Louisiana Clauses Relating to Venture Interests

Description

How to fill out Clauses Relating To Venture Interests?

Are you inside a place that you need to have paperwork for both business or individual reasons almost every working day? There are plenty of legitimate file templates available on the net, but locating versions you can depend on is not easy. US Legal Forms delivers 1000s of develop templates, such as the Louisiana Clauses Relating to Venture Interests, that happen to be composed to fulfill federal and state requirements.

In case you are previously informed about US Legal Forms site and have an account, simply log in. Following that, you are able to down load the Louisiana Clauses Relating to Venture Interests design.

Should you not have an bank account and wish to begin using US Legal Forms, abide by these steps:

- Find the develop you require and make sure it is for that right town/region.

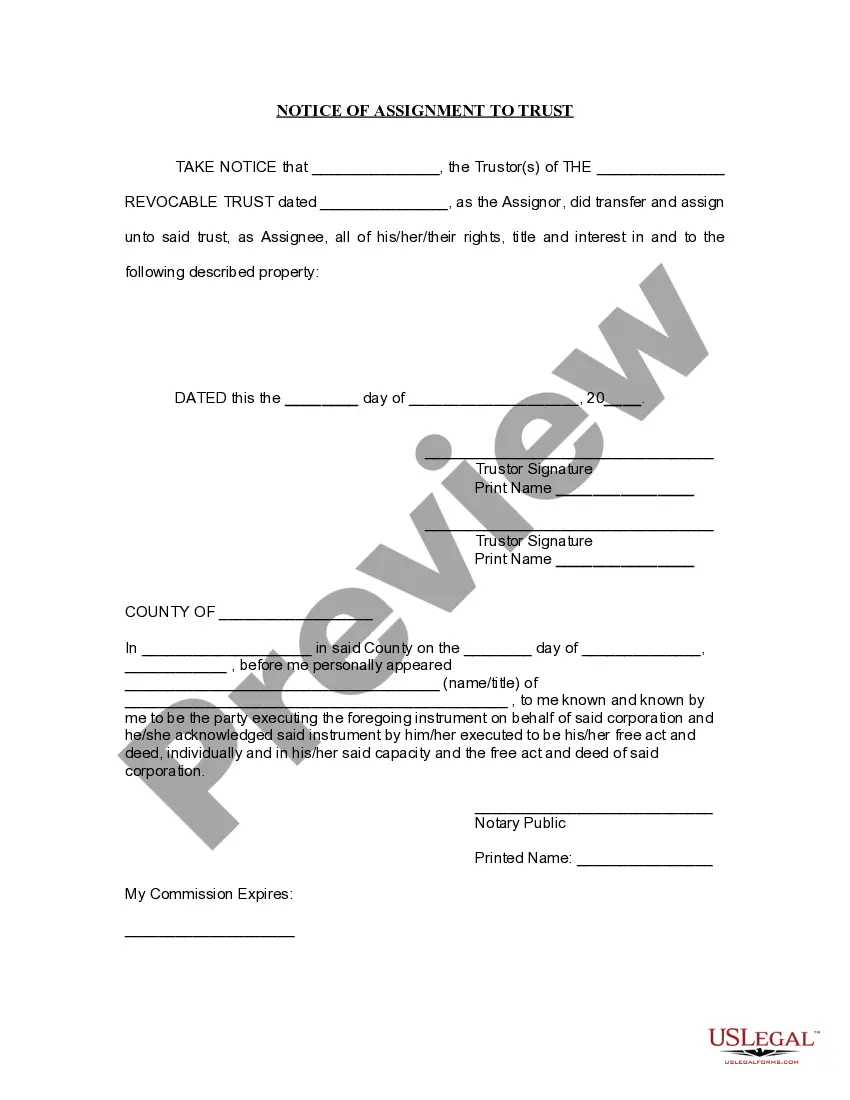

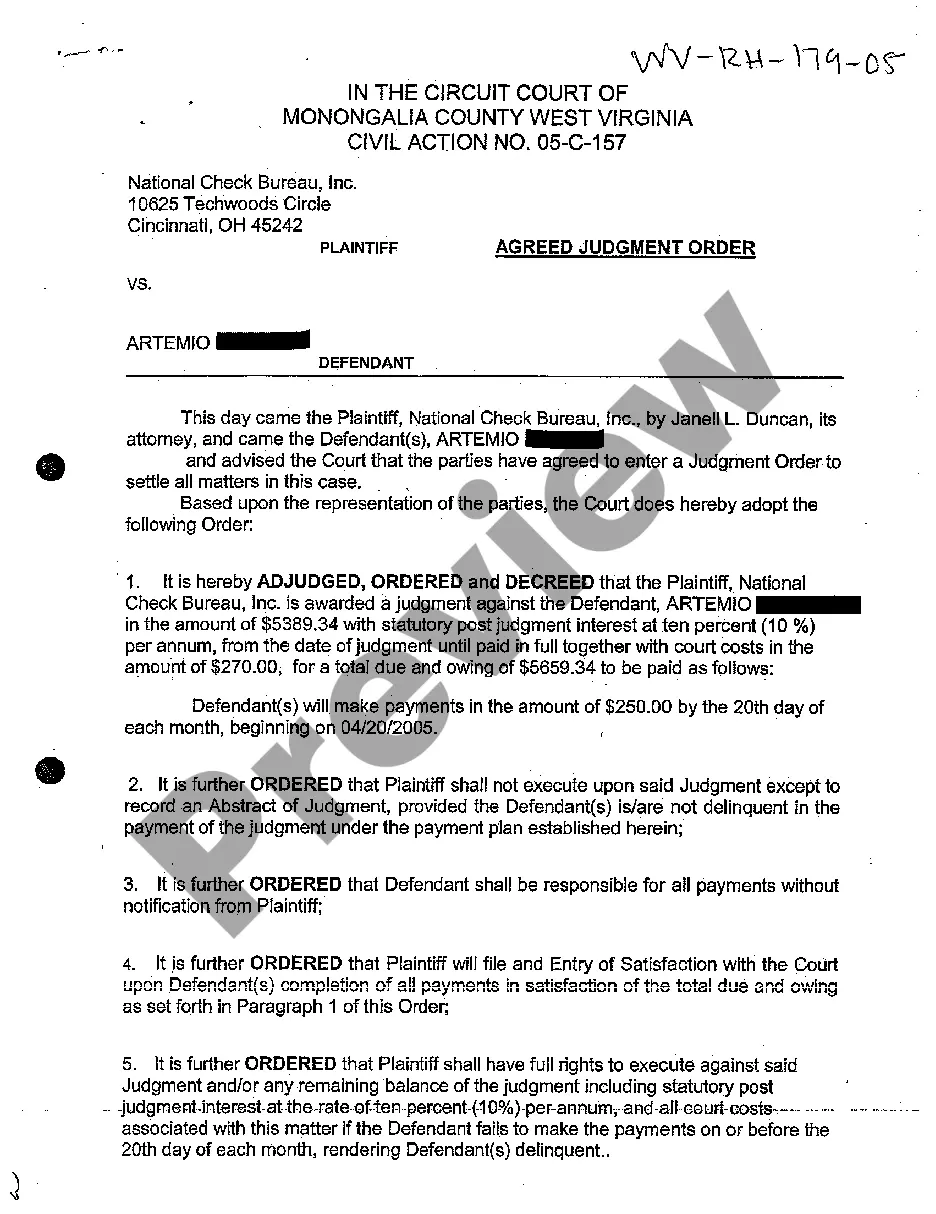

- Make use of the Review option to review the shape.

- Look at the description to ensure that you have chosen the correct develop.

- In case the develop is not what you are trying to find, use the Look for discipline to discover the develop that fits your needs and requirements.

- Whenever you discover the right develop, click on Get now.

- Pick the rates plan you want, complete the required information to create your bank account, and buy the transaction using your PayPal or bank card.

- Decide on a practical document format and down load your version.

Locate all the file templates you might have purchased in the My Forms food list. You may get a more version of Louisiana Clauses Relating to Venture Interests at any time, if required. Just go through the needed develop to down load or produce the file design.

Use US Legal Forms, one of the most comprehensive collection of legitimate types, to save time as well as steer clear of faults. The services delivers skillfully produced legitimate file templates that you can use for a variety of reasons. Create an account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

Indemnification is protection against loss or damage. When a contract is breached, the parties look to its indemnity clause to determine the compensation due to the aggrieved party by the nonperformer. The point is to restore the damaged party to where they would have been if not for the nonperformance.

Exit clauses are mechanisms that allow the parties to protect their interests when one of the reasons to exit a JV arises. If drafted correctly, they can provide a party with an elegant and equitable solution to exit a JV by disposing its shares or to take full control of it by acquiring the shares of the other party.

A Joint Venture Agreement is a contract between two or more parties who want to do business together for a period of time, without creating a formal partnership or new legal entity. Usually, both parties have an equal stake in the venture, and will both reap the benefits.

The indemnity clause is a common contractual method of allocating liability. In addition to a contractual indemnification, the party being indemnified takes a covenant from the indemnitor that he will obtain insurance against the risk of liability.

Essentially, a joint venture is, as a matter of Louisiana case law, a partnership under Louisiana law. The jurisprudence has established that the essential elements of a joint venture are generally the same as those of partnership, i.e., two or more parties combining their property, labor, skill, etc.

The indemnity clause is a common contractual method of allocating liability. In addition to a contractual indemnification, the party being indemnified takes a covenant from the indemnitor that he will obtain insurance against the risk of liability.

An indemnity clause is a provision in a contract that requires one party (the indemnifier) to take financial responsibility for any losses or liabilities that the other party (the indemnified) may incur as a result of a specific event or circumstances outlined in the contract.

The indemnification clause is a crucial element in commercial contracts as it helps mitigate the risks and consequences associated with potential breaches of contracts. This clause also ensures that the parties are fairly compensated for their losses and helps maintain a stable and predictable business relationship.