Louisiana Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

Description

How to fill out Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

US Legal Forms - one of several largest libraries of legal varieties in the States - gives an array of legal document web templates you are able to obtain or produce. Utilizing the internet site, you can find a huge number of varieties for company and person purposes, sorted by categories, suggests, or keywords.You can get the latest versions of varieties such as the Louisiana Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) in seconds.

If you currently have a registration, log in and obtain Louisiana Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) from your US Legal Forms collection. The Download option will show up on each and every form you view. You get access to all formerly delivered electronically varieties from the My Forms tab of your own accounts.

In order to use US Legal Forms initially, listed here are basic recommendations to help you get started off:

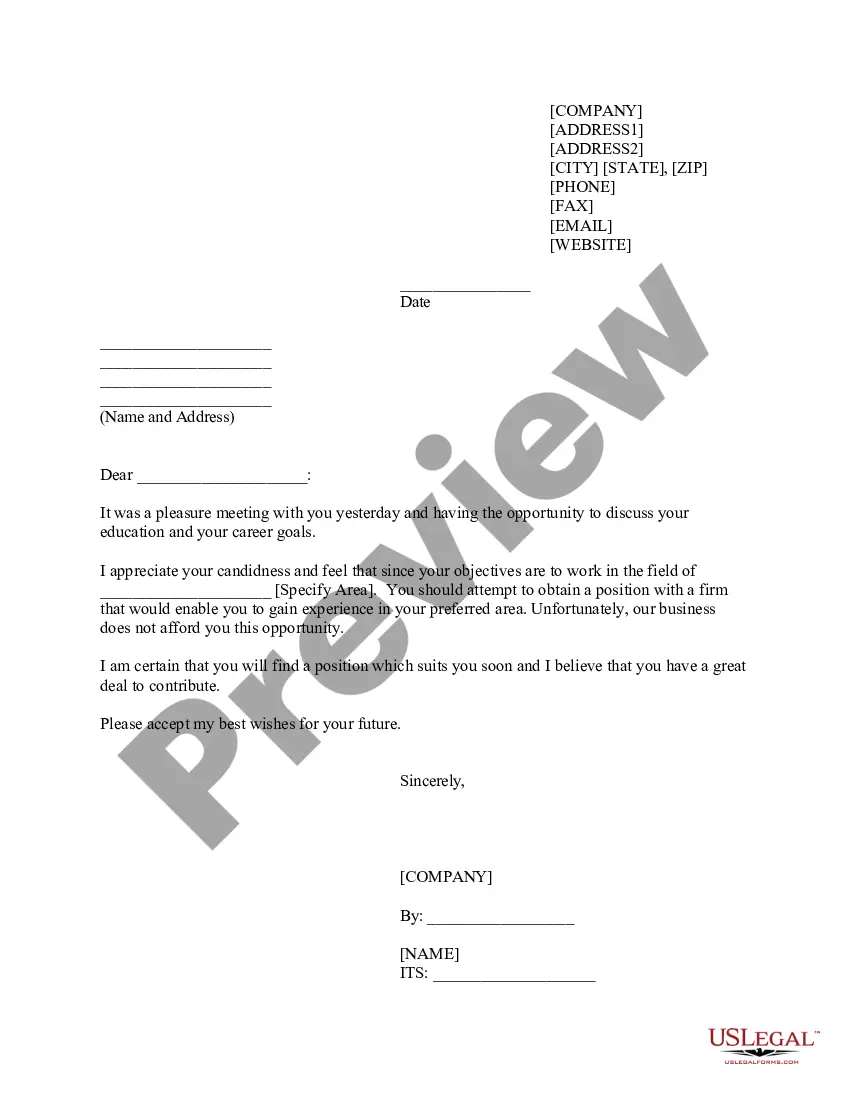

- Be sure to have chosen the right form for your personal metropolis/state. Go through the Review option to review the form`s articles. Look at the form outline to ensure that you have selected the correct form.

- In case the form doesn`t match your needs, take advantage of the Search area at the top of the screen to get the one that does.

- When you are content with the form, confirm your decision by clicking the Get now option. Then, choose the rates plan you like and supply your accreditations to register for an accounts.

- Method the transaction. Use your bank card or PayPal accounts to perform the transaction.

- Choose the structure and obtain the form in your system.

- Make adjustments. Load, change and produce and indicator the delivered electronically Louisiana Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool).

Each and every web template you included with your money does not have an expiry date and is yours permanently. So, if you would like obtain or produce an additional version, just check out the My Forms section and then click around the form you need.

Gain access to the Louisiana Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) with US Legal Forms, the most comprehensive collection of legal document web templates. Use a huge number of professional and state-particular web templates that fulfill your company or person requirements and needs.

Form popularity

FAQ

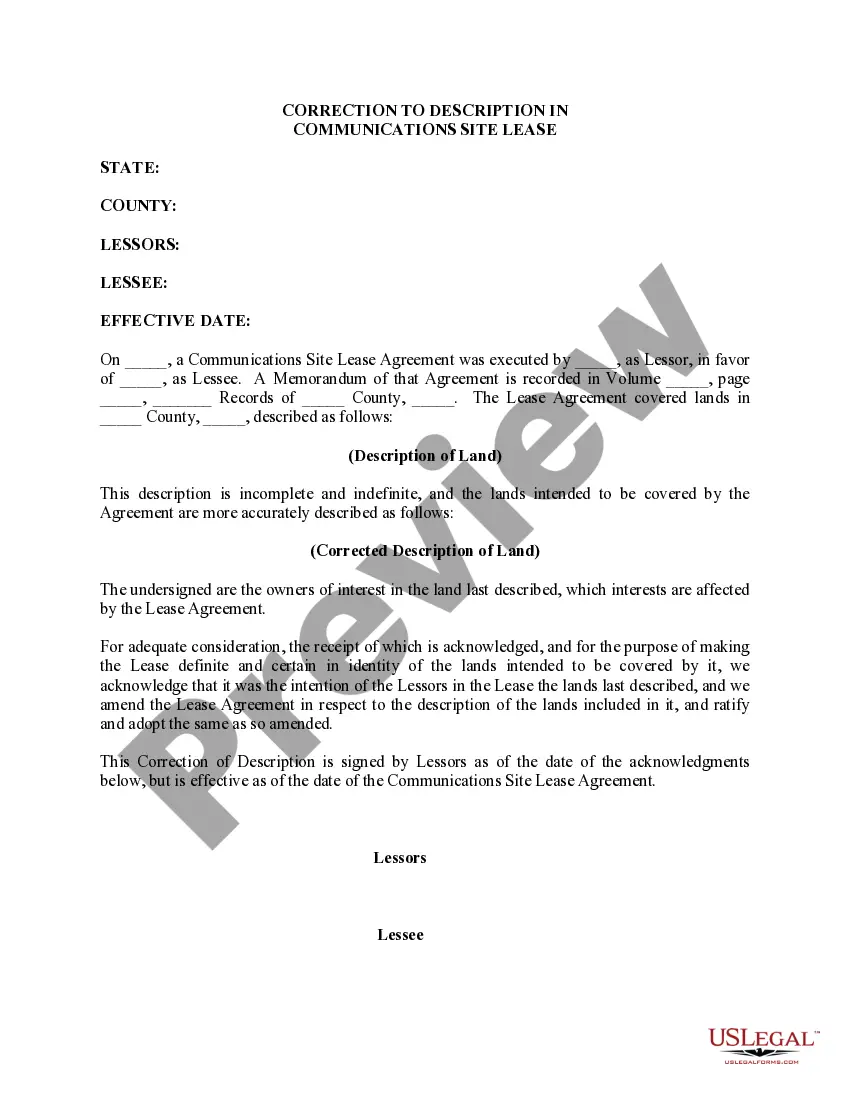

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

You can be forced pooled, however, in LA, you cannot be forced to participate (come up with your share in advance), nor can you be penalized for not participating (in that you are not charged more than your share of the well cost for not participating).

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.