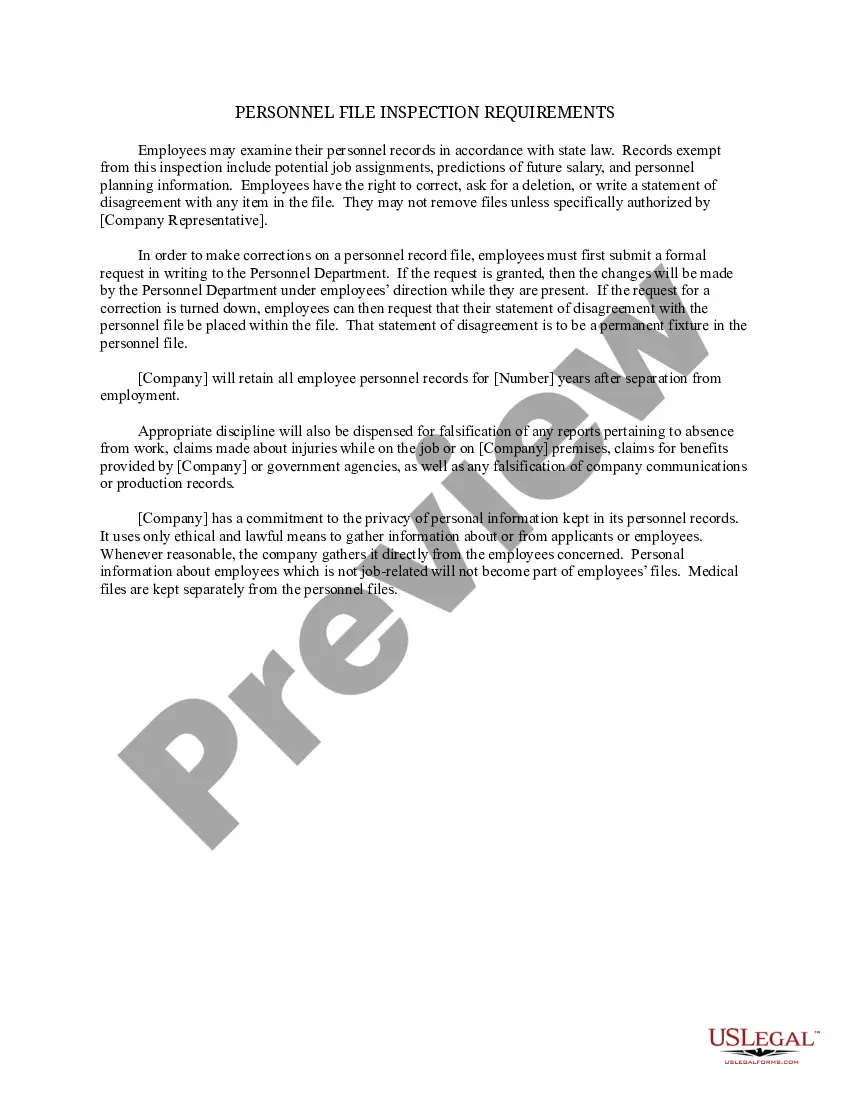

- First, make certain you have selected the best document design to the area/area that you pick. Browse the type information to make sure you have picked out the appropriate type. If offered, utilize the Review switch to check through the document design too.

- In order to get yet another variation of the type, utilize the Lookup industry to obtain the design that meets your requirements and requirements.

- Once you have located the design you need, simply click Purchase now to proceed.

- Select the rates program you need, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Full the transaction. You should use your bank card or PayPal bank account to fund the legitimate type.

- Select the format of the document and acquire it for your product.

- Make modifications for your document if needed. You are able to comprehensive, change and sign and print Louisiana Amended Equity Fund Partnership Agreement.

Down load and print a huge number of document templates making use of the US Legal Forms website, which provides the largest variety of legitimate kinds. Use professional and status-certain templates to tackle your business or specific requires.

Form popularity

FAQ

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

PART 2: CREDIT FOR CERTAIN DISABILITIES ? A credit of $100 against the tax is permitted for the taxpayer, spouse, or dependent who is blind, deaf, mentally incapacitated, or has lost the use of a limb. Only one credit is allowed per person.

You would not be required to file a tax return. But you might want to file a return, because even though you are not required to pay taxes on your Social Security, you may be able to get a refund of any money withheld from your paycheck for taxes.

Louisiana will recognize and accept the federal extension authorizing the same extended due date as the federal. Attach a copy of your federal application, Federal Form 7004, to your completed Louisiana return. If you do not have a federal extension, you should use this form to apply for a state extension.

Pass-Through Entity (PTE) Election Under the statute, an S corporation or entity taxed as a partnership for federal income tax purposes may elect to be taxed for Louisiana income tax purposes as if the entity had been required to file an income tax return with the IRS as a C corp.

For 2023, the threshold is taxable income up to $364,200 if married filing jointly, or up to $182,100 if single. If your income is within this threshold, your pass-through deduction is equal to 20% of your qualified business income (QBI). This is the maximum possible pass-through deduction.

Partners who are corporations are required to file Form CIFT-620 to report any partnership income. Partners who are Louisiana resident estates and trusts are required to file Form IT-541 to report partnership income. Partners who are themselves partnerships are required to file all applicable Louisiana tax returns.

What is a PTE? The pass-through entity tax (PTE) allows partnerships, S Corporations and LLCs to elect to be taxed at the entity level for state income tax purposes.