Louisiana Acquisition Worksheet

Description

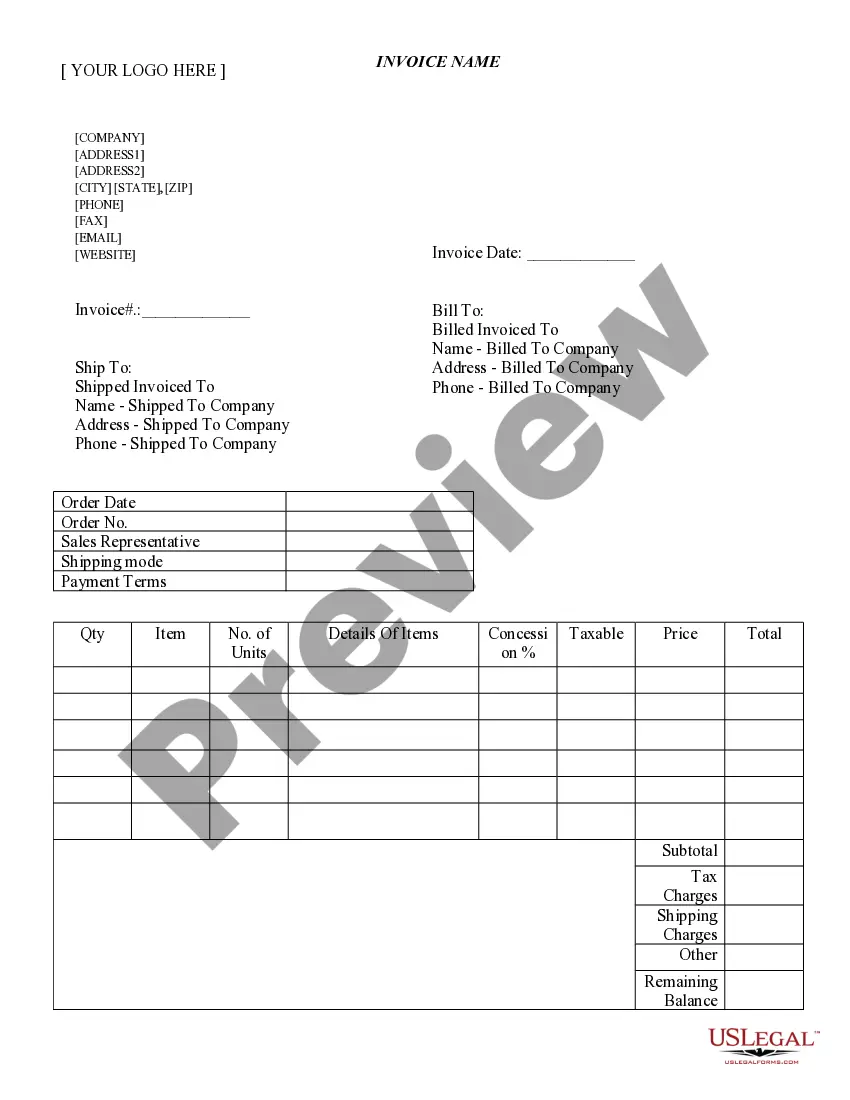

How to fill out Acquisition Worksheet?

Finding the right lawful papers format can be a battle. Obviously, there are tons of templates available on the Internet, but how will you obtain the lawful form you need? Use the US Legal Forms website. The assistance offers thousands of templates, including the Louisiana Acquisition Worksheet, that can be used for business and personal demands. All the types are examined by pros and meet federal and state requirements.

In case you are already signed up, log in to your bank account and then click the Obtain button to obtain the Louisiana Acquisition Worksheet. Make use of bank account to search from the lawful types you may have bought previously. Proceed to the My Forms tab of your respective bank account and get one more duplicate in the papers you need.

In case you are a fresh consumer of US Legal Forms, allow me to share easy instructions that you should comply with:

- First, make sure you have selected the right form to your area/region. You may look over the form utilizing the Review button and look at the form outline to guarantee it will be the best for you.

- When the form does not meet your needs, take advantage of the Seach area to find the appropriate form.

- Once you are sure that the form is proper, click on the Buy now button to obtain the form.

- Choose the pricing program you need and type in the essential details. Make your bank account and buy an order with your PayPal bank account or credit card.

- Pick the data file structure and acquire the lawful papers format to your system.

- Comprehensive, change and print and indicator the acquired Louisiana Acquisition Worksheet.

US Legal Forms is the biggest local library of lawful types for which you can discover a variety of papers templates. Use the company to acquire skillfully-made paperwork that comply with status requirements.

Form popularity

FAQ

Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or exchanged at a price higher than its basis. Basis is an asset's purchase price, plus commissions and the cost of improvements less depreciation.

You can claim up to $3,000 of this money per year against ordinary income until your excess is gone. You can also use this carryover deduction to reduce any capital gains in future years. So, if you realized $10,500 in capital gains in 2022, your excess contributions can reduce your capital gains tax liability to $0.

If you have a net capital gain, a lower tax rate may apply to the gain than the tax rate that applies to your ordinary income. The term "net capital gain" means the amount by which your net long-term capital gain for the year is more than your net short-term capital loss for the year.

Additional State Capital Gains Tax Information for Louisiana Louisiana allows taxpayers to deduct federal income taxes from their state taxable income. The Combined Rate accounts for State and Local tax rates on capital gains income, the 3.8 percent Surtax on capital gains and the marginal effect of Pease Limitations.

Louisiana Revised Statute 3(9)(a)(xvii) provides a deduction for net capital gains resulting from the sale or exchange of an equity interest or from the sale or exchange of substantially all of the assets of a nonpublicly traded corporation, partnership, limited liability company, or other business organization ...