Louisiana Clauses Relating to Capital Withdrawals, Interest on Capital

Description

How to fill out Clauses Relating To Capital Withdrawals, Interest On Capital?

Have you been within a position the place you need to have papers for both business or personal functions almost every time? There are plenty of legal papers web templates available online, but finding versions you can rely isn`t straightforward. US Legal Forms offers 1000s of kind web templates, just like the Louisiana Clauses Relating to Capital Withdrawals, Interest on Capital, that are composed in order to meet state and federal specifications.

In case you are presently acquainted with US Legal Forms website and get an account, just log in. Next, you are able to download the Louisiana Clauses Relating to Capital Withdrawals, Interest on Capital design.

Should you not have an bank account and wish to begin using US Legal Forms, abide by these steps:

- Find the kind you will need and make sure it is for that appropriate city/region.

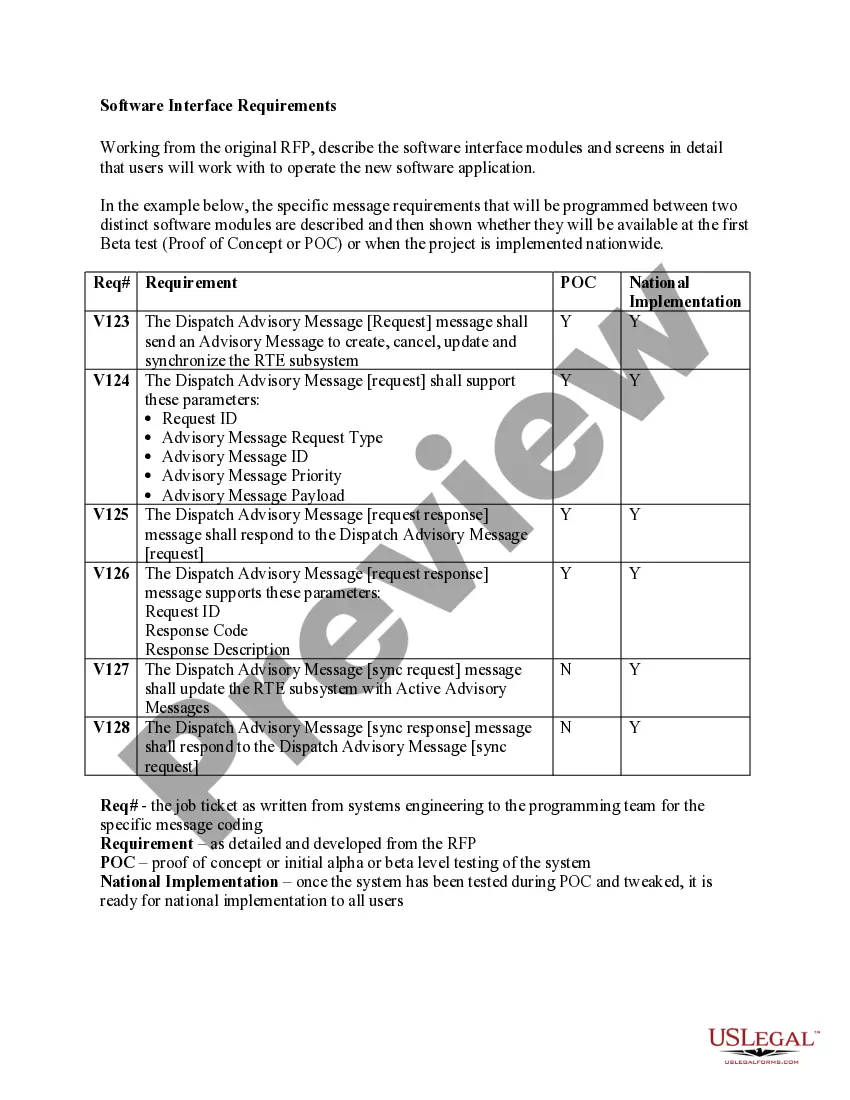

- Make use of the Preview switch to examine the shape.

- Read the explanation to ensure that you have selected the correct kind.

- When the kind isn`t what you`re seeking, utilize the Look for industry to discover the kind that meets your requirements and specifications.

- Whenever you find the appropriate kind, simply click Purchase now.

- Pick the pricing strategy you want, fill out the desired info to make your bank account, and buy the order using your PayPal or Visa or Mastercard.

- Select a convenient file format and download your backup.

Discover all of the papers web templates you have purchased in the My Forms menu. You can obtain a more backup of Louisiana Clauses Relating to Capital Withdrawals, Interest on Capital anytime, if possible. Just click the needed kind to download or print out the papers design.

Use US Legal Forms, probably the most substantial assortment of legal types, to save some time and steer clear of mistakes. The support offers expertly produced legal papers web templates that you can use for an array of functions. Generate an account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

The partners are paid interest on the capital that remains outstanding. The maximum rate of interest that can be paid to the owners is 12% as per the Income Tax Act u/s 40(b). If a partner introduces any further capital to the business then the additional capital is also taken into account for providing interest.

Pass-Through Entity (PTE) Election Under the statute, an S corporation or entity taxed as a partnership for federal income tax purposes may elect to be taxed for Louisiana income tax purposes as if the entity had been required to file an income tax return with the IRS as a C corp.

The tax consequences of the sale are straightforward. Pursuant to Section 741,[1] gain or loss from the sale of a partnership interest is treated as gain or loss from the sale or exchange of a capital asset, except as otherwise provided in section 751.

LLP can claim interest on capital maximum to the extent of 12% p.a. (simple interest) Any extra interest will be dis-allowed.

The tax consequences of granting, vesting and forfeiting a capital interest in a partnership is governed by IRC section 83. Under IRC section 83, the grant of a capital interest in exchange for services is taxable at the time of grant unless subject to a substantial risk of forfeiture.

Interest on Partner's Capital The rate of interest should not exceed 12%. If the amount of interest exceeds 12% of the capital then such excess amount is disallowed. It is not allowed if the tax is paid on presumptive basis under section 44AD or section 44ADA.

Interest on capital will be paid to the partners if provided for in the agreement but only from profits. Interest on capital is an appropriation and not a charge against profit hence, is provided only to the extent of profits.

Ing to Section 28, the business partner will be subject to taxation on the interest earned on capital. This means the income generated from interest will be taxable under profits and gains from business and profession.