Louisiana Journalist - Reporter Agreement - Self-Employed Independent Contractor

Description

How to fill out Journalist - Reporter Agreement - Self-Employed Independent Contractor?

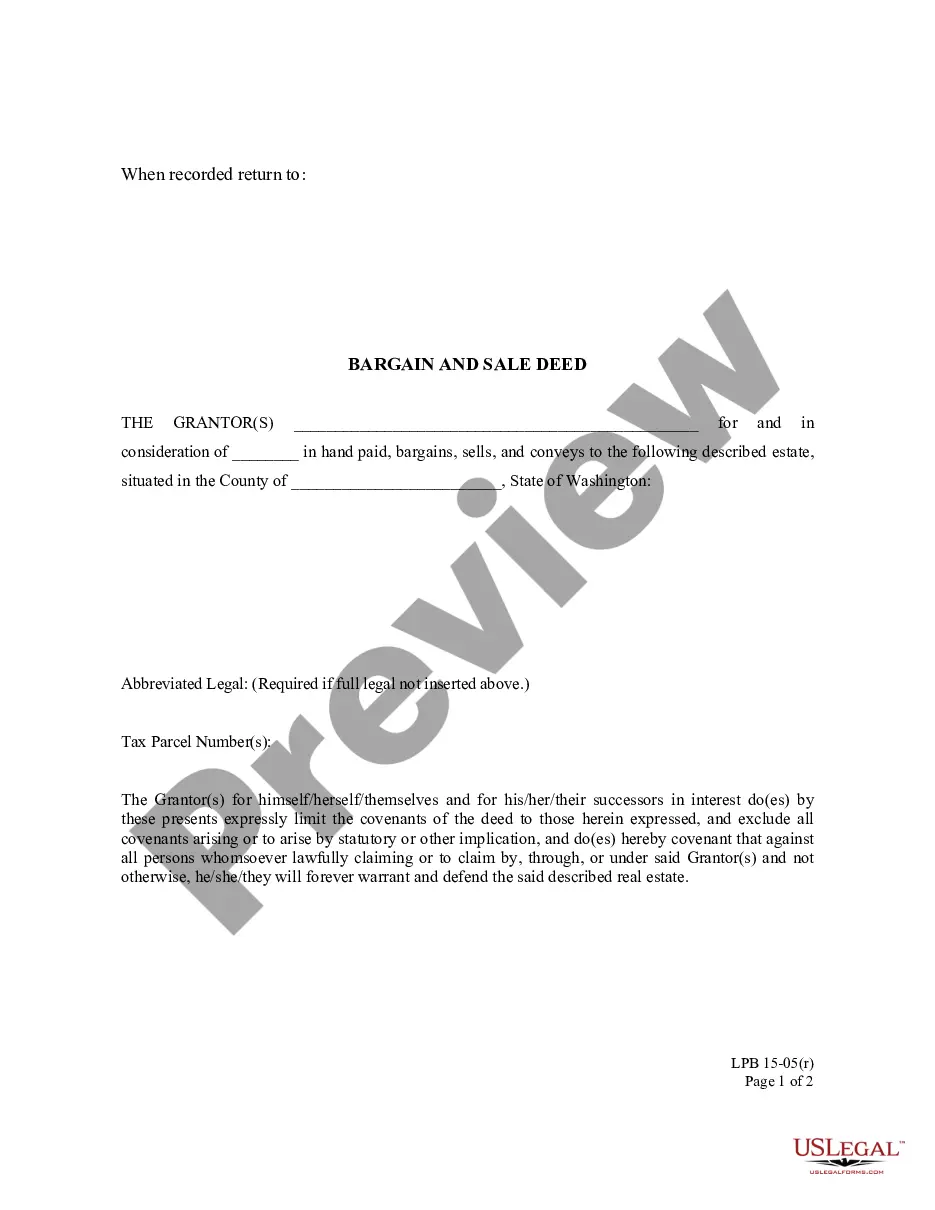

Choosing the right authorized file template could be a struggle. Needless to say, there are plenty of web templates accessible on the Internet, but how can you get the authorized kind you need? Utilize the US Legal Forms web site. The services delivers a large number of web templates, such as the Louisiana Journalist - Reporter Agreement - Self-Employed Independent Contractor, that you can use for organization and personal requires. All the kinds are inspected by specialists and meet state and federal needs.

If you are presently registered, log in for your profile and then click the Download button to get the Louisiana Journalist - Reporter Agreement - Self-Employed Independent Contractor. Make use of profile to appear through the authorized kinds you have ordered in the past. Visit the My Forms tab of the profile and get one more copy in the file you need.

If you are a brand new consumer of US Legal Forms, allow me to share simple instructions that you should adhere to:

- Very first, make certain you have selected the appropriate kind for your city/region. It is possible to check out the form making use of the Review button and look at the form description to make sure this is the right one for you.

- In case the kind does not meet your expectations, make use of the Seach industry to get the appropriate kind.

- When you are certain that the form is proper, click the Buy now button to get the kind.

- Pick the rates strategy you want and type in the necessary information. Create your profile and pay money for the order using your PayPal profile or Visa or Mastercard.

- Choose the submit structure and acquire the authorized file template for your product.

- Full, modify and printing and indicator the acquired Louisiana Journalist - Reporter Agreement - Self-Employed Independent Contractor.

US Legal Forms may be the largest library of authorized kinds that you can find numerous file web templates. Utilize the company to acquire appropriately-made documents that adhere to status needs.

Form popularity

FAQ

Many freelance journalists, musicians, translators and other workers in California can operate as independent contractors under a new law signed by Gov. Gavin Newsom on Sept. 4.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

An independent contractor is not employed by a businessinstead, they work with a business as a third party....Here are some examples of professions that frequently work as independent contractors:Electricians.Plumbers.Carpenters.Painters.Auto mechanics.Florists.Dentists.Veterinarians.More items...?

As an independent contractor, a freelance social media manager is also responsible for all of their own taxes and benefits.

An independent contractor often functions as a freelancer, but typically will work with one client for a longer time frame. In many cases, independent contractors work for an hourly rate. Furthermore, they might work through a third party or agency but can also work on their own.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Many freelance journalists, musicians, translators and other workers in California can operate as independent contractors under a new law signed by Gov. Gavin Newsom on Sept. 4.