Louisiana Self-Employed Part Time Employee Contract

Description

How to fill out Self-Employed Part Time Employee Contract?

You can spend multiple hours online searching for the legal document template that complies with the state and federal requirements you desire.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

It is easy to download or print the Louisiana Self-Employed Part-Time Employee Contract from our platform.

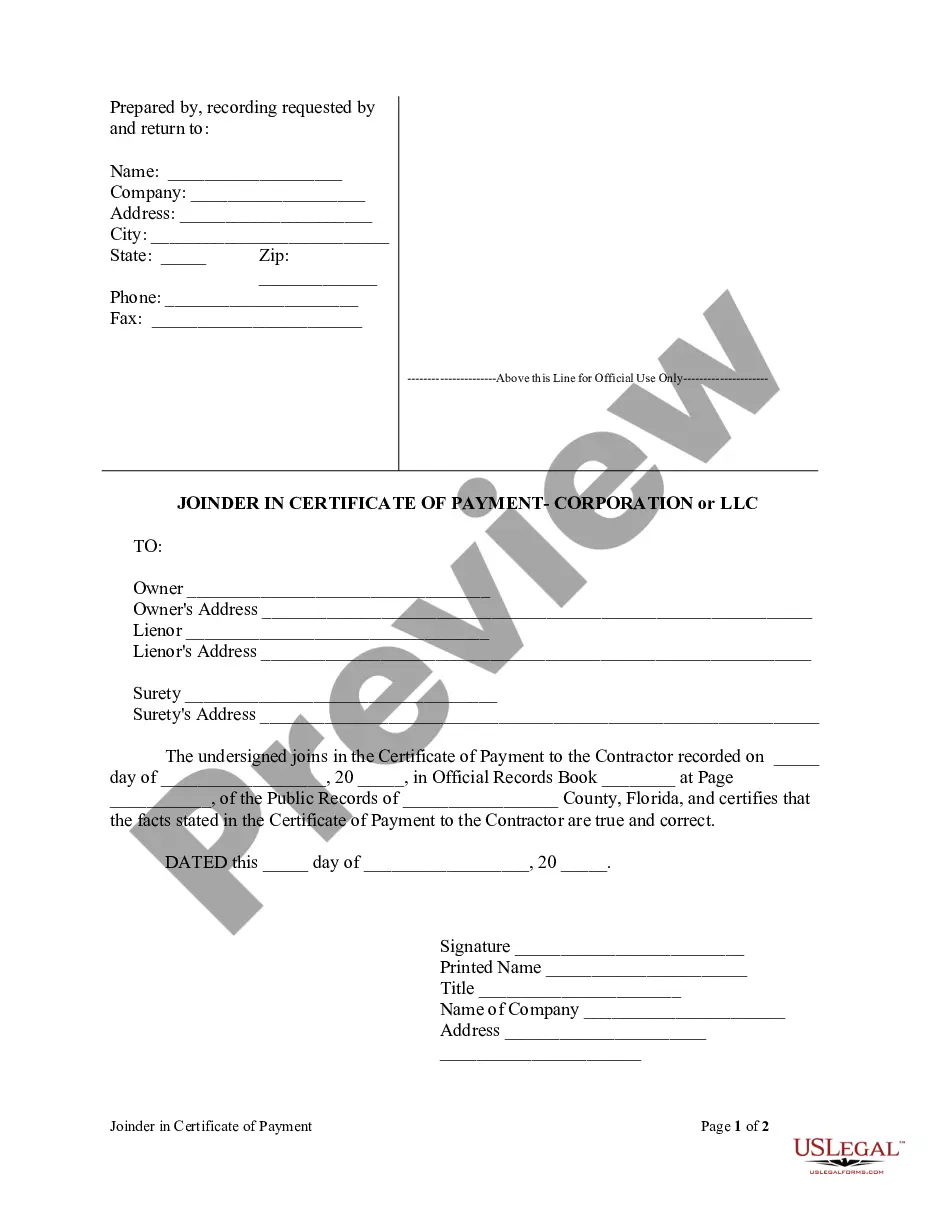

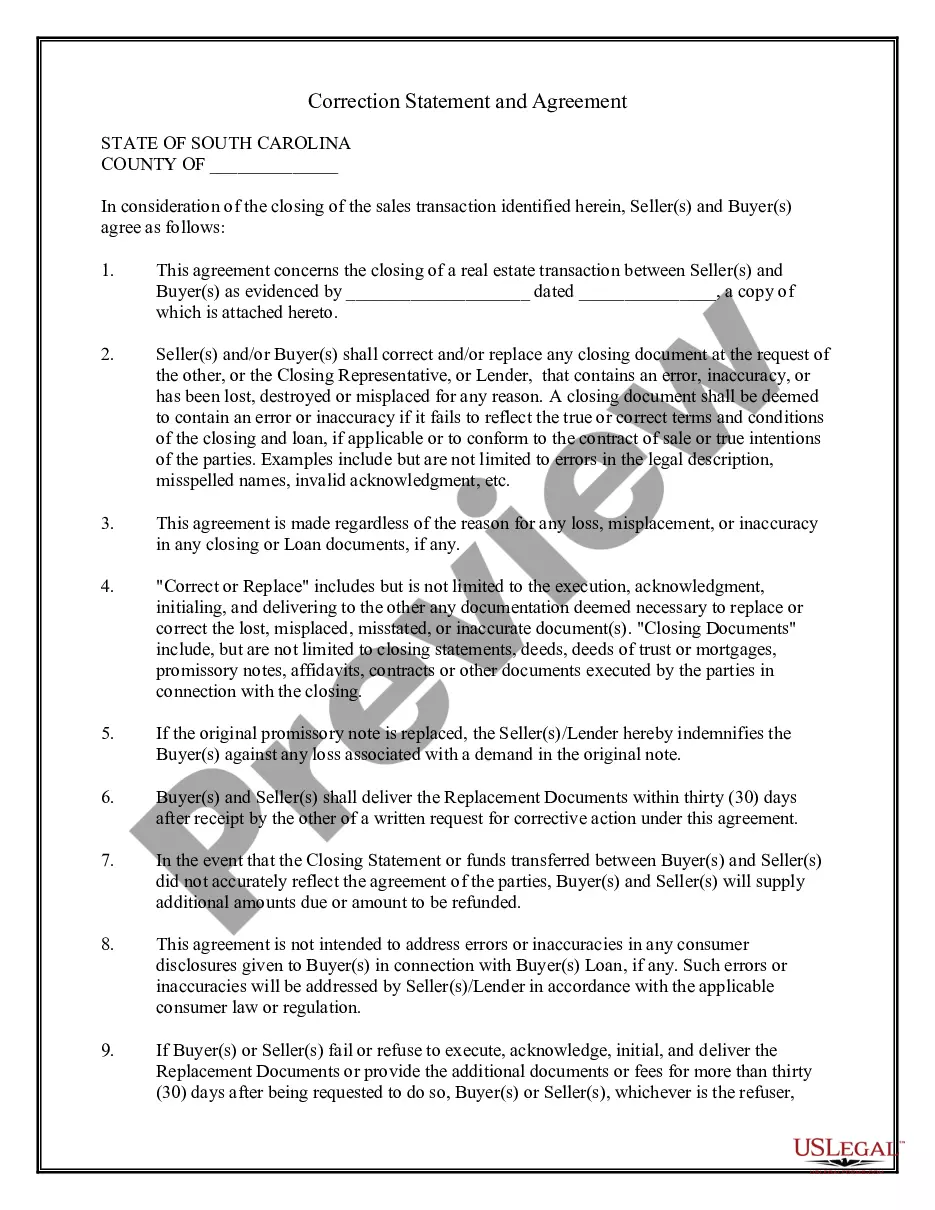

If available, use the Preview button to view the document template as well. To get another version of the form, use the Search field to find the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Louisiana Self-Employed Part-Time Employee Contract.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/area of your choice.

- Review the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

No, a contract is not the same as being self-employed. A contract is a legal agreement that details the terms of a working relationship, while being self-employed refers to your employment status. It's essential to have a Louisiana Self-Employed Part Time Employee Contract in place to solidify your working terms.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Self-employed people earn a living by working for themselves, not as employees of someone else or as owners (shareholders) of a corporation.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

Yes. Even part time staff must have a contract. The law applies if employees: Have a fixed employment period.

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

Employment contracts are valid for as long as an individual is employed with your company. There is typically no need to re-write employment contracts each year under most circumstances. If an employee is promoted, you may consider updating their job description and request they sign the updated form.